USD/CAD Exchange Rate: Trump's Influence On Canadian Dollar

Table of Contents

Trump's Trade Policies and their Effect on the USD/CAD

Trump's "America First" approach significantly impacted the USD/CAD exchange rate, primarily through his trade policies. The renegotiation of NAFTA and the imposition of tariffs created uncertainty and volatility in the currency markets.

NAFTA Renegotiation (USMCA): A Trade Agreement's Impact on USD/CAD Volatility

The renegotiation of the North American Free Trade Agreement (NAFTA) into the United States-Mexico-Canada Agreement (USMCA) generated considerable uncertainty for the Canadian economy. The prolonged negotiations and threats of withdrawal created volatility in the USD/CAD exchange rate.

- Changes: The USMCA introduced changes to dispute resolution mechanisms, intellectual property rights, and labor provisions, all of which impacted trade flows between the US and Canada.

- Market Reactions: The Canadian dollar experienced periods of both appreciation and depreciation during the negotiation process, reflecting market uncertainty about the final outcome.

- Short-term and long-term consequences: While some argue the USMCA ultimately provided more stability than the initial fear suggested, the uncertainty during the negotiation period undeniably impacted the USD/CAD exchange rate, causing short-term volatility and influencing long-term investor sentiment. The overall long-term impact is still being assessed by economists.

Tariffs and Trade Disputes: A Direct Impact on the USD/CAD Fluctuations

Trump's administration imposed tariffs on various Canadian goods, including lumber and aluminum. These tariffs ignited trade disputes and negatively impacted Canadian exports, influencing the USD/CAD exchange rate.

- Examples of specific tariffs: Tariffs on Canadian softwood lumber led to retaliatory measures from Canada, further impacting bilateral trade and creating USD/CAD fluctuations.

- Canadian responses: Canada responded with counter-tariffs, escalating the trade war and adding to the uncertainty in the currency markets.

- Impact on specific sectors: The lumber and aluminum industries in Canada were significantly affected by these tariffs, leading to job losses and reduced economic activity, ultimately impacting the Canadian dollar.

Impact on Canadian Exports and Economic Growth: A Weakening CAD?

Trump's trade policies significantly impacted key Canadian export sectors, such as energy and agriculture, affecting overall economic growth and influencing the CAD.

- Statistics on export volumes: Data revealed a decrease in Canadian exports to the US during periods of heightened trade tensions, which negatively impacted GDP growth.

- GDP growth: The slowdown in export-oriented sectors contributed to slower GDP growth in Canada, leading to a weaker Canadian dollar relative to the US dollar.

- Investor sentiment: Negative investor sentiment toward the Canadian economy, fueled by trade uncertainty, further contributed to the weakening of the CAD.

Trump's Domestic Policies and their Ripple Effect on the USD/CAD

Trump's domestic policies, particularly those related to interest rates and economic growth, also indirectly influenced the USD/CAD exchange rate.

US Interest Rate Policy: The Federal Reserve's Influence

The Federal Reserve's interest rate decisions under Trump's administration directly affected the value of the US dollar and, consequently, the USD/CAD rate.

- Specific interest rate changes: The Federal Reserve's actions, including both interest rate hikes and cuts, influenced the attractiveness of the US dollar as an investment, thereby affecting its value against the CAD.

- Market responses: Changes in interest rates often triggered immediate reactions in the currency markets, with the USD/CAD exchange rate moving in response to these policy shifts.

- Analysis of monetary policy: The overall monetary policy environment under Trump, while aiming for economic growth, contributed to the fluctuations in the USD/CAD rate.

US Economic Growth and Investor Confidence: A Strong USD and Weak CAD?

The performance of the US economy under Trump's administration affected investor confidence and capital flows, influencing the USD/CAD exchange rate.

- Economic growth data: Periods of strong US economic growth generally led to increased demand for the US dollar, strengthening it relative to the Canadian dollar.

- Stock market performance: A robust US stock market tended to attract foreign investment, further boosting the value of the US dollar.

- Foreign investment trends: Investor confidence in the US economy influenced capital flows, with increased investment leading to a stronger US dollar.

Geopolitical Factors and Trump's Role in Shaping the USD/CAD

Trump's foreign policy also played a role in shaping the USD/CAD exchange rate by impacting global market stability.

Trump's Foreign Policy and its Impact on Global Markets: Uncertainty and Volatility

Trump's unconventional approach to international relations, characterized by protectionist trade policies and unpredictable diplomatic maneuvers, introduced significant uncertainty into global markets and thus influenced the USD/CAD.

- Examples of specific foreign policy decisions and their market impact: For example, Trump's withdrawal from international agreements or his confrontational stance toward certain countries created uncertainty and volatility in global financial markets, influencing currency exchange rates, including the USD/CAD.

- Citing news sources: Numerous financial news outlets reported on the correlation between Trump's foreign policy actions and the subsequent shifts in the USD/CAD exchange rate.

Conclusion: The Lasting Legacy of Trump's Influence on the USD/CAD Exchange Rate

Trump's presidency left a lasting impact on the USD/CAD exchange rate, primarily through his trade policies, domestic economic management, and foreign policy actions. The renegotiation of NAFTA, imposition of tariffs, and shifts in US interest rates all contributed to periods of significant volatility. His "America First" approach created uncertainty, influencing investor sentiment and capital flows, thereby impacting the Canadian dollar. While some effects were short-lived, others continue to shape the economic relationship between the US and Canada and remain factors in understanding future USD/CAD trends.

