US Tariffs Halt Shein's Planned London IPO

Table of Contents

The Impact of US Tariffs on Shein's Global Strategy

Shein's phenomenal success is built on a foundation of ultra-low prices and a lightning-fast supply chain. However, this very model is now under severe pressure from US tariffs. These tariffs, imposed on various clothing and textile imports from China, significantly increase the cost of Shein's products entering the US market – its largest and arguably most crucial market. The financial implications are substantial:

- Increased production costs: Tariffs directly translate to higher manufacturing costs, squeezing profit margins.

- Reduced profitability and market share: Higher prices could lead to reduced competitiveness and a loss of market share in the face of other fast-fashion brands less affected by the tariffs.

- Negative impact on investor confidence: The uncertainty surrounding tariffs and their financial impact makes potential investors hesitant about committing to Shein's London IPO.

- Supply chain disruption: Shein's reliance on a complex, global supply chain makes it particularly vulnerable to trade disputes and tariff-related logistical challenges.

Shein's business model thrives on low-cost manufacturing. This vulnerability to trade disputes, particularly the ongoing tensions between the US and China, is now a major obstacle to its growth. The tariffs force Shein to re-evaluate its pricing strategy, potentially eroding its competitive advantage built on affordability.

Shein's London IPO Plans and Market Expectations

Shein's planned London IPO was anticipated to be a massive undertaking, potentially raising billions of dollars and valuing the company at hundreds of billions. This public listing would have marked a significant milestone for the company, providing substantial capital for future expansion and solidifying its position as a global fast-fashion leader. Expectations were high:

- Expected investor interest: Shein's rapid growth and substantial market share had attracted considerable interest from investors worldwide.

- Significant capital raising: The IPO was poised to generate significant capital, fueling further expansion and innovation.

- Strategic implications: A successful IPO would have provided Shein with the resources to navigate challenges and pursue strategic acquisitions.

The news of the IPO delay sent shockwaves through the market. Stock market analysts and investors reacted negatively, highlighting the uncertainty surrounding Shein's future and the impact of the US tariffs on its long-term prospects.

Alternative Strategies and Future Outlook for Shein

Facing the challenges posed by the US tariffs, Shein now needs to explore alternative strategies. Delaying the London IPO until tariff uncertainties resolve seems a likely first step. Other options include:

- Negotiating with the US government: Shein might lobby for tariff reductions or exemptions, seeking to alleviate the financial pressures.

- Supply chain diversification: Reducing its reliance on tariff-affected regions by diversifying its manufacturing base to countries with more favorable trade relations could be crucial.

- Focusing on other markets: Shein could prioritize growth in other international markets less impacted by the US tariffs to offset potential losses.

The long-term implications of the tariff-related delay on Shein's growth trajectory are significant. The company’s ability to adapt and innovate will determine its capacity to overcome these hurdles and achieve its ambitious global goals.

Conclusion: The Uncertain Future of Shein's London IPO

US tariffs have significantly impacted Shein's business model, leading to the unexpected halt of its planned London IPO. The increased production costs, reduced profitability, and uncertainty surrounding the US market have all contributed to this delay. This situation underscores the vulnerability of fast-fashion businesses to global trade policy changes and the inherent unpredictability of international markets. Key takeaways include the crucial role of trade policy in shaping the global fast-fashion landscape and Shein’s need for agile adaptation. The future of Shein’s London IPO remains uncertain, highlighting the crucial role of trade policy in shaping the global fast fashion landscape. Stay tuned for updates on this developing story and its effect on Shein's global ambitions.

Featured Posts

-

2025 Fox And Espns New Standalone Streaming Services Unveiled

May 04, 2025

2025 Fox And Espns New Standalone Streaming Services Unveiled

May 04, 2025 -

Me T Department Issues Weather Alert For West Bengal High Tide And Temperature During Holi

May 04, 2025

Me T Department Issues Weather Alert For West Bengal High Tide And Temperature During Holi

May 04, 2025 -

Belfast Hospital Hammer Incident Ex Soldiers Violent Act

May 04, 2025

Belfast Hospital Hammer Incident Ex Soldiers Violent Act

May 04, 2025 -

Cusmas Fate Carney And Trumps Crucial Meeting

May 04, 2025

Cusmas Fate Carney And Trumps Crucial Meeting

May 04, 2025 -

Utrechts Wastewater Plant Unveils Groundbreaking Heat Pump Technology

May 04, 2025

Utrechts Wastewater Plant Unveils Groundbreaking Heat Pump Technology

May 04, 2025

Latest Posts

-

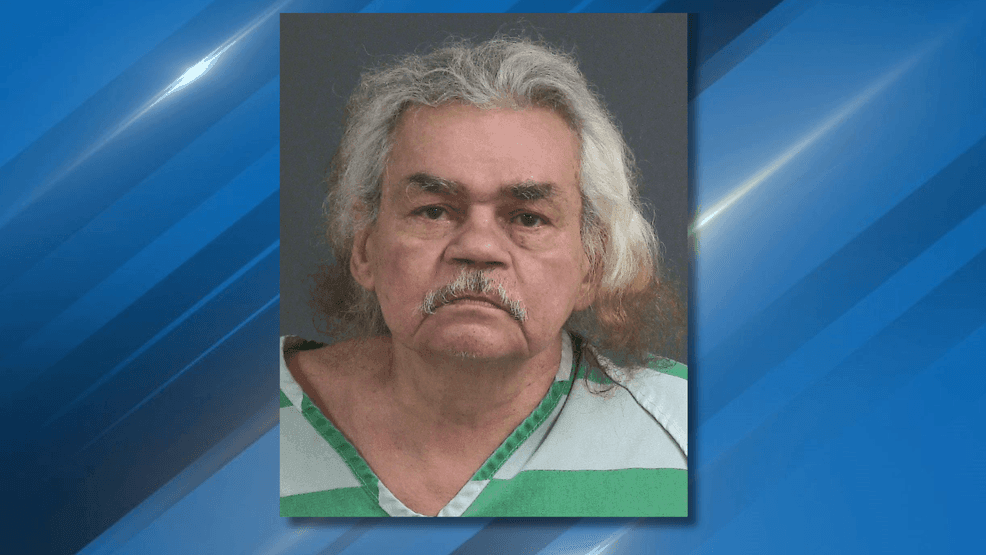

Murder Charge Filed Against Stepfather Alleged Torture And Starvation Of 16 Year Old Stepson Led To Death

May 04, 2025

Murder Charge Filed Against Stepfather Alleged Torture And Starvation Of 16 Year Old Stepson Led To Death

May 04, 2025 -

16 Year Old Stepsons Death Stepfather Arrested Accused Of Murder Torture And Starvation

May 04, 2025

16 Year Old Stepsons Death Stepfather Arrested Accused Of Murder Torture And Starvation

May 04, 2025 -

Stepfather Faces Murder Charge In Stepsons Death Allegations Of Torture Starvation And Assault

May 04, 2025

Stepfather Faces Murder Charge In Stepsons Death Allegations Of Torture Starvation And Assault

May 04, 2025 -

16 Year Olds Torture Death Mother Faces Criminal Neglect Charges

May 04, 2025

16 Year Olds Torture Death Mother Faces Criminal Neglect Charges

May 04, 2025 -

Mother Charged In 16 Year Olds Torture Murder Criminal Neglect Allegations

May 04, 2025

Mother Charged In 16 Year Olds Torture Murder Criminal Neglect Allegations

May 04, 2025