Why Current Stock Market Valuations Shouldn't Deter Investors (BofA)

Table of Contents

The Importance of Long-Term Investing and Perspective

Market fluctuations are inherent; short-term volatility is a normal part of the investment cycle and shouldn't dictate long-term investment strategies. History consistently demonstrates the remarkable resilience of the stock market. While short-term corrections are inevitable, the long-term trend reveals substantial growth. Focusing on the long game is crucial.

- Historical Data: Data shows that despite numerous market corrections and bear markets throughout history, the stock market has consistently delivered positive returns over the long term. For example, the S&P 500 has historically averaged annual returns of approximately 10%, although past performance is not indicative of future results.

- Past Corrections and Recoveries: The dot-com bubble burst of 2000 and the 2008 financial crisis are prime examples of significant market corrections followed by substantial recoveries. These events highlight the importance of weathering short-term downturns to reap the benefits of long-term growth.

- Time in the Market vs. Timing the Market: Trying to time the market – attempting to buy low and sell high – is notoriously difficult and often unsuccessful. The most effective strategy is usually to maintain a consistent investment approach over the long term, allowing the power of compounding to work its magic. This emphasizes the importance of "time in the market" over "timing the market."

Analyzing Stock Market Valuations Beyond Simple Metrics

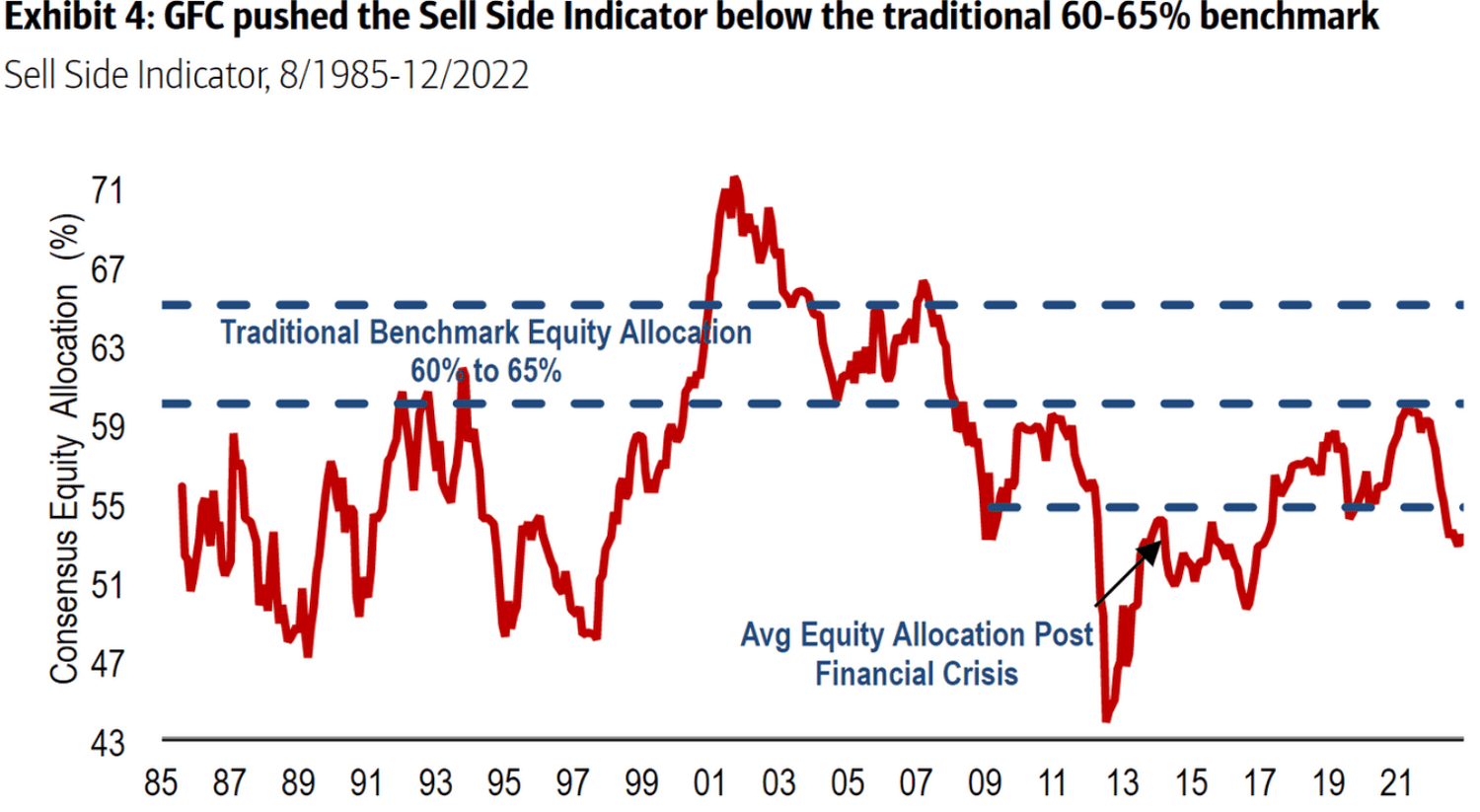

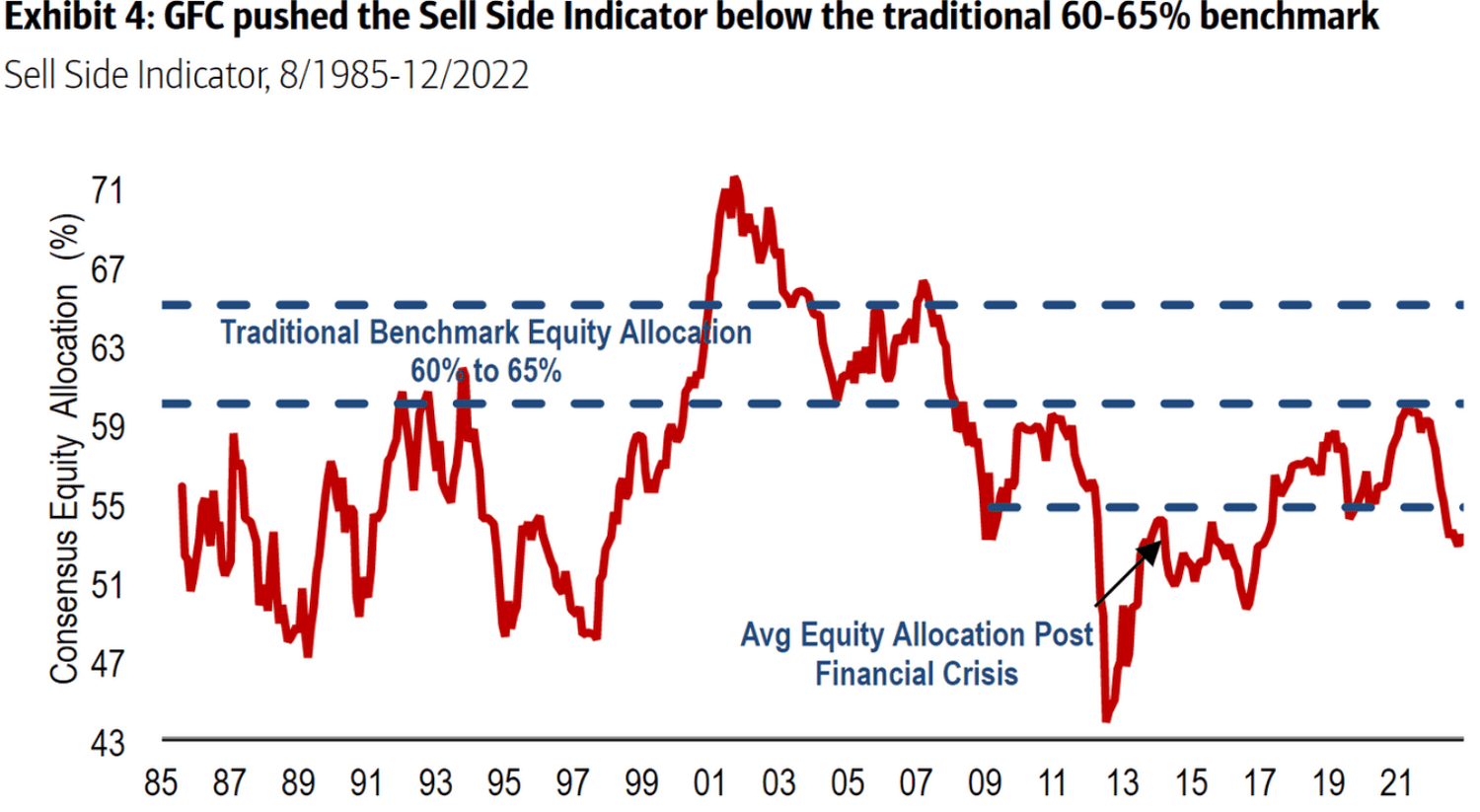

Relying solely on simplistic valuation metrics like the Price-to-Earnings (P/E) ratio can be misleading. A high P/E ratio, often interpreted as an overvalued market, doesn't tell the whole story. Several other factors significantly influence stock market valuations.

- Alternative Valuation Metrics: Consider using alternative metrics like the Shiller P/E ratio (CAPE), which adjusts for inflation, or Tobin's Q, which compares a company's market value to its asset replacement cost, for a more nuanced view.

