US Stock Market: Dow Futures, Earnings Reports, And Market Action

Table of Contents

Deciphering Dow Futures: A Preview of Market Sentiment

Dow Futures contracts offer a glimpse into the likely direction of the Dow Jones Industrial Average before the regular trading session begins. Analyzing these futures can provide valuable insights into investor sentiment and potential market movements. Essentially, they act as a pre-market indicator, reflecting the collective expectations of traders regarding the opening bell.

- Dow Futures reflect investor expectations for the opening price of the Dow. A significant increase in Dow Futures before the market opens often suggests a bullish sentiment, while a decrease points towards bearish expectations.

- Significant price movements in Dow Futures can signal bullish or bearish trends. Large swings in Dow Futures can foreshadow major market movements during the regular trading session. Experienced traders closely watch these pre-market fluctuations.

- Understanding the relationship between Dow Futures and actual market performance is key to informed trading. While Dow Futures offer a valuable preview, it's crucial to remember that they are not a perfect predictor of the market's actual performance. Other factors can influence the final outcome.

- Factors influencing Dow Futures include economic news, political events, and corporate announcements. Unexpected news releases, geopolitical events, or significant corporate announcements can significantly impact Dow Futures and subsequent market action. Keeping abreast of these factors is vital for effective analysis.

The Impact of Earnings Reports on Stock Prices

Corporate earnings reports are a major catalyst for stock price fluctuations. Companies release quarterly and annual financial statements revealing their profitability and future outlook. These reports significantly influence investor decisions and market sentiment, often leading to periods of increased stock market volatility, particularly during earnings season.

- Positive earnings surprises often lead to stock price increases. When a company surpasses analysts' expectations, investors often react positively, driving up the stock price.

- Negative earnings surprises can trigger significant price drops. Conversely, if a company underperforms expectations, the stock price may experience a substantial decline.

- Analyzing earnings reports requires understanding key financial metrics like EPS (Earnings Per Share) and revenue growth. Investors need to look beyond simple headline numbers and delve deeper into the financial statements to understand the company's financial health.

- Earnings season is a period of heightened market volatility. During this period, many companies release their reports concurrently, leading to significant market swings based on the collective performance.

Analyzing Key Financial Metrics in Earnings Reports

To effectively analyze earnings reports, investors should focus on several key financial metrics:

- EPS (Earnings Per Share): This indicates a company's profitability on a per-share basis. A rising EPS usually suggests improving profitability.

- Revenue Growth: This metric reveals the growth rate of a company's sales. Consistent revenue growth often signals a healthy and expanding business.

- Profit Margins: This shows the profitability relative to revenue. High profit margins indicate efficient operations and pricing strategies.

- Debt Levels: High debt can burden a company and increase risk. Analyzing debt-to-equity ratios helps assess financial stability.

- Financial Statements: A comprehensive analysis necessitates a thorough review of the income statement, balance sheet, and cash flow statement.

Interpreting Market Action: Technical and Fundamental Analysis

Understanding market action involves combining both technical and fundamental analysis. Technical analysis focuses on chart patterns and indicators, while fundamental analysis examines a company's financial health and overall economic conditions. Both approaches provide a holistic view of the stock market.

- Technical analysis identifies trends and potential trading opportunities based on price and volume data. Technical analysts use charts, indicators (like moving averages and RSI), and patterns to predict future price movements.

- Fundamental analysis assesses the intrinsic value of a stock based on its financial performance and future prospects. Fundamental analysts examine financial statements, industry trends, and management quality to determine a stock's fair market value.

- Combining both approaches provides a more comprehensive view of market action. A successful investor often incorporates both methods to identify well-supported trading opportunities.

- Paying attention to overall market indices, like the S&P 500 and Nasdaq, provides a broader context. Understanding the broader market trend is crucial before focusing on individual stocks.

Conclusion

Successfully navigating the US stock market requires a thorough understanding of Dow Futures, earnings reports, and overall market action. By analyzing these factors and employing both technical and fundamental analysis, investors can make more informed decisions and potentially improve their investment outcomes. Stay informed about upcoming earnings reports and monitor Dow Futures to gain valuable insights into the market's direction. Continue learning about the complexities of the US Stock Market, and refine your understanding of Dow Futures and the impact of earnings reports to enhance your market action analysis. Don't hesitate to seek professional financial advice when making investment decisions.

