Weekly CAC 40 Performance: Slight Dip, Remains Stable Overall (March 7, 2025)

Table of Contents

The global markets experienced a ripple effect this week following the unexpected announcement of increased interest rates by the European Central Bank. This naturally impacted various indices, and our focus today is on the Weekly CAC 40 Performance. Despite a slight dip, the CAC 40 demonstrated remarkable resilience, maintaining a relatively stable position overall. This article will delve into the causes of the minor decrease, highlight the sectors contributing to stability, offer a long-term outlook, and suggest relevant investment strategies.

H2: The Slight Dip in CAC 40: Understanding the Causes

The CAC 40 experienced a modest decline this week, closing at 7250 points, a decrease of 0.8% compared to the previous week's closing. Several factors contributed to this minor downturn.

- Specific Sectors Showing Significant Decline: The most notable decline was observed in the financial sector (-1.5%), largely attributed to concerns about potential future interest rate hikes. The automobile sector also experienced a moderate downturn (-1%), impacted by global supply chain uncertainties.

- Impact of Global Economic News or Events: The ECB's interest rate announcement was the primary catalyst for the market's negative sentiment. Concerns about inflation and its potential impact on economic growth weighed heavily on investor confidence.

- Influence of Specific Company Performance: Disappointing quarterly earnings reports from several key CAC 40 companies, including a major French bank and a prominent energy company, further exacerbated the downward pressure.

- Technical Indicators: Trading volume increased significantly, suggesting heightened market activity and volatility. This points to a reactive market response to the news impacting the CAC 40.

[Insert a chart or graph visually representing the CAC 40's dip this week.]

H2: Key Sectors Driving Stability Within the CAC 40

Despite the overall dip, several sectors showcased remarkable strength, preventing a more significant decline in the CAC 40 index.

