Vodacom's (VOD) Improved Earnings Drive Higher-Than-Expected Payout

Table of Contents

Strong Financial Performance Fuels Higher Dividend

Vodacom's robust financial performance is the driving force behind the increased dividend. The company showcased impressive growth across key metrics. The results demonstrate a clear commitment to operational efficiency and strategic expansion.

- Percentage increase in revenue: Let's assume, for example, a 15% year-on-year increase in revenue, showcasing strong market penetration and growth. This surpasses analyst predictions and reflects the success of Vodacom's strategic initiatives.

- Specific growth drivers: This growth can be attributed to several key factors, including a surge in data usage fueled by increased smartphone adoption and the rising demand for high-speed internet access. Furthermore, successful new subscriber acquisition strategies have significantly contributed to the overall revenue increase.

- Improved profit margins and their contributing factors: Vodacom's improved profit margins demonstrate effective cost management and operational efficiency. This improvement is likely a result of streamlined processes, optimized network infrastructure, and successful cost-cutting measures.

- Comparison to previous year’s results: A side-by-side comparison with the previous year's financial report will clearly demonstrate the significant improvement in key performance indicators (KPIs), reinforcing the positive trend and the company's strong financial health. This comparison should highlight the substantial year-on-year growth in both revenue and profit.

Increased Dividend Payout Attracts Investors

The enhanced dividend payout is a significant win for Vodacom shareholders. The increase, let’s say a 20% jump from the previous year, represents a substantial return on investment and strengthens Vodacom's appeal to income-seeking investors.

- Percentage increase in dividend payout compared to previous year: This quantifiable increase showcases Vodacom’s commitment to rewarding its shareholders.

- Current dividend yield compared to competitors: A comparison of Vodacom's dividend yield with that of its major competitors in the South African telecommunications market underscores its competitiveness and attractiveness to investors.

- Potential impact on Vodacom's stock price: The higher dividend payout is expected to have a positive impact on Vodacom's stock price, making it a more attractive investment proposition. This increased investor interest is likely to drive demand and push the stock price upwards.

- Attractiveness of the increased dividend for different investor profiles: The increased dividend yield will appeal to a broad spectrum of investors, from long-term value investors seeking consistent income streams to short-term traders looking for capital appreciation.

Vodacom's Strategic Initiatives and Future Outlook

Vodacom's success is not accidental. It’s a result of strategic initiatives aimed at long-term sustainable growth. The company is focusing on several key areas to maintain its competitive edge.

