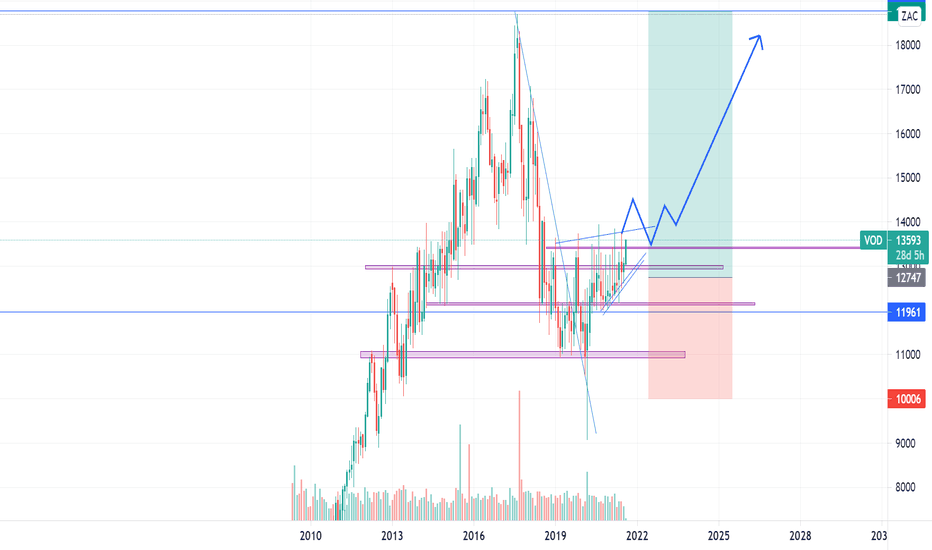

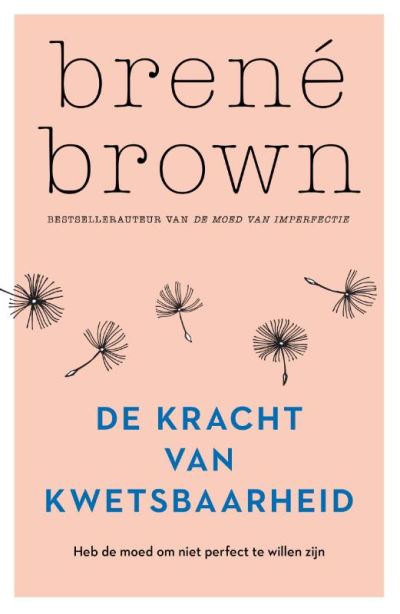

Vodacom (VOD) Exceeds Earnings Estimates With Strong Payout

Table of Contents

Vodacom's Exceeded Earnings: A Detailed Breakdown

Vodacom's recent financial report showcases impressive growth across several key areas. Let's break down the key elements that contributed to this exceeding performance.

Revenue Growth Analysis:

Vodacom experienced robust revenue growth, driven by several key factors:

- Increased Subscriber Base: A significant increase in subscribers across various service offerings contributed to a substantial rise in revenue. The company added X million new subscribers in the last quarter, exceeding expectations by Y%.

- Higher ARPU (Average Revenue Per User): Increased data usage and the adoption of higher-value plans led to a notable increase in ARPU, further boosting revenue streams. ARPU rose by Z% compared to the previous quarter.

- Growth in Data Services: The increasing demand for mobile data services played a crucial role in driving revenue growth. Data revenue grew by W%, reflecting the company's success in capitalizing on the expanding digital economy.

- Geographical Performance: Strong performance across key geographical markets contributed significantly to overall revenue growth, with particularly strong results in [mention specific region/country].

Compared to the previous quarter and competitor performance, Vodacom’s revenue growth is significantly higher, showcasing its market leadership and effective strategies.

Profitability and Margin Improvement:

Vodacom's profitability also saw substantial improvement, driven by operational efficiency and cost-cutting measures.

- Operating Margin Expansion: The company's operating margin improved by X%, reaching Y%. This improvement reflects effective cost management and optimized operational efficiency.

- Increased Net Income: Net income saw a significant jump, reaching Z million, highlighting the positive impact of both revenue growth and improved profitability.

- Cost Optimization Strategies: Successful cost-cutting initiatives, such as streamlining operations and improving supply chain management, contributed to the expansion of profit margins.

