Where To Invest Now: The Country's Fastest-Growing Business Regions

Table of Contents

Technological Hubs: The Silicon Valleys of Tomorrow

The rise of technology continues to reshape the global economy, creating lucrative investment opportunities in fastest-growing business regions driven by innovation. Let's explore some key technological hubs:

The Rise of Tech in Austin, Texas:

- Rapid expansion of tech startups and established companies: Austin boasts a vibrant startup ecosystem, attracting major players like Google, Apple, and Tesla, alongside a thriving community of innovative smaller firms. This influx of businesses fuels economic growth and job creation.

- High concentration of skilled labor in software development, AI, and data science: The University of Texas at Austin and other educational institutions produce a steady stream of highly skilled tech graduates, providing a robust talent pool.

- Government incentives and support for technological innovation: Texas offers various tax incentives and programs designed to attract and retain tech companies, further stimulating growth in the region.

- Examples of successful tech companies based in the region: Beyond the giants, Austin is home to successful startups in fintech, SaaS, and other high-growth sectors, representing diverse investment opportunities.

- Investment opportunities: Venture capital funding is readily available, alongside opportunities in commercial real estate and tech stocks of both established and emerging companies. This makes Austin one of the top fastest-growing business regions for tech investment.

Boston, Massachusetts: A Breeding Ground for Innovation:

- Focus on specific tech niches (e.g., biotech, renewable energy): Boston's proximity to world-renowned universities and research institutions has fostered a strong concentration in biotechnology and clean energy, offering specialized investment opportunities.

- Strong university partnerships fostering research and development: Collaboration between universities and businesses drives innovation and creates a pipeline of cutting-edge technologies.

- Access to funding and mentorship programs for entrepreneurs: Numerous incubators and accelerators provide support and resources for startups, increasing the success rate of new ventures.

- Growth potential in related industries (e.g., infrastructure, logistics): The growth of the biotech and clean energy sectors creates demand in supporting industries, offering further investment avenues.

- Investment strategies tailored to the region’s specialized tech sector: Investors can focus on specific niches like biotech venture capital or renewable energy infrastructure projects, optimizing their portfolios within this dynamic ecosystem.

Booming Infrastructure Projects: Building the Future

Massive infrastructure investments are reshaping many fastest-growing business regions, creating substantial opportunities for investors.

Investing in Infrastructure Development:

- Government investment in transportation (high-speed rail, airports): Large-scale transportation projects stimulate economic activity and create demand for various services and materials.

- Expansion of energy infrastructure (renewable energy projects): The shift towards renewable energy sources is driving significant investment in wind, solar, and other green technologies.

- Growth in construction and related industries: Infrastructure projects generate substantial demand for construction materials, equipment, and labor, boosting related industries.

- Opportunities in infrastructure bonds and related investments: Investors can participate in infrastructure development through various financial instruments, including bonds and infrastructure funds.

- Risks associated with large-scale infrastructure projects: Potential risks include cost overruns, delays, and regulatory hurdles. Thorough due diligence is essential.

Denver, Colorado – A Transportation and Logistics Powerhouse:

- Strategic location facilitating trade and logistics: Denver's central location and excellent transportation links make it a crucial hub for logistics and distribution.

- Significant investment in airport expansion and modernization: Upgrades to Denver International Airport are boosting its capacity and efficiency, further strengthening its role as a transportation hub.

- Increased demand for warehousing and distribution facilities: The growth in e-commerce and related industries fuels demand for modern warehousing and logistics infrastructure.

- Investment opportunities in logistics companies and real estate: Investors can capitalize on the growing demand for warehousing space and invest in logistics companies operating in the region.

- Potential challenges related to environmental concerns and labor costs: Sustainable practices and competitive labor markets are crucial considerations for investors in this sector.

Emerging Markets with Untapped Potential

Beyond established hubs, several emerging markets offer significant potential for those seeking high-growth investment opportunities within the fastest-growing business regions.

