US Regulatory Developments Drive Bitcoin To New All-Time High

Table of Contents

The cryptocurrency market is experiencing a significant upswing, with Bitcoin hitting a new all-time high. This remarkable surge isn't just a matter of speculation; it's largely attributed to recent US regulatory developments. These actions are shaping the future of digital assets and profoundly impacting investor sentiment. This article will delve into the key regulatory shifts and their influence on Bitcoin's price, offering insights for both seasoned investors and newcomers alike.

Increased Institutional Investment Following Regulatory Clarity

Clearer regulatory guidelines are a game-changer for institutional investors. The reduced uncertainty significantly lowers the perceived risk of Bitcoin investment, encouraging larger players to enter the market. This influx of capital has been a major driver in Bitcoin's price increase.

- Grayscale Bitcoin Trust's success and its impact on institutional adoption: The Grayscale Bitcoin Trust (GBTC) has played a pivotal role. By offering a regulated vehicle for institutional investment in Bitcoin, it has made the asset more accessible and less risky for large firms. The success of GBTC has demonstrated the appetite for Bitcoin within established financial institutions.

- Examples of major financial institutions investing in Bitcoin: Many major players, from MicroStrategy to Tesla, have publicly announced significant Bitcoin purchases, showcasing a growing acceptance of Bitcoin as a viable asset class. This institutional adoption signals a shift towards mainstream acceptance and contributes to price stability and upward momentum.

- Decreased regulatory uncertainty leading to increased institutional FOMO (Fear Of Missing Out): As regulatory clarity increases, the fear of missing out (FOMO) among institutional investors intensifies. They see the potential for substantial returns and, with less uncertainty, are more willing to allocate significant capital to Bitcoin.

The Impact of SEC Actions on Bitcoin's Price

The Securities and Exchange Commission (SEC)'s actions, or rather, the lack of overly harsh crackdowns, have significantly impacted Bitcoin's price. While the SEC continues to scrutinize certain cryptocurrencies, its relatively measured approach has boosted investor confidence.

- Analysis of recent SEC statements regarding cryptocurrencies: Although the SEC has taken action against fraudulent projects, its approach to Bitcoin has been less overtly antagonistic than some anticipated. This measured stance has been interpreted positively by the market.

- How the absence of harsh regulatory crackdowns boosts investor confidence: The absence of a widespread regulatory crackdown instills confidence in investors. It suggests a more nuanced understanding of the cryptocurrency market and reduces the fear of sudden, disruptive changes.

- Discussion of potential future SEC regulations and their likely impact: While future SEC regulations remain uncertain, the current atmosphere of relatively cautious regulation is generally viewed as positive for Bitcoin’s price. Predictable regulations, even if restrictive, are often preferred to complete uncertainty.

Growing Adoption of Bitcoin as a Hedge Against Inflation

Bitcoin's growing adoption as a hedge against inflation is another key factor driving its price. With global inflation rising, investors are seeking assets that can protect their purchasing power.

- Explanation of Bitcoin's deflationary nature and its appeal as an inflation hedge: Unlike fiat currencies, Bitcoin has a fixed supply of 21 million coins. This scarcity contributes to its deflationary nature, making it an attractive alternative during inflationary periods.

- Comparison of Bitcoin's performance against traditional assets during inflationary periods: Historical data shows a positive correlation between inflationary pressures and Bitcoin's price appreciation. This reinforces its role as a potential inflation hedge within diversified portfolios.

- Analysis of investor behavior during periods of economic instability: During times of economic uncertainty, investors often seek safe haven assets. Bitcoin's decentralized and independent nature makes it appealing in such scenarios, leading to increased demand and higher prices.

The Role of Stablecoins in Bitcoin's Price Surge

Stablecoins, particularly regulated ones pegged to the US dollar, play a crucial, albeit indirect, role in Bitcoin's price surge. They improve market liquidity by providing a stable trading pair for Bitcoin, reducing volatility and making it easier for investors to enter and exit positions. This increased liquidity fosters a more stable and efficient market, further supporting Bitcoin’s price.

Conclusion

Recent US regulatory developments, including increased clarity, the absence of overly harsh actions, and the stabilizing influence of regulated stablecoins, have significantly contributed to Bitcoin reaching new all-time highs. The increasing institutional investment and Bitcoin's growing adoption as an inflation hedge further solidify its position in the evolving financial landscape. This confluence of factors presents a compelling case for Bitcoin's continued growth.

