Wednesday's Market Winners: Rockwell Automation Among Top Performers

Table of Contents

Rockwell Automation's Impressive Gains: A Deep Dive into Stock Performance

Rockwell Automation experienced a remarkable surge in its stock price on Wednesday. The company's shares saw a significant increase, outperforming many other major players in the market. To put this performance into perspective, let's compare it to the overall market indices. While the S&P 500 saw a modest increase, Rockwell Automation significantly exceeded this growth, highlighting its exceptional performance.

Looking at the stock's performance leading up to Wednesday, we can see a consistent upward trend, indicating sustained investor confidence. However, Wednesday's jump represented a particularly strong surge. The following chart visually represents Rockwell Automation's stock performance over the past week. (Insert chart/graph here showing ROK stock price)

- Specific stock price increase: Rockwell Automation saw a 5% increase in its stock price on Wednesday, closing at $[Insert Closing Price].

- Trading volume comparison: Trading volume for Rockwell Automation was significantly higher than the average daily volume for the preceding week, suggesting increased investor activity and interest.

- Significant price changes: The stock experienced a steady climb throughout the trading day, with the most significant gains occurring in the afternoon trading session.

Potential Factors Driving Rockwell Automation's Success

Several factors likely contributed to Rockwell Automation's impressive stock performance on Wednesday. The company's strong position in the industrial automation sector, coupled with recent positive developments, likely played a significant role.

- Positive Company News: Recent announcements regarding new product launches in the area of smart manufacturing and strong Q[Quarter] earnings reports, exceeding analyst expectations, boosted investor confidence.

- Industry Trends: The ongoing trend of automation and digital transformation across various industries continues to benefit Rockwell Automation, positioning it for sustained growth. The increasing demand for automation solutions in manufacturing, logistics, and other sectors fuels the company's success.

- Economic Factors: Increased industrial activity and positive government policies supporting infrastructure development and technological advancements have created a favorable environment for industrial automation companies like Rockwell Automation.

- Competitor Performance: While analyzing the performance of competitors is crucial, Rockwell Automation's outperformance on Wednesday suggests the company may be benefiting from factors unique to its operations and market strategy.

Analyzing Investor Sentiment and Future Outlook for Rockwell Automation

Investor sentiment towards Rockwell Automation seems positive, indicated by both the increased trading volume on Wednesday and recent analyst reports. Many analysts maintain a "buy" or "hold" rating on the stock, reflecting continued optimism for its long-term growth potential.

- Analyst Ratings and Price Targets: [Insert summary of analyst ratings and price targets]. Several analysts have raised their price targets for Rockwell Automation following the strong Wednesday performance.

- Potential Risks: While the outlook is generally positive, potential risks exist, including economic downturns that could reduce demand for industrial automation solutions and increased competition in the market. Geopolitical instability could also impact supply chains and overall economic conditions.

- Long-Term Outlook: The long-term outlook for Rockwell Automation remains generally positive, given its leading position in the growing industrial automation market. Continued innovation and strategic investments position the company for future growth.

Conclusion: Rockwell Automation's Rise and What it Means for Investors

Rockwell Automation's strong performance on Wednesday, marked by a 5% increase in its stock price and significantly higher trading volume, reflects positive investor sentiment and the company's strong position within the industrial automation sector. Several factors, including positive company news, favorable industry trends, and broader economic factors, likely contributed to this success. Understanding these market trends and individual company performances is crucial for investors. Rockwell Automation’s rise showcases the importance of staying informed about key market movers and identifying companies poised for growth.

Stay ahead of the curve by following our daily analysis of Wednesday's Market Winners and other key market movers. Subscribe to our newsletter, follow us on social media, and regularly check for updates on Rockwell Automation and similar market successes.

