Wedbush's Apple Outlook: Bullish Despite Price Target Reduction – Should Investors Follow Suit?

Table of Contents

Wedbush's Bullish Rationale Despite Price Target Reduction

Wedbush's Apple price target reduction doesn't signal a loss of faith in the company's long-term prospects. Their bullish sentiment stems from several key factors indicating strong Apple growth prospects.

-

Robust Services Revenue Growth: Apple's services segment, encompassing subscriptions like Apple Music, iCloud, and Apple TV+, continues to demonstrate impressive growth. This recurring revenue stream provides a stable foundation, mitigating reliance on cyclical hardware sales. The expansion into new services and the increasing engagement of existing users contributes significantly to the positive Apple stock valuation.

-

Innovation Pipeline: Apple consistently introduces innovative products and services. The anticipation surrounding future releases, particularly in augmented reality/virtual reality (AR/VR) with rumored Apple headsets, fuels investor confidence in the company's ability to maintain a competitive edge and capture new market segments. This potential for future product innovation significantly bolsters the long-term Apple growth prospects.

-

Resilient iPhone Sales: Despite economic headwinds, iPhone sales remain robust, solidifying Apple's position as a dominant player in the smartphone market. While sales figures might fluctuate, the enduring demand for iPhones provides a significant contribution to overall revenue and profitability, supporting the bullish outlook for Apple stock.

-

Price Target Adjustment: Wedbush lowered its Apple stock price target, likely due to recent market volatility and a slight revision of growth projections for the near term. However, this adjustment shouldn't be interpreted as a bearish signal; rather, it reflects a more conservative valuation given current market conditions.

Analyzing the Risks: Counterarguments to Wedbush's Outlook

While Wedbush's outlook is optimistic, it's crucial to consider potential risks that could impact Apple's performance.

-

Intense Competition: Apple faces increasing competition from Samsung in the smartphone market and from Google and other players in the services sector. Maintaining market share requires continued innovation and effective marketing strategies.

-

Macroeconomic Headwinds: Global economic uncertainty, including inflation and potential recessionary pressures, can negatively influence consumer spending, impacting demand for Apple products. This macroeconomic risk is a factor impacting all stocks, not just Apple stock.

-

Supply Chain Disruptions: Geopolitical instability and logistical challenges can disrupt Apple's intricate global supply chain, leading to production delays and impacting product availability. Supply chain issues continue to be a significant risk for many companies, including Apple.

-

Inflationary Pressures: Rising costs of raw materials and manufacturing can squeeze Apple's profit margins, necessitating adjustments to pricing strategies. Managing the impact of inflation on profitability and consumer behavior represents a significant challenge.

Should Investors Follow Wedbush's Advice? A Balanced Perspective

Wedbush's bullish stance on Apple warrants consideration, but investors should maintain a balanced perspective. The decision to invest in Apple stock hinges on several factors:

-

Risk Tolerance: Apple stock, like any other investment, carries inherent risks. Investors should assess their risk tolerance and investment goals before making a decision. High-risk investors might find the potential for high returns attractive, while more conservative investors might prefer less volatile options.

-

Portfolio Diversification: It is crucial to diversify your investment portfolio, avoiding over-reliance on any single stock. Apple stock should be part of a larger, balanced investment strategy.

-

Long-Term Investment Horizon: Wedbush's optimistic outlook focuses on Apple's long-term growth potential. Investors with a longer time horizon are better positioned to withstand short-term market fluctuations. A long-term investment strategy is recommended for Apple stock, given the nature of the company's growth trajectory.

-

Due Diligence: Before making any investment decisions, conduct thorough due diligence, researching Apple's financials, market position, and future prospects. Independent analysis is essential before deciding whether to buy or sell Apple stock.

Conclusion

Wedbush's maintained bullish outlook on Apple, despite a price target reduction, presents a compelling case for long-term growth. However, investors should carefully weigh the potential risks, including competition, macroeconomic factors, and supply chain disruptions. A well-diversified portfolio and a thorough understanding of Apple's market position are crucial elements of a sound investment strategy. Before making any decisions regarding your Apple stock investment strategy, conduct thorough research and consider seeking advice from a qualified financial advisor. Stay informed on the latest developments regarding the Wedbush Apple outlook and other pertinent market information. Remember to manage your risk appropriately when considering any Apple stock investment.

