Why Analysts Are Worried About Future Corporate Earnings

Table of Contents

Inflation's Bite: Eroding Profit Margins and Consumer Spending

High inflation is a significant headwind for corporate earnings, impacting businesses in two primary ways: it squeezes profit margins and dampens consumer spending. The rising cost of raw materials, energy, and labor directly reduces profit margins, as businesses struggle to pass on these increased costs to consumers completely. Simultaneously, reduced consumer spending power, a direct consequence of inflation, leads to lower demand for goods and services, impacting revenue generation.

- Impact on Profit Margins: Increased input costs, including raw materials, energy, and transportation, directly eat into profit margins. Companies face a difficult choice: absorb the increased costs and reduce profits or raise prices, risking reduced consumer demand.

- Reduced Consumer Spending: Inflation erodes purchasing power, forcing consumers to cut back on discretionary spending. This decreased demand impacts businesses across various sectors, leading to slower revenue growth and potentially declining sales.

- Industries Heavily Impacted: Manufacturing, retail, and hospitality are among the sectors most vulnerable to inflation's effects. Manufacturing faces escalating raw material costs, while retail grapples with decreased consumer spending and higher transportation costs. The hospitality sector faces higher labor and energy costs, affecting profitability.

- Data & Statistics: For example, the Consumer Price Index (CPI) has shown a significant increase in recent months, indicating a substantial rise in the cost of living, directly impacting consumer spending and business profitability. (Note: Insert relevant statistical data here from reputable sources).

Supply Chain Disruptions: Continued Uncertainty and Increased Costs

Ongoing supply chain bottlenecks continue to pose a significant challenge to businesses, disrupting production and driving up costs. Geopolitical instability, natural disasters, and logistical challenges contribute to these disruptions, creating uncertainty and impacting inventory management. The inability to obtain necessary raw materials or components on time leads to production delays, increased costs, and ultimately, a negative impact on corporate earnings.

- Production Delays & Increased Costs: Supply chain bottlenecks result in delays in production, forcing companies to either halt operations or incur higher costs to source materials from alternative suppliers. This leads to higher production costs and potentially lower output.

- Geopolitical Risk & Natural Disasters: Events such as the war in Ukraine, port congestion, and extreme weather events have significantly disrupted global supply chains, impacting the availability and cost of goods.

- Inventory Management Challenges: The unpredictability of supply chains makes it challenging for businesses to effectively manage inventory levels. Insufficient inventory can lead to lost sales, while excessive inventory ties up capital and increases storage costs.

- Real-world Examples: Many companies have publicly acknowledged the impact of supply chain disruptions on their earnings, citing increased costs and reduced production as major factors. (Note: Insert examples of specific companies and their experiences).

Recessionary Fears: The Looming Threat to Corporate Growth

The increased likelihood of a recession presents a significant threat to corporate earnings. A recession typically involves decreased consumer and business spending, leading to a slowdown in economic activity and reduced corporate revenue. Job losses are also a common consequence of a recession, further dampening consumer spending and impacting corporate performance.

- Decreased Spending: During a recession, consumers and businesses reduce spending due to economic uncertainty and declining confidence. This directly impacts corporate revenue, as demand for goods and services falls.

- Job Losses: Recessions often lead to job losses, further impacting consumer spending and corporate performance. Reduced consumer confidence exacerbates the situation, further depressing demand.

- Economic Forecasts: Many economic forecasters are predicting an increased likelihood of a recession in the near future, citing high inflation, rising interest rates, and weakening economic indicators. (Note: Insert data and forecasts from reputable economic sources such as the IMF or World Bank).

Geopolitical Uncertainty: A Global Impact on Corporate Earnings

International conflicts and political instability significantly affect global markets and corporate earnings. Sanctions, trade wars, and currency fluctuations create uncertainty and volatility, impacting businesses operating in global markets. These events can disrupt supply chains, increase costs, and reduce demand, leading to a decline in corporate earnings.

