Why Did CoreWeave Inc. (CRWV) Stock Fall On Tuesday?

Table of Contents

Broad Market Downturn and Tech Sector Weakness

The decline in CRWV stock wasn't an isolated incident. Tuesday saw a broader market downturn, with the tech sector particularly hard hit. This negative investor sentiment significantly impacted growth stocks like CoreWeave, which are often more sensitive to economic shifts. Several factors contributed to this overall market weakness:

- Negative investor sentiment towards the tech sector as a whole: Concerns about inflation, interest rate hikes, and a potential recession led investors to reduce their exposure to riskier assets, including many tech stocks. This general risk aversion created a downward pressure across the board.

- Increased interest rates and their effect on growth stocks: Higher interest rates increase borrowing costs for companies, impacting their profitability and making growth stocks, which rely on future earnings, less attractive. This is particularly relevant for companies like CoreWeave that are still in their growth phase.

- Nasdaq's parallel decline: The Nasdaq Composite, a key benchmark for technology stocks, experienced a substantial drop on Tuesday, mirroring the downward trend seen in CRWV. This indicates a broader sector-wide issue rather than a company-specific problem. [Link to relevant Nasdaq news article]

Specific News or Announcements Affecting CoreWeave

While the broader market contributed to the CRWV stock fall, it's also crucial to examine any company-specific news that might have exacerbated the decline. Although no single catastrophic announcement directly caused the drop, several factors might have played a role:

- Absence of positive news or guidance: The lack of positive news or updated guidance from CoreWeave itself might have disappointed investors anticipating further bullish announcements. The absence of positive news can lead to sell-offs, especially in a volatile market.

- Increased competition in the cloud computing sector: The cloud computing market is fiercely competitive. Announcements from rival companies, such as new partnerships or product launches, could indirectly impact investor confidence in CoreWeave's future prospects. [Link to news article on competitor activity]

- Analyst revisions (if any): Any downgrades or revisions of price targets by leading financial analysts covering CRWV could have further fueled the sell-off. Analyst sentiment heavily influences investor decisions. [Link to relevant analyst reports, if available]

Analyst Reactions and Trading Volume

Following the CRWV stock fall, analysts offered varied perspectives. Some attributed the decline solely to the broader market conditions, while others pointed to potential company-specific concerns. Analyzing the trading volume on Tuesday provides further insight:

- Analyst commentary: [Insert quotes from analysts, if available, referencing their analysis of the CRWV stock drop and its potential causes].

- High trading volume: An unusually high trading volume on Tuesday might indicate a significant sell-off, suggesting a larger number of investors were simultaneously offloading their CRWV shares. [Include data on trading volume compared to previous days, if available].

- Unusual trading patterns: Any unusual trading patterns, such as a large number of sell orders at the opening bell, could also provide clues regarding the market's reaction to perceived negative news.

Technical Analysis: Chart Patterns and Indicators

While fundamental analysis is crucial, a brief look at technical indicators can offer additional context. [If applicable, insert a chart showing CRWV stock performance around the date of the fall].

- Support and resistance levels: Did the stock price break through a key support level, triggering further selling pressure? [Explain any relevant support and resistance levels broken, if applicable].

- Technical indicators (RSI, MACD, etc.): Did any commonly used technical indicators signal a potential downturn prior to the fall? [Mention any relevant technical indicators and their implications, keeping it concise and avoiding excessive jargon].

Conclusion: Recap and Future Outlook for CRWV Stock

The CoreWeave Inc. (CRWV) stock fall on Tuesday was likely a confluence of factors. The broader market downturn impacting the tech sector, coupled with the absence of positive company-specific news, might have triggered a sell-off. Analyzing trading volume and, if applicable, technical indicators provides further insights into the market's reaction.

Predicting the future of CRWV stock is challenging. However, CoreWeave's long-term prospects depend on its ability to navigate the competitive cloud computing landscape, maintain innovation, and adapt to evolving market conditions. Staying informed about CRWV through official company announcements, financial news, and analyst reports is crucial. Conduct thorough research and carefully consider your risk tolerance before making any investment decisions related to CoreWeave stock or any other investment.

