Where To Invest: Identifying The Country's Top Business Growth Areas

Table of Contents

The Booming Tech Sector: A Hotspot for Investment

The tech sector is undeniably a hotspot for investment, presenting numerous opportunities for substantial ROI. Keywords like tech investments, software development, fintech, AI, cybersecurity, tech startups, and venture capital frequently appear in discussions about high-growth sectors. Several factors contribute to this sector's explosive growth:

-

Rapid growth of the tech startup ecosystem fueled by government initiatives and venture capital funding. Government support programs and readily available venture capital are fostering innovation and providing the necessary resources for tech startups to flourish. This creates a fertile ground for investment, allowing early-stage participation in potentially game-changing technologies.

-

High demand for software developers, AI specialists, and cybersecurity experts creating numerous employment opportunities. The tech industry's rapid expansion requires a skilled workforce, resulting in high demand and competitive salaries for professionals in these fields. This translates to strong potential for companies providing training and staffing solutions within the tech sector.

-

Focus on fintech, e-commerce, and digital solutions driving significant investment interest. The increasing adoption of digital technologies across various industries fuels the growth of fintech, e-commerce, and other digital solutions. Investments in these areas offer exposure to a sector experiencing exponential growth.

-

Potential risks: High competition, rapid technological advancements requiring constant adaptation. The fast-paced nature of the tech industry means that companies must continuously innovate to remain competitive. This requires careful due diligence and a keen understanding of technological trends to avoid investing in soon-to-be obsolete technologies.

Bullet Points:

- Invest in promising tech startups with disruptive technologies.

- Consider investing in established tech companies with a proven track record and strong growth potential.

- Explore opportunities in the rapidly expanding fintech sector, focusing on solutions addressing financial inclusion or streamlining processes.

Renewable Energy: A Sustainable Investment for the Future

Renewable energy investments represent a sustainable path to long-term growth, aligning with increasing global concerns about climate change and the growing adoption of ESG (environmental, social, and governance) investing. Keywords like renewable energy investments, solar power, wind energy, green technologies, and sustainable investments are increasingly important in the investment world.

-

Increasing government support and incentives for renewable energy projects. Many governments worldwide are actively promoting renewable energy through subsidies, tax breaks, and regulatory frameworks, making it a financially attractive sector.

-

Growing consumer demand for sustainable energy solutions. Consumers are increasingly conscious of their environmental impact and are actively seeking sustainable energy solutions, driving demand for renewable energy products and services.

-

Opportunities in solar panel manufacturing, wind turbine installation, and smart grid technologies. The renewable energy sector encompasses a wide range of opportunities, from manufacturing and installation to grid management and energy storage solutions.

-

Potential risks: Intermittency of renewable energy sources, dependence on government policies. The intermittent nature of solar and wind power requires investment in energy storage solutions to ensure a stable energy supply. Furthermore, changes in government policies can impact the profitability of renewable energy projects.

Bullet Points:

- Explore opportunities in solar energy infrastructure development, focusing on large-scale solar farms or community solar projects.

- Invest in companies developing innovative clean energy technologies, such as next-generation solar panels or advanced battery storage systems.

- Consider investing in green bonds or ESG funds focused on renewable energy.

Healthcare and Biotechnology: A Sector with Long-Term Growth Potential

The healthcare and biotechnology sector offers long-term growth potential driven by several factors. Keywords like healthcare investments, biotechnology, pharmaceuticals, medical devices, and aging population are crucial to understanding the sector's growth drivers.

-

An aging population driving increasing demand for healthcare services and products. The global population is aging, leading to a surge in demand for healthcare services, pharmaceuticals, and medical devices.

-

Advancements in biotechnology leading to new treatments and therapies. Breakthroughs in biotechnology are continually producing innovative treatments and therapies, creating substantial opportunities for investment.

-

Growth in telemedicine and digital health solutions. The adoption of telemedicine and other digital health solutions is rapidly expanding, offering new avenues for investment and growth.

