Why Did CoreWeave (CRWV) Stock Price Jump Last Week?

Table of Contents

Last week saw a significant jump in CoreWeave (CRWV) stock price, leaving many investors wondering about the contributing factors. This article delves into the key events and market dynamics that likely propelled CRWV's share value, providing insights into the company's performance and future prospects. We'll explore potential reasons behind this surge and what it means for investors in CRWV stock.

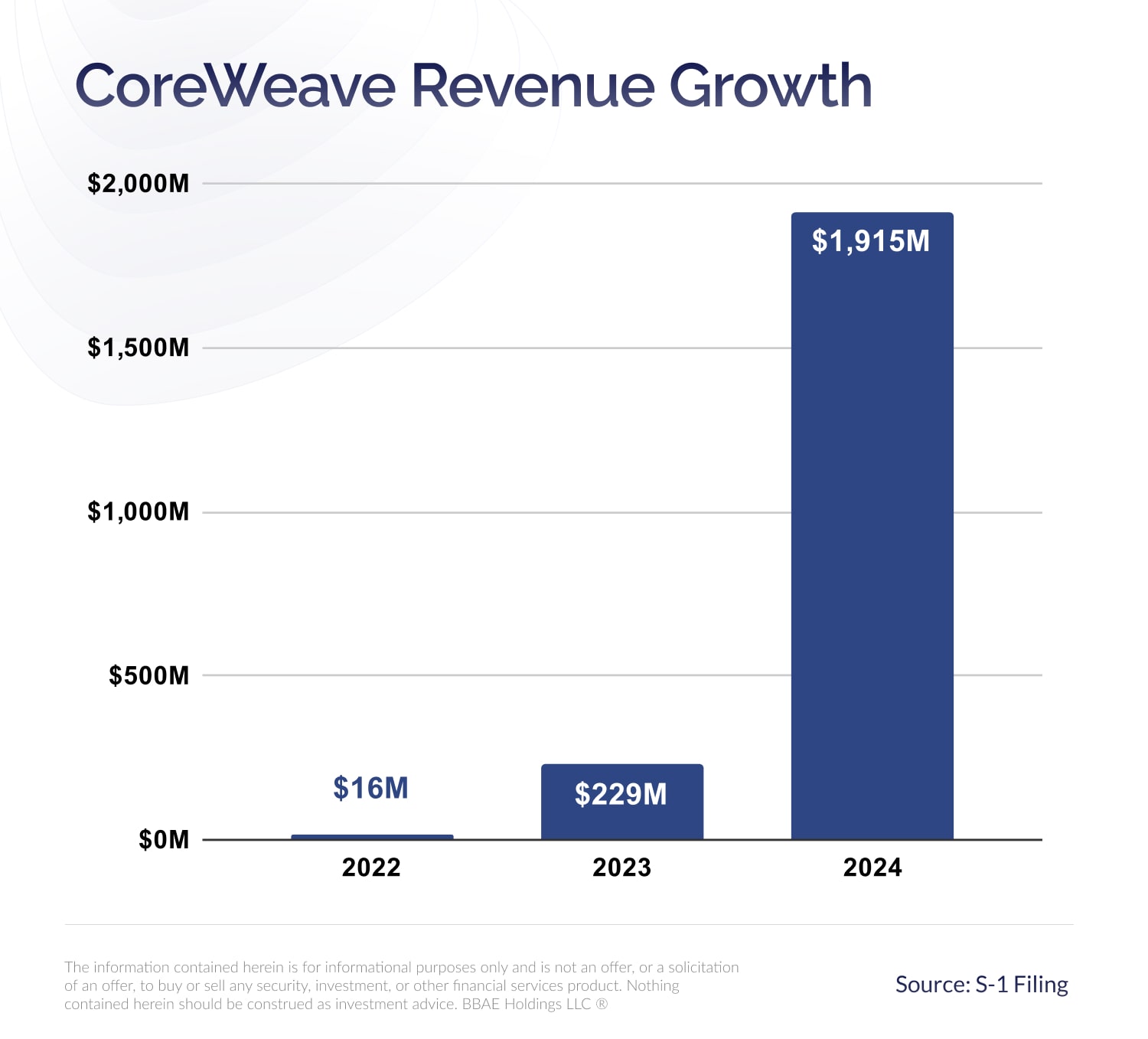

Positive Earnings Report and Revenue Growth

Exceeding Expectations:

CoreWeave's recent earnings report likely exceeded Wall Street's expectations for both revenue and earnings per share (EPS). While precise figures may vary depending on the reporting date and sources, a significant positive surprise is usually a key driver of stock price increases. A strong beat on revenue expectations, especially coupled with upwardly revised guidance for future quarters, can significantly impact investor confidence and drive up share prices.

