Walleye Credit & Commodities: Prioritizing Core Groups For Improved Performance

Table of Contents

Identifying Your Core Groups in Walleye Credit & Commodities

Defining your core groups is the foundational step to optimizing your walleye credit and commodity portfolio. This involves identifying specific segments within the broader market that consistently deliver superior performance and align with your risk tolerance.

Defining "Core Groups":

In the context of walleye credit and commodities, "core groups" represent specific segments offering concentrated opportunities. These could include:

- Geographic Regions: Focusing on specific lakes or regions known for high-quality walleye harvests and stable market demand. For example, focusing on a region with consistent high yields and established buyer networks.

- Buyer/Seller Types: Targeting specific buyers like large processing plants or restaurants with established purchasing power and consistent demand. Understanding the needs and pricing strategies of different buyer types is crucial.

- Commodity Grades: Focusing on specific sizes and qualities of walleye, prioritizing those with the highest market value and consistent demand. This might include focusing on larger, higher-quality fillets versus smaller, less valuable fish.

Key Considerations:

- Analyze historical performance data, including pricing trends, volume, and profitability for each segment.

- Consider your risk tolerance. Diversification across core groups can help mitigate potential losses from any single segment underperforming.

- Evaluate future market projections, taking into account factors like climate change, consumer demand, and potential regulatory changes.

- Develop objective criteria for adding and removing core groups from your portfolio based on predefined metrics.

Optimizing Resource Allocation for Core Groups

Once you’ve identified your core groups, strategically allocating your capital is paramount. This involves directing resources to the most promising segments to maximize returns.

Strategic Investment in Core Walleye Credit & Commodities:

Proportionate capital allocation is key. Don't spread your investments too thinly.

- Develop a robust financial model to project returns and assess risk within each core group. Factor in potential price fluctuations, supply chain disruptions, and operational costs.

- Implement a dynamic allocation strategy. Market conditions change. Be ready to adjust your investments based on real-time data and market signals.

- Explore hedging strategies to protect against unforeseen price drops or market volatility. This could involve futures contracts or other risk mitigation techniques.

- Utilize technology and data analytics. Invest in tools and software that provide real-time market insights, performance monitoring, and risk management capabilities.

Monitoring and Evaluating Performance of Core Groups

Continuous monitoring and evaluation are crucial for maintaining a high-performing portfolio. Regularly assessing your core groups’ performance ensures that you remain on track and can make necessary adjustments.

Key Performance Indicators (KPIs) for Walleye Credit & Commodities:

Tracking key metrics is vital for informed decision-making.

- Regularly review financial statements and operational data for each core group to identify trends and potential issues.

- Track key metrics such as return on investment (ROI), risk-adjusted returns, and market share. Benchmark your performance against industry averages.

- Conduct regular portfolio reviews (e.g., quarterly or annually) to assess progress, identify areas for improvement, and make necessary adjustments to your strategy.

- Implement a system for ongoing monitoring and reporting, using dashboards or other visualization tools to track key metrics and performance trends over time.

Adapting to Market Changes & Emerging Opportunities

The walleye credit and commodity market is dynamic. Staying ahead requires continuous adaptation and a willingness to embrace emerging opportunities.

Staying Ahead in the Dynamic Walleye Credit & Commodities Market:

Proactive adaptation is crucial for long-term success.

- Conduct ongoing market research and competitive analysis to understand shifting market dynamics and identify emerging opportunities.

- Monitor regulatory changes and their impact on your core groups. Stay informed on any new legislation or policies that may affect your investments.

- Stay abreast of technological advancements that impact the walleye industry, such as sustainable fishing practices or improved processing techniques.

- Be prepared to adjust your strategies based on market signals, including changes in consumer demand, environmental factors, or emerging competitors.

Conclusion

Successfully managing walleye credit and commodity investments hinges on identifying and prioritizing core groups. This strategic approach, coupled with effective resource allocation, rigorous performance monitoring, and adaptable strategies, is crucial for maximizing returns and mitigating risk. By focusing on high-performing segments and employing a data-driven approach, you can significantly improve your profitability within the walleye credit & commodities market. Start optimizing your portfolio today! Implement the strategies outlined above to unlock significant opportunities for improved profitability in your walleye credit & commodities investments.

