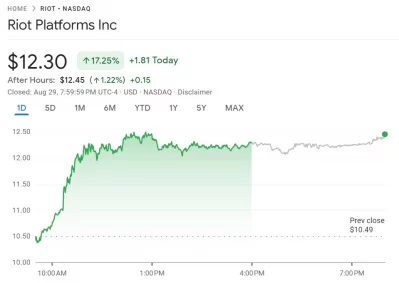

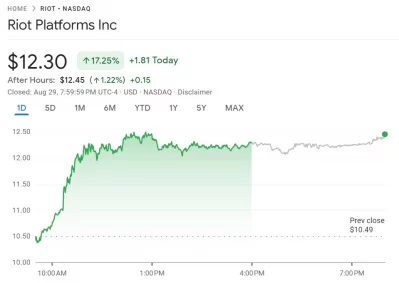

What's Driving The Price Of Riot Platforms Stock (RIOT)?

Table of Contents

Bitcoin's Price and RIOT's Stock Performance

The correlation between Bitcoin's price and RIOT's stock price is undeniably strong. Riot Platforms is a Bitcoin mining company; therefore, its profitability is directly tied to the value of Bitcoin.

- Higher Bitcoin prices generally lead to increased mining profitability for RIOT. As Bitcoin's value rises, the revenue generated from mining increases proportionally.

- Increased profitability translates to higher revenue and potentially higher stock valuations. More profitable mining operations result in stronger financial performance, attracting investors and driving up the stock price.

- Conversely, a drop in Bitcoin's price negatively impacts RIOT's profitability and stock price. When Bitcoin's price falls, mining becomes less lucrative, impacting RIOT's bottom line and consequently its stock value.

[Insert chart or graph illustrating the correlation between Bitcoin and RIOT stock price here]

The volatility of Bitcoin price is a significant risk factor for RIOT investors. Understanding Bitcoin price volatility and its impact on mining revenue and market capitalization is essential for assessing RIOT's potential.

The Efficiency and Scalability of Riot's Bitcoin Mining Operations

Riot's mining infrastructure, including its hashrate, energy costs, and operational efficiency, significantly impacts its profitability and, consequently, its stock value.

- Increased hashrate contributes to higher Bitcoin mining rewards. A higher hashrate means Riot can solve more complex cryptographic puzzles, leading to a greater chance of earning Bitcoin rewards.

- Energy costs significantly impact profitability. Energy-efficient mining is crucial for maintaining profitability. Reducing operational costs, including electricity expenses, directly increases the company's margins.

- Riot's expansion plans and their potential impact on future profitability are key factors to consider. Investments in new mining facilities and technological upgrades can significantly boost the company's future hashrate and profitability.

Analyzing Riot's operational efficiency and its future expansion plans provides valuable insights into the company's long-term potential and its impact on the RIOT stock price.

Regulatory Landscape and its Influence on RIOT

The regulatory landscape surrounding cryptocurrency mining significantly influences RIOT's operations and stock price.

- Government policies on Bitcoin mining in different regions play a crucial role. Changes in regulations, such as stricter environmental regulations or limitations on mining licenses, can directly impact Riot's operations.

- Stricter regulations can negatively affect RIOT's operations. This could lead to increased compliance costs, limitations on expansion, or even operational shutdowns in certain jurisdictions.

- Upcoming regulations should be carefully monitored. Any significant changes in crypto regulation, particularly those impacting energy consumption or licensing requirements, can have a substantial impact on Riot's profitability and investor confidence.

Understanding the evolving landscape of crypto regulation and environmental regulations is crucial for assessing the long-term viability of Riot Platforms and the potential impact on its stock price.

Competition in the Bitcoin Mining Industry

RIOT operates in a competitive Bitcoin mining industry. Its market position relative to its competitors directly affects its stock price.

- Comparing RIOT's performance against key competitors is essential. This involves analyzing metrics such hashrate, operational efficiency, and profitability.

- Market share and its implications on RIOT's stock price are important considerations. A larger market share generally translates to greater influence and potentially higher profitability.

- Identifying RIOT's competitive advantages is crucial for investors. This might include technological advancements, cost-effective energy solutions, or strategic partnerships.

Analyzing the competitive landscape provides investors with a comprehensive understanding of RIOT's position and potential future growth.

Investor Sentiment and Market Speculation

Investor sentiment and market speculation significantly influence RIOT's stock price.

- News and events impacting investor confidence can trigger price fluctuations. Positive news about Bitcoin's adoption or technological advancements in mining can increase investor confidence, while negative news can trigger sell-offs.

- Market trends and overall economic conditions affect investor behavior. A bullish stock market generally supports higher valuations for growth stocks like RIOT, while economic downturns can lead to decreased investor appetite.

- Analyst ratings and recommendations play a significant role in shaping investor sentiment. Positive analyst ratings can boost investor confidence, while negative ratings can lead to a decline in the stock price.

Understanding market sentiment, investor confidence, and stock market trends is crucial for making informed investment decisions regarding RIOT.

Conclusion

The price of Riot Platforms Stock (RIOT) is driven by a complex interplay of factors: Bitcoin's price, the efficiency of Riot's mining operations, the regulatory landscape, competition, and investor sentiment. Understanding these interconnected elements is essential for assessing the risks and potential rewards associated with investing in RIOT.

Understanding the factors driving the price of Riot Platforms Stock (RIOT) is essential for informed investment choices. Continue your research and stay informed about the evolving cryptocurrency landscape.

Featured Posts

-

Sdr Azad Kshmyr Awr Brtanwy Parlymnt Ka Mshtrkh Mwqf Kshmyr Ka Msylh

May 02, 2025

Sdr Azad Kshmyr Awr Brtanwy Parlymnt Ka Mshtrkh Mwqf Kshmyr Ka Msylh

May 02, 2025 -

Paramount Leaders Considered 20 Million Settlement In Trump Lawsuit

May 02, 2025

Paramount Leaders Considered 20 Million Settlement In Trump Lawsuit

May 02, 2025 -

Luxury Middle East Resorts Balsillie Golf Venture And Saudi Developer Join Forces

May 02, 2025

Luxury Middle East Resorts Balsillie Golf Venture And Saudi Developer Join Forces

May 02, 2025 -

T Mobile Data Breaches Cost Company 16 Million In Fines

May 02, 2025

T Mobile Data Breaches Cost Company 16 Million In Fines

May 02, 2025 -

The Implications Of Fortnite Removing Game Modes A Player Perspective

May 02, 2025

The Implications Of Fortnite Removing Game Modes A Player Perspective

May 02, 2025

Latest Posts

-

Challenges For Reform Uk A Potential Party Split Looms

May 03, 2025

Challenges For Reform Uk A Potential Party Split Looms

May 03, 2025 -

Afghan Migrants Death Threat Against Nigel Farage During Uk Trip

May 03, 2025

Afghan Migrants Death Threat Against Nigel Farage During Uk Trip

May 03, 2025 -

Farages Reform Uk Internal Divisions And The Threat Of A Split

May 03, 2025

Farages Reform Uk Internal Divisions And The Threat Of A Split

May 03, 2025 -

Reform Uks Future Uncertain Breakaway Threat From Former Deputy

May 03, 2025

Reform Uks Future Uncertain Breakaway Threat From Former Deputy

May 03, 2025 -

Farage Faces Tory Accusations Over Reform Party Defection Claims

May 03, 2025

Farage Faces Tory Accusations Over Reform Party Defection Claims

May 03, 2025