WestJet Stake Sale: Onex Realizes Full Return On Investment

Table of Contents

Onex's Initial Investment in WestJet

Onex, a renowned private equity firm with a history of successful investments in various sectors, initially acquired a substantial stake in WestJet with a long-term vision. Their acquisition strategy involved identifying undervalued assets with significant growth potential, followed by strategic operational improvements and eventual divestment at a considerable profit. The timeline of Onex's involvement with WestJet demonstrates a clear and well-executed plan.

- Date of initial investment: [Insert Date]

- Investment amount: [Insert Amount]

- Percentage of WestJet shares acquired: [Insert Percentage]

- Key individuals involved: [Insert Names and Titles, if publicly available]

The initial investment period presented both challenges and opportunities. The fluctuating global economy and the inherent volatility within the airline industry – including fuel price shocks and global events like the COVID-19 pandemic – created uncertainty. However, Onex recognized WestJet's potential for growth and market share expansion, particularly in the Canadian market.

WestJet's Performance Under Onex Ownership

During Onex's ownership, WestJet experienced a period of significant transformation. Onex implemented several strategic initiatives aimed at enhancing operational efficiency, expanding its route network, and improving customer experience. These efforts, combined with WestJet's inherent strengths, contributed to considerable financial success.

- Key financial metrics: [Insert data on Revenue Growth, Profit Margins, Market Share, etc. Include sources where possible.]

- Significant strategic initiatives: [Examples: Fleet modernization, route expansion, loyalty program enhancements, cost-cutting measures.]

- Major operational improvements: [Examples: Improved on-time performance, enhanced customer service, streamlined processes.]

- Impact of external factors: [Discussion of how fuel prices, economic downturns, and the pandemic affected WestJet's performance.]

These positive changes significantly impacted WestJet's market position and solidified its reputation as a major player in the Canadian airline landscape.

The WestJet Stake Sale and Onex's Full Return

The WestJet stake sale marked the culmination of Onex's successful investment strategy. The sale involved [Insert Buyer's Name], and it resulted in a substantial return for Onex.

- Date of the stake sale: [Insert Date]

- Buyer of the WestJet stake: [Insert Buyer's Name]

- Sale price: [Insert Sale Price]

- Onex's total return on investment (ROI): [Insert Percentage and Monetary Value. Show calculations if possible.]

- Reasons for the stake sale: [Discuss reasons such as maximizing profit, strategic portfolio realignment, or capitalizing on market opportunities.]

The sale not only generated substantial profits for Onex but also signified a successful exit strategy, demonstrating their ability to identify, develop, and divest from investments at optimal times.

Market Implications of the WestJet Stake Sale

The WestJet stake sale had a notable impact on both the airline industry and the investment market. The transaction influenced investor sentiment toward the airline sector and provided a benchmark for the valuation of similar companies.

- Impact on WestJet's stock price: [Describe the immediate and subsequent impact on the stock price.]

- Effect on investor sentiment: [Discuss how the sale affected investor confidence in the airline industry and similar investments.]

- Potential future acquisitions or mergers: [Analyze the potential for future mergers and acquisitions within the airline industry, triggered by the WestJet sale.]

Conclusion: Analyzing the Success of the WestJet Stake Sale

Onex's investment in WestJet stands as a case study in successful private equity investment in the airline industry. The WestJet stake sale demonstrates the potential for significant returns when a strategic vision is combined with effective management and a well-timed exit strategy. The transaction’s implications extend beyond Onex's financial gains, influencing the valuation of other airline assets and shaping future investment decisions within the sector. Learn more about successful private equity investments and how to analyze the potential returns of airline stock by exploring our other resources on [link to relevant resource]. Stay informed on future developments regarding the WestJet stake sale and other major airline transactions by subscribing to our newsletter [link to newsletter].

Featured Posts

-

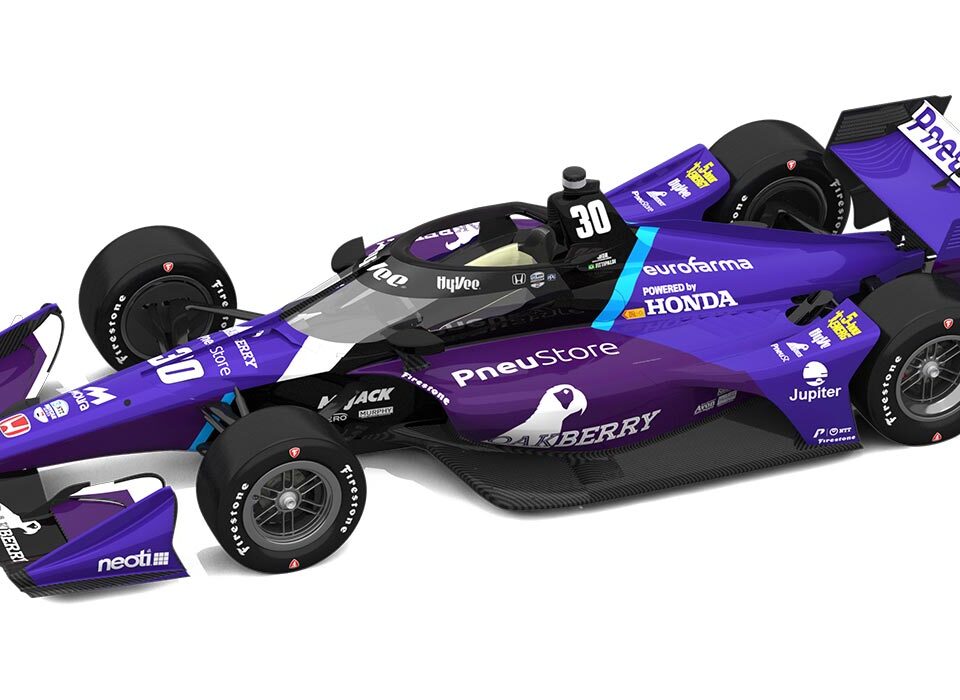

Indy Car 2025 Analyzing Rahal Letterman Lanigan Racings Chances

May 11, 2025

Indy Car 2025 Analyzing Rahal Letterman Lanigan Racings Chances

May 11, 2025 -

Salinda And Velos Record Setting Round At The Zurich Classic

May 11, 2025

Salinda And Velos Record Setting Round At The Zurich Classic

May 11, 2025 -

Bayern Munich Celebrates Bundesliga Win Thomas Muellers Last Home Game

May 11, 2025

Bayern Munich Celebrates Bundesliga Win Thomas Muellers Last Home Game

May 11, 2025 -

John Wick 5 Debunking The Myth Of John Wicks Resurrection

May 11, 2025

John Wick 5 Debunking The Myth Of John Wicks Resurrection

May 11, 2025 -

1 000 Games And Counting Is Aaron Judge A Lock For The Hall Of Fame

May 11, 2025

1 000 Games And Counting Is Aaron Judge A Lock For The Hall Of Fame

May 11, 2025