Featured Posts

-

Nantes La Croissance Des Immeubles De Grande Hauteur Et Le Metier De Cordistes

May 22, 2025

Nantes La Croissance Des Immeubles De Grande Hauteur Et Le Metier De Cordistes

May 22, 2025 -

Cassidy Hutchinson January 6th Testimony And Upcoming Memoir

May 22, 2025

Cassidy Hutchinson January 6th Testimony And Upcoming Memoir

May 22, 2025 -

Us G7 Trade Relations A Delicate Balance For Finance Ministers

May 22, 2025

Us G7 Trade Relations A Delicate Balance For Finance Ministers

May 22, 2025 -

Bwtshytynw Ydm Thlatht Laebyn Lawl Mrt Lqaymt Mntkhb Alwlayat Almthdt

May 22, 2025

Bwtshytynw Ydm Thlatht Laebyn Lawl Mrt Lqaymt Mntkhb Alwlayat Almthdt

May 22, 2025 -

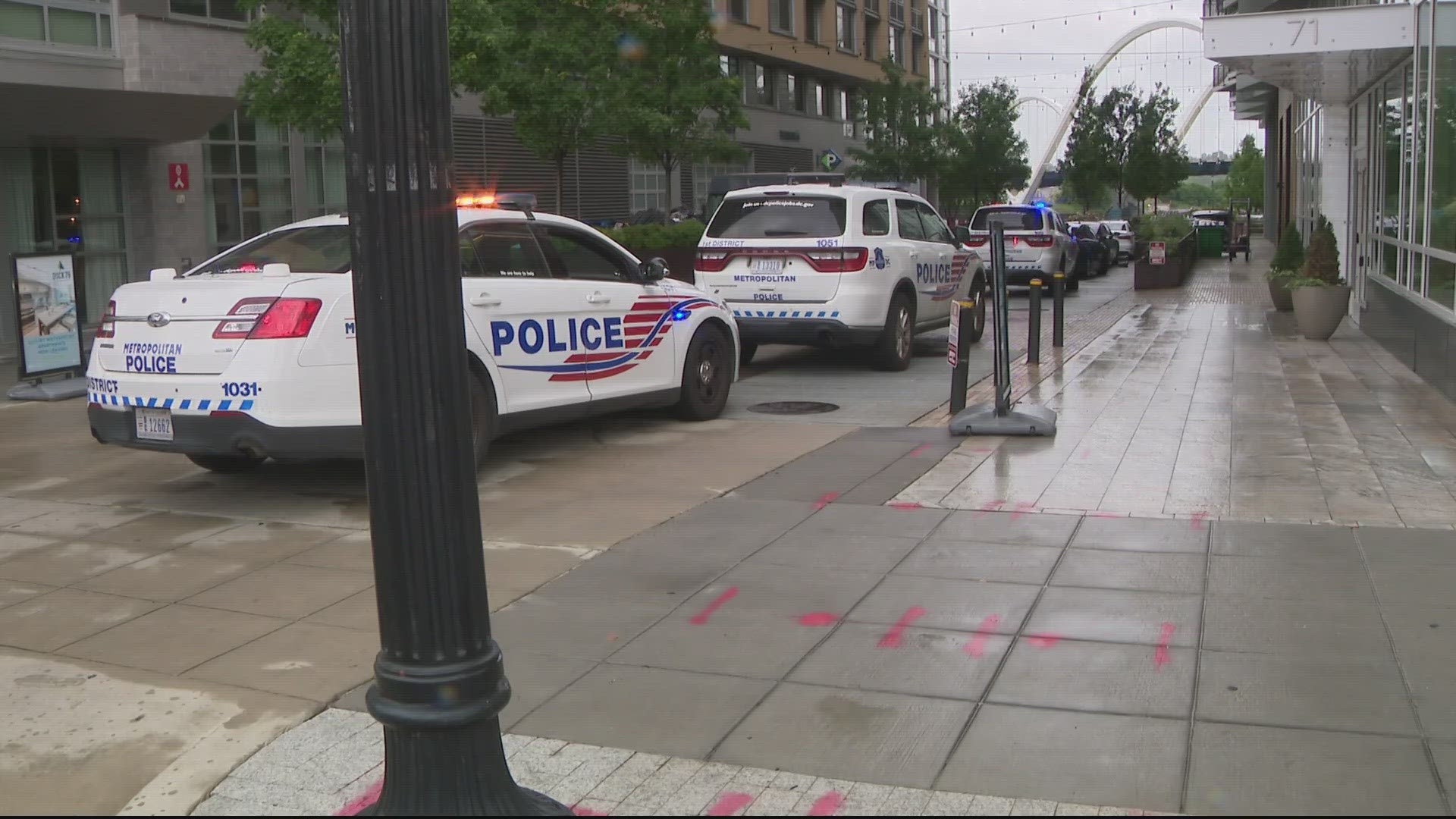

Dc Terrorist Attack Victims Identified As Yaron Lischinsky And Sarah Milgrim

May 22, 2025

Dc Terrorist Attack Victims Identified As Yaron Lischinsky And Sarah Milgrim

May 22, 2025

Latest Posts

-

Dc Terrorist Attack Victims Identified As Yaron Lischinsky And Sarah Milgrim

May 22, 2025

Dc Terrorist Attack Victims Identified As Yaron Lischinsky And Sarah Milgrim

May 22, 2025 -

Couple Slain In Dc Terror Attack Identified

May 22, 2025

Couple Slain In Dc Terror Attack Identified

May 22, 2025 -

Israeli Embassy Victims Identified Young Couple Days From Engagement

May 22, 2025

Israeli Embassy Victims Identified Young Couple Days From Engagement

May 22, 2025 -

Second Dc Shooting Victim Identified Remembering Sarah Milgram

May 22, 2025

Second Dc Shooting Victim Identified Remembering Sarah Milgram

May 22, 2025 -

Sarah Milgram Jewish American Employee At Israeli Embassy Dc Shooting Victim

May 22, 2025

Sarah Milgram Jewish American Employee At Israeli Embassy Dc Shooting Victim

May 22, 2025