-

Potential risks: Stringent regulations, high research and development costs. The healthcare industry is heavily regulated, which can impact the speed and cost of bringing new products to market. Research and development in this sector is also incredibly expensive.

Bullet Points:

- Invest in pharmaceutical companies developing innovative drugs and therapies for chronic diseases.

- Consider investing in companies providing healthcare technology solutions, such as electronic health record systems or telehealth platforms.

- Explore opportunities in the growing telemedicine sector, particularly in underserved areas.

Infrastructure Development: A Foundation for Long-Term Growth

Infrastructure development is a cornerstone of economic growth, and investments in this sector offer substantial long-term potential. Keywords such as infrastructure investments, construction, transportation, real estate, and logistics are critical to understanding this sector.

-

Government spending on infrastructure projects creating numerous opportunities. Government investment in infrastructure projects generates numerous opportunities for investors in related sectors.

-

Growth in construction, transportation, and logistics sectors. Infrastructure projects stimulate growth in related industries, such as construction, transportation, and logistics, creating investment opportunities across the value chain.

-

Potential for high returns on long-term infrastructure investments. Well-planned infrastructure projects often deliver high returns over the long term, offering investors stable and predictable income streams.

-

Potential risks: Economic downturns impacting government spending, project delays. Economic fluctuations can impact government spending on infrastructure, affecting project timelines and returns. Delays in project completion can also impact overall profitability.

Bullet Points:

- Invest in real estate projects related to infrastructure development, such as properties near new transportation hubs or industrial parks.

- Consider investing in construction companies involved in major infrastructure projects, particularly those with a strong track record and financial stability.

- Explore opportunities in transportation and logistics companies that benefit from improved infrastructure.

Conclusion

Identifying the country's top business growth areas requires a thorough analysis of various economic factors and market trends. This article highlighted key sectors offering significant investment opportunities, including technology, renewable energy, healthcare, and infrastructure development. While each sector presents unique risks and rewards, careful due diligence and a well-defined investment strategy are essential for maximizing returns. Remember to conduct thorough research before investing and consult with a financial advisor to determine the best investment approach for your individual circumstances. Start exploring these top business growth areas today and find the perfect place where to invest your capital for optimal growth and ROI.

