Voyager Technologies: Space Defense IPO Filing

Table of Contents

Voyager Technologies' Technological Prowess and Market Position

Voyager Technologies boasts cutting-edge technology in space defense, setting it apart from competitors. Its unique selling propositions stem from a commitment to innovation and a strong focus on several key areas within space-based defense. The company's competitive advantage is built upon a foundation of patented technologies, successful product launches, and a rapidly growing market share.

- Patented technology in advanced laser-based missile defense: Voyager Technologies holds several patents for its innovative laser systems designed to neutralize incoming ballistic missiles, offering a significant leap forward in space-based defense capabilities.

- Successful deployment of 15 satellites for early warning systems: The company has successfully deployed a constellation of 15 satellites, providing crucial early warning capabilities against various threats, demonstrating its operational readiness and technological prowess.

- Market leadership in small satellite constellation technology: Voyager Technologies has established itself as a leader in designing, building, and deploying cost-effective small satellite constellations, a crucial element in modern space-based surveillance and defense strategies.

- Strong partnerships with key government agencies and private companies: Voyager Technologies enjoys strong collaborative relationships with leading government agencies and influential private sector companies, providing access to crucial resources and expertise. This network solidifies its position within the industry.

Key Details of the Voyager Technologies IPO Filing

The Voyager Technologies IPO filing provides crucial details for potential investors. While specific figures are subject to change, the preliminary information reveals a significant investment opportunity. The prospectus, filed with the SEC (link to be inserted here once available), provides a comprehensive overview of the offering.

- Expected IPO date: [Insert expected date here, or "To be announced"]

- Number of shares offered: [Insert number of shares here, or "To be announced"]

- Projected share price range: [Insert projected price range here, or "To be announced"]

- Lead underwriters involved: [Insert names of underwriters here, or "To be announced"]

- Use of proceeds: The proceeds from the IPO will primarily be used to fund further research and development (R&D), expand operational capabilities, and potentially reduce existing debt.

Investment Implications and Potential Risks

The space defense sector is experiencing rapid growth, presenting significant investment potential. Voyager Technologies, with its innovative technology and strong market position, is well-placed to capitalize on this growth. However, potential investors should carefully assess the associated risks.

- Potential for high growth in the space defense sector: The increasing demand for sophisticated space-based defense systems presents a significant opportunity for high growth and strong returns.

- Risks associated with investing in a high-growth, emerging market: High-growth markets are inherently volatile. Fluctuations in investor sentiment and unforeseen technological challenges can significantly impact returns.

- Competition from other space defense companies: The space defense industry is becoming increasingly competitive. Voyager Technologies faces competition from established players and emerging startups.

- Dependence on government contracts: A significant portion of Voyager Technologies' revenue may depend on government contracts. Changes in government policy or budget allocations could significantly impact the company's financial performance.

- Technological risks and obsolescence: Rapid technological advancements in the space industry create the risk of obsolescence. Voyager Technologies' continued success depends on its ability to adapt and innovate.

Analyzing Voyager Technologies' Financial Performance

Voyager Technologies' financial statements (to be reviewed once publicly available) will provide a detailed picture of its financial health. Key metrics to analyze include revenue growth, profitability (margins), debt levels, and cash flow. A thorough assessment of these factors is crucial for informed investment decisions. Positive revenue growth, strong profitability, manageable debt levels, and healthy cash flow will indicate a financially sound company with the potential for significant future growth.

Conclusion

Voyager Technologies' IPO filing marks a pivotal moment for the space defense industry. The company’s innovative technology, strong market position, and the potential for high growth in the sector present a compelling investment opportunity. However, potential investors must conduct thorough due diligence, carefully considering the inherent risks associated with investing in a high-growth, emerging market. The details of the IPO, including the projected share price and the use of proceeds, should be carefully reviewed. Remember to consult a financial advisor before making any investment decisions. Voyager Technologies' IPO filing presents a significant opportunity within the exciting world of space defense; seize this opportunity with informed and strategic investment.

