Warren Buffett's Apple Stock Sale: What Does It Mean For Investors?

Table of Contents

Berkshire Hathaway's Apple Stock Reduction: The Facts and Figures

Berkshire Hathaway's sale of Apple stock was substantial, marking a significant shift in their investment portfolio. The exact figures varied slightly depending on the reporting period, but it involved the sale of millions of shares, representing a considerable percentage decrease in their overall Apple holdings. This reduction occurred over several quarters, suggesting a deliberate strategy rather than a sudden panic sell-off. The price per share at the time of these sales fluctuated, influenced by the overall market conditions and Apple's own performance. While Berkshire Hathaway hasn't released detailed explanations for the timing of each tranche of sales, their quarterly filings provide the necessary data for market analysis by investors and analysts. Key data points to consider include:

- Number of shares sold: (Insert actual number of shares sold, if available, or cite the range of sales)

- Percentage reduction in holdings: (Insert the percentage reduction in Berkshire's Apple holdings)

- Average sale price: (Insert the approximate average sale price per share)

- Dates of sales: (Mention the relevant quarters or periods when the sales took place)

These figures are crucial for understanding the scale of the sale and its immediate financial impact on Berkshire Hathaway. Keywords such as Berkshire Hathaway Apple holdings, share sales, stock price, and investment strategy are essential for proper SEO.

Potential Reasons Behind Buffett's Apple Stock Sale Decision

Several factors could have contributed to Buffett's decision to reduce Berkshire Hathaway's Apple stock holdings. It's unlikely a single reason explains the entire strategy, but rather a combination of factors.

Shifting Investment Strategy

The macroeconomic environment plays a significant role in investment decisions. Potential shifts in interest rates, inflation, or global economic uncertainty might have prompted Buffett to reallocate resources. It's possible that he identified more lucrative investment opportunities in other sectors, potentially ones offering higher returns given the current market conditions. This could indicate a strategic realignment of Berkshire Hathaway's overall investment approach.

Portfolio Diversification

Buffett is known for his prudent investment philosophy, which often includes diversification. Reducing Apple's weight in the portfolio might be a strategic move to balance risk and enhance returns through diversification. While Apple has been a remarkably successful investment, diversifying across various sectors and asset classes is a standard practice for minimizing exposure to sector-specific risks. Berkshire Hathaway may be actively pursuing investments in energy, infrastructure, or other sectors considered undervalued or poised for strong growth.

Profit-Taking

Given the substantial gains Berkshire Hathaway had realized from its Apple investment, a portion of the sale could simply be a strategic profit-taking exercise. Realizing profits at favorable market prices allows for reinvestment in other opportunities and strengthens the company’s overall financial position. This isn't necessarily a bearish sign on Apple’s future, but rather a savvy financial maneuver.

Impact of the Sale on Apple Stock Price and Market Sentiment

The news of Berkshire Hathaway's Apple stock sale initially caused some volatility in Apple's stock price. However, the long-term effects remain to be seen. The immediate reaction typically involves short-term price fluctuations depending on overall market sentiment and investor interpretation of the sale’s implications. Whether this leads to a sustained decline in Apple's share price depends on numerous other factors, including Apple’s future financial performance, broader macroeconomic trends, and investor confidence in the technology sector. The sale may have slightly dampened market sentiment towards technology stocks generally, as investor perceptions of high-growth sectors can be sensitive to such news.

Keywords like Apple stock price, market reaction, market sentiment, technology stocks, and stock volatility are crucial here.

What This Means for Individual Investors

The implications of Buffett's Apple stock sale are complex and require careful consideration by individual investors.

Re-evaluating Your Apple Investment

Investors holding Apple stock should reassess their investment based on their individual risk tolerance and long-term financial goals. The sale doesn't necessarily dictate a sell-off; investors should weigh their personal circumstances.

- Holding: If you're invested in Apple for the long term and believe in its future prospects, holding onto your shares might be a viable option.

- Selling: If you're concerned about the market's reaction or have a lower risk tolerance, selling a portion or all of your shares might be considered.

- Buying More: Conversely, some investors might view the dip in price as a buying opportunity, particularly if they believe in Apple's long-term potential.

Considering Broader Market Implications

This event has implications beyond just Apple stock. It serves as a reminder of the importance of portfolio diversification and long-term investment strategies. Investors should analyze their portfolios and ensure proper diversification across different sectors to mitigate risks.

Conclusion: Navigating the Aftermath of Buffett's Apple Stock Sale

Warren Buffett's reduction of Berkshire Hathaway's Apple stock holdings is a significant event in the investment world. While the exact reasons are multifaceted, potential motives include a shifting investment strategy, portfolio diversification, and profit-taking. The sale's immediate impact on Apple's stock price was noticeable, underscoring the influence of even the most seasoned investors’ actions on market sentiment. For individual investors, this highlights the importance of personal assessment, risk management, and long-term investment strategies. Before making any investment decisions related to Warren Buffett's Apple stock sale, conduct thorough research, analyze your risk tolerance and long-term goals, and, if needed, consult a financial advisor for personalized guidance.

