US IPO Filing: Omada Health Secures Funding From Andreessen Horowitz

Table of Contents

Omada Health's Business Model and Target Market

Omada Health specializes in chronic disease management using innovative digital therapeutics and telehealth platforms. Their core business model centers around providing remote patient monitoring, personalized coaching, and digital tools to help individuals manage conditions like diabetes and hypertension. Their target market encompasses individuals at high risk of developing or already living with chronic diseases, specifically focusing on demographics most affected by these conditions. This includes individuals with limited access to traditional healthcare, those seeking convenient and effective disease management, and those looking for proactive preventative care.

- Preventative Care: Omada Health proactively engages patients through risk assessments and personalized interventions, aiming to prevent the onset or worsening of chronic conditions.

- AI and Data Analytics: Their platforms leverage AI and data analytics to personalize treatment plans, monitor patient progress, and offer timely interventions.

- Patient Engagement Strategies: Omada Health employs various engagement strategies, including gamification, community support, and regular check-ins with healthcare professionals, to foster patient adherence and improve outcomes. Their use of a comprehensive telehealth platform allows for effective remote patient monitoring. They offer a range of digital therapeutics designed to complement traditional healthcare approaches.

Andreessen Horowitz's Investment and its Significance

Andreessen Horowitz's investment in Omada Health represents a substantial influx of capital, further validating the company's innovative approach to chronic disease management. While the exact amount remains undisclosed (often kept confidential until official filings), the involvement of such a prominent venture capital firm signifies a strong vote of confidence. Andreessen Horowitz likely chose to invest in Omada Health due to several factors, including the company's proven track record, its scalable digital platform, and the significant market opportunity within the chronic disease management space. This investment provides Omada Health with the resources to accelerate growth, expand its product offerings, and potentially explore strategic acquisitions.

- Strategic Partnerships: The investment could facilitate new strategic partnerships with other healthcare providers and technology companies, extending Omada Health’s reach and capabilities.

- Future Funding Rounds: This investment sets the stage for future rounds of funding, potentially paving the way for a successful IPO.

- Industry Influence: Andreessen Horowitz's reputation and extensive network within the tech and healthcare industries will significantly benefit Omada Health's visibility and credibility. The "Series [insert Series number] funding" will bolster Omada Health's position in the competitive digital health market.

Implications of the IPO Filing for the Digital Health Sector

Omada Health's IPO filing has significant implications for the broader digital health market. It signals a growing maturity of the sector, attracting increased investor interest and potentially triggering a wave of similar IPOs from other digital health companies. This could significantly boost digital health funding and accelerate innovation within the field. The success of Omada Health's IPO will likely influence investor sentiment and funding decisions for similar companies working in areas like telehealth, remote patient monitoring, and digital therapeutics.

- Market Share Dynamics: The IPO will likely intensify competition within the digital health market, prompting other companies to refine their offerings and strengthen their market positions.

- Regulatory Scrutiny: The increased visibility resulting from the IPO may lead to increased regulatory scrutiny of the digital health sector.

- Business Model Sustainability: Omada Health's success will contribute to validating the long-term sustainability and viability of the digital health business model, attracting further investment.

Omada Health's Future Prospects and Challenges

As Omada Health prepares for its IPO, it faces both opportunities and challenges. The company’s ability to scale its operations while maintaining high levels of patient engagement and clinical efficacy will be crucial. The competitive landscape is dynamic, with several other players offering similar solutions. Omada Health's success will hinge on its ability to differentiate its offerings, enhance its technological capabilities, and effectively address the specific needs of its target market.

- IPO Risks: The IPO process itself carries inherent risks, including market volatility and the potential for negative investor sentiment.

- Market Expansion: Omada Health has opportunities to expand into new geographical markets and diversify its service offerings, catering to a broader range of chronic conditions.

- Strategic Vision: The company's long-term strategic vision will guide its ability to navigate the competitive landscape and capitalize on emerging trends in the digital health market, ensuring robust revenue projections and market growth.

Conclusion

Omada Health's US IPO filing and substantial investment from Andreessen Horowitz mark a significant turning point for the company and the digital health sector. This development underscores the growing potential of digital health solutions in addressing chronic diseases and improving healthcare access. The success of the Omada Health IPO will significantly impact the digital health market, attracting further investment and accelerating innovation. The future of healthcare is undeniably intertwined with digital solutions, and this event is a key step toward a more accessible and efficient healthcare system. Learn more about Omada Health, explore the ever-evolving digital health market, and stay informed about the latest Omada Health IPO news to understand the future of healthcare and consider the potential to invest in digital health. Understanding the Omada Health stock performance will be vital in tracking the success of this investment and the broader digital health market.

