Weihong Liu's Hudson's Bay Acquisition: A Deep Dive Into The Billionaire's Real Estate Strategy

Table of Contents

Understanding Weihong Liu's Investment Portfolio

Weihong Liu, a prominent Chinese billionaire and real estate mogul, has built a formidable reputation through shrewd investments and a keen eye for opportunity in the global real estate market. His success stems from a long-term, opportunistic investment style, characterized by a relatively high risk tolerance and a focus on maximizing returns. Before the Weihong Liu's Hudson's Bay Acquisition, his portfolio already included a diverse range of high-value assets.

- Investment Style: Liu's approach is often described as value investing combined with a strategic vision. He identifies undervalued assets with significant redevelopment potential and invests for the long term.

- Key Sectors: His portfolio showcases a diverse range of holdings, with a strong focus on retail, commercial, and residential real estate. He's proven adept at navigating different market segments.

- Geographical Diversification: Liu's investments are not limited to a single geographic area. He boasts a globally diversified portfolio, mitigating risk through strategic international investments. This global perspective makes the Weihong Liu's Hudson's Bay Acquisition even more significant.

The Hudson's Bay Company Acquisition: A Detailed Analysis

The specifics of Liu's investment in HBC remain somewhat opaque, with the exact percentage stake and purchase price not fully publicly disclosed. However, it is known that he secured a substantial portion, enough to significantly influence the company's direction. The timeline of the acquisition also involved several stages of negotiation and regulatory approvals. This raises speculation about the overarching aims of the investment. Was it solely a financial play on undervalued assets, or does Liu see strategic synergies and long-term opportunities within the HBC portfolio?

- HBC's Financial State: HBC, prior to the acquisition, was facing significant financial challenges within the evolving retail landscape. The Weihong Liu's Hudson's Bay Acquisition could inject much needed capital and strategic expertise.

- Synergies and Portfolio Integration: The integration of HBC's extensive real estate holdings – including prime locations in major Canadian cities – into Liu's existing portfolio could create substantial synergies, unlocking potential value through redevelopment or strategic partnerships.

- Future Development Plans: Liu's acquisition suggests potential plans for HBC's future, including possible redevelopment of its flagship stores and other prime properties. It could also include a reimagining of HBC’s retail strategy, enhancing its online presence, optimizing its physical stores, and perhaps even expanding into new markets.

Strategic Implications and Market Impact of the Acquisition

The Weihong Liu's Hudson's Bay Acquisition has created a significant ripple effect across the Canadian real estate and retail sectors. The implications are multifaceted and far-reaching.

- Impact on Canadian Real Estate: The acquisition has the potential to significantly influence property values in areas where HBC owns substantial real estate. Redevelopment of these locations could boost surrounding property values.

- Impact on HBC Competitors: Competitors will need to closely monitor Liu's actions and potentially adjust their strategies to remain competitive. The acquisition may trigger a reassessment of the Canadian retail landscape.

- Impact on the Retail Sector: The acquisition brings increased attention to the challenges and opportunities within the Canadian retail sector, highlighting the increasing importance of real estate as a strategic asset for retailers.

Future Projections and Potential Outcomes

The future trajectory of HBC under Liu's ownership is subject to many factors. While the Weihong Liu's Hudson's Bay Acquisition presents significant opportunities, it also presents challenges.

- Redevelopment and Repurposing: Liu might focus on maximizing the value of HBC's real estate holdings through redevelopment and repurposing. Converting underperforming retail spaces into residential or mixed-use developments is a possibility.

- Market Expansion: Opportunities exist for HBC to expand into new markets, leveraging Liu's international connections and expertise.

- Integration Challenges: Integrating HBC into Liu's existing portfolio will require careful planning and execution.

- Regulatory Hurdles and Public Backlash: Regulatory approvals and potential public backlash related to foreign investment and the future of a beloved Canadian icon could also pose challenges.

Conclusion

The Weihong Liu's Hudson's Bay Acquisition is a landmark event in the Canadian and global real estate markets. It signals a significant shift in the ownership and strategic direction of an iconic Canadian retailer and highlights the growing influence of international investment in the country's real estate sector. The strategic implications for both HBC and the broader retail and real estate sectors are substantial and will continue to unfold.

Stay informed about the unfolding developments in Weihong Liu's investment strategy and its impact on the future of the Hudson's Bay Company and the real estate market by following our future updates on Weihong Liu's Hudson's Bay Acquisition. Learn more about similar high-profile real estate transactions and investment strategies.

