Weaker Spending And Tariffs Contribute To 0.2% U.S. Economic Contraction

Table of Contents

Weaker Consumer Spending: A Key Driver of the Contraction

Weaker consumer spending is a significant factor in the recent U.S. economic contraction. Persistent inflation has eroded purchasing power, leading to a decline in real consumer spending and impacting key economic indicators. Several factors contribute to this decline:

-

Decline in real consumer spending: Inflation, currently hovering around [Insert current inflation rate]%, significantly reduces the value of consumers' disposable income. This means that even if nominal spending remains the same, the actual purchasing power has decreased.

-

Reduced consumer confidence: The persistent economic uncertainty, coupled with high inflation and rising interest rates, has led to a decline in consumer confidence. The Consumer Confidence Index (CCI) [cite specific data and source] reflects this diminished optimism, impacting discretionary spending decisions. Consumers are delaying major purchases like cars and appliances, opting instead for essential goods and services.

-

Rising interest rates impacting borrowing and investment: The Federal Reserve's efforts to curb inflation through interest rate hikes have increased borrowing costs. This makes it more expensive for consumers to finance large purchases, further dampening spending on housing, vehicles, and other credit-dependent items.

Impact of Inflation on Consumer Behavior

High inflation disproportionately affects lower-income households, forcing them to cut back on non-essential spending. Even higher-income individuals are re-evaluating their purchasing decisions. We're seeing a noticeable shift in consumer behavior:

-

Reduced spending on durable goods: Sales of durable goods, such as automobiles and appliances, have declined significantly as consumers postpone larger purchases.

-

Increased focus on value and discounts: Consumers are actively seeking out deals and discounts, favoring budget-friendly options over premium products.

-

Shift towards essential spending: A larger portion of disposable income is allocated to essential expenses like groceries, rent, and utilities, leaving less for discretionary spending.

The Lingering Impact of Tariffs on Economic Growth

The ongoing impact of tariffs continues to weigh on economic growth. While initially intended to protect domestic industries, tariffs have resulted in several negative consequences:

-

Increased import costs: Tariffs directly increase the price of imported goods, leading to higher prices for consumers and businesses. This contributes to inflation and reduces purchasing power.

-

Supply chain disruption: Tariffs disrupt global supply chains, leading to shortages of certain goods and increased production costs for businesses relying on imported components.

-

Negative impact on specific industries: Industries heavily reliant on imported goods, such as manufacturing and retail, have been disproportionately affected by tariffs. This can lead to job losses and reduced economic activity.

Global Economic Uncertainty and its Role

The effects of tariffs are exacerbated by global economic uncertainty and geopolitical instability. The interconnected nature of the global economy means that disruptions in one region can quickly ripple across the world. This uncertainty makes businesses hesitant to invest, further hindering economic growth.

Other Contributing Factors to the Economic Slowdown

Beyond weaker spending and tariffs, other factors contributed to the economic slowdown:

-

Decreased business investment: Economic uncertainty has led businesses to postpone or reduce investments in new equipment, technology, and expansion projects.

-

Slowdown in the housing market: Rising interest rates and reduced consumer confidence have cooled the housing market, impacting related industries like construction and real estate.

-

Impact of government fiscal policy: Government spending policies can significantly influence economic growth. [Discuss the current fiscal policy and its impact – for instance, are there any significant cuts or increases in spending?]

-

Labor shortages: Persistent labor shortages in some sectors continue to constrain economic output.

Conclusion

The 0.2% contraction in the U.S. economy in Q2 2024 is largely attributable to weaker consumer spending, fueled by inflation, and the continuing negative effects of tariffs. These factors, coupled with decreased business investment and a cooling housing market, have created a challenging economic environment. Understanding the causes of this U.S. economic contraction – specifically the intertwined impact of weaker spending and tariffs – is crucial for policymakers and businesses alike. Further analysis and proactive measures, including addressing inflation and re-evaluating trade policies, are needed to mitigate these challenges and foster sustainable economic growth. Stay informed about the latest developments regarding the U.S. economic contraction and its implications for your financial well-being.