Featured Posts

-

Canadians Prioritize Domestic Travel Airbnb Bookings Soar

May 01, 2025

Canadians Prioritize Domestic Travel Airbnb Bookings Soar

May 01, 2025 -

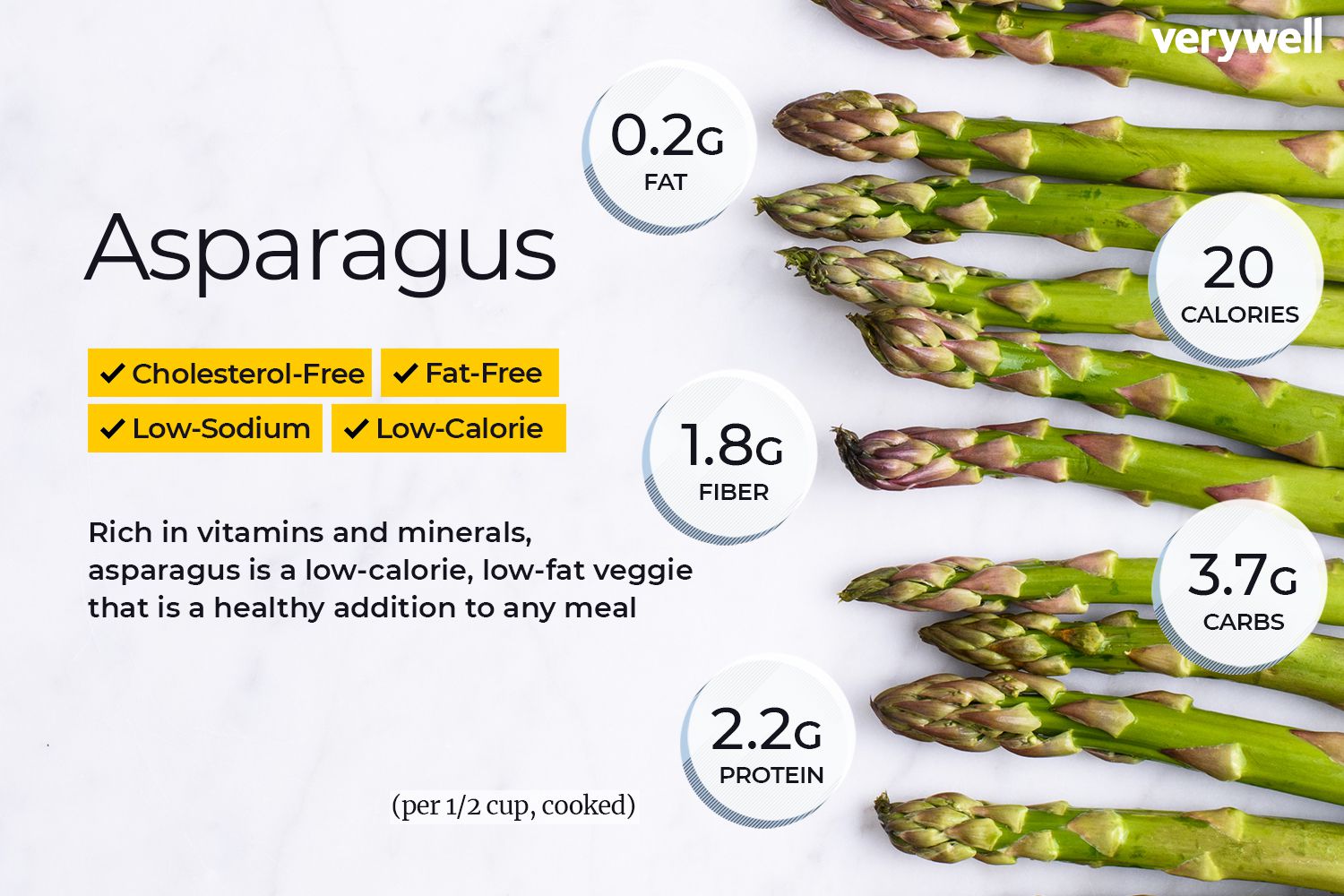

Asparagus Nutrition How This Vegetable Benefits Your Body

May 01, 2025

Asparagus Nutrition How This Vegetable Benefits Your Body

May 01, 2025 -

Broadcoms Extreme V Mware Price Hike At And T Faces 1 050 Cost Increase

May 01, 2025

Broadcoms Extreme V Mware Price Hike At And T Faces 1 050 Cost Increase

May 01, 2025 -

Michael Jordan Fast Facts And Career Highlights

May 01, 2025

Michael Jordan Fast Facts And Career Highlights

May 01, 2025 -

Little Coffee Secures Four Investment Offers From Dragons Den

May 01, 2025

Little Coffee Secures Four Investment Offers From Dragons Den

May 01, 2025