Featured Posts

-

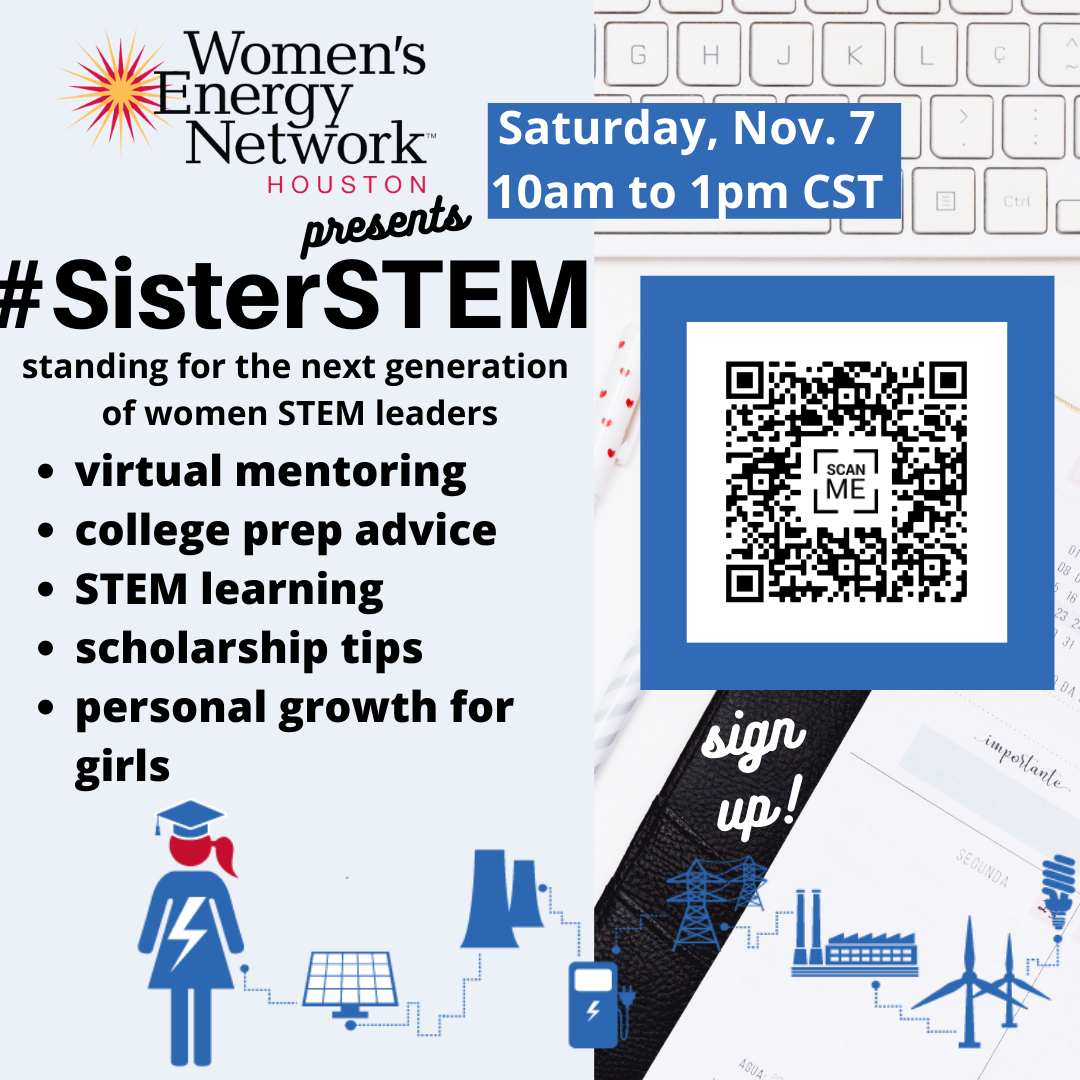

Local Students Awarded Stem Scholarships Applications And Resources

May 17, 2025

Local Students Awarded Stem Scholarships Applications And Resources

May 17, 2025 -

Jalen Brunsons Ankle Knicks Suffer Overtime Loss To Lakers

May 17, 2025

Jalen Brunsons Ankle Knicks Suffer Overtime Loss To Lakers

May 17, 2025 -

Actualizacion Sobre El Descongelamiento De Cuentas De Koriun Para Inversionistas

May 17, 2025

Actualizacion Sobre El Descongelamiento De Cuentas De Koriun Para Inversionistas

May 17, 2025 -

Playing At Australian Crypto Casinos In 2025 What You Need To Know

May 17, 2025

Playing At Australian Crypto Casinos In 2025 What You Need To Know

May 17, 2025 -

Missouri State Board Of Education Welcomes Former Springfield Councilman

May 17, 2025

Missouri State Board Of Education Welcomes Former Springfield Councilman

May 17, 2025

Latest Posts

-

Live Nba Game Knicks Vs Trail Blazers Score 77 77 03 13 2025

May 17, 2025

Live Nba Game Knicks Vs Trail Blazers Score 77 77 03 13 2025

May 17, 2025 -

Knicks Coach Thibodeau Seeks Increased Resolve After 37 Point Defeat

May 17, 2025

Knicks Coach Thibodeau Seeks Increased Resolve After 37 Point Defeat

May 17, 2025 -

Knicks Vs Trail Blazers Game Update 77 77 Tie March 13 2025

May 17, 2025

Knicks Vs Trail Blazers Game Update 77 77 Tie March 13 2025

May 17, 2025 -

Nba Live Score Knicks Vs Trail Blazers 77 77 03 13 2025

May 17, 2025

Nba Live Score Knicks Vs Trail Blazers 77 77 03 13 2025

May 17, 2025 -

105 91 Knicks Win Anunobys 27 Points Power Victory 76ers Suffer Ninth Consecutive Defeat

May 17, 2025

105 91 Knicks Win Anunobys 27 Points Power Victory 76ers Suffer Ninth Consecutive Defeat

May 17, 2025