Featured Posts

-

The Good Life Finding Happiness And Fulfillment

May 31, 2025

The Good Life Finding Happiness And Fulfillment

May 31, 2025 -

Solve The Nyt Mini Crossword Tuesday March 18 Clues And Answers

May 31, 2025

Solve The Nyt Mini Crossword Tuesday March 18 Clues And Answers

May 31, 2025 -

Jannik Sinner Tro Lai Rome Masters San Sang Doi Dau Carlos Alcaraz

May 31, 2025

Jannik Sinner Tro Lai Rome Masters San Sang Doi Dau Carlos Alcaraz

May 31, 2025 -

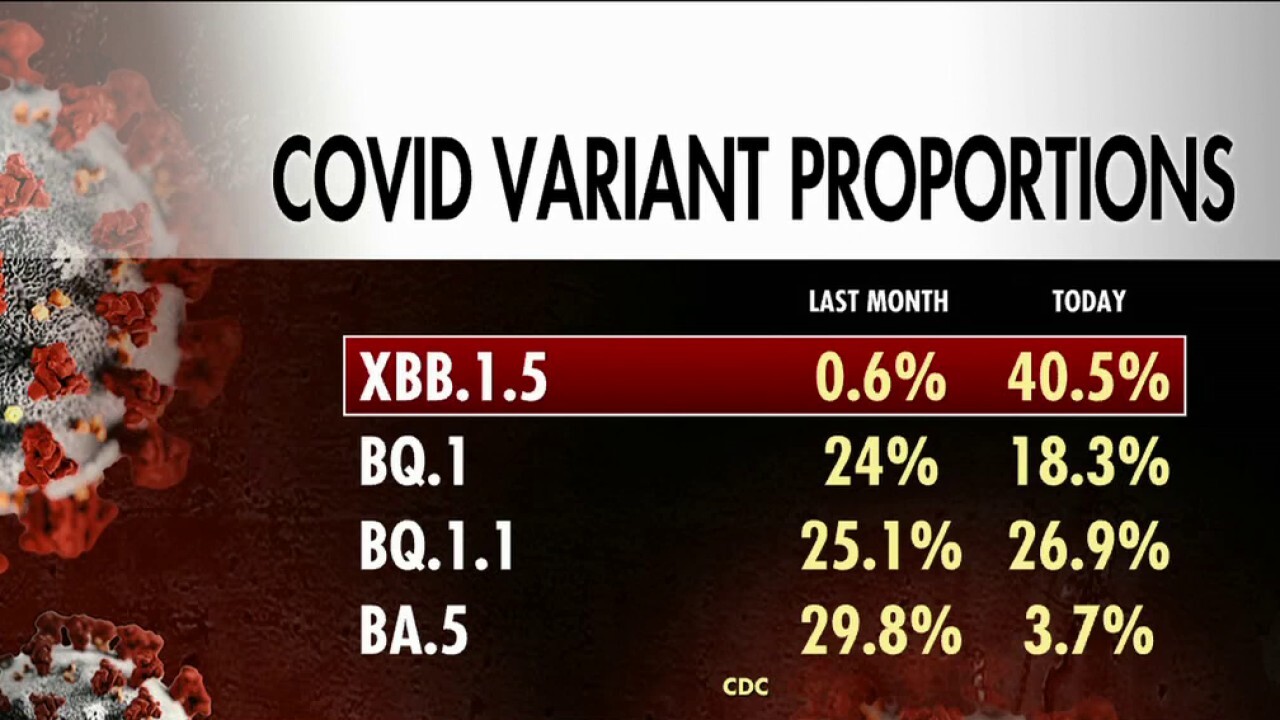

Understanding The Impact The New Covid 19 Variant And Its Spread

May 31, 2025

Understanding The Impact The New Covid 19 Variant And Its Spread

May 31, 2025 -

The Good Life Finding Happiness And Purpose

May 31, 2025

The Good Life Finding Happiness And Purpose

May 31, 2025