- Interest Rates and Valuations: Interest rate changes heavily influence stock valuations. Lower interest rates generally support higher valuations, as they reduce the cost of borrowing for companies and increase the present value of future earnings. Conversely, rising interest rates tend to decrease valuations.

- Inflation's Impact: Inflation erodes purchasing power and impacts corporate earnings. Higher inflation can lead to increased input costs for companies, affecting profitability and potentially dampening valuations. Understanding the interplay between inflation, interest rates, and stock market valuations is essential.

The Role of Innovation and Technological Advancements

Technological advancements and innovation are fundamental drivers of long-term economic growth and corporate profitability. These factors often justify seemingly high valuations, particularly in sectors at the forefront of technological change.

- Innovative Companies: Companies leading in areas like artificial intelligence, biotechnology, and renewable energy are often characterized by high valuations, reflecting the immense growth potential of their innovations.

- Disruptive Technologies: Disruptive technologies have the power to reshape entire industries, creating significant opportunities for long-term growth and justifying high valuations for companies pioneering these advancements.

- Earnings Growth: Technological advancements can lead to significant increases in corporate earnings, supporting higher valuation multiples. This potential for future growth is a crucial factor to consider when assessing current stock market valuations.

BofA's Perspective and Investment Strategies

BofA's analysis often acknowledges the high valuations but emphasizes the importance of long-term investing and strategic diversification. Their recommendations usually stress the importance of maintaining a balanced portfolio across various asset classes to mitigate risks.

- BofA Recommendations: BofA analysts frequently provide insights and recommendations based on their thorough assessment of the market, suggesting specific sectors or investment strategies tailored to different risk tolerances.

- Asset Class Diversification: Diversifying across different asset classes, such as stocks, bonds, and real estate, can help mitigate the impact of market volatility and enhance long-term returns.

- Risk Management Strategies: Implementing effective risk management strategies, such as dollar-cost averaging, regular portfolio rebalancing, and setting stop-loss orders, can help protect investments during periods of market uncertainty.

Conclusion: Don't Let High Stock Market Valuations Deter Your Investment Strategy

Current high stock market valuations shouldn't dissuade long-term investors. We've explored the importance of long-term perspectives, the limitations of simplistic valuation metrics, the role of innovation, and BofA's strategic recommendations. Remember that market fluctuations are normal, and a long-term approach, coupled with strategic diversification, is key. To effectively navigate the market, consult with a qualified financial advisor, review BofA's research on assessing current stock market valuations, and develop a robust long-term investment plan that accounts for market volatility and your individual risk tolerance. Begin your journey towards understanding stock market valuations and building a successful long-term investment strategy today.

Featured Posts

-

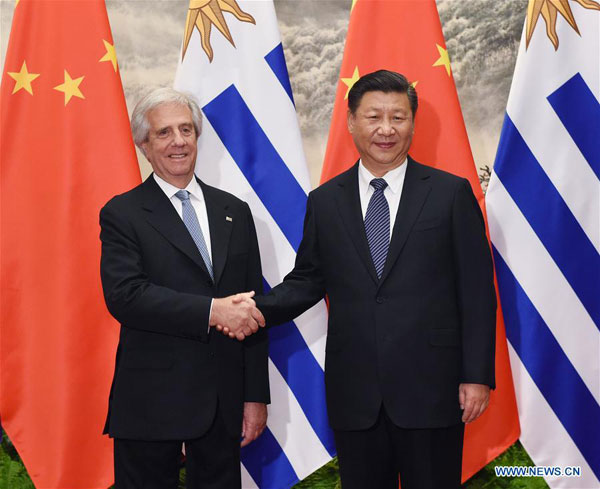

Uruguay Envia Tres Toros A China Como Regalo Para El Presidente Xi

May 11, 2025

Uruguay Envia Tres Toros A China Como Regalo Para El Presidente Xi

May 11, 2025 -

End Of Refugee Outings Fabers Announcement

May 11, 2025

End Of Refugee Outings Fabers Announcement

May 11, 2025 -

Farrah Abrahams Post Teen Mom Life Success Struggle And Controversy

May 11, 2025

Farrah Abrahams Post Teen Mom Life Success Struggle And Controversy

May 11, 2025 -

The Masters 2024 Lowrys Encouraging Words For Mc Ilroy Reflects Deep Bond

May 11, 2025

The Masters 2024 Lowrys Encouraging Words For Mc Ilroy Reflects Deep Bond

May 11, 2025 -

Bayern Munich Celebrates Bundesliga Win Thomas Muellers Last Home Game

May 11, 2025

Bayern Munich Celebrates Bundesliga Win Thomas Muellers Last Home Game

May 11, 2025