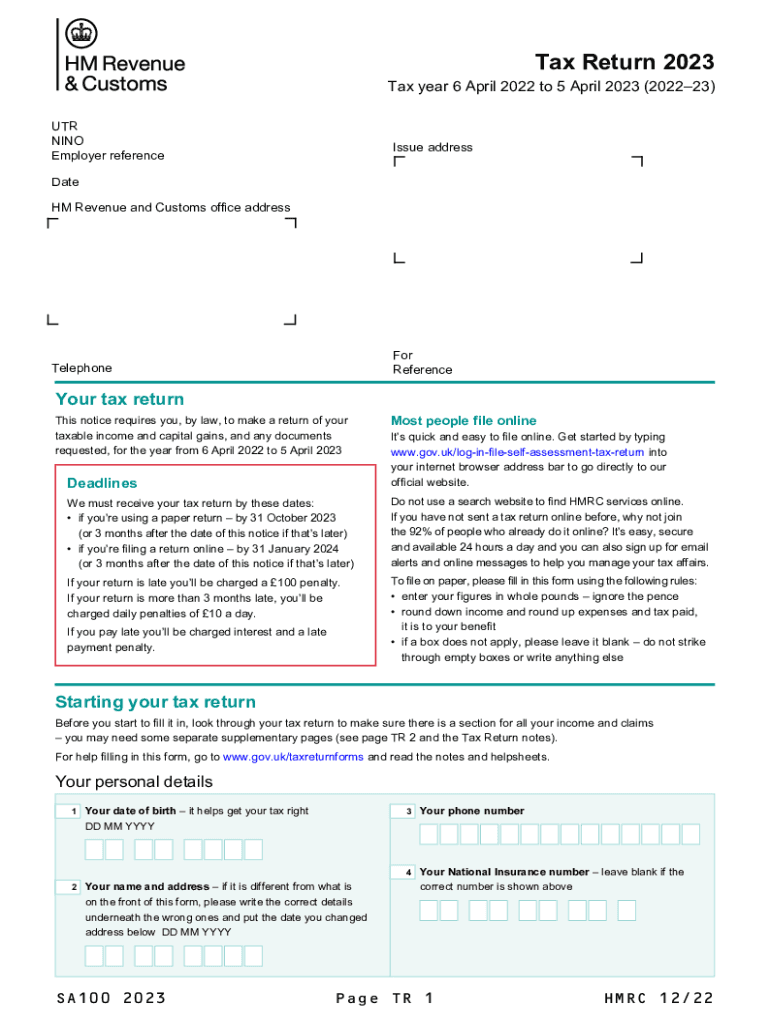

Voice Recognition Technology Improves HMRC Call Efficiency

Table of Contents

Faster Call Handling & Reduced Wait Times

Voice recognition technology is dramatically improving HMRC call handling and slashing wait times. The system works by intelligently routing calls based on the caller's spoken words, instantly identifying the nature of their enquiry. This automated call routing, powered by sophisticated keyword and intent recognition, significantly reduces the time spent navigating phone menus.

-

Automated call routing based on keywords and intent: The system analyzes the caller's speech to identify key terms and understand their needs, instantly directing them to the appropriate agent or self-service option. This eliminates the need for lengthy menu navigation, saving valuable time for both the caller and the HMRC agent.

-

Immediate access to relevant taxpayer information: Integrated with HMRC databases, the voice recognition system can quickly access a taxpayer's details using their unique identifier, such as National Insurance number. This immediate access to relevant information allows agents to address queries more efficiently, reducing handling time.

-

Self-service options via voice commands (e.g., checking tax return status): Taxpayers can utilize voice commands to access information independently, such as checking the status of their tax return or obtaining payment details. This 24/7 availability of self-service options significantly reduces the volume of calls handled by agents.

-

Reduced need for extensive agent training on complex procedures: By automating many routine tasks, voice recognition technology frees up agents to focus on more complex issues, reducing the need for extensive training on various procedures. This also allows for more efficient resource allocation within the HMRC call center. Keywords: HMRC call handling, call routing, automated call routing, wait times, self-service, call efficiency, voice command

Improved Accuracy & Reduced Errors

Human error is a significant factor in call center operations. Voice recognition technology minimizes this by accurately transcribing taxpayer information and interpreting complex tax queries. This results in fewer errors and improves overall data accuracy.

-

Accurate transcription of taxpayer information: The system accurately captures and transcribes taxpayer information, minimizing the risk of data entry errors that can lead to delays and frustrations.

-

Minimized data entry errors leading to fewer corrections and appeals: Fewer errors mean less time spent on corrections and fewer appeals, enhancing efficiency and freeing up resources.

-

Improved accuracy in understanding complex tax queries: The system's ability to process nuanced language significantly improves the accuracy of understanding complex tax questions, leading to quicker and more effective resolutions.

-

Enhanced compliance through accurate data capture: Accurate data capture is crucial for compliance. Voice recognition contributes to a more reliable and compliant system, reducing the risk of discrepancies and penalties. Keywords: Data entry errors, accuracy, transcription, compliance, HMRC data, voice recognition accuracy

Enhanced Customer Satisfaction & Experience

Faster call resolution and efficient service directly translate into higher customer satisfaction. Voice recognition technology empowers HMRC to provide a superior taxpayer experience.