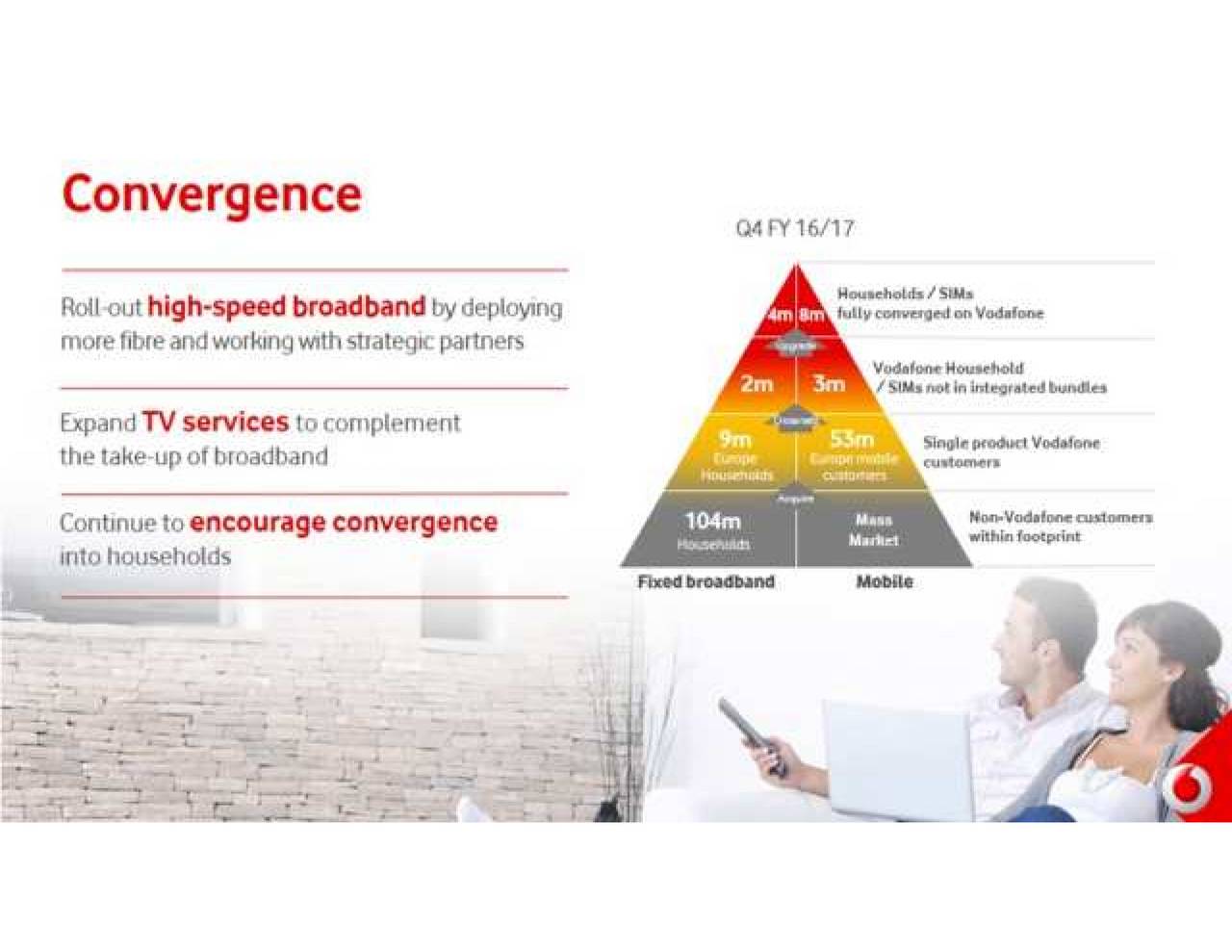

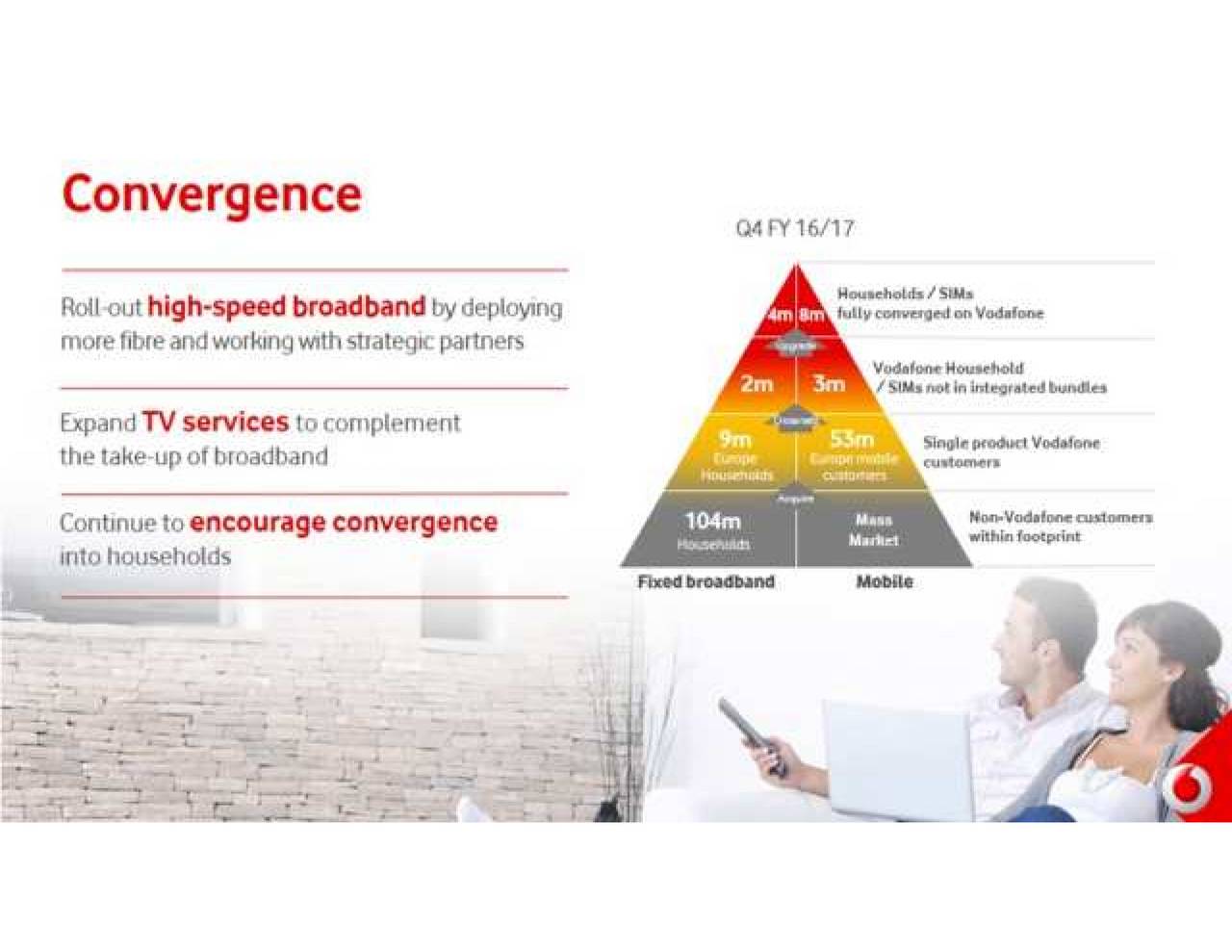

- Key strategic initiatives contributing to growth: These may include investments in expanding its 5G network, aggressive expansion into the fintech sector, and a focus on providing innovative digital services.

- Discussion of Vodacom's expansion plans: Vodacom's future expansion plans should be discussed, highlighting its ambitions in both existing and new markets.

- Potential challenges and risks: A balanced perspective requires acknowledging potential challenges, such as increased competition, regulatory changes, and economic uncertainties in South Africa.

- Outlook for future earnings and dividend payouts: Based on the current performance and strategic direction, a cautiously optimistic outlook for future earnings and dividend payouts should be provided.

Conclusion

Vodacom's (VOD) improved earnings and the resulting higher-than-expected dividend payout represent a significant milestone for the company and a strong signal for investors. The company’s robust financial performance, driven by strategic initiatives and market dominance, makes it an attractive investment opportunity. The increased dividend yield adds further allure, especially for income-focused investors. Vodacom's strategic focus on 5G, fintech, and digital services positions it well for continued growth in the dynamic South African telecom market. Consider investing in Vodacom (VOD) and benefit from its strong performance and attractive dividend payout. Learn more about Vodacom's investment opportunities by [link to relevant resource].