Featured Posts

-

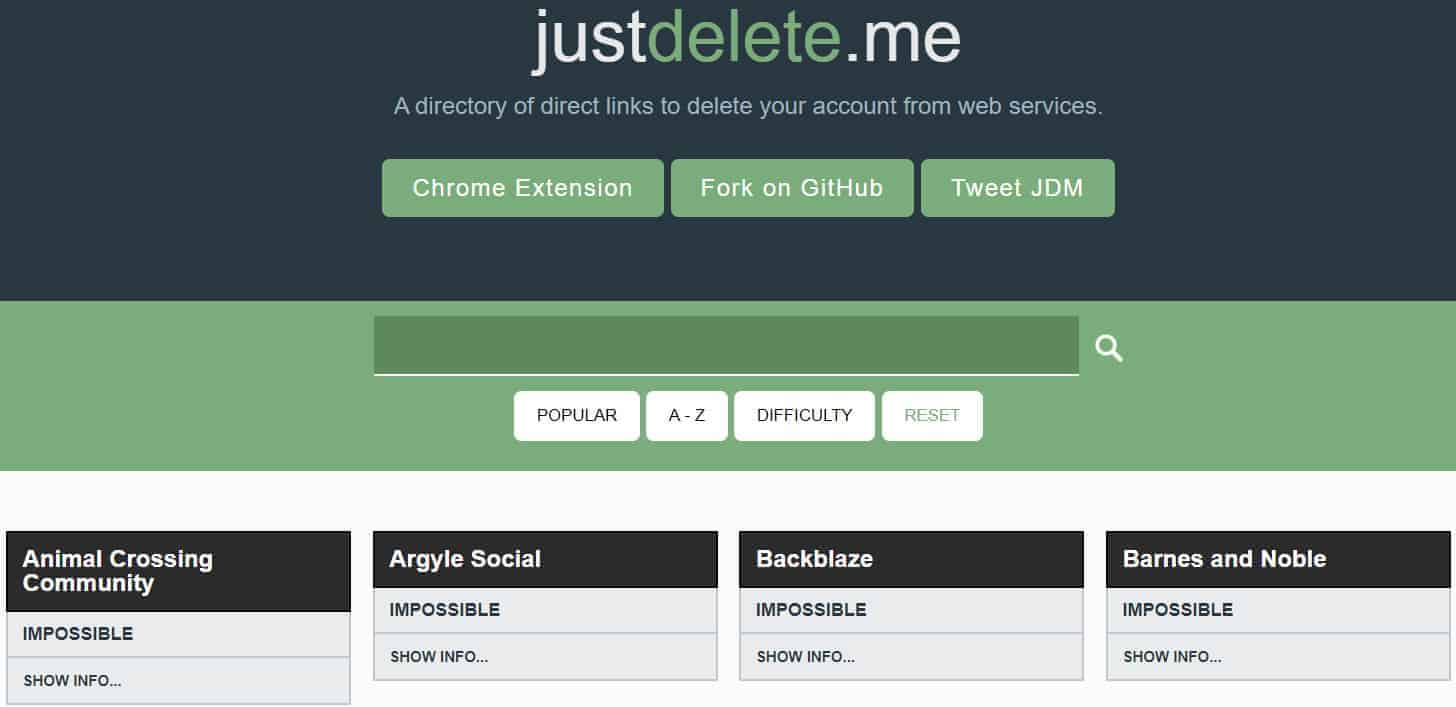

How To Delete Your Online Accounts And Data Safely And Securely

Apr 23, 2025

How To Delete Your Online Accounts And Data Safely And Securely

Apr 23, 2025 -

Double Trouble In Hollywood Writers And Actors Strike Cripples Industry

Apr 23, 2025

Double Trouble In Hollywood Writers And Actors Strike Cripples Industry

Apr 23, 2025 -

Colorado Rockies Win Brenton Doyles 5 Rbis Fuel 7 2 Victory

Apr 23, 2025

Colorado Rockies Win Brenton Doyles 5 Rbis Fuel 7 2 Victory

Apr 23, 2025 -

Record Breaking Game Yankees Hit 9 Home Runs Judges 3 Spark Victory

Apr 23, 2025

Record Breaking Game Yankees Hit 9 Home Runs Judges 3 Spark Victory

Apr 23, 2025 -

Detroit Tigers Protest Umpires Call Manager Hinch Requests Video Review

Apr 23, 2025

Detroit Tigers Protest Umpires Call Manager Hinch Requests Video Review

Apr 23, 2025