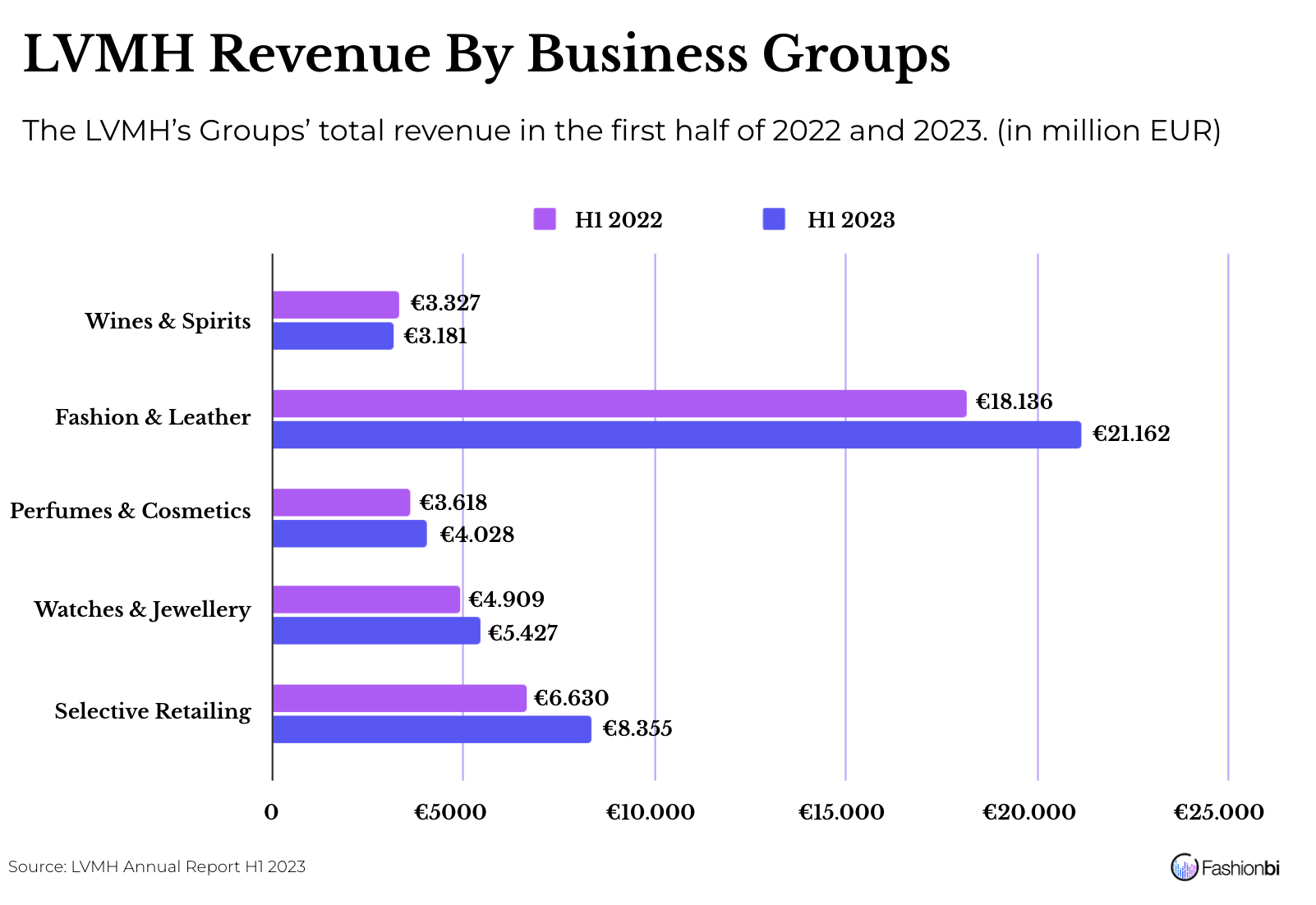

- Top-Performing Sectors: The luxury goods sector (+1.2%) continued its impressive performance, driven by strong demand from both domestic and international markets. The technology sector also saw moderate growth (+0.5%), buoyed by positive technological advancements and investment. The energy sector remained relatively stable, largely unaffected by the broader market sentiment.

- Reasons for Strong Performance: The resilience of the luxury goods sector reflects its inherent resistance to economic downturns, while the technology sector benefits from ongoing innovation and investor confidence in long-term growth. The relatively stable energy sector is linked to consistent global energy demand.

[Insert a chart or graph visually representing the performance of the top-performing sectors.]

H2: Long-Term Outlook and Predictions for CAC 40 Performance

While the short-term outlook might present some uncertainty, the long-term prospects for the CAC 40 remain cautiously optimistic.

- Upcoming Economic Indicators: The upcoming release of inflation data and employment figures will be crucial in determining the future trajectory of the index. Positive data could boost investor confidence, while negative data could trigger further market corrections.

- Potential Risks and Opportunities: Geopolitical risks and ongoing supply chain disruptions remain potential headwinds. However, opportunities exist within the growing renewable energy sector and technological advancements.

- Analyst Predictions: Several leading financial analysts predict moderate growth for the CAC 40 in the coming year, citing the strength of several key sectors and the potential for positive economic developments. (Source: [Cite relevant financial news sources]).

H2: Investment Strategies in Light of the Weekly CAC 40 Performance

The current market conditions call for a balanced and diversified investment approach.

- Long-Term Perspective: Investors with a long-term horizon should consider maintaining their current portfolio allocations, focusing on companies with strong fundamentals and growth potential. Dollar-cost averaging can help mitigate the impact of market volatility.

- Short-Term Gains: Investors seeking short-term gains may want to consider more tactical approaches, such as short-term trades based on market trends and technical analysis. However, this strategy carries higher risk.

- Risk Management: Diversification remains a cornerstone of effective risk management. Spreading investments across different sectors and asset classes can help mitigate potential losses.

