Why Current Stock Market Valuations Shouldn't Deter Investors: BofA's Analysis

Table of Contents

BofA's Key Arguments Against Immediate Market Concerns

BofA's analysis counters the prevailing negativity surrounding high stock market valuations. Their perspective considers several crucial factors that paint a more optimistic, albeit cautious, picture of the current market landscape.

The Role of Interest Rates and Inflation

BofA's analysis carefully considers the interplay between interest rates, inflation, and stock valuations. High inflation erodes purchasing power, affecting corporate earnings and consequently, market pricing. However, BofA's projections suggest that while inflation remains a factor, the current interest rate hikes are likely to curb its impact in the foreseeable future.

- How inflation affects corporate earnings and market pricing: High inflation increases input costs for businesses, squeezing profit margins and potentially leading to lower earnings growth. This, in turn, can impact investor sentiment and put downward pressure on stock prices.

- BofA's prediction on future interest rate movements and their implications: BofA anticipates a slowdown in interest rate hikes as inflation cools. This implies that the negative impact of interest rates on stock valuations may lessen over time, creating a potentially more favorable environment for investment.

- Discussion of real interest rates and their effect on stock valuation: Real interest rates (nominal interest rates minus inflation) are a key determinant of stock valuations. BofA's analysis likely considers the relationship between real interest rates and the attractiveness of equity investments compared to fixed-income securities. Lower real interest rates can boost stock valuations.

Long-Term Growth Potential and Valuation Metrics

BofA's assessment considers the long-term economic growth prospects and their influence on stock prices. While current valuations might seem high based on certain metrics, the long-term growth potential of many companies warrants a more nuanced approach.

- Analysis of different valuation metrics (P/E ratio, PEG ratio, etc.) and their current levels: BofA likely analyzes various valuation metrics like the Price-to-Earnings (P/E) ratio, Price-to-Earnings-Growth (PEG) ratio, and others to determine whether current market valuations are justified. They might find that while some sectors might be overvalued, others present potentially attractive opportunities.

- Comparison to historical valuations and the potential for future growth: A comparison to historical valuations helps put the current market situation in perspective. BofA likely considers whether current valuations are significantly above historical averages and factors in anticipated future earnings growth.

- Mention of specific sectors or companies BofA identifies as undervalued: BofA's analysis might highlight specific sectors or companies that, despite the overall high market valuations, present attractive investment opportunities due to their strong growth potential and relatively lower valuations.

Sector-Specific Opportunities and Diversification

Given the current market conditions, BofA likely recommends focusing on specific sectors less vulnerable to valuation concerns and emphasizes the importance of portfolio diversification.

- Explanation of why certain sectors are considered less vulnerable to valuation concerns: Certain sectors, such as those with strong cash flows and less sensitivity to interest rate changes, might be seen as less vulnerable to the current market environment.

- Emphasis on the benefits of a well-diversified investment portfolio: A diversified portfolio reduces risk by spreading investments across various asset classes and sectors. This mitigates the impact of potential underperformance in specific areas.

- Examples of sectors or investment strategies supported by BofA's analysis: BofA may suggest specific sectors or investment strategies (value investing, growth investing, etc.) that align with their overall analysis and provide a more balanced approach to investing in the current market.

Addressing Investor Concerns and Sentiment

High stock market valuations often trigger fear and uncertainty among investors. BofA's analysis addresses these concerns, emphasizing the importance of a long-term perspective and a robust investment strategy.

Understanding Market Volatility and Short-Term Fluctuations

Short-term market fluctuations are a normal part of the investment cycle. These fluctuations shouldn't dissuade long-term investors with a well-defined strategy.

- Importance of maintaining a long-term investment horizon: Focusing on long-term goals reduces the impact of short-term market volatility. The ups and downs will even out over time.

- Historical examples of market corrections and subsequent recoveries: History shows that market corrections are followed by periods of growth. Understanding this historical pattern can help manage anxieties.

- Advice on how to manage emotional responses to market volatility: Disciplined investing requires managing emotional reactions. Having a pre-defined strategy and sticking to it is crucial during volatile periods.

The Importance of a Robust Investment Strategy

A well-defined investment strategy is essential for navigating market uncertainties, regardless of current valuations.

- Importance of risk tolerance assessment: Understanding your risk tolerance is fundamental. It informs your investment choices and helps manage potential losses.

- Benefits of professional financial advice: Seeking professional guidance provides personalized advice tailored to your specific financial situation and goals.

- Strategies for managing portfolio risk during periods of high valuation: Strategies like diversification, dollar-cost averaging, and rebalancing can mitigate portfolio risk during periods of high valuations.

Conclusion

BofA's analysis suggests that while current stock market valuations may appear high, a cautious yet optimistic approach remains warranted. The key takeaways are the importance of long-term growth prospects, diversified investment strategies, and understanding market volatility. Don't let perceived high stock market valuations deter you from investing wisely. Consider seeking professional financial advice and developing a robust long-term investment strategy to navigate current market conditions. Learn more about BofA's market analysis and adapt your approach to current stock market valuations. Remember, successful long-term investing requires a clear understanding of both market conditions and your personal investment goals.