Featured Posts

-

Ftc Shifts Focus To Defense In Meta Monopoly Trial

May 18, 2025

Ftc Shifts Focus To Defense In Meta Monopoly Trial

May 18, 2025 -

The Collapse Of Russias Peace Talks Putins Diplomatic Defeat

May 18, 2025

The Collapse Of Russias Peace Talks Putins Diplomatic Defeat

May 18, 2025 -

Months Long Contamination Toxic Chemical Residue From Ohio Train Derailment

May 18, 2025

Months Long Contamination Toxic Chemical Residue From Ohio Train Derailment

May 18, 2025 -

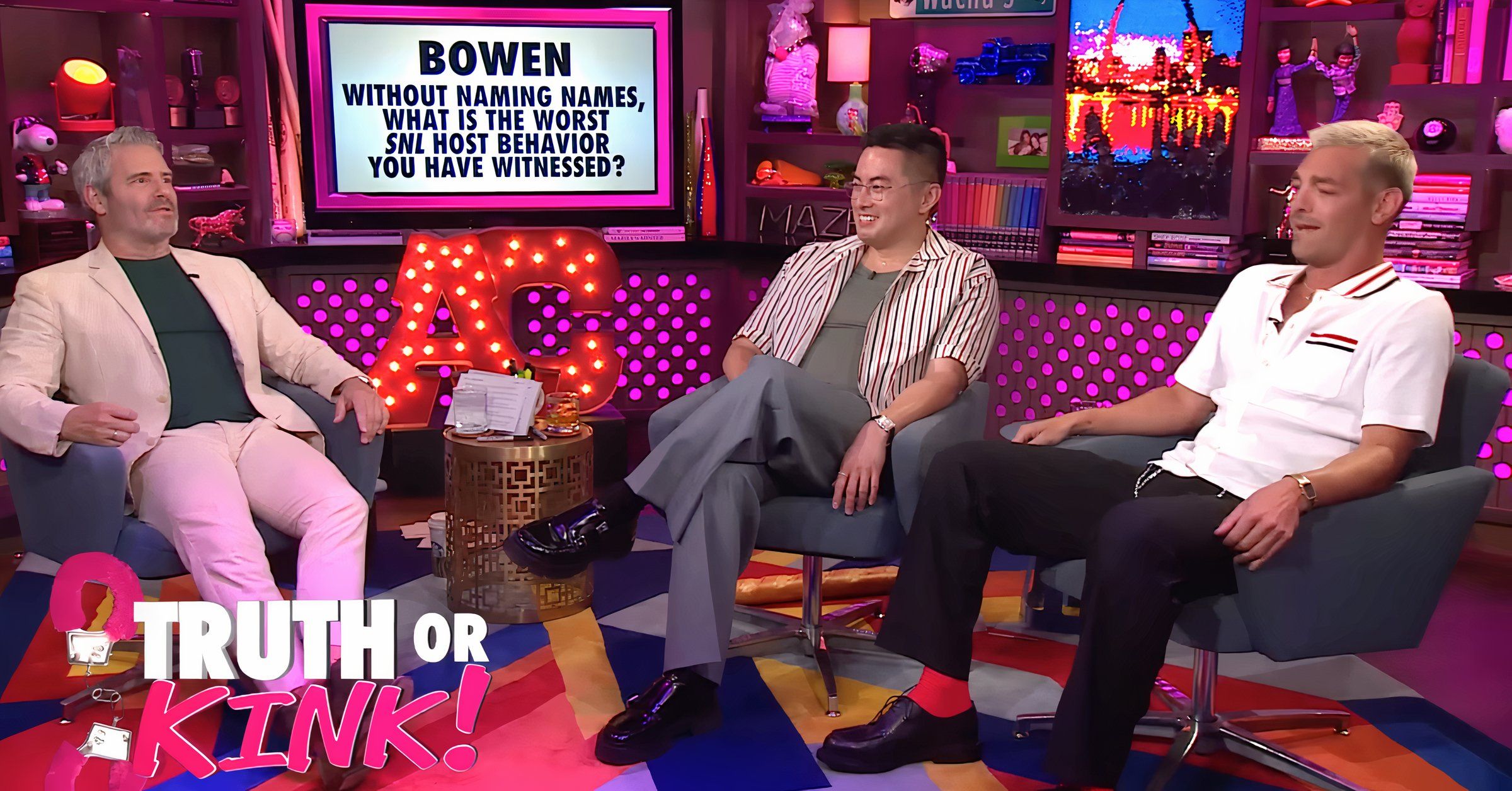

Bowen Yangs Plea Should Snl Embrace Stronger Language

May 18, 2025

Bowen Yangs Plea Should Snl Embrace Stronger Language

May 18, 2025 -

Rain Delayed Game Paris Homer Lifts Angels Over White Sox

May 18, 2025

Rain Delayed Game Paris Homer Lifts Angels Over White Sox

May 18, 2025

Latest Posts

-

Dodgers Conforto A Hernandez Esque Impact

May 18, 2025

Dodgers Conforto A Hernandez Esque Impact

May 18, 2025 -

Confortos Path To Success Following In Hernandezs Footsteps

May 18, 2025

Confortos Path To Success Following In Hernandezs Footsteps

May 18, 2025 -

Dodgers Bet On Conforto Following Hernandezs Success

May 18, 2025

Dodgers Bet On Conforto Following Hernandezs Success

May 18, 2025 -

Pete Crow Reports Cubs Clinch Series With Armstrongs Two Homer Performance

May 18, 2025

Pete Crow Reports Cubs Clinch Series With Armstrongs Two Homer Performance

May 18, 2025 -

Dodgers Vs Cubs Armstrongs Two Home Runs Decide Series

May 18, 2025

Dodgers Vs Cubs Armstrongs Two Home Runs Decide Series

May 18, 2025