Featured Posts

-

Luxury Car Sales In China Bmw Porsche And The Shifting Landscape

May 18, 2025

Luxury Car Sales In China Bmw Porsche And The Shifting Landscape

May 18, 2025 -

Taylor Swift And Trump The Unexpected Fallout And Maga Response

May 18, 2025

Taylor Swift And Trump The Unexpected Fallout And Maga Response

May 18, 2025 -

Russias Failed Peace Overture Analyzing Putins Diplomatic Missteps

May 18, 2025

Russias Failed Peace Overture Analyzing Putins Diplomatic Missteps

May 18, 2025 -

Cubs Defeat Dodgers Armstrongs Two Home Runs Secure Series Victory

May 18, 2025

Cubs Defeat Dodgers Armstrongs Two Home Runs Secure Series Victory

May 18, 2025 -

The Moral Implications Of Betting On The Los Angeles Wildfires

May 18, 2025

The Moral Implications Of Betting On The Los Angeles Wildfires

May 18, 2025

Latest Posts

-

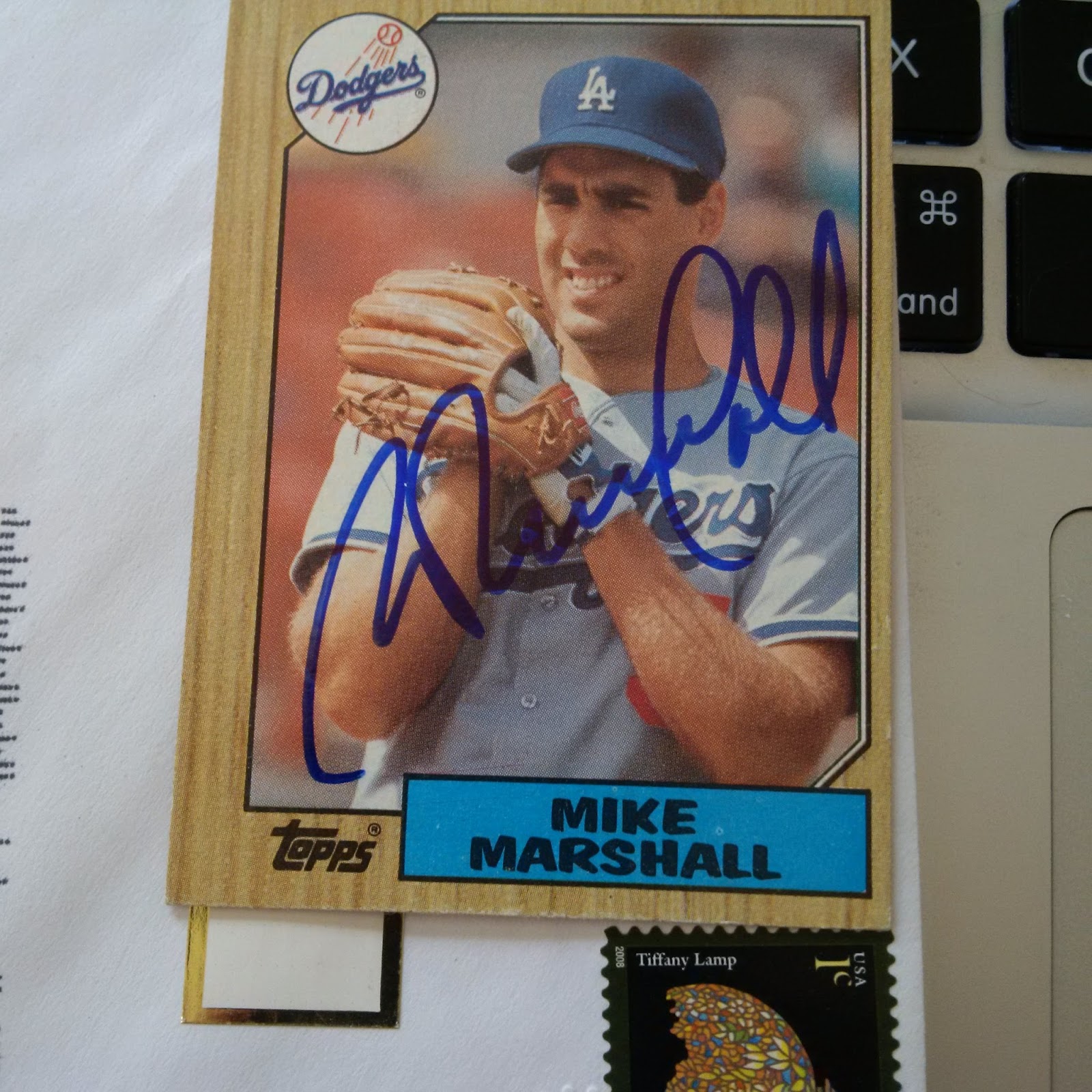

Dodgers New Acquisition Confortos Potential Compared To Hernandez

May 18, 2025

Dodgers New Acquisition Confortos Potential Compared To Hernandez

May 18, 2025 -

Analyzing Confortos Potential A Hernandez Esque Impact On The Dodgers

May 18, 2025

Analyzing Confortos Potential A Hernandez Esque Impact On The Dodgers

May 18, 2025 -

Conforto And Hernandez A Dodgers Success Story In The Making

May 18, 2025

Conforto And Hernandez A Dodgers Success Story In The Making

May 18, 2025 -

Dodgers Conforto Can He Replicate Hernandezs Success

May 18, 2025

Dodgers Conforto Can He Replicate Hernandezs Success

May 18, 2025 -

Confortos Path To Dodger Success Can He Follow Hernandezs Lead

May 18, 2025

Confortos Path To Dodger Success Can He Follow Hernandezs Lead

May 18, 2025