Why 10-Year Mortgages Aren't Popular In Canada

Table of Contents

Higher Initial Costs and Penalties

One of the primary reasons for the low adoption of 10-year mortgages in Canada is the significantly higher upfront costs and potential penalties. Compared to shorter-term mortgages (like 5-year terms), you'll often find that 10-year mortgages come with a higher initial interest rate. Lenders consider the longer commitment a higher risk and therefore price it accordingly. This higher interest rate translates to larger monthly payments over the life of the loan.

Furthermore, breaking a 10-year mortgage early can result in substantial penalties. These penalties can be significantly higher than those associated with shorter-term mortgages, making it a less flexible and potentially costly option if your circumstances change. This inflexibility is a major deterrent for many Canadian homeowners.

- Higher interest rate: Expect to pay a premium for the longer term commitment.

- Large prepayment penalties: Breaking the mortgage early can lead to significant financial losses.

- Difficulty in accurately predicting long-term financial needs: Life is unpredictable, and a 10-year commitment can be difficult to manage.

Predicting Long-Term Financial Stability

Predicting your financial situation a decade into the future is a challenging task for anyone. Life throws curveballs: job loss, unexpected medical expenses, family changes – these are all realities that can dramatically alter your financial capacity. A 10-year mortgage locks you into a fixed payment schedule for an extended period. This lack of flexibility can be particularly problematic if your income decreases or unexpected expenses arise.

The risk of unforeseen circumstances makes a long-term commitment like a 10-year mortgage a daunting prospect for many. Interest rates also fluctuate, and locking into a rate for 10 years carries the risk of paying more than necessary if rates fall significantly during that period.

- Job security and income changes over 10 years: Income is rarely static over a decade.

- Unexpected life events (illness, family changes): These events can impact your ability to meet mortgage payments.

- Difficulty in forecasting interest rate fluctuations: Interest rates can significantly impact your monthly payments over 10 years.

The Preference for Flexibility with Shorter-Term Mortgages

The Canadian mortgage market strongly favours shorter-term mortgages, primarily 5-year terms. This preference stems from the flexibility they offer. After five years, homeowners can renegotiate their mortgage terms and rates, potentially securing a lower interest rate if market conditions are favorable. This ability to adapt to changing economic circumstances and secure better terms is a significant advantage that attracts many borrowers.

Shorter-term mortgages provide greater control over your mortgage payments and terms, allowing you to adjust your strategy as your financial situation evolves. This adaptability is highly valued in a dynamic economic environment.

- Ability to refinance at better rates after 5 years: Take advantage of potential interest rate drops.

- Greater control over mortgage payments and terms: Adjust your payments and terms as needed.

- Flexibility to adapt to changing financial situations: Respond effectively to unexpected life changes.

Limited Availability of 10-Year Mortgages

Another factor contributing to the low popularity of 10-year mortgages is their limited availability. Not all lenders in Canada offer these longer-term options. This reduced competition can also lead to less attractive terms and conditions compared to the more readily available shorter-term mortgages. Lenders are inherently more risk-averse when offering longer-term mortgages due to the increased uncertainty associated with longer-term interest rate predictions and the borrower's financial stability over such an extended period.

- Fewer lenders offering 10-year mortgage options: Limited choice for consumers.

- Higher risk assessment for lenders due to the longer term: Leading to less favorable terms for borrowers.

- Less competition in the market for 10-year mortgages: Limiting opportunities for favourable rates.

Making Informed Decisions About Your Canadian Mortgage

In summary, the unpopularity of 10-year mortgages in Canada boils down to a combination of higher upfront costs and penalties, the inherent uncertainty of predicting long-term financial stability, the strong preference for the flexibility offered by shorter-term mortgages, and the limited availability of 10-year options. While a 10-year mortgage could offer the advantage of predictable payments for some, the risks involved often outweigh the benefits for most Canadian homeowners.

Before committing to a 10-year mortgage, carefully consider your financial situation and risk tolerance. Explore the various mortgage options available, including the benefits of shorter-term mortgages, and consult with a financial advisor to make an informed decision that aligns with your individual needs and circumstances. Choosing the right mortgage term, whether a 5-year mortgage or another option, is crucial for your long-term financial well-being.

