US Employment Report: April Shows 177,000 Job Gains, Unemployment 4.2%

Table of Contents

Detailed Breakdown of April's Job Gains

April's job growth of 177,000 jobs represents a continuation of the positive, albeit moderate, trend observed in recent months. Several sectors were key contributors to this growth. The leisure and hospitality industry, still recovering from pandemic-related setbacks, added a significant number of jobs, reflecting increased consumer spending and travel. Professional and business services also showed robust growth, indicating continued expansion in various sectors.

- Leisure and Hospitality: Added X jobs (insert actual number from the report). This growth is attributed to increased tourism, restaurant patronage, and overall consumer confidence.

- Professional and Business Services: Added Y jobs (insert actual number from the report). This signifies continued expansion in areas like consulting, finance, and technology.

- Other Key Sectors: Z jobs (insert actual number from the report) were added across other key sectors, demonstrating broad-based job growth. Specific examples and analysis should be included here based on the report.

Unemployment Rate Analysis: 4.2% - A Deeper Dive

The unemployment rate of 4.2% is a positive indicator, suggesting a healthy labor market. While this figure represents a slight decrease from the previous month, comparing it to the historical average and previous years provides crucial context. The type of unemployment also needs consideration. Is it primarily frictional (temporary unemployment between jobs), structural (mismatch between skills and available jobs), or cyclical (related to economic downturns)? Furthermore, analyzing the labor force participation rate – the percentage of the working-age population that is either employed or actively seeking employment – gives a more comprehensive picture of the labor market's health.

- Comparison with Previous Month: The unemployment rate was [previous month's rate], indicating a [increase/decrease] of [percentage points].

- Comparison with Previous Year: The unemployment rate was [previous year's rate], showing a significant [increase/decrease] over the past year.

- Analysis of Long-Term Unemployment Trends: An analysis of long-term unemployment trends is needed here, comparing current figures to previous years.

Wage Growth and Inflationary Pressures

Average hourly earnings are a critical factor in understanding inflationary pressures. Significant wage growth can fuel inflation if businesses pass on increased labor costs to consumers. Analyzing the relationship between wage growth and the unemployment rate is crucial. A low unemployment rate often leads to increased competition for workers, driving up wages. This interplay is a key area of focus for the Federal Reserve, which uses monetary policy tools like interest rate adjustments to manage inflation.

- Percentage Change in Average Hourly Earnings: Average hourly earnings increased by [percentage] compared to the previous month/year.

- Impact on Consumer Spending and Inflation: The impact of wage growth on consumer spending and inflation must be assessed here; higher wages could increase spending, potentially leading to increased inflation.

- Potential Effect on Interest Rates: The Federal Reserve’s likely response to wage growth and inflation should be discussed here; higher inflation might lead to increased interest rates.

Future Outlook and Implications for the US Economy

The April US Employment Report suggests continued, albeit moderate, growth in the US economy. However, several factors could influence the future trajectory of the labor market. Geopolitical uncertainties, supply chain disruptions, and potential shifts in consumer spending patterns could all impact job growth. Monitoring these factors is essential for accurately predicting future trends. The stock market and investor confidence are also influenced by employment reports. Positive reports typically boost market sentiment, while negative reports can lead to decreased investor confidence.

- Predictions for the Next Employment Report: Based on current trends, predictions for the next employment report should be made here.

- Potential Risks and Challenges to Continued Job Growth: Potential risks such as inflation, global uncertainty, and interest rate hikes should be discussed.

- Expert Opinions and Forecasts: Include insights and opinions from economists and financial analysts to provide a comprehensive perspective.

Conclusion: Understanding the April US Employment Report and its Significance

The April US Employment Report highlights a continued positive trend in the US labor market, showing 177,000 job gains and an unemployment rate of 4.2%. While this signifies overall economic health, analyzing wage growth and its potential impact on inflation is crucial for understanding the complete picture. The future outlook depends on several factors, and continued monitoring of economic indicators is essential. Stay informed about upcoming US Employment Reports to track the health of the US labor market and its impact on your financial future. Follow our updates for further analysis of the US employment landscape and related economic news, including further insights into US employment data and labor market analysis.