Bangalore, India: A Rising Star in Technology and Services:

- Rapid economic growth driven by technology and services: Bangalore's IT sector is booming, attracting both domestic and international companies, leading to rapid economic expansion.

- A young and growing population with a strong workforce: A large and skilled workforce provides a foundation for sustainable economic growth and expansion.

- Opportunities for foreign direct investment (FDI): The Indian government actively encourages FDI, providing a favorable environment for foreign investors.

- Potential risks associated with emerging markets (political instability, currency fluctuations): Investors should carefully assess political and economic risks before committing capital.

- Strategies for mitigating risks in emerging market investments: Diversification, hedging strategies, and thorough due diligence are vital for managing risks in emerging markets.

Ciudad Juarez, Mexico: Attracting Investment with Tax Incentives:

- Government initiatives to attract foreign investment: Mexico offers various tax incentives and programs to attract foreign investment, particularly in manufacturing and export-oriented industries.

- Tax breaks and other incentives for businesses: These incentives can significantly reduce the cost of doing business and increase profitability.

- Growth potential in specific sectors (e.g., manufacturing, renewable energy): Ciudad Juarez is strategically positioned for growth in manufacturing and renewable energy, given its proximity to the US.

- Opportunities for real estate investment and business development: Investors can benefit from the growing demand for industrial and commercial real estate.

- Evaluating the long-term viability of tax incentive-driven investments: While tax incentives offer short-term advantages, investors must analyze the long-term viability and sustainability of the investment.

Conclusion

Identifying the country's fastest-growing business regions requires careful analysis of various economic indicators and market trends. This article highlighted several key areas demonstrating significant growth potential across diverse sectors – from technological innovation to infrastructure development and emerging markets. By understanding the drivers of growth in each region and carefully assessing potential risks, investors can make informed decisions that maximize returns. Remember to conduct thorough due diligence before making any investment. Start your journey towards financial success by further researching these fastest-growing business regions and discovering the investment opportunities that best align with your goals.