Featured Posts

-

Examining The Ethical Overlap Veganism And Halal Meat Practices

May 13, 2025

Examining The Ethical Overlap Veganism And Halal Meat Practices

May 13, 2025 -

Boateng And Kruse Clash Over Hertha Berlins Poor Form

May 13, 2025

Boateng And Kruse Clash Over Hertha Berlins Poor Form

May 13, 2025 -

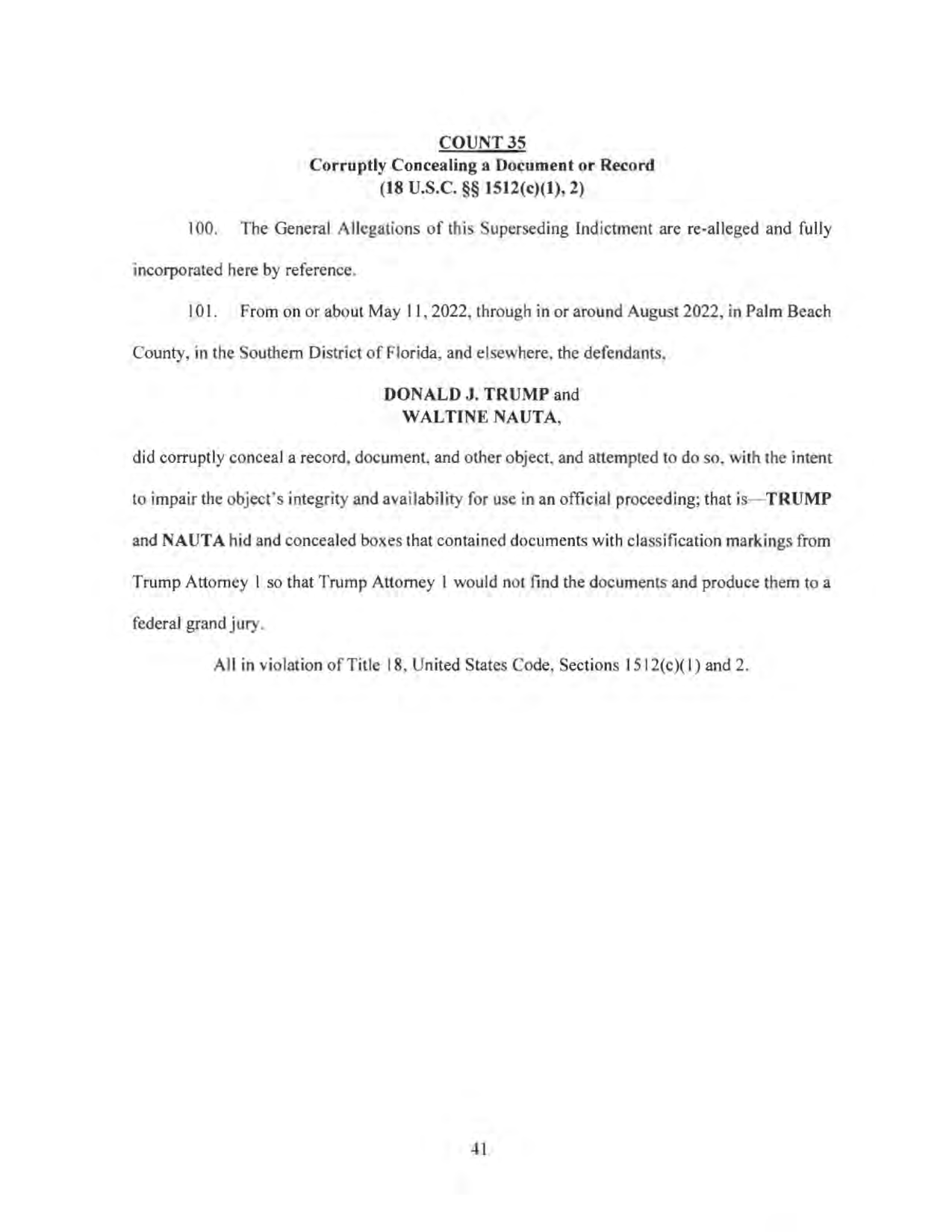

Court Upholds Trump Administrations Use Of Irs Data To Identify Undocumented Migrants

May 13, 2025

Court Upholds Trump Administrations Use Of Irs Data To Identify Undocumented Migrants

May 13, 2025 -

Reviewing Lara Croft Tomb Raider The Cradle Of Life A Critical Analysis

May 13, 2025

Reviewing Lara Croft Tomb Raider The Cradle Of Life A Critical Analysis

May 13, 2025 -

Mosque Responds To Police Investigation In Muslim Mega City

May 13, 2025

Mosque Responds To Police Investigation In Muslim Mega City

May 13, 2025

Latest Posts

-

Watch Scotty Mc Creerys Son Honors George Strait With Sweet Tribute

May 14, 2025

Watch Scotty Mc Creerys Son Honors George Strait With Sweet Tribute

May 14, 2025 -

Scotty Mc Creerys Sons Adorable George Strait Tribute Watch The Video

May 14, 2025

Scotty Mc Creerys Sons Adorable George Strait Tribute Watch The Video

May 14, 2025 -

Scotty Mc Creerys Son Honors George Strait A Must See Video

May 14, 2025

Scotty Mc Creerys Son Honors George Strait A Must See Video

May 14, 2025 -

Scotty Mc Creerys Son Channels George Strait A Heartwarming Video

May 14, 2025

Scotty Mc Creerys Son Channels George Strait A Heartwarming Video

May 14, 2025 -

Adorable Video Scotty Mc Creerys Son Pays Tribute To George Strait

May 14, 2025

Adorable Video Scotty Mc Creerys Son Pays Tribute To George Strait

May 14, 2025