- Highlighting Growth Areas: CoreWeave's growth likely stems from increased demand for its cloud computing services, particularly those catering to the burgeoning Artificial Intelligence (AI) infrastructure market. Strong performance in this sector is a key indicator of future potential.

- Positive Future Guidance: Positive guidance from CoreWeave management for upcoming quarters indicates confidence in continued growth and profitability. Such forward-looking statements are closely watched by investors and can heavily influence stock valuations.

- Comparative Performance: Comparing the current quarter's performance against previous quarters reveals the rate of growth. A consistently upward trend reinforces a positive narrative for investors, signaling sustained momentum.

Analyzing the financial report data, it's clear that significant growth in revenue and profitability, exceeding analyst predictions, directly impacted investor confidence, leading to a surge in CRWV's stock price.

Increased Institutional Investor Interest

Large Purchases and Ratings Upgrades:

Increased interest from institutional investors is another significant factor that likely contributed to the CRWV stock price jump. Large-scale purchases by hedge funds, mutual funds, or other institutional players inject substantial capital into the market, increasing demand and driving up the price.

- Specific Institutional Actions: Identifying specific institutional investors who increased their holdings in CRWV provides concrete evidence of increased interest and confidence in the company's future.

- Positive Analyst Ratings: Positive analyst ratings and increased price targets from reputable financial institutions provide further validation of CRWV's growth prospects, attracting additional investment.

- Boosting Market Confidence: The participation of large, sophisticated institutional investors signals a level of confidence that can influence other, smaller investors, creating a positive feedback loop.

The significant influx of capital from institutional investors, coupled with positive analyst assessments, contributed significantly to the upward pressure on CRWV's stock price.

Growing Demand for AI Infrastructure

CoreWeave's Position in the AI Market:

CoreWeave is uniquely positioned to benefit from the explosive growth of the AI market. Their specialized infrastructure provides the computational power needed to train and deploy complex AI models, making them a crucial player in this rapidly expanding sector.

- Role in AI Applications: CoreWeave's services are essential for powering AI applications across various sectors, including machine learning, natural language processing, and computer vision.

- New Partnerships and Contracts: Securing new partnerships and contracts with major players in the AI industry demonstrates the market's demand for CoreWeave's services, indicating ongoing growth potential.

- Impact of AI Market Growth: The overall growth trajectory of the AI sector directly translates to increased demand for CoreWeave's infrastructure, driving revenue growth and, consequently, stock price appreciation.

The undeniable link between CoreWeave's business and the surging demand for AI infrastructure is a major factor contributing to the positive investor sentiment and the subsequent stock price increase.

Market Sentiment and Speculation

Overall Market Conditions and Investor Psychology:

While company-specific factors are crucial, the broader market sentiment and investor psychology also play a significant role in short-term stock price fluctuations.

- Broader Market Conditions: A generally positive market environment, with low interest rates or positive economic indicators, can positively influence investor appetite for riskier growth stocks like CRWV.

- Tech Sector Sentiment: Positive sentiment towards the technology sector as a whole, particularly within cloud computing and AI, creates a supportive environment for companies like CoreWeave.

- Positive News and Events: Positive news coverage or significant events related to CRWV or the broader technology sector can positively influence investor perception and drive up stock prices.

Understanding the psychology of investor behavior—including the impact of speculation and herd mentality—is important for understanding short-term price volatility. Positive news, combined with generally positive market sentiment, can amplify the impact of other positive factors.

Conclusion:

The recent CoreWeave (CRWV) stock price jump can be attributed to a confluence of factors: strong financial performance exceeding expectations, a surge in institutional investment, the expanding AI market's demand for CoreWeave's services, and a positive overall market sentiment.

Call to Action: Understanding the reasons behind CRWV's stock price movements is crucial for informed investment decisions. Continue researching CoreWeave (CRWV) and stay updated on market trends to make sound investment choices. Learn more about CoreWeave (CRWV) stock and its future potential. Consider diversifying your portfolio appropriately and always consult with a financial advisor before making any investment decisions.