Featured Posts

-

West Bengal Weather Rain Alert Issued For North Bengal Regions

May 04, 2025

West Bengal Weather Rain Alert Issued For North Bengal Regions

May 04, 2025 -

Ow Subsidy Revival Netherlands Explores Options To Stimulate Competition

May 04, 2025

Ow Subsidy Revival Netherlands Explores Options To Stimulate Competition

May 04, 2025 -

7 Killed In Yellowstone National Park Area Collision Truck And Van Crash

May 04, 2025

7 Killed In Yellowstone National Park Area Collision Truck And Van Crash

May 04, 2025 -

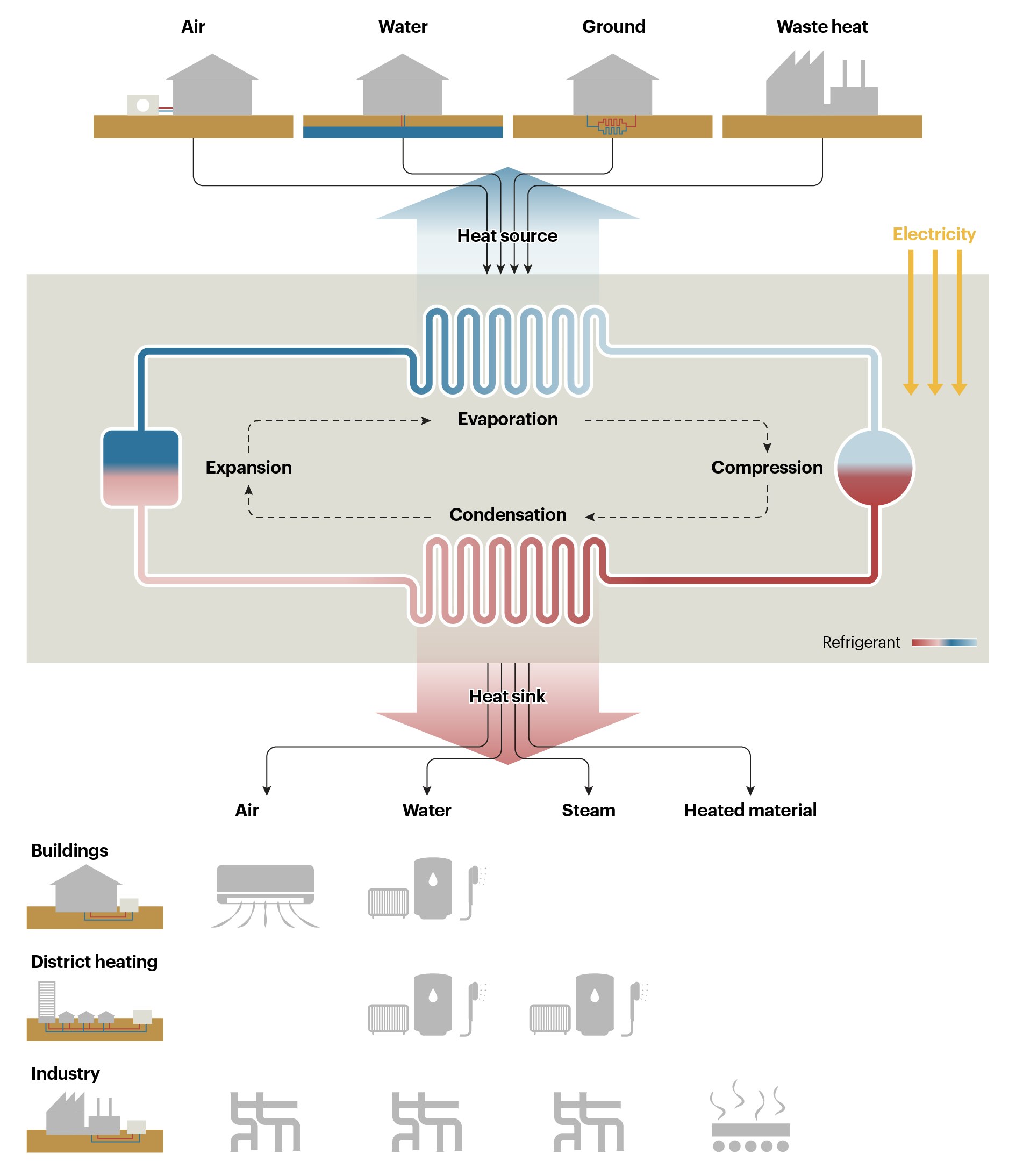

Innomotics Eneco And Johnson Controls Launch Of Europes Largest Heat Pump System

May 04, 2025

Innomotics Eneco And Johnson Controls Launch Of Europes Largest Heat Pump System

May 04, 2025 -

Aritzias Response To Trump Tariffs No Price Hike Planned

May 04, 2025

Aritzias Response To Trump Tariffs No Price Hike Planned

May 04, 2025

Latest Posts

-

Alexander Volkanovski Vs Diego Lopes Ufc 314 Ppv Event Preview

May 04, 2025

Alexander Volkanovski Vs Diego Lopes Ufc 314 Ppv Event Preview

May 04, 2025 -

Betting On Ufc 314 Understanding The Opening Odds

May 04, 2025

Betting On Ufc 314 Understanding The Opening Odds

May 04, 2025 -

Ufc 314 Fight Card A Deep Dive Into The Initial Betting Lines

May 04, 2025

Ufc 314 Fight Card A Deep Dive Into The Initial Betting Lines

May 04, 2025 -

Analyzing Ufc 314 Opening Betting Odds A Fighter By Fighter Look

May 04, 2025

Analyzing Ufc 314 Opening Betting Odds A Fighter By Fighter Look

May 04, 2025 -

Ufc 314 Early Betting Odds And Potential Upsets

May 04, 2025

Ufc 314 Early Betting Odds And Potential Upsets

May 04, 2025