US Stocks Struggle As Emerging Markets Recover From Losses

Table of Contents

Weakening US Economic Indicators Weigh on US Stock Performance

Recent US economic data has cast a shadow over investor sentiment, contributing significantly to the struggles of US stocks. Concerns surrounding inflation concerns, persistent interest rate hikes by the Federal Reserve, and growing recession fears are all playing a role. The GDP growth slowdown is further dampening investor enthusiasm, leading to increased stock market volatility.

- Decline in consumer confidence: Weakening consumer spending, a key driver of US economic growth, reflects dwindling confidence in the economic outlook.

- Rising inflation impacting corporate earnings: Persistent inflation is squeezing corporate profit margins, leading to reduced earnings and impacting stock valuations.

- Potential for further interest rate increases by the Federal Reserve: The Federal Reserve's commitment to combating inflation through interest rate hikes increases borrowing costs for businesses and consumers, potentially hindering economic growth.

- Uncertainty surrounding future economic growth: The overall economic uncertainty is making investors hesitant, leading to decreased investment in US stocks. This uncertainty is reflected in the volatility of the market and the cautious approach many investors are taking. Analyzing US economic data carefully is crucial for navigating this environment.

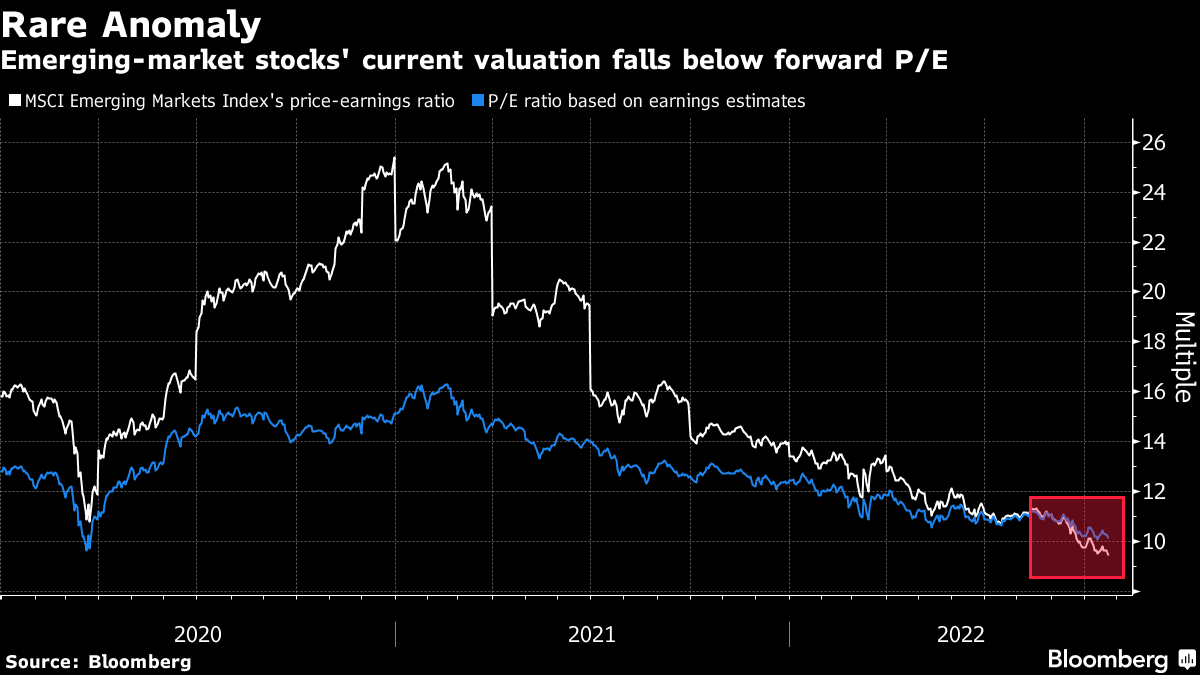

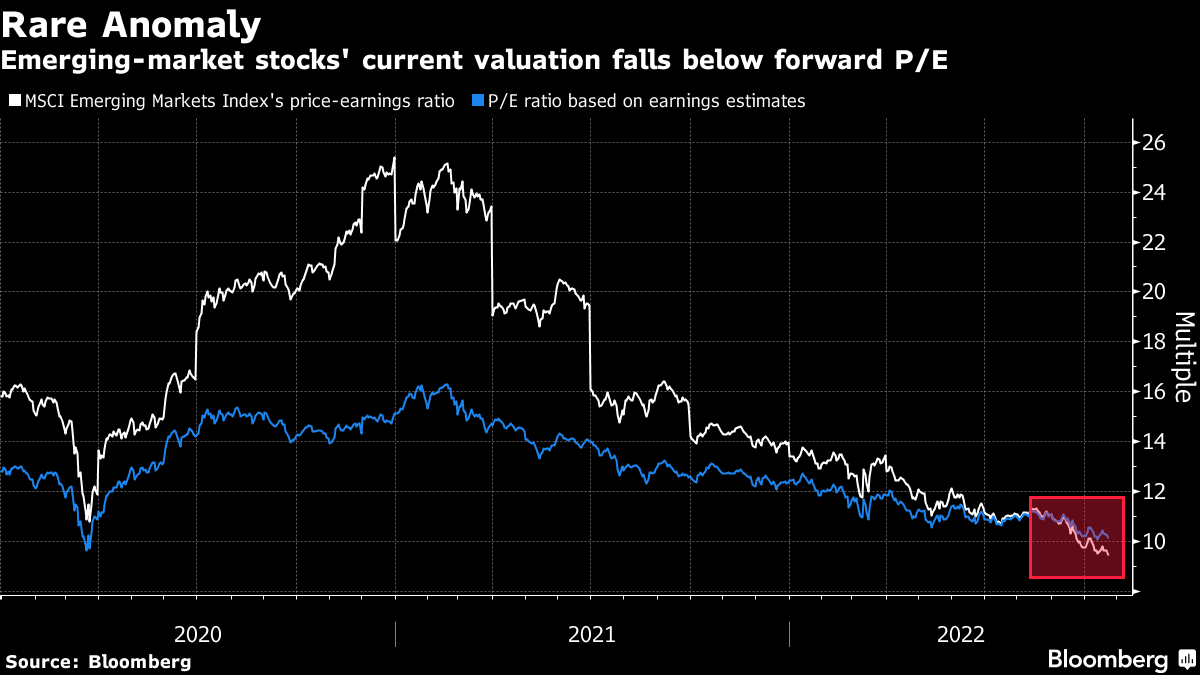

Emerging Markets' Resilience Driven by Factors Including Commodity Prices and Diversification

In stark contrast to the US market, emerging markets are demonstrating resilience, recovering from previous losses. This recovery is driven by several key factors, including soaring commodity prices, increased economic growth in specific regions, and the benefits of diversification.

- Increased demand for commodities from China and other developing nations: Strong demand, particularly from China, for raw materials like metals and energy, is boosting the economies of commodity-exporting emerging markets.

- Stronger-than-expected economic growth in certain emerging economies: Several emerging economies are experiencing robust economic growth, attracting foreign investment and driving stock market performance.

- Reduced dependence on the US dollar in some emerging markets: Some emerging markets are actively diversifying away from the US dollar, reducing their vulnerability to US monetary policy changes.

- Attractive investment opportunities drawing foreign capital: The relatively higher growth potential and attractive valuations in some emerging markets are drawing significant foreign capital, further fueling their recovery. Understanding these regional differences is vital for strategic investment decisions.

The Role of the US Dollar and Global Geopolitical Events

The strength of the US dollar and ongoing geopolitical risks are significantly impacting both US and emerging markets. These external factors add another layer of complexity to the current market dynamics.

