Why Current Stock Market Valuations Are Not A Red Flag: A BofA Analysis

Table of Contents

BofA's Methodology: Deconstructing the Valuation Narrative

BofA employs a sophisticated methodology to analyze stock market valuations, moving beyond simple headline metrics to paint a more nuanced picture. Their approach goes beyond the usual superficial glances, considering a broader range of factors that influence market dynamics.

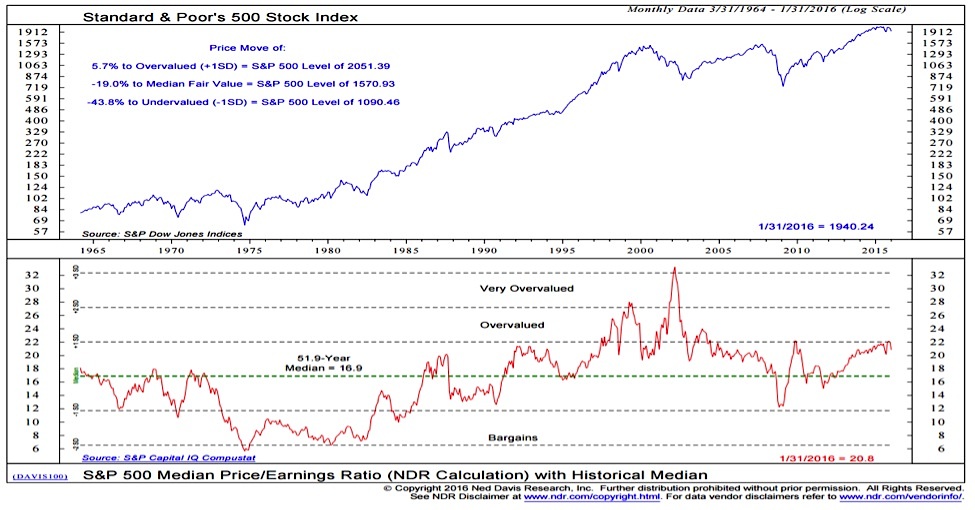

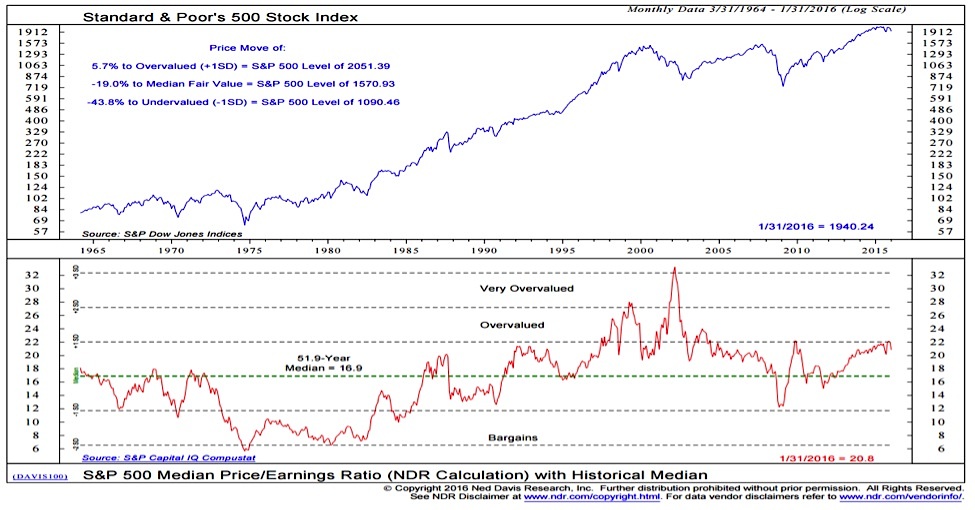

- Specific valuation metrics: BofA utilizes a combination of traditional and less conventional metrics to assess valuations. This includes the widely used Price-to-Earnings ratio (P/E), the cyclically adjusted price-to-earnings ratio (Shiller PE), and other forward-looking valuation models. The choice of these metrics reflects a desire for a comprehensive evaluation, considering both historical performance and future projections.

- Beyond traditional metrics: Recognizing that simplistic valuation ratios alone can be misleading, BofA incorporates crucial contextual factors. These include prevailing interest rates, inflation rates, projected economic growth, and geopolitical uncertainties. This holistic approach aims to provide a more accurate representation of the underlying value of the market.

- Data sources and models: BofA's analysis draws upon a vast array of data sources, including their own proprietary economic models, government statistics, and independent market research. This multi-faceted approach ensures robustness and reduces the risk of relying on a single, potentially flawed data point.

The Role of Interest Rates and Inflation in Shaping Valuations

Interest rates and inflation play a significant role in shaping stock market valuations. Understanding their influence is vital to interpreting the current market climate.

- Inverse relationship between interest rates and stock valuations: Lower interest rates generally lead to higher stock valuations. This is because lower borrowing costs make it cheaper for companies to invest and grow, boosting earnings and increasing investor demand for stocks. Conversely, rising interest rates tend to put downward pressure on stock valuations as higher borrowing costs stifle growth and make bonds more attractive.

- Inflation's impact on corporate earnings and investor expectations: Inflation impacts stock valuations indirectly by affecting corporate earnings and investor expectations. High inflation can erode profit margins, reducing company earnings, while also influencing investor expectations for future returns. BofA's analysis likely incorporates inflation forecasts to project their impact on future earnings.

