Vatican Defrauded: London Real Estate Deal Ruled Fraudulent By British Court

Table of Contents

The Controversial London Property Deal

The deal centered around a luxury property located in [Specific London Location, e.g., Mayfair], valued at approximately [Value in USD or GBP]. The Vatican, through [Specific Vatican entity, e.g., APSA, the Administration of the Patrimony of the Apostolic See], initially invested [Amount] in the property, working with a network of brokers and intermediaries. The investment, intended as a sound financial opportunity, quickly became embroiled in controversy.

Several suspicious aspects of the deal raised red flags:

- Inflated Property Valuation: Evidence suggests the property was significantly overvalued, inflating the Vatican's initial investment and potentially masking illicit financial activity.

- Lack of Transparency in Financial Transactions: Financial records related to the transaction were reportedly incomplete and obfuscated, hindering proper due diligence and oversight.

- Potential Conflicts of Interest among Brokers: Allegations of conflicts of interest among the brokers involved in the deal further clouded the transaction's legitimacy. Multiple parties potentially profited from the inflated valuation.

- Evidence of Bribery or Corruption: Court documents hinted at the possibility of bribery or corruption, with payments made to individuals to facilitate the deal and ensure favorable outcomes.

The British Court's Ruling

The British court, after a thorough review of evidence, including witness testimonies and financial documents, delivered a damning verdict, declaring the London real estate deal fraudulent. The court’s decision was based on [mention specific legal grounds, e.g., breach of contract, misrepresentation, and fraud].

Key aspects of the court's decision include:

- Specific Charges Found to be Proven: The court found [Specific charges, e.g., fraudulent misrepresentation, conspiracy to defraud] to be proven beyond a reasonable doubt.

- Financial Penalties Imposed: Significant financial penalties were levied against [parties involved, e.g., brokers, intermediaries], aiming to recover some of the Vatican's losses.

- Potential Criminal Investigations: The ruling opens the door for potential criminal investigations into individuals involved, potentially leading to further legal repercussions.

- Impact on the Reputation of Involved Parties: The reputational damage to those involved, including the brokers and potentially Vatican officials, is significant and far-reaching.

The Vatican's Response and Internal Investigations

The Vatican issued a statement acknowledging the court's ruling, expressing [Vatican's stated sentiment, e.g., disappointment, commitment to transparency]. While the statement expressed a commitment to recovering funds and holding those responsible accountable, the specific details regarding internal investigations remain largely undisclosed.

Potential consequences for the Vatican include:

- Reputational Damage: The scandal severely damages the Vatican's reputation, particularly regarding its financial transparency and management.

- Financial Losses: Beyond the direct financial losses from the fraudulent deal, the scandal could lead to further financial difficulties and diminished trust from investors.

- Increased Scrutiny of Financial Practices: The Vatican's financial practices will undoubtedly face increased scrutiny from international bodies and financial watchdogs.

- Potential Legal Repercussions Beyond This Case: This case may set a precedent for further legal challenges and investigations into other Vatican financial dealings.

Implications for Future Vatican Investments

This landmark case of Vatican real estate fraud has significant long-term implications for the Holy See’s future investments. The need for enhanced due diligence processes is paramount. Moving forward, the Vatican must implement stricter vetting procedures for brokers and intermediaries, demand complete transparency in financial transactions, and establish stronger internal controls. The increased need for accountability and transparency in all aspects of Vatican finances cannot be overstated. This scandal necessitates a fundamental shift in how the Vatican approaches investments, prioritizing ethical considerations and robust risk management.

Conclusion

The British court's ruling on the fraudulent London real estate deal involving the Vatican exposes serious vulnerabilities in the Holy See's financial management. This case highlights the need for greater transparency and accountability in the Vatican's investment practices to prevent similar scandals in the future. The repercussions extend beyond financial losses, impacting the Vatican's reputation and potentially leading to significant internal reforms.

Call to Action: Stay informed about the ongoing developments in this landmark case of Vatican real estate fraud. Follow our updates for further analysis and insights into the evolving implications for the Holy See's financial future. Understanding the intricacies of this scandal is crucial for comprehending the evolving landscape of Vatican finance.