- Impact of a strong US dollar on emerging market currencies: A strong US dollar can make it more expensive for emerging market countries to service their dollar-denominated debt, potentially impacting their economies.

- The effect of geopolitical instability on investor confidence: Geopolitical tensions, such as the ongoing war in Ukraine and trade disputes, create uncertainty and can negatively impact investor confidence in both US and emerging markets.

- Disruptions to global supply chains and their effect on market performance: Global supply chain disruptions, exacerbated by geopolitical events, continue to impact businesses and contribute to inflation, further affecting market performance. Analyzing the impact of currency fluctuations and carefully assessing global supply chains is crucial.

Comparing Investment Strategies: US vs. Emerging Markets

Investing in either US or emerging markets presents unique opportunities and challenges. Successful investment strategies require careful consideration of risk management and portfolio diversification.

- Advantages and disadvantages of investing in US stocks: US stocks offer relative stability and liquidity, but growth potential may be lower compared to emerging markets.

- Advantages and disadvantages of investing in emerging market stocks: Emerging markets offer higher growth potential but carry greater risks due to political and economic instability.

- Importance of diversification in a global investment portfolio: Diversification across both US and emerging markets is crucial for managing risk and maximizing long-term returns. Consider your long-term investments and short-term investments carefully.

Conclusion: Navigating the Shifting Landscape of US and Emerging Markets

In summary, while US stocks struggle as emerging markets recover from losses, the reasons are multifaceted and complex. Weakening US economic indicators, coupled with the strength of the US dollar and geopolitical risks, are creating challenges for US investors. Conversely, emerging markets are benefiting from strong commodity demand, diversified economies, and attractive investment opportunities. Understanding these dynamics is crucial for making informed investment decisions. Stay informed about the latest trends affecting US and emerging markets to make well-informed investment choices. Understanding the complexities behind "US stocks struggle as emerging markets recover from losses" is crucial for successful long-term investing.

Featured Posts

-

Upcoming Bold And The Beautiful Liams Promise Hopes Crisis And Lunas Rising Stakes

Apr 24, 2025

Upcoming Bold And The Beautiful Liams Promise Hopes Crisis And Lunas Rising Stakes

Apr 24, 2025 -

Canadian Auto Dealers Propose Five Point Plan Amidst Us Trade War

Apr 24, 2025

Canadian Auto Dealers Propose Five Point Plan Amidst Us Trade War

Apr 24, 2025 -

Ella Bleu Travolta 24 Unveils A Bold New Image In Fashion Magazine Spread

Apr 24, 2025

Ella Bleu Travolta 24 Unveils A Bold New Image In Fashion Magazine Spread

Apr 24, 2025 -

Bethesda Confirms Oblivion Remastered Release

Apr 24, 2025

Bethesda Confirms Oblivion Remastered Release

Apr 24, 2025 -

Saudi India Oil Refinery Project A Two Refinery Initiative

Apr 24, 2025

Saudi India Oil Refinery Project A Two Refinery Initiative

Apr 24, 2025

Latest Posts

-

Ufc 315 The Shevchenko Fiorot Showdown And The Retirement Question

May 12, 2025

Ufc 315 The Shevchenko Fiorot Showdown And The Retirement Question

May 12, 2025 -

Shevchenko Faces Fiorots Challenge Retirement On The Line At Ufc 315

May 12, 2025

Shevchenko Faces Fiorots Challenge Retirement On The Line At Ufc 315

May 12, 2025 -

Ufc 315 Will Fiorot End Shevchenkos Career

May 12, 2025

Ufc 315 Will Fiorot End Shevchenkos Career

May 12, 2025 -

Shevchenkos Ufc 315 Fight Fiorot Presents A Tough Retirement Test

May 12, 2025

Shevchenkos Ufc 315 Fight Fiorot Presents A Tough Retirement Test

May 12, 2025 -

Valentina Shevchenko Ignores Manon Fiorots Callout

May 12, 2025

Valentina Shevchenko Ignores Manon Fiorots Callout

May 12, 2025