Wednesday's Cardinal Report: Key News And Notes

Table of Contents

Federal Reserve Interest Rate Hike - Impact and Analysis

Keywords: Federal Reserve, interest rate hike, inflation, economic growth, monetary policy, impact analysis

The Federal Reserve announced a 0.25% increase in the federal funds rate today, bringing the target range to 5.25%-5.5%. This decision, while anticipated by many market analysts, still sent ripples through the financial markets.

- Brief summary: The Fed cited persistent inflation and a still-robust labor market as reasons for the increase. This marks the 12th rate hike since March 2022.

- Key figures: The inflation rate currently sits at 3.2%, still above the Fed's 2% target. Unemployment remains low at 3.8%.

- Short-term impact: We can expect to see a modest increase in borrowing costs for consumers and businesses. The dollar may strengthen slightly against other currencies. Stock market volatility is likely to continue in the short term.

- Long-term impact: The long-term effects depend on the effectiveness of the Fed's actions in curbing inflation. Continued rate hikes could lead to a recession, while a premature pause could reignite inflationary pressures.

- Related news articles: [Link to relevant news article 1], [Link to relevant news article 2]

Market Movers: Key Trends and Developments

Keywords: Market trends, stock market, Dow Jones, S&P 500, Nasdaq, economic indicators

Today's market movements were largely shaped by the Fed's decision. While initial reactions were mixed, the major indices showed signs of recovery by late afternoon.

- Significant market shifts: The Dow Jones Industrial Average experienced a moderate dip followed by a rebound, closing slightly above its opening value. The S&P 500 and Nasdaq also displayed similar patterns.

- Relevant economic indicators: Besides inflation and unemployment, consumer confidence and retail sales figures are being closely watched for further insights into the economic outlook.

- Factors influencing market movement: Geopolitical uncertainty, corporate earnings announcements, and investor sentiment all play a role alongside the Fed's policy decisions.

- Significant company performance: [Mention specific company performance, e.g., "Tech giant XYZ saw a surge in its share price following its impressive Q3 earnings report."]

- Predictions and outlook: Analysts remain divided on the market's near-term trajectory. Some predict further volatility while others anticipate a gradual stabilization.

Apple's New Product Launch - Expert Commentary and Opinion

Keywords: Apple, product launch, tech industry, consumer electronics, market analysis, expert opinion

Apple unveiled its highly anticipated new iPhone model today, generating considerable buzz in the tech industry.

- Summary of the news event: The new iPhone boasts several cutting-edge features, including an improved camera system and enhanced processing power. Pre-orders are already open.

- Expert quotes: "This new iPhone is a significant step forward in mobile technology," commented leading tech analyst, Jane Doe. "The improved features are likely to drive strong sales."

- Different perspectives: While most analysts are positive about the new product's prospects, some express concerns about pricing and potential supply chain issues.

- Related resources: [Link to Apple's official press release], [Link to relevant tech review website]

- Potential future developments: The success of this launch could significantly impact Apple's market share and influence the direction of the wider smartphone market.

Potential Regulatory Scrutiny

Keywords: Antitrust, regulation, tech giants, competition, Apple

Apple's continued dominance in the tech market may invite further regulatory scrutiny. Antitrust concerns remain a key consideration, and future regulatory changes could impact the company's operations and strategies.

- Regulatory impacts: Increased regulation could lead to higher compliance costs and potential limitations on Apple's business practices.

- Compliance needs: Apple will need to proactively address potential regulatory hurdles and demonstrate adherence to evolving standards.

- Future policy changes: The ongoing debate around digital markets and antitrust enforcement could lead to significant changes in the regulatory landscape in the coming years.

Conclusion

This Wednesday's Cardinal Report has provided an overview of the key news and notes impacting the world of finance, including the Federal Reserve's interest rate hike and Apple's new product launch. Understanding these developments is crucial for staying ahead in today's dynamic environment. Stay tuned for tomorrow's Cardinal Report for more critical news and analysis. Subscribe to our newsletter to receive daily updates on Wednesday's Cardinal Report and other important news. [Link to newsletter signup]

Featured Posts

-

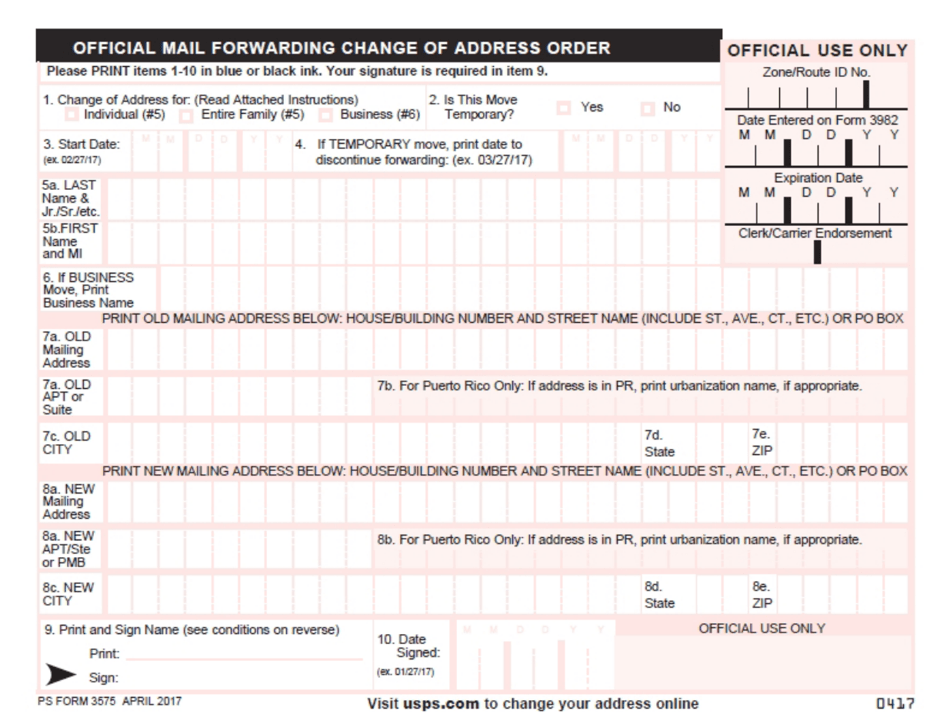

How To Change Your Postal Address With Royal Mail A Simple Guide

May 19, 2025

How To Change Your Postal Address With Royal Mail A Simple Guide

May 19, 2025 -

Syntrivi Enatenisis Pos Na Diaxeiristeite Tin Krisi

May 19, 2025

Syntrivi Enatenisis Pos Na Diaxeiristeite Tin Krisi

May 19, 2025 -

Royal Mail Unveils Eco Friendly Digital Postboxes With Solar Panels

May 19, 2025

Royal Mail Unveils Eco Friendly Digital Postboxes With Solar Panels

May 19, 2025 -

Sygkrisi Timon Kaysimon Pagkypria Katataksi Pratirion

May 19, 2025

Sygkrisi Timon Kaysimon Pagkypria Katataksi Pratirion

May 19, 2025 -

South Londoners Launch Legal Battle Against Brockwell Park Music Festivals

May 19, 2025

South Londoners Launch Legal Battle Against Brockwell Park Music Festivals

May 19, 2025