Featured Posts

-

Can Trumps Tax Cuts Survive Republican Infighting

Apr 29, 2025

Can Trumps Tax Cuts Survive Republican Infighting

Apr 29, 2025 -

Move Over Quinoa Introducing The Next Big Health Food

Apr 29, 2025

Move Over Quinoa Introducing The Next Big Health Food

Apr 29, 2025 -

Musks X Debt A Financial Performance Review Post Sale

Apr 29, 2025

Musks X Debt A Financial Performance Review Post Sale

Apr 29, 2025 -

Papal Conclave Debate Over Convicted Cardinals Voting Eligibility

Apr 29, 2025

Papal Conclave Debate Over Convicted Cardinals Voting Eligibility

Apr 29, 2025 -

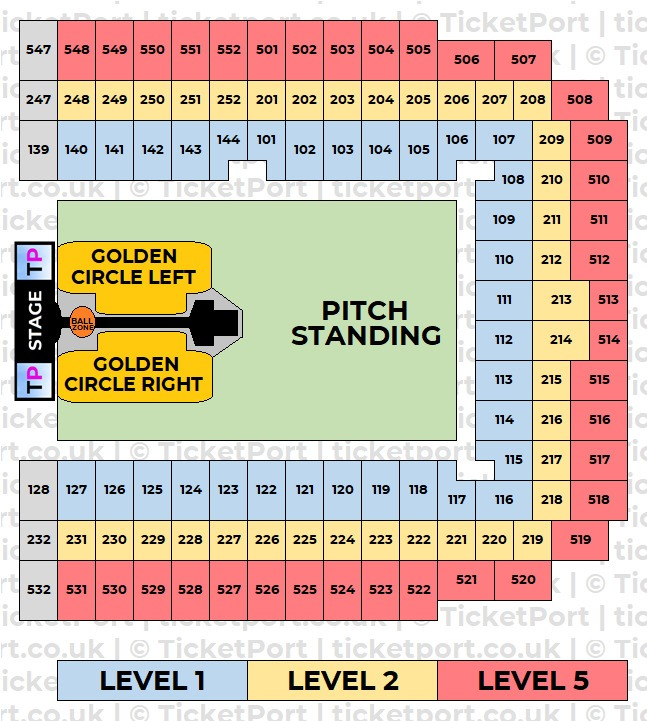

Capital Summertime Ball 2025 How To Buy Tickets Successfully

Apr 29, 2025

Capital Summertime Ball 2025 How To Buy Tickets Successfully

Apr 29, 2025

Latest Posts

-

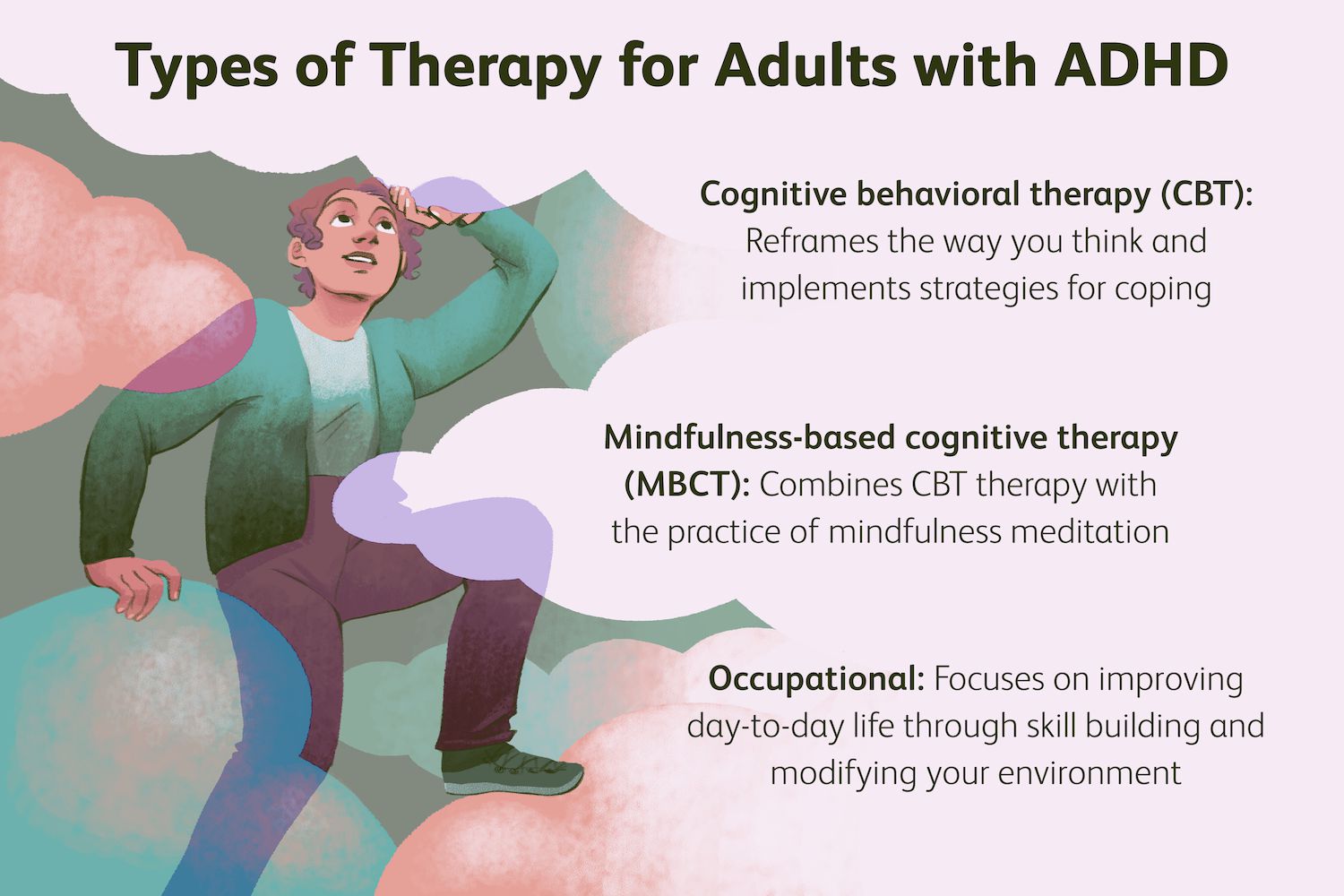

Adhd Management The Power Of Group Support

Apr 29, 2025

Adhd Management The Power Of Group Support

Apr 29, 2025 -

Capital Summertime Ball 2025 Tickets A Step By Step Guide Braintree And Witham

Apr 29, 2025

Capital Summertime Ball 2025 Tickets A Step By Step Guide Braintree And Witham

Apr 29, 2025 -

Finding Capital Summertime Ball 2025 Tickets In Braintree And Witham

Apr 29, 2025

Finding Capital Summertime Ball 2025 Tickets In Braintree And Witham

Apr 29, 2025 -

Braintree And Witham Your Guide To Capital Summertime Ball 2025 Tickets

Apr 29, 2025

Braintree And Witham Your Guide To Capital Summertime Ball 2025 Tickets

Apr 29, 2025 -

Capital Summertime Ball 2025 Ticket Information For Braintree And Witham

Apr 29, 2025

Capital Summertime Ball 2025 Ticket Information For Braintree And Witham

Apr 29, 2025