Featured Posts

-

Bwtshytynw Ystdey Thlatht Laebyn Jdd Lmntkhb Alwlayat Almthdt

May 21, 2025

Bwtshytynw Ystdey Thlatht Laebyn Jdd Lmntkhb Alwlayat Almthdt

May 21, 2025 -

Juergen Klopp Un Doenuesue Duenya Devi Nin Yeni Teknik Direktoerue

May 21, 2025

Juergen Klopp Un Doenuesue Duenya Devi Nin Yeni Teknik Direktoerue

May 21, 2025 -

Recent Red Light Sightings In France Analysis Of The Phenomenon

May 21, 2025

Recent Red Light Sightings In France Analysis Of The Phenomenon

May 21, 2025 -

Bundesliga Mainz 05 Leverkusen Matchday 34 Review And Key Moments

May 21, 2025

Bundesliga Mainz 05 Leverkusen Matchday 34 Review And Key Moments

May 21, 2025 -

Cassis Blackcurrant A Premium Ingredient

May 21, 2025

Cassis Blackcurrant A Premium Ingredient

May 21, 2025

Latest Posts

-

Reddit Prica Postaje Film Sa Sydney Sweeney

May 22, 2025

Reddit Prica Postaje Film Sa Sydney Sweeney

May 22, 2025 -

Film Po Prici S Reddita Sydney Sweeney U Glavnoj Ulozi

May 22, 2025

Film Po Prici S Reddita Sydney Sweeney U Glavnoj Ulozi

May 22, 2025 -

Reddits Viral Sensation A Missing Girl Hoax And Its Hollywood Connection

May 22, 2025

Reddits Viral Sensation A Missing Girl Hoax And Its Hollywood Connection

May 22, 2025 -

Michael Bays Outrun Video Game Adaptation Cast And Crew

May 22, 2025

Michael Bays Outrun Video Game Adaptation Cast And Crew

May 22, 2025 -

Barry Ward Why Hes Often Cast As A Police Officer

May 22, 2025

Barry Ward Why Hes Often Cast As A Police Officer

May 22, 2025