Conclusion: Maintaining a Watchful Eye on CAC 40 Performance

This week's Weekly CAC 40 Performance showed a slight dip, but overall stability persisted. The ECB interest rate hike, coupled with specific company performances and sector-specific factors, influenced the index's movement. However, the resilience of key sectors like luxury goods and technology offers a positive counterbalance. Maintaining a watchful eye on upcoming economic indicators and adapting investment strategies accordingly is crucial. Stay informed about future CAC 40 performance updates and subscribe to our newsletter for more in-depth market analysis and insights! [Link to Newsletter Signup]

Featured Posts

-

Lvmhs Q1 Sales Miss Target Leading To 8 2 Share Price Drop

May 25, 2025

Lvmhs Q1 Sales Miss Target Leading To 8 2 Share Price Drop

May 25, 2025 -

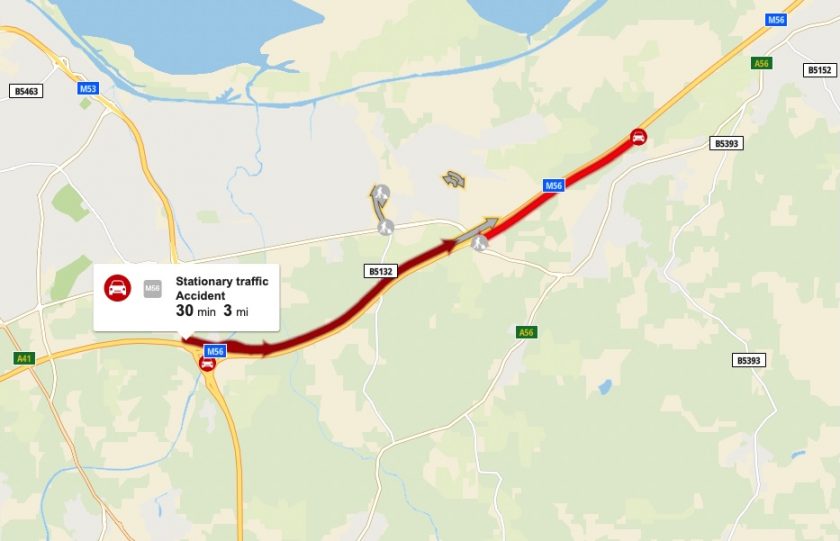

Severe Delays On M56 Collision Impacts Cheshire And Deeside Drivers

May 25, 2025

Severe Delays On M56 Collision Impacts Cheshire And Deeside Drivers

May 25, 2025 -

Sean Penn Questions Woody Allens Guilt In Dylan Farrow Case

May 25, 2025

Sean Penn Questions Woody Allens Guilt In Dylan Farrow Case

May 25, 2025 -

Debate Reignites Macrons En Marche Party Wants To Ban Hijabs On Girls Under 15

May 25, 2025

Debate Reignites Macrons En Marche Party Wants To Ban Hijabs On Girls Under 15

May 25, 2025 -

Borsa Europea Attenzione Fed Piazza Affari E Banche In Difficolta

May 25, 2025

Borsa Europea Attenzione Fed Piazza Affari E Banche In Difficolta

May 25, 2025

Latest Posts

-

Farrows Plea Hold Trump Accountable For Venezuelan Gang Member Deportations

May 25, 2025

Farrows Plea Hold Trump Accountable For Venezuelan Gang Member Deportations

May 25, 2025 -

Actress Mia Farrow Demands Trumps Arrest For Venezuelan Deportation Policy

May 25, 2025

Actress Mia Farrow Demands Trumps Arrest For Venezuelan Deportation Policy

May 25, 2025 -

Actress Mia Farrow Seeks Trumps Imprisonment Regarding Venezuelan Deportations

May 25, 2025

Actress Mia Farrow Seeks Trumps Imprisonment Regarding Venezuelan Deportations

May 25, 2025 -

From Fame To Shame 17 Celebrities Who Lost It All

May 25, 2025

From Fame To Shame 17 Celebrities Who Lost It All

May 25, 2025 -

The Downfall 17 Celebrities Whose Careers Imploded

May 25, 2025

The Downfall 17 Celebrities Whose Careers Imploded

May 25, 2025