Featured Posts

-

Crisi Dazi Mercati Azionari In Ribasso La Ue Risponde

May 24, 2025

Crisi Dazi Mercati Azionari In Ribasso La Ue Risponde

May 24, 2025 -

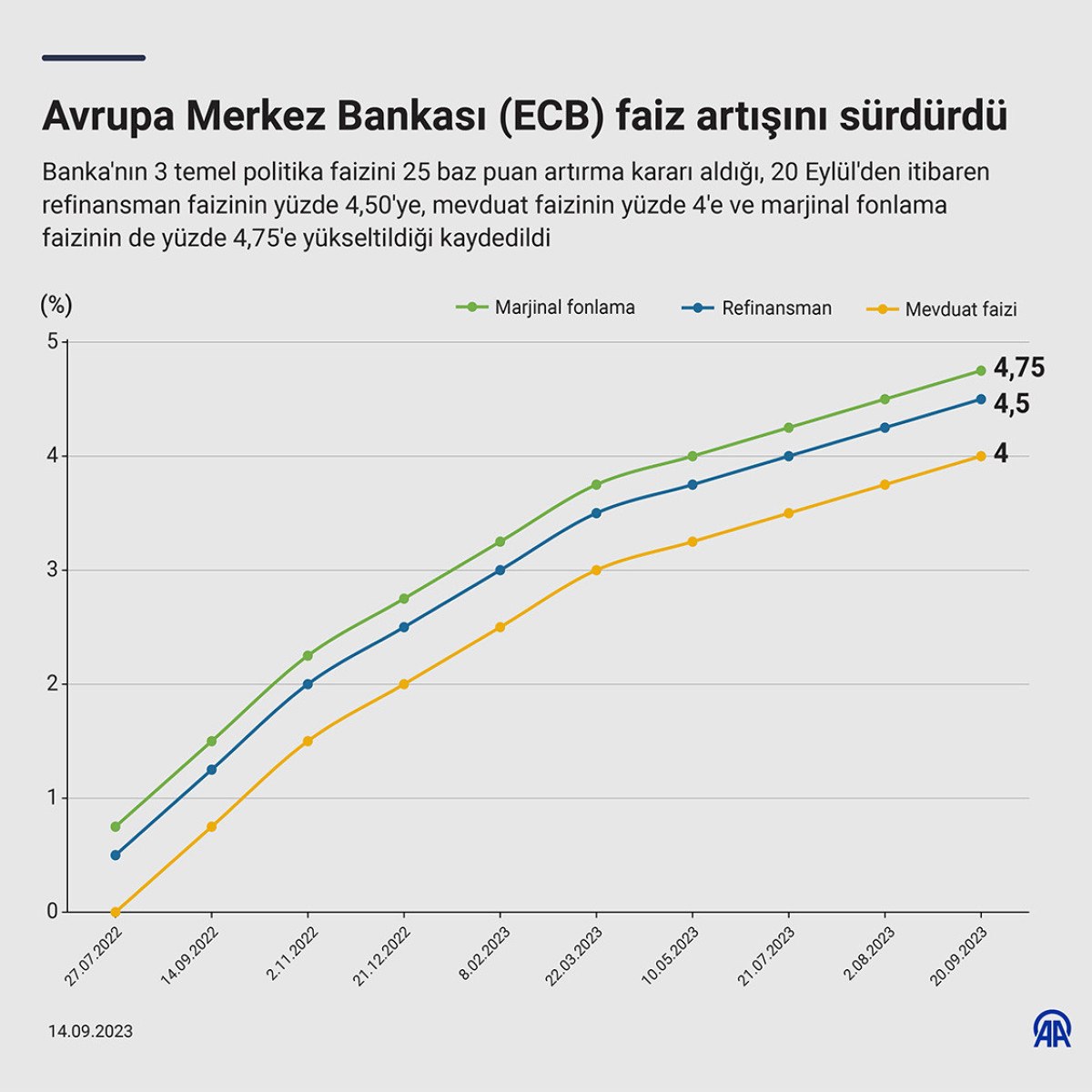

Ecb Faiz Karari Ve Avrupa Borsalarinin Tepkisi

May 24, 2025

Ecb Faiz Karari Ve Avrupa Borsalarinin Tepkisi

May 24, 2025 -

Mia Farrow Calls For Trumps Arrest Over Venezuelan Deportations

May 24, 2025

Mia Farrow Calls For Trumps Arrest Over Venezuelan Deportations

May 24, 2025 -

Euronext Amsterdam Sees 8 Stock Increase After Us Tariff Suspension

May 24, 2025

Euronext Amsterdam Sees 8 Stock Increase After Us Tariff Suspension

May 24, 2025 -

Alix Earle And The Dancing With The Stars Effect A Gen Z Influencers Journey

May 24, 2025

Alix Earle And The Dancing With The Stars Effect A Gen Z Influencers Journey

May 24, 2025

Latest Posts

-

Gas Prices To Hit Decade Lows For Memorial Day Weekend Travel

May 24, 2025

Gas Prices To Hit Decade Lows For Memorial Day Weekend Travel

May 24, 2025 -

Memorial Day Travel Gas Prices At Multi Decade Lows

May 24, 2025

Memorial Day Travel Gas Prices At Multi Decade Lows

May 24, 2025 -

Lowest Gas Prices In Decades Expected For Memorial Day Weekend

May 24, 2025

Lowest Gas Prices In Decades Expected For Memorial Day Weekend

May 24, 2025 -

2025 Memorial Day Weekend Beach Forecast Ocean City Rehoboth Beach Sandy Point

May 24, 2025

2025 Memorial Day Weekend Beach Forecast Ocean City Rehoboth Beach Sandy Point

May 24, 2025 -

Ocean City Rehoboth And Sandy Point Beach Weather Memorial Day Weekend 2025

May 24, 2025

Ocean City Rehoboth And Sandy Point Beach Weather Memorial Day Weekend 2025

May 24, 2025