Featured Posts

-

Calcul Des Droits De Douane Guide Pas A Pas

May 30, 2025

Calcul Des Droits De Douane Guide Pas A Pas

May 30, 2025 -

Jon Jones Details His Daily Hasbulla Fights

May 30, 2025

Jon Jones Details His Daily Hasbulla Fights

May 30, 2025 -

El Recuerdo De Agassi Rios Un Rival Formidable

May 30, 2025

El Recuerdo De Agassi Rios Un Rival Formidable

May 30, 2025 -

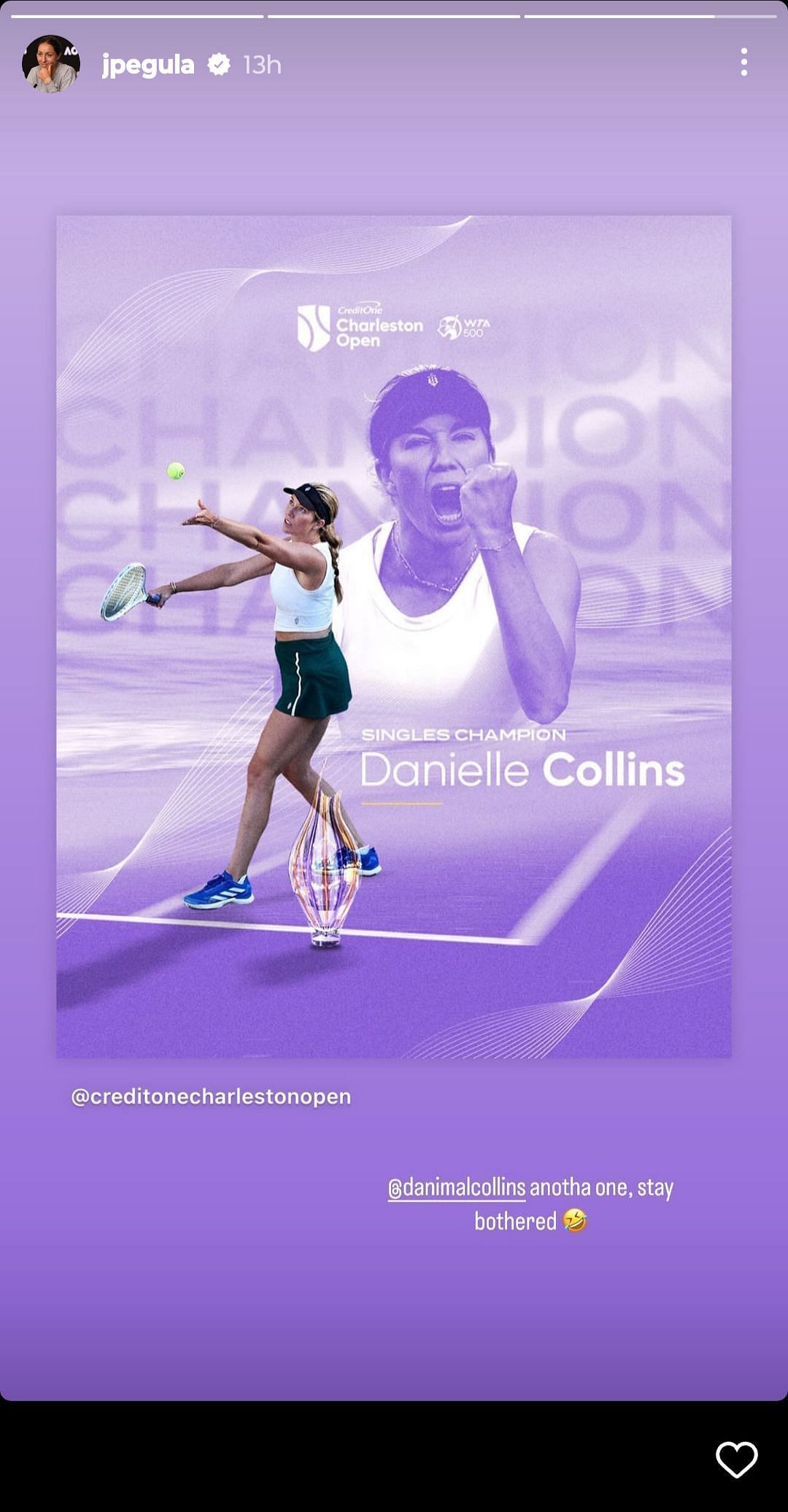

Charleston Tennis Pegula Triumphs Against Collins

May 30, 2025

Charleston Tennis Pegula Triumphs Against Collins

May 30, 2025 -

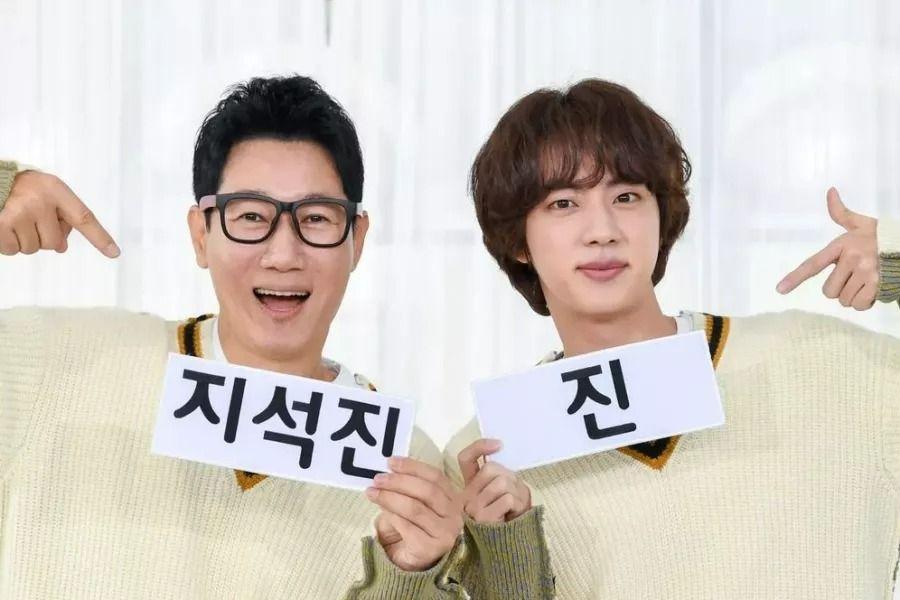

El Nuevo Episodio De Run Bts Presenta A Jin En Una Pelicula De Accion

May 30, 2025

El Nuevo Episodio De Run Bts Presenta A Jin En Una Pelicula De Accion

May 30, 2025