Featured Posts

-

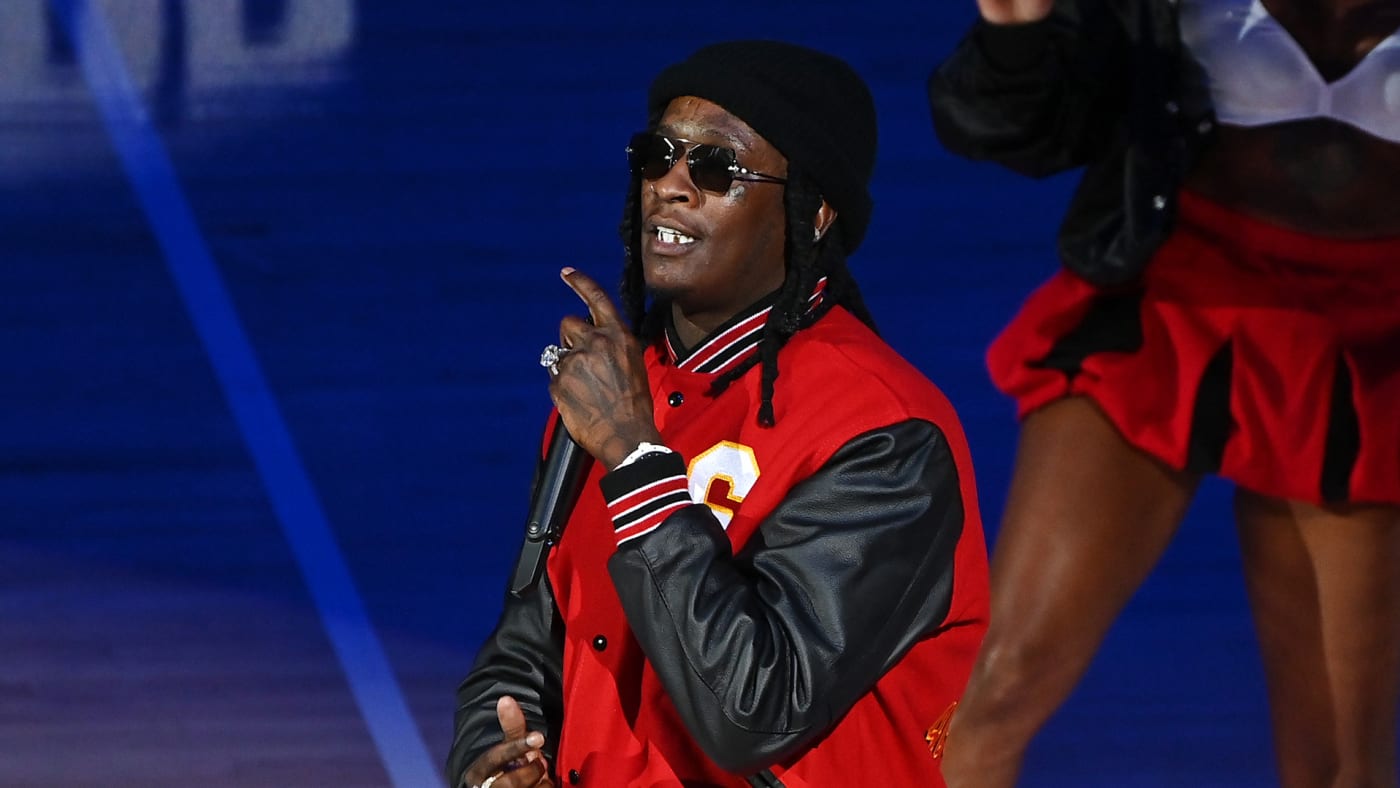

Young Thug Will Not Be Joining The Next Blue Origin Mission

May 10, 2025

Young Thug Will Not Be Joining The Next Blue Origin Mission

May 10, 2025 -

Nyt Strands Answers For Tuesday March 4 Game 366

May 10, 2025

Nyt Strands Answers For Tuesday March 4 Game 366

May 10, 2025 -

Jeanine Pirro Advises Ignoring The Stock Market In The Coming Weeks

May 10, 2025

Jeanine Pirro Advises Ignoring The Stock Market In The Coming Weeks

May 10, 2025 -

43 Billion Boost Space X Stake Now Worth More Than Musks Tesla Shares

May 10, 2025

43 Billion Boost Space X Stake Now Worth More Than Musks Tesla Shares

May 10, 2025 -

Analyzing Aocs Fact Check Of Jeanine Pirros Fox News Appearance

May 10, 2025

Analyzing Aocs Fact Check Of Jeanine Pirros Fox News Appearance

May 10, 2025