What Caused The D-Wave Quantum (QBTS) Stock Price To Rise On Friday?

Table of Contents

Friday saw a significant jump in D-Wave Quantum (QBTS) stock price, leaving many investors wondering about the underlying causes. This article delves into the potential reasons behind this surge, exploring market factors, company news, and industry trends that may have contributed to the positive investor sentiment. We will examine the key events and their impact on QBTS stock performance, providing a comprehensive analysis of this exciting development in the quantum computing sector.

Positive Company News and Announcements

Positive news and announcements from D-Wave Quantum itself often act as significant catalysts for stock price movements. Let's examine some potential contributing factors:

New Partnerships or Contracts

New partnerships and contracts can inject significant capital and credibility into a company, thereby boosting investor confidence. Consider these possibilities:

- Specific partnership details: A major announcement regarding a collaboration with a leading technology firm or a prominent research institution could significantly impact QBTS stock. Such a partnership might involve joint development of quantum computing applications, access to new markets, or significant funding infusions.

- Potential impact: The successful signing of a large contract with a major corporation looking to leverage D-Wave's quantum annealing technology for optimization problems in logistics, finance, or materials science would likely lead to increased revenue projections and a positive market reaction.

- Analyst commentary: Positive commentary from financial analysts following the news of such partnerships is a strong indicator of market sentiment and a predictor of further stock price appreciation. Increased buy ratings and upward revisions to price targets would reflect a bullish outlook.

Technological Advancements and Product Launches

Demonstrations of technological advancements and the launch of new products frequently lead to increased investor interest and subsequent stock price increases. Consider the following:

- Improved capabilities: Announcements of significant improvements in D-Wave's quantum computing capabilities, such as increased qubit count, improved connectivity, or lower error rates, would attract considerable attention from investors.

- New hardware or services: The release of new hardware or the launch of enhanced cloud-based quantum computing services could make D-Wave's technology more accessible and attractive to a wider range of users, boosting revenue potential.

- Successful demonstrations: Successful demonstrations of D-Wave's technology solving complex problems that classical computers struggle with would be highly impactful, showcasing the practical value of their quantum annealing approach.

Overall Market Sentiment and Industry Trends

The broader quantum computing industry landscape and macroeconomic factors also play a crucial role in influencing QBTS stock performance.

Broader Interest in Quantum Computing

Growing interest and investment in the quantum computing sector generally benefit all players in the field, including D-Wave Quantum.

- Industry investment: Increased investments by venture capitalists and government agencies into quantum computing research and development signal a growing belief in the technology’s potential. This positive sentiment can spill over to individual companies like D-Wave.

- Industry breakthroughs: Major breakthroughs in quantum computing, even those not directly related to D-Wave's specific technology, can fuel broader excitement and increase overall investor interest in the sector.

- Market optimism: General market optimism and positive economic indicators often lead to increased risk appetite among investors, which can benefit even relatively speculative stocks such as QBTS.

Impact of Macroeconomic Factors

Macroeconomic factors can significantly influence investor behavior and market trends.

- Market trends: Positive economic indicators, such as low unemployment and strong economic growth, often lead to increased investor confidence and higher stock prices across various sectors, including quantum computing.

- Investor sentiment: Investor sentiment is highly sensitive to macroeconomic news. Positive economic news boosts investor confidence and risk tolerance, potentially driving up the price of growth stocks.

- Interest rates: Changes in interest rates and overall monetary policy can significantly affect investor decisions, influencing the valuation of growth stocks like QBTS.

Speculation and Short Covering

Speculation and short covering can also contribute to significant price swings in a stock like QBTS.

Analysis of Trading Volume and Volatility

Unusual trading activity warrants closer examination.

- High trading volume: An unusually high trading volume on Friday, compared to recent trading days, suggests significant investor activity, possibly driven by a combination of buying and short covering.

- Price volatility: Sharp price movements and increased volatility on Friday indicate a high degree of market uncertainty and potentially strong buying pressure.

- Short covering: Short sellers, who bet against a stock's price, might have been forced to cover their positions (buy the stock to limit their losses) leading to increased buying pressure and a rapid price increase.

Social Media and Investor Sentiment

Social media platforms can significantly influence investor sentiment and stock price movements.

- Social media discussions: Positive discussions and trends on platforms like Twitter or Reddit, focusing on D-Wave’s potential or positive news, can impact investor perception and drive buying pressure.

- Online sentiment: A sudden shift in online sentiment towards optimism about D-Wave's prospects could contribute to a stock price increase.

- Influence on price: Positive social media sentiment can create a self-fulfilling prophecy, as more investors react to the buzz and buy the stock, further driving up the price.