Featured Posts

-

Auto Dealers Renewed Opposition To Ev Mandates A Closer Look

May 22, 2025

Auto Dealers Renewed Opposition To Ev Mandates A Closer Look

May 22, 2025 -

Exclusive Partnership Ford And Nissans Joint Venture In Ev Battery Production

May 22, 2025

Exclusive Partnership Ford And Nissans Joint Venture In Ev Battery Production

May 22, 2025 -

The Controversy Behind An Australian Trans Influencers Record Breaking Feat

May 22, 2025

The Controversy Behind An Australian Trans Influencers Record Breaking Feat

May 22, 2025 -

Cau Ma Da Noi Dong Nai Binh Phuoc Du Kien Khoi Cong Thang 6

May 22, 2025

Cau Ma Da Noi Dong Nai Binh Phuoc Du Kien Khoi Cong Thang 6

May 22, 2025 -

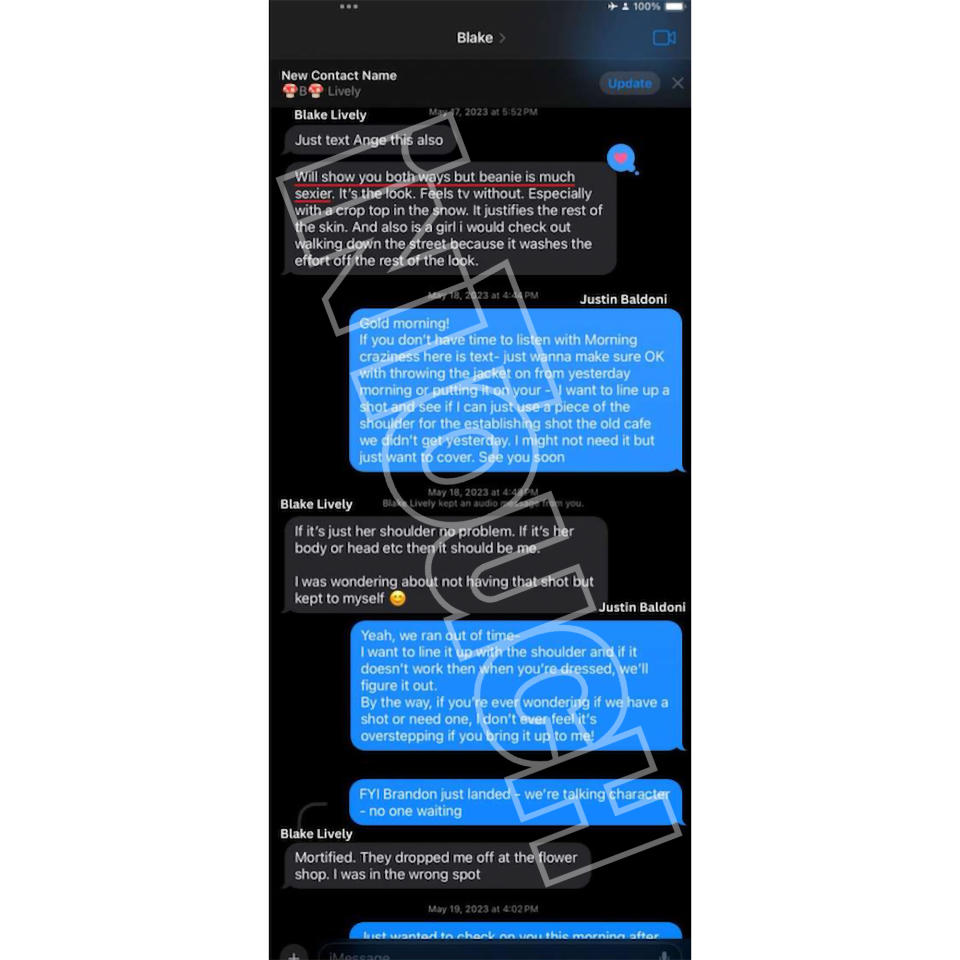

Blake Lively Alleged Controversies And Recent News

May 22, 2025

Blake Lively Alleged Controversies And Recent News

May 22, 2025

Latest Posts

-

Lindsi Grem Ta Posilennya Sanktsiy Proti Rf Detali Zakonoproektu

May 22, 2025

Lindsi Grem Ta Posilennya Sanktsiy Proti Rf Detali Zakonoproektu

May 22, 2025 -

S Sh A Gotovyat Novye Sanktsii Protiv Rossii Reaktsiya Senata

May 22, 2025

S Sh A Gotovyat Novye Sanktsii Protiv Rossii Reaktsiya Senata

May 22, 2025 -

Senat S Sh A Ugrozhaet Uzhestochit Sanktsii Protiv Rossii Novye Detali

May 22, 2025

Senat S Sh A Ugrozhaet Uzhestochit Sanktsii Protiv Rossii Novye Detali

May 22, 2025 -

Sanktsiyi Proti Rosiyi Lindsi Grem Napolyagaye Na Yikh Posilenni

May 22, 2025

Sanktsiyi Proti Rosiyi Lindsi Grem Napolyagaye Na Yikh Posilenni

May 22, 2025 -

Dodatkovi Sanktsiyi Proti Rf Lindsi Grem Ta Noviy Zakonoproekt

May 22, 2025

Dodatkovi Sanktsiyi Proti Rf Lindsi Grem Ta Noviy Zakonoproekt

May 22, 2025