- Impact of Sanctions & Trade Wars: Trade wars and sanctions disrupt international trade, impacting businesses reliant on global supply chains and markets. This can lead to higher costs, reduced sales, and lost market share.

- Currency Fluctuations: Changes in exchange rates can significantly impact the profitability of multinational corporations, affecting their revenue and earnings in different currencies.

- Specific Geopolitical Events: The war in Ukraine, for example, has created significant disruption to global energy markets and supply chains, impacting various industries and corporate earnings worldwide.

Conclusion: Navigating the Uncertainty – Understanding the Future of Corporate Earnings

The confluence of inflation, supply chain disruptions, recessionary fears, and geopolitical uncertainty creates a challenging environment for businesses. Understanding these factors is crucial for both investors and business leaders. Analyzing the potential impact of these challenges on corporate earnings is essential for effective risk management and strategic planning. By staying informed about these critical developments, businesses can better navigate the current economic landscape and adapt their strategies accordingly. Stay informed about the latest developments affecting corporate earnings to make informed investment decisions, and to ensure your business remains resilient in these turbulent times.

Featured Posts

-

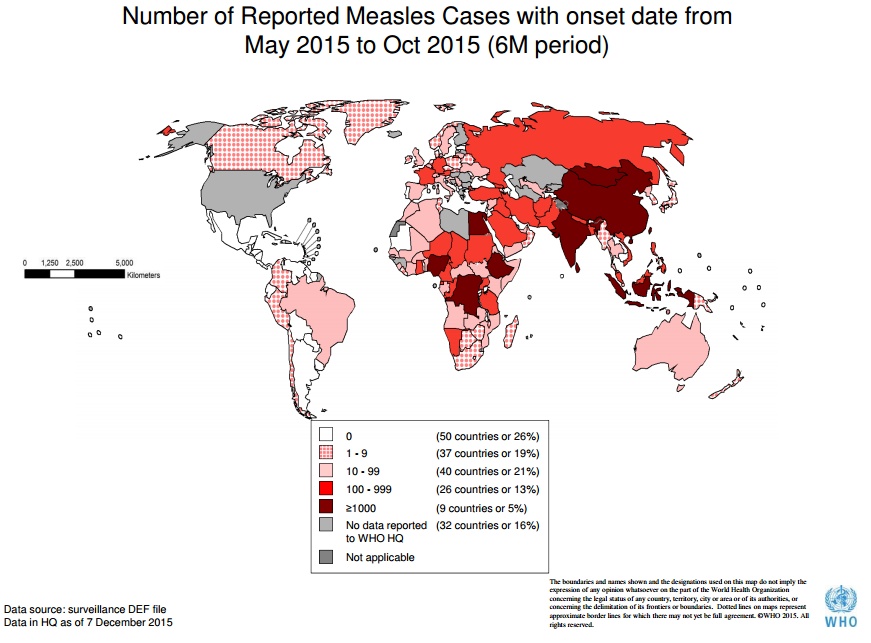

Declining Measles Cases In The United States Understanding The Trends

May 30, 2025

Declining Measles Cases In The United States Understanding The Trends

May 30, 2025 -

Setlist Fm Y Ticketmaster Se Unen Una Mejor Experiencia Para Los Fans

May 30, 2025

Setlist Fm Y Ticketmaster Se Unen Una Mejor Experiencia Para Los Fans

May 30, 2025 -

Tv Programmata Megaloy Savvatoy 19 4

May 30, 2025

Tv Programmata Megaloy Savvatoy 19 4

May 30, 2025 -

Harmful Algal Bloom Crisis Californias Coastal Wildlife At Risk

May 30, 2025

Harmful Algal Bloom Crisis Californias Coastal Wildlife At Risk

May 30, 2025 -

Reforme Des Retraites Convergence Inattendue Entre Le Rn Et La Gauche

May 30, 2025

Reforme Des Retraites Convergence Inattendue Entre Le Rn Et La Gauche

May 30, 2025