Featured Posts

-

Slowdown In Dutch Conversions Vacant Office And Shop Buildings Remain Unused

May 28, 2025

Slowdown In Dutch Conversions Vacant Office And Shop Buildings Remain Unused

May 28, 2025 -

Romes Champion Driven To Achieve More

May 28, 2025

Romes Champion Driven To Achieve More

May 28, 2025 -

Stowers And Conine Power Marlins To Victory Over Nationals

May 28, 2025

Stowers And Conine Power Marlins To Victory Over Nationals

May 28, 2025 -

Top Strikers Arsenal Transfer Decision Tottenhams 58m Bid Faces Rejection

May 28, 2025

Top Strikers Arsenal Transfer Decision Tottenhams 58m Bid Faces Rejection

May 28, 2025 -

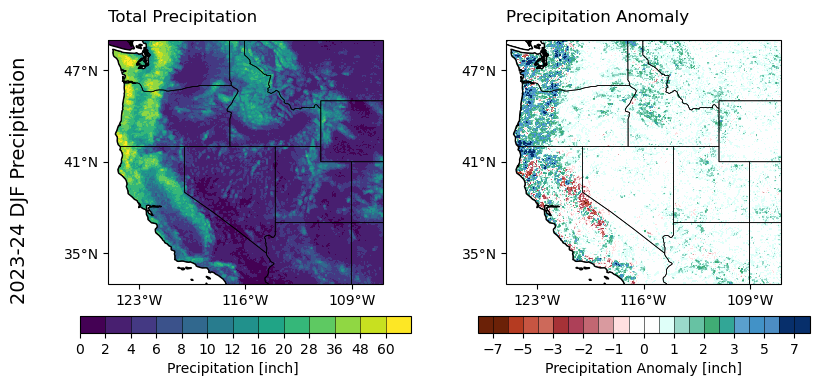

Drought Forecast Unsettling Parallels Between Spring 1968 And Spring 2024

May 28, 2025

Drought Forecast Unsettling Parallels Between Spring 1968 And Spring 2024

May 28, 2025

Latest Posts

-

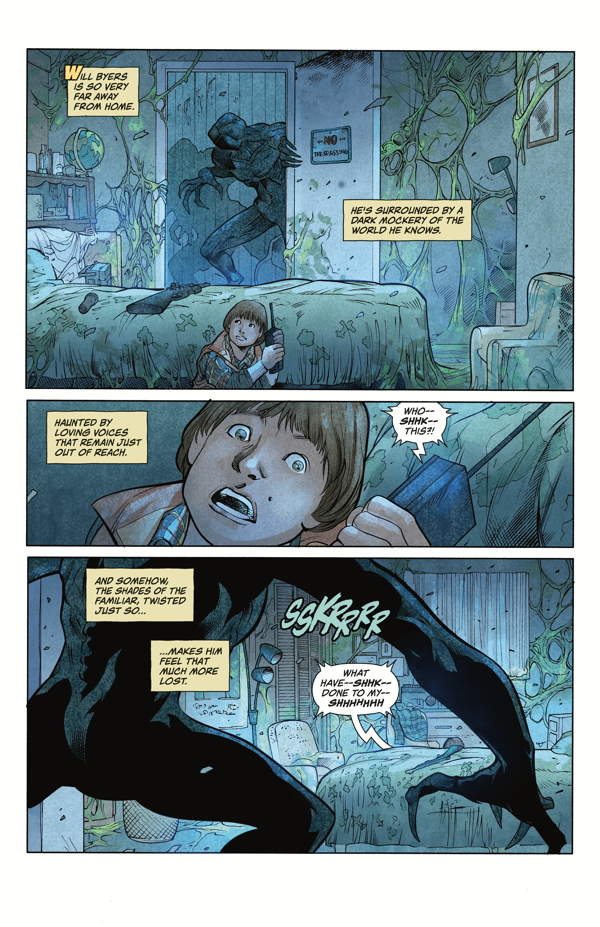

Experience More Stranger Things Comics To Hold You Over Until Season 5

May 29, 2025

Experience More Stranger Things Comics To Hold You Over Until Season 5

May 29, 2025 -

Cardiff Welcomes Stranger Things Star For New Tv Series

May 29, 2025

Cardiff Welcomes Stranger Things Star For New Tv Series

May 29, 2025 -

Stranger Things Season 5 Wait Dive Into The Comics

May 29, 2025

Stranger Things Season 5 Wait Dive Into The Comics

May 29, 2025 -

Fill The Void Stranger Things Comics Before Season 5 Arrives

May 29, 2025

Fill The Void Stranger Things Comics Before Season 5 Arrives

May 29, 2025 -

Stranger Things Actor Spotted Filming In Cardiff

May 29, 2025

Stranger Things Actor Spotted Filming In Cardiff

May 29, 2025