Featured Posts

-

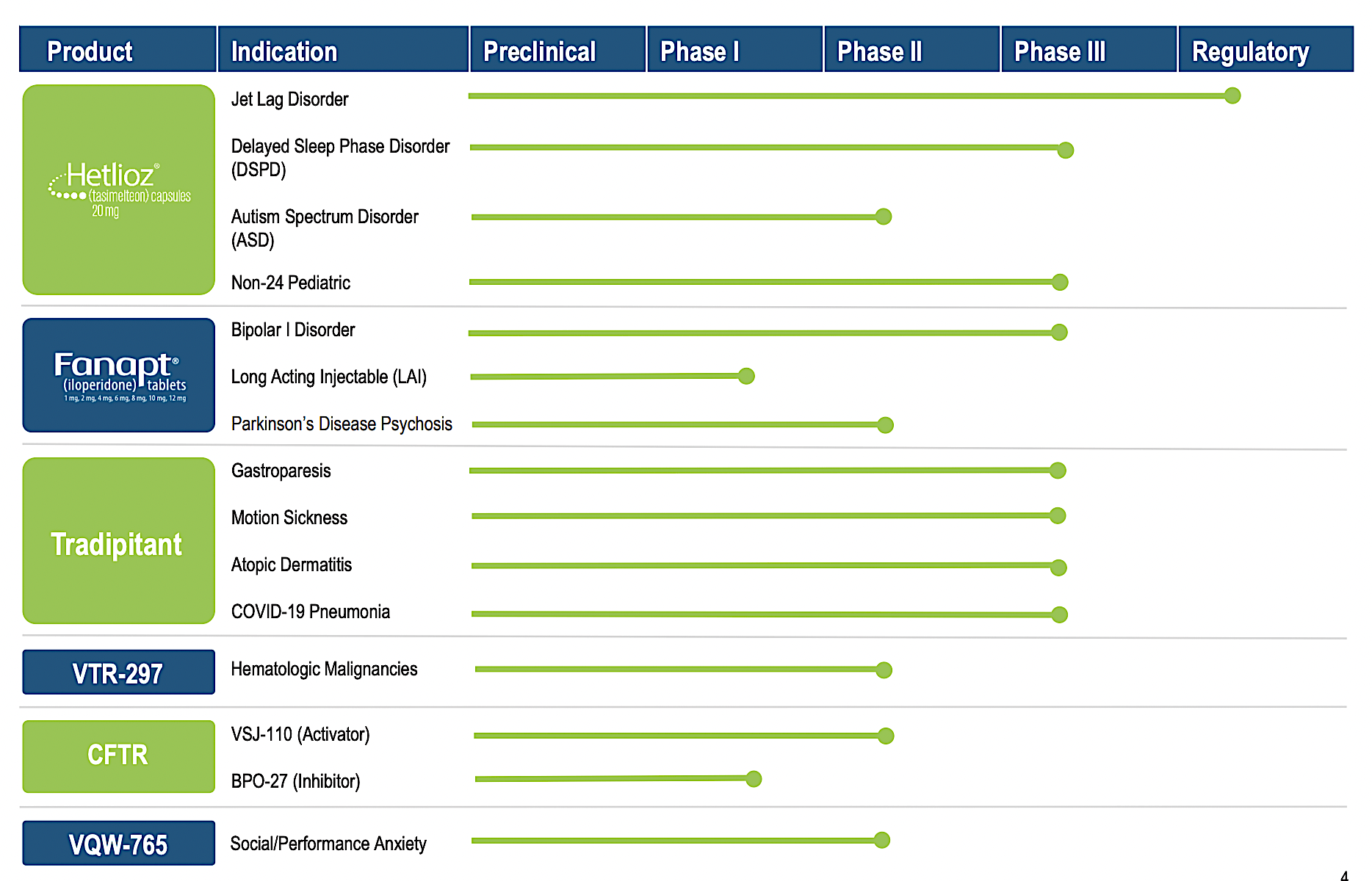

Capitals Announce All Caps 2025 Playoffs Initiatives Vanda Pharmaceuticals Inc Partnership

May 04, 2025

Capitals Announce All Caps 2025 Playoffs Initiatives Vanda Pharmaceuticals Inc Partnership

May 04, 2025 -

Carneys Economic Vision A New Era For The Economy

May 04, 2025

Carneys Economic Vision A New Era For The Economy

May 04, 2025 -

Solid Jobs Growth In April U S Adds 177 000 Jobs Unemployment At 4 2

May 04, 2025

Solid Jobs Growth In April U S Adds 177 000 Jobs Unemployment At 4 2

May 04, 2025 -

Sharp Temperature Drop In West Bengal Weather Report

May 04, 2025

Sharp Temperature Drop In West Bengal Weather Report

May 04, 2025 -

Nintendos Action Forces Ryujinx Emulator Development To Cease

May 04, 2025

Nintendos Action Forces Ryujinx Emulator Development To Cease

May 04, 2025

Latest Posts

-

Catch Red Wings And Tigers Games Together Fox 2 Simulcast

May 04, 2025

Catch Red Wings And Tigers Games Together Fox 2 Simulcast

May 04, 2025 -

Internet Buzz Over Emma Stones Unique Snl Gown The Popcorn Butt Lift Debate

May 04, 2025

Internet Buzz Over Emma Stones Unique Snl Gown The Popcorn Butt Lift Debate

May 04, 2025 -

Indy Car And Fox A Winning Partnership

May 04, 2025

Indy Car And Fox A Winning Partnership

May 04, 2025 -

Indy Car On Fox A New Era Begins

May 04, 2025

Indy Car On Fox A New Era Begins

May 04, 2025 -

2025 Fox And Espns New Standalone Streaming Services Unveiled

May 04, 2025

2025 Fox And Espns New Standalone Streaming Services Unveiled

May 04, 2025