Featured Posts

-

Iam Expat Fair Your One Stop Shop For Housing Finance And Family Fun

May 25, 2025

Iam Expat Fair Your One Stop Shop For Housing Finance And Family Fun

May 25, 2025 -

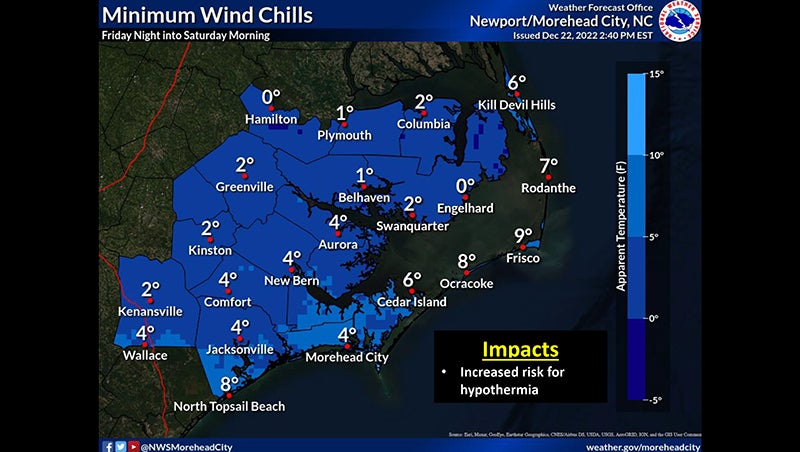

Protecting Yourself From Flash Floods A Guide To Flood Warnings And Alerts

May 25, 2025

Protecting Yourself From Flash Floods A Guide To Flood Warnings And Alerts

May 25, 2025 -

A Practical Guide To Escaping To The Country

May 25, 2025

A Practical Guide To Escaping To The Country

May 25, 2025 -

Ai Powered Podcast Creation Analyzing And Transforming Scatological Data

May 25, 2025

Ai Powered Podcast Creation Analyzing And Transforming Scatological Data

May 25, 2025 -

Kriza Zasahuje Nemecko Prepustanie V Najvaecsich Spolocnostiach

May 25, 2025

Kriza Zasahuje Nemecko Prepustanie V Najvaecsich Spolocnostiach

May 25, 2025

Latest Posts

-

Miami Valley Under Flood Advisory Impacts And Safety Precautions

May 25, 2025

Miami Valley Under Flood Advisory Impacts And Safety Precautions

May 25, 2025 -

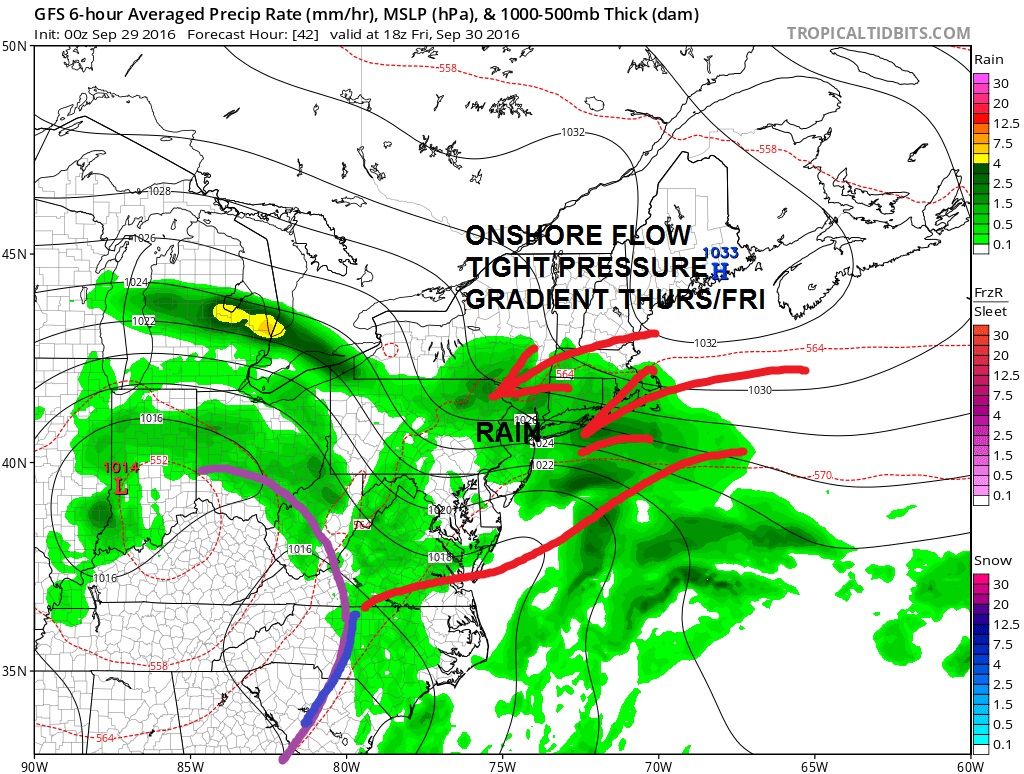

Urgent Coastal Flood Advisory For Southeast Pennsylvania Wednesday

May 25, 2025

Urgent Coastal Flood Advisory For Southeast Pennsylvania Wednesday

May 25, 2025 -

Flash Flood Warning Bradford And Wyoming Counties Until Tuesday

May 25, 2025

Flash Flood Warning Bradford And Wyoming Counties Until Tuesday

May 25, 2025 -

Flood Warnings And Advisories For Miami Valley What You Need To Know

May 25, 2025

Flood Warnings And Advisories For Miami Valley What You Need To Know

May 25, 2025 -

Wednesday Coastal Flood Warning Southeast Pa Update

May 25, 2025

Wednesday Coastal Flood Warning Southeast Pa Update

May 25, 2025