Key takeaways: Trump's policies significantly influenced USD/CAD volatility, primarily due to trade disputes and fluctuating investor confidence. The long-term impacts are still unfolding.

Future outlook: The lingering effects of Trump's policies on the bilateral relationship and the global economic landscape will continue to influence the USD/CAD exchange rate in the coming years. The current geopolitical climate and ongoing economic uncertainties will play a significant role in shaping future trends.

Call to action: Stay informed on the ever-changing USD/CAD exchange rate and its sensitivity to global political and economic climates. Learn more about managing currency risk and understanding the factors influencing this crucial currency pair.

Featured Posts

-

The Road To Six Nations 2025 Frances Rugby Ambitions

May 02, 2025

The Road To Six Nations 2025 Frances Rugby Ambitions

May 02, 2025 -

Rolls Royce 2025 Forecast Tariffs Pose No Significant Threat

May 02, 2025

Rolls Royce 2025 Forecast Tariffs Pose No Significant Threat

May 02, 2025 -

2024 Open Ai Developer Event New Tools For Voice Assistant Development

May 02, 2025

2024 Open Ai Developer Event New Tools For Voice Assistant Development

May 02, 2025 -

Daily Lotto Results For Tuesday 15th April 2025

May 02, 2025

Daily Lotto Results For Tuesday 15th April 2025

May 02, 2025 -

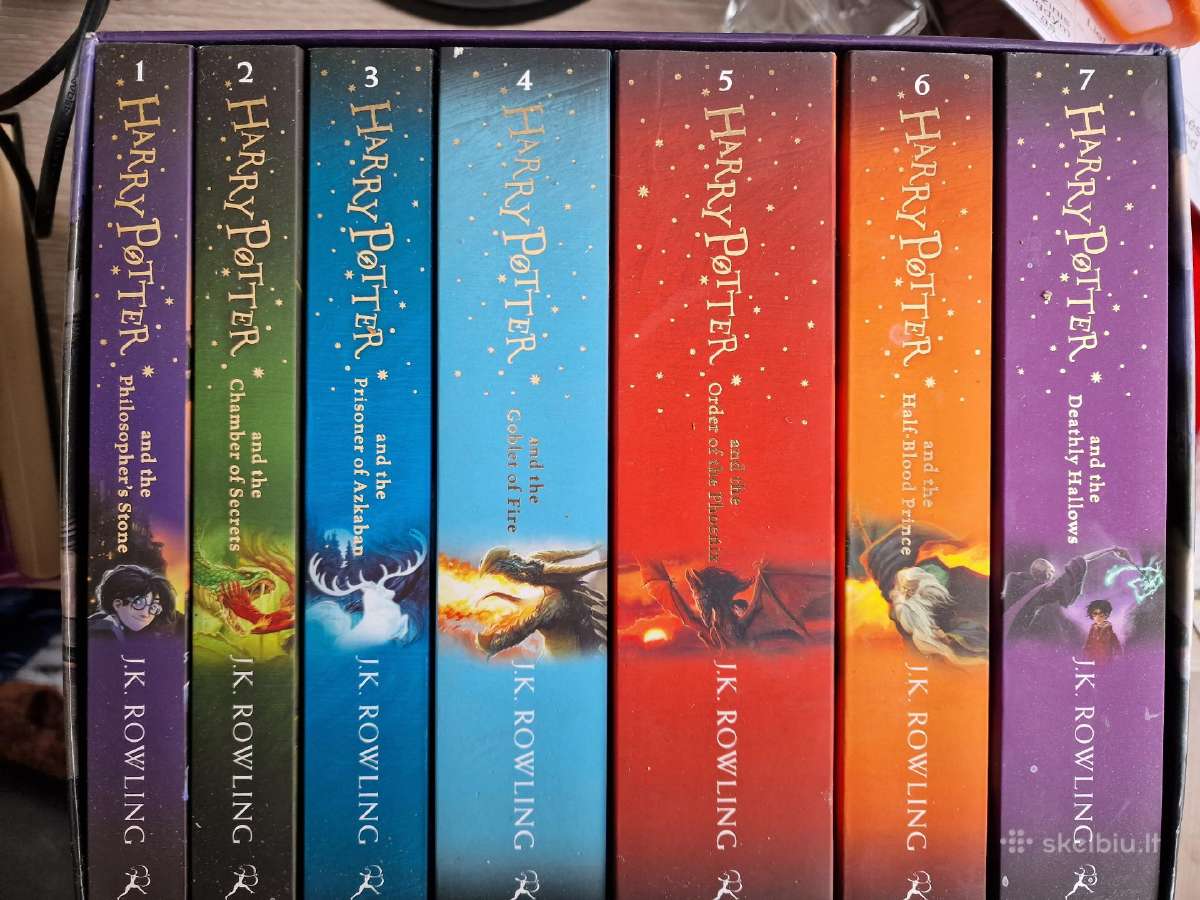

2027 Metai Laukiama Hario Poterio Parko Sanchajuje Atidarymo

May 02, 2025

2027 Metai Laukiama Hario Poterio Parko Sanchajuje Atidarymo

May 02, 2025