- BofA's data insights: BofA likely uses its proprietary models to demonstrate how the current relatively low interest rate environment and controlled inflation levels, while still present, are factored into their valuation assessments, suggesting that the current valuations are not overly inflated in comparison to these factors.

Long-Term Growth Prospects and Future Earnings Expectations

BofA's analysis incorporates a forward-looking perspective, assessing long-term economic growth and its implications for corporate earnings. This focus on future potential is crucial in understanding their optimistic valuation assessment.

- Future earnings growth projections: BofA's projections for future earnings growth are likely central to their argument. By showing strong anticipated earnings growth, they demonstrate that current valuations, while perhaps high in a historical context, are justifiable given the anticipated future performance of companies.

- Justification for current valuations: The key to BofA's argument rests on demonstrating that projected earnings growth is robust enough to support current stock prices. Their analysis likely includes detailed sector-specific analyses to justify these projections.

- Strong growth sectors: BofA’s analysis might highlight specific sectors or industries—technology, healthcare, or renewable energy, for instance—as drivers of future growth, justifying elevated valuations in those areas.

Addressing Counterarguments: Why Other Metrics Might Be Misleading

Critics often point to historical comparisons to argue that current valuations are unsustainable. BofA's analysis likely addresses these counterarguments directly.

- Refuting historical comparisons: BofA’s analysis likely emphasizes the unique circumstances of the present economic climate. Factors such as technological advancements, globalization, and evolving monetary policy differ significantly from historical periods, making simple historical comparisons misleading.

- Relevance of valuation metrics: The analysis might highlight that certain commonly used valuation metrics might be less relevant in the current environment, requiring a more nuanced approach. For instance, traditional P/E ratios might be less informative in a period of rapid technological disruption.

- Data-driven counterarguments: BofA would use its extensive data and modeling to demonstrate that current valuations, while perhaps high in a historical context, are justified by current economic conditions and long-term growth projections.

BofA's Investment Recommendations Based on Current Stock Market Valuations

Based on their in-depth analysis, BofA likely offers specific investment recommendations.

- Sector-specific recommendations: They may suggest overweighting specific sectors poised for strong growth, aligning with their future earnings projections.

- Cautionary notes and risk factors: Despite their generally positive outlook, BofA would acknowledge potential risks and uncertainties. This demonstrates a balanced and responsible approach to investment advice.

- Overall market outlook: BofA's summary outlook likely reflects a cautiously optimistic stance, acknowledging the complexities of the market while emphasizing the potential for continued growth.

Conclusion

BofA's analysis suggests that current stock market valuations, while seemingly high, are not necessarily a cause for alarm. This conclusion rests on a sophisticated methodology considering interest rates, inflation, and robust future earnings growth projections. While acknowledging potential risks, their analysis indicates that a balanced perspective, accounting for long-term growth potential and the unique circumstances of the current economic climate, offers a more nuanced understanding of the market.

Learn more about BofA's analysis of current stock market valuations and refine your investment strategy today!

Featured Posts

-

Walmart And Target Executives To Meet Trump Amidst Tariff Concerns

Apr 23, 2025

Walmart And Target Executives To Meet Trump Amidst Tariff Concerns

Apr 23, 2025 -

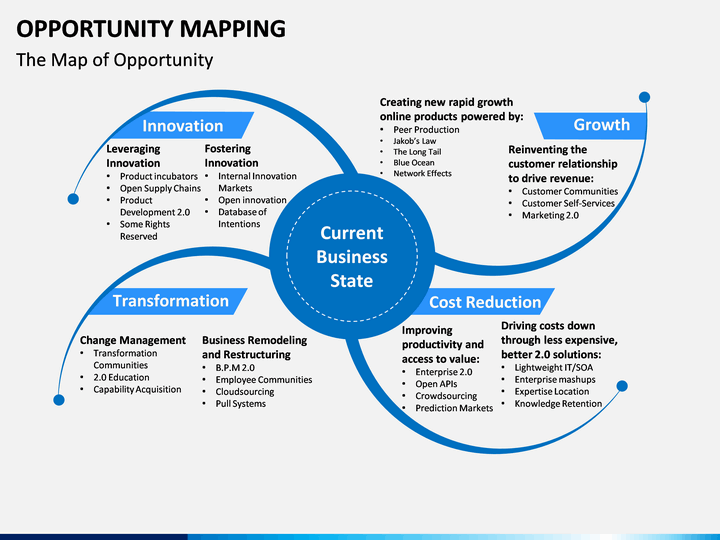

Investment Opportunities Mapping The Countrys Hottest New Business Areas

Apr 23, 2025

Investment Opportunities Mapping The Countrys Hottest New Business Areas

Apr 23, 2025 -

Yankees Smash Team Record With 9 Homers In 2025 Opener

Apr 23, 2025

Yankees Smash Team Record With 9 Homers In 2025 Opener

Apr 23, 2025 -

Diamondbacks Defeat Brewers Naylors Clutch Rbi The Key

Apr 23, 2025

Diamondbacks Defeat Brewers Naylors Clutch Rbi The Key

Apr 23, 2025 -

Profitable Mlb Player Prop Predictions Jazz Vs Steeltown

Apr 23, 2025

Profitable Mlb Player Prop Predictions Jazz Vs Steeltown

Apr 23, 2025