-

Quicker resolution of tax queries: By streamlining the call handling process and improving accuracy, voice recognition ensures quicker resolutions to taxpayer queries, leading to increased satisfaction.

-

Improved accessibility for those with disabilities: Voice recognition technology offers improved accessibility for taxpayers with disabilities, providing an alternative to traditional phone menus and improving inclusivity.

-

24/7 availability of self-service options: The constant availability of self-service options via voice commands provides taxpayers with convenient access to information at any time, enhancing their overall experience.

-

Increased taxpayer trust and confidence in HMRC services: Efficient and accurate service builds trust and confidence in HMRC's ability to provide effective tax administration. Keywords: Customer satisfaction, HMRC customer service, taxpayer experience, accessibility, self-service, call resolution

Cost Savings for HMRC

Beyond improved service, voice recognition technology offers significant cost savings for HMRC. By increasing efficiency and automating tasks, it leads to reduced operational expenses and improved resource allocation.

-

Reduced labor costs due to increased agent productivity: Agents can handle more calls in less time, leading to increased productivity and reduced labor costs.

-

Lower operational expenses through automated processes: Automation of routine tasks reduces the need for manual intervention, leading to lower operational expenses.

-

Improved resource allocation: Resources can be reallocated from handling routine tasks to more complex issues, improving overall operational efficiency.

-

Enhanced return on investment (ROI) from technology upgrades: The cost savings generated by increased efficiency and reduced errors contribute to a strong return on investment for the technology upgrades. Keywords: Cost savings, ROI, operational efficiency, resource allocation, HMRC budget, technology investment

Conclusion

Voice recognition technology is significantly improving HMRC call efficiency, leading to faster call handling, reduced errors, enhanced customer satisfaction, and significant cost savings. By embracing this innovative technology, HMRC is streamlining its services, improving taxpayer experiences, and creating a more efficient and effective tax administration system. To learn more about how voice recognition is transforming government services and improving taxpayer interactions, explore the latest advancements in [link to relevant resource]. Invest in improving your HMRC call efficiency with the power of voice recognition technology today!

Featured Posts

-

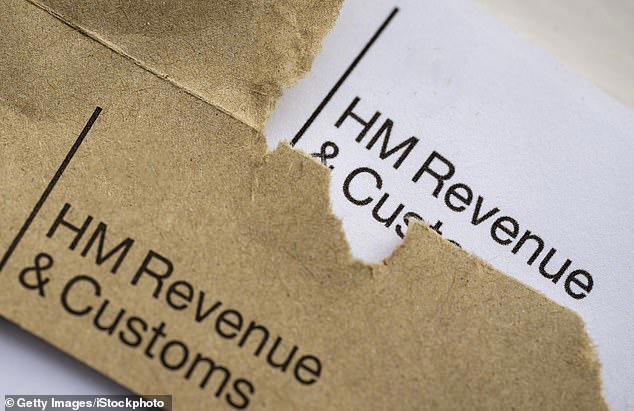

March 22 Nyt Mini Crossword Solutions

May 20, 2025

March 22 Nyt Mini Crossword Solutions

May 20, 2025 -

Millau Dans Les Memoires De Marc Lievremont

May 20, 2025

Millau Dans Les Memoires De Marc Lievremont

May 20, 2025 -

Hmrc Tax Letters What To Do If You Earn Over 23 000 In The Uk

May 20, 2025

Hmrc Tax Letters What To Do If You Earn Over 23 000 In The Uk

May 20, 2025 -

Todays Nyt Mini Crossword Answers For April 2nd

May 20, 2025

Todays Nyt Mini Crossword Answers For April 2nd

May 20, 2025 -

Hmrcs New Side Hustle Tax Rules A Us Style Snooping Scheme

May 20, 2025

Hmrcs New Side Hustle Tax Rules A Us Style Snooping Scheme

May 20, 2025

Latest Posts

-

Conference De Presse 15eme Salon International Du Livre D Abidjan

May 20, 2025

Conference De Presse 15eme Salon International Du Livre D Abidjan

May 20, 2025 -

Salon International Du Livre D Abidjan Lancement De La 15eme Edition

May 20, 2025

Salon International Du Livre D Abidjan Lancement De La 15eme Edition

May 20, 2025 -

Bcr En Action Descentes Surprise Dans Les Marches D Abidjan

May 20, 2025

Bcr En Action Descentes Surprise Dans Les Marches D Abidjan

May 20, 2025 -

Cote D Ivoire La Brigade De Controle Rapide Bcr Sevit Dans Les Marches Abidjanais

May 20, 2025

Cote D Ivoire La Brigade De Controle Rapide Bcr Sevit Dans Les Marches Abidjanais

May 20, 2025 -

Abidjan Controles Inopines De La Bcr Dans Les Marches De La Ville

May 20, 2025

Abidjan Controles Inopines De La Bcr Dans Les Marches De La Ville

May 20, 2025