Where To Invest: A Map Of The Country's Top Business Growth Areas

Table of Contents

The Tech Hubs: Silicon Valley and Beyond

Silicon Valley's Continued Dominance

- Strong venture capital presence: Silicon Valley attracts billions in venture capital funding annually, fueling innovation and growth.

- Highly skilled workforce: A large pool of engineers, programmers, and designers ensures a readily available talent pool.

- Thriving startup ecosystem: A culture of entrepreneurship fosters collaboration and competition, driving technological advancements.

- Government incentives: State and local governments offer various tax breaks and grants to attract and retain tech companies.

Details: Cities like San Jose, Palo Alto, and Mountain View within Silicon Valley offer unique advantages. The presence of giants like Google, Apple, and Facebook attracts a supporting ecosystem of smaller tech companies and contributes to the area's overall economic strength. This concentration of talent and capital makes Silicon Valley a consistently attractive location for investment.

Emerging Tech Clusters

- Austin, Texas: Boasting a rapidly growing tech scene, Austin attracts major tech companies and startups, driven by a lower cost of living and a strong university system (University of Texas at Austin).

- Seattle, Washington: Home to Amazon and other major tech companies, Seattle benefits from a highly skilled workforce and proximity to leading research institutions.

- Boston, Massachusetts: A hub for biotech and other high-tech industries, Boston's strong research universities and well-established life sciences sector make it a powerful contender.

Details: These emerging tech clusters offer compelling alternatives to Silicon Valley, often presenting lower costs of operation and a less saturated market. However, they also require careful consideration of their unique challenges and opportunities. Factors like access to talent, infrastructure, and the specific niche of the tech sector should be thoroughly investigated before investment.

The Manufacturing Powerhouses: The Midwest and its Industries

Reshoring and its Impact

- Increased domestic manufacturing: The trend of reshoring – bringing manufacturing back to the country – is boosting economic activity in specific regions.

- Focus on specific industries: Industries like automotive, aerospace, and advanced manufacturing are seeing significant growth due to reshoring.

- Job creation: The resurgence of manufacturing creates numerous well-paying jobs, contributing to regional economic vitality.

Details: States in the Midwest, known historically for manufacturing, are experiencing a renaissance. Companies are drawn to the region's skilled workforce, robust infrastructure, and access to key transportation networks. Successful manufacturing companies are leveraging advanced technologies and focusing on automation to compete on a global scale.

Infrastructure and Logistics Advantages

- Extensive transportation networks: A well-developed highway system, rail lines, and inland waterways provide efficient transportation of goods.

- Access to major ports: Proximity to key ports ensures ease of international trade and lowers transportation costs.

- Strategic location: Central location facilitates distribution across the country, reducing logistics expenses.

Details: The Midwest's robust infrastructure contributes significantly to the cost-effectiveness and efficiency of manufacturing operations. This streamlined logistics system allows manufacturers to reduce transportation costs and improve delivery times, making the region an attractive destination for businesses looking to expand or relocate.

Renewable Energy and Sustainable Investments: Opportunities in the Southwest

Government Incentives and Funding

- Tax credits and deductions: Federal and state governments offer various tax incentives to encourage investment in renewable energy.

- Grants and subsidies: Funding programs are available to support the development and deployment of renewable energy technologies.

- Investment tax credits (ITCs): ITCs significantly reduce the upfront cost of renewable energy projects, making them more financially viable.

Details: The Southwest, with its abundant sunshine and wind resources, is a prime location for renewable energy investments. Government incentives significantly reduce investment risks, making this sector increasingly attractive for investors.

Growth Potential and Market Demand

- Increasing demand for clean energy: Growing concerns about climate change and a push toward carbon neutrality are fueling demand for renewable energy sources.

- High returns on investment: The renewable energy sector is projected to experience significant growth, offering the potential for substantial returns on investment.

- Long-term sustainability: Investing in renewable energy not only generates financial returns but also contributes to a sustainable future.

Details: Projections indicate continued strong growth in the renewable energy sector for the foreseeable future. This growth, driven by both governmental policy and market demand, creates substantial opportunities for investors seeking both financial returns and positive social impact.

Analyzing Investment Risks and Rewards: A Balanced Approach

- Market volatility: Consider the impact of market fluctuations and economic cycles on investment returns.

- Regulatory changes: Analyze the potential impact of government regulations and policies on the investment's viability.

- Due diligence: Thorough research and analysis are essential to mitigate risks and identify promising opportunities.

Details: While the potential rewards in these growth areas are significant, it's crucial to conduct thorough due diligence before committing to any investment. Analyzing market trends, regulatory landscapes, and potential risks is paramount to making informed decisions and maximizing potential returns.

Conclusion: Finding Your Ideal Investment Location: Where to Invest

This article has highlighted several key areas of significant business growth across diverse sectors. From the established tech hubs to the resurgent manufacturing powerhouses and the burgeoning renewable energy sector, there are numerous opportunities for investors to explore. Remember that careful consideration of risks and rewards, along with thorough due diligence, are essential for successful investment. To discover where to invest effectively, you need to conduct thorough research and tailor your strategy to your specific risk tolerance and financial goals. Further research into each of these regions and sectors will help you map your investment strategy and achieve your financial objectives. To learn more about making data-driven investment decisions, check out [Link to a relevant resource].

Featured Posts

-

Remembering Priscilla Pointer Celebrated Dalla Actress Dies At 100

May 01, 2025

Remembering Priscilla Pointer Celebrated Dalla Actress Dies At 100

May 01, 2025 -

Canadians Prioritize Domestic Travel Airbnb Bookings Soar

May 01, 2025

Canadians Prioritize Domestic Travel Airbnb Bookings Soar

May 01, 2025 -

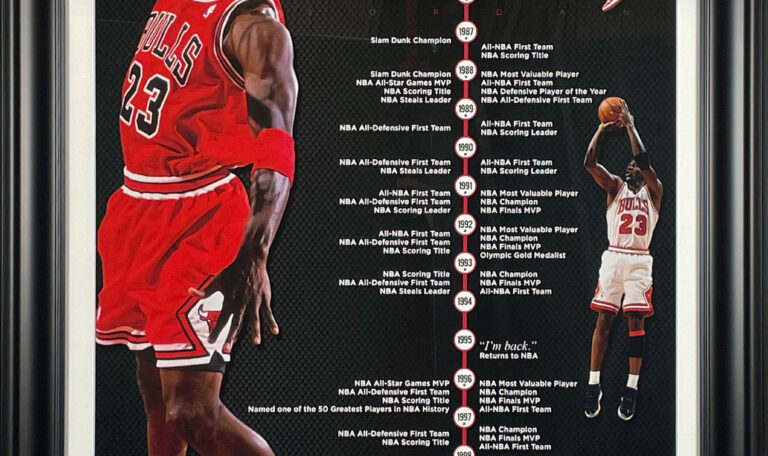

The Michael Jordan Story Fast Facts And Key Achievements

May 01, 2025

The Michael Jordan Story Fast Facts And Key Achievements

May 01, 2025 -

Apurate 3 Dias Para Empezar Clases De Boxeo En Edomex

May 01, 2025

Apurate 3 Dias Para Empezar Clases De Boxeo En Edomex

May 01, 2025 -

Michael Sheens 1 Million Giveaway How To Participate

May 01, 2025

Michael Sheens 1 Million Giveaway How To Participate

May 01, 2025