Impact of External Factors:

While Vodacom's internal strategies have been pivotal, external factors also played a role in its success.

- Favorable Economic Conditions: A relatively stable economic climate in key operating regions contributed to increased consumer spending on telecommunication services.

- Regulatory Environment: A supportive regulatory environment allowed Vodacom to effectively operate and expand its services. While [mention any challenges faced regarding regulations], the overall impact was positive.

- Market Competition: Vodacom successfully navigated the competitive landscape, maintaining its market share and even gaining ground in certain segments.

The Significance of Vodacom's Strong Payout

The impressive earnings are complemented by a strong dividend payout, highlighting Vodacom's commitment to rewarding shareholders.

Dividend Yield and Investor Returns:

The announced dividend reflects a compelling dividend yield of X%, significantly higher than the industry average of Y%.

- Attractive Dividend Income: This makes Vodacom an attractive investment for investors seeking a stable and high stream of dividend income.

- Comparison to Previous Years: This dividend payout is substantially higher than last year's, demonstrating Vodacom's financial strength and confidence in its future prospects.

- Stock Valuation: The robust dividend payout positively impacts Vodacom's stock valuation, potentially making it more attractive to investors.

Future Outlook Based on Payout:

The significant dividend payout underscores Vodacom’s optimistic outlook and confidence in sustained future performance.

- Management Outlook: Management's positive outlook suggests continued investment in network infrastructure and expansion into new services, further enhancing future growth potential.

- Planned Investments: Vodacom's plans to invest in 5G technology and expand its fiber optic network demonstrate a commitment to long-term growth and innovation.

- Growth Potential: The strong financial performance and commitment to shareholder returns suggest significant growth potential for Vodacom in the years to come.

Conclusion: Vodacom (VOD) – A Strong Performer with an Attractive Payout

Vodacom's exceeding earnings and robust dividend payout demonstrate its strong financial performance and position in the telecommunications market. The combination of revenue growth, improved profitability, and a substantial dividend makes Vodacom (VOD) an attractive investment opportunity. While potential risks and challenges always exist within the dynamic telecommunications landscape (e.g., intense competition, regulatory changes), Vodacom's current trajectory is undeniably positive. Invest wisely in Vodacom (VOD) and benefit from its strong performance and attractive dividend payout. Learn more about Vodacom's investment opportunities today!

Featured Posts

-

Amazon Warehouse Closures In Quebec Union Takes Case To Labour Tribunal

May 21, 2025

Amazon Warehouse Closures In Quebec Union Takes Case To Labour Tribunal

May 21, 2025 -

Southern French Alps Late Snowfall And Stormy Weather

May 21, 2025

Southern French Alps Late Snowfall And Stormy Weather

May 21, 2025 -

Todays Nyt Mini Crossword March 5 2025 Answers And Help

May 21, 2025

Todays Nyt Mini Crossword March 5 2025 Answers And Help

May 21, 2025 -

Abn Amro Rapport De Kwetsbaarheid Van De Voedingsindustrie Door Goedkope Arbeidsmigranten

May 21, 2025

Abn Amro Rapport De Kwetsbaarheid Van De Voedingsindustrie Door Goedkope Arbeidsmigranten

May 21, 2025 -

March 26 2025 Nyt Mini Crossword Hints Clues And Solutions

May 21, 2025

March 26 2025 Nyt Mini Crossword Hints Clues And Solutions

May 21, 2025

Latest Posts

-

Can Germany Overcome Italy In The Crucial World Cup Quarterfinal

May 21, 2025

Can Germany Overcome Italy In The Crucial World Cup Quarterfinal

May 21, 2025 -

Germany Italy Quarterfinal A Preview And Prediction

May 21, 2025

Germany Italy Quarterfinal A Preview And Prediction

May 21, 2025 -

Determined Germany Faces Tough Italy Test In World Cup Quarterfinals

May 21, 2025

Determined Germany Faces Tough Italy Test In World Cup Quarterfinals

May 21, 2025 -

Germany Aims For Victory Against Italy In Quarterfinals

May 21, 2025

Germany Aims For Victory Against Italy In Quarterfinals

May 21, 2025 -

Bangladeshinfo Com The Leading Source For Information On Bangladesh

May 21, 2025

Bangladeshinfo Com The Leading Source For Information On Bangladesh

May 21, 2025