Call to Action: Stay informed about the latest US regulatory developments impacting the Bitcoin market and consider diversifying your portfolio with Bitcoin investments. Learn more about managing your Bitcoin investments wisely and navigating the evolving regulatory landscape. #BitcoinInvestment #CryptoInvesting #USRegulation #BitcoinPrice #BitcoinHedge

Featured Posts

-

England Names Test Team For Zimbabwe Clash

May 23, 2025

England Names Test Team For Zimbabwe Clash

May 23, 2025 -

Neal Mc Donoughs Powerful Performance In The Last Rodeo

May 23, 2025

Neal Mc Donoughs Powerful Performance In The Last Rodeo

May 23, 2025 -

Memorial Day 2025 Where To Find The Best Sales And Deals

May 23, 2025

Memorial Day 2025 Where To Find The Best Sales And Deals

May 23, 2025 -

The Close Call Dylan Dreyer And Her Near Absence From The Today Show

May 23, 2025

The Close Call Dylan Dreyer And Her Near Absence From The Today Show

May 23, 2025 -

Elias Rodriguez Suspect In Israeli Embassy Attack Shouting Free Palestine

May 23, 2025

Elias Rodriguez Suspect In Israeli Embassy Attack Shouting Free Palestine

May 23, 2025

Latest Posts

-

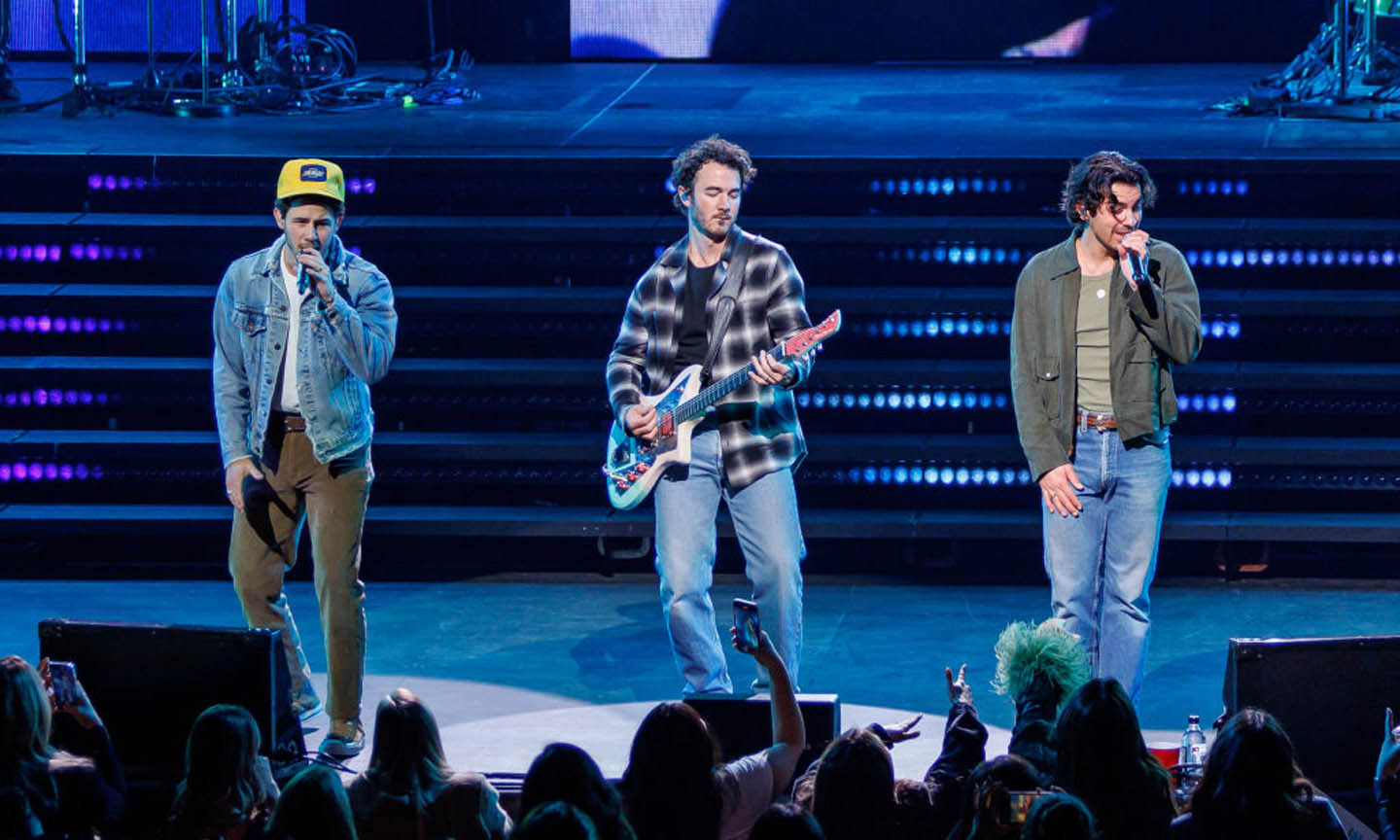

Joe Jonass Mature Response To A Couples Argument

May 23, 2025

Joe Jonass Mature Response To A Couples Argument

May 23, 2025 -

Jonathan Groffs Just In Time A Broadway Contender For The Tony Awards

May 23, 2025

Jonathan Groffs Just In Time A Broadway Contender For The Tony Awards

May 23, 2025 -

Jonathan Groffs Just In Time Broadway Performance A Tony Contender

May 23, 2025

Jonathan Groffs Just In Time Broadway Performance A Tony Contender

May 23, 2025 -

The Jonas Brothers Drama A Married Couples Public Argument And Joes Response

May 23, 2025

The Jonas Brothers Drama A Married Couples Public Argument And Joes Response

May 23, 2025 -

Joe Jonas A Fan Couples Fight And His Response

May 23, 2025

Joe Jonas A Fan Couples Fight And His Response

May 23, 2025