Conclusion

The Friday surge in D-Wave Quantum (QBTS) stock price likely resulted from a confluence of factors. Positive company news, such as new partnerships or technological advancements, combined with broader positive sentiment within the quantum computing industry and potentially some speculation and short covering, likely contributed to the increase. Understanding the interplay of these factors is key to analyzing future performance.

Call to Action: Stay informed about future developments in the quantum computing market and the performance of D-Wave Quantum (QBTS) stock. Continue researching and monitoring QBTS stock for further insights. However, remember to consult with a financial advisor before making any investment decisions related to D-Wave Quantum (QBTS) or any other quantum computing stocks. Understanding the risks associated with investing in emerging technologies is crucial before allocating your capital to QBTS or similar quantum computing stocks.

Featured Posts

-

John Lithgow En Jimmy Smits Hun Rollen In Dexter Resurrection

May 21, 2025

John Lithgow En Jimmy Smits Hun Rollen In Dexter Resurrection

May 21, 2025 -

Blockbusters On Bgt The Performances You Need To See

May 21, 2025

Blockbusters On Bgt The Performances You Need To See

May 21, 2025 -

Ing Provides Project Finance Facility To Freepoint Eco Systems

May 21, 2025

Ing Provides Project Finance Facility To Freepoint Eco Systems

May 21, 2025 -

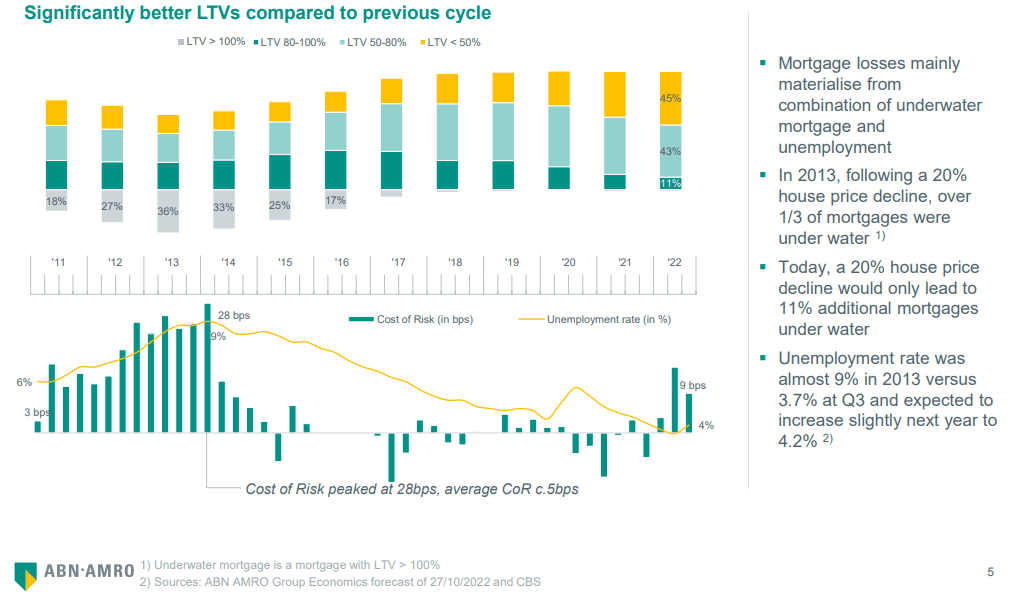

Geen Stijl Vs Abn Amro Debat Over Betaalbaarheid Van Huizen In Nederland

May 21, 2025

Geen Stijl Vs Abn Amro Debat Over Betaalbaarheid Van Huizen In Nederland

May 21, 2025 -

10 Minute Unpiloted Lufthansa Flight Investigation Into Co Pilot Medical Emergency

May 21, 2025

10 Minute Unpiloted Lufthansa Flight Investigation Into Co Pilot Medical Emergency

May 21, 2025

Latest Posts

-

The Traverso Family A Cannes Photography Legacy

May 22, 2025

The Traverso Family A Cannes Photography Legacy

May 22, 2025 -

A Family Legacy The Traversos And The Cannes Film Festival

May 22, 2025

A Family Legacy The Traversos And The Cannes Film Festival

May 22, 2025 -

Coldplays No 1 Hit A Concert Of Music Light And Love

May 22, 2025

Coldplays No 1 Hit A Concert Of Music Light And Love

May 22, 2025 -

Exploring Culinary History The Manhattan Forgotten Foods Festival

May 22, 2025

Exploring Culinary History The Manhattan Forgotten Foods Festival

May 22, 2025 -

The Funniest White House Moments Featuring Trump The Irish Pm And Jd Vance

May 22, 2025

The Funniest White House Moments Featuring Trump The Irish Pm And Jd Vance

May 22, 2025