Why Elevated Stock Market Valuations Shouldn't Scare Investors: BofA's Take

Table of Contents

BofA's Rationale Behind Elevated Stock Market Valuations

BofA's analysis of current market conditions provides a reasoned perspective on elevated stock market valuations. Their justification rests on several key pillars:

-

Low Interest Rates: Historically low interest rates play a significant role in supporting higher valuations. When borrowing costs are low, companies can invest more readily, boosting earnings and making stocks more attractive relative to bonds. This low-cost capital fuels growth and contributes to higher price-to-earnings (P/E) ratios.

-

Strong Corporate Earnings and Projected Economic Growth: BofA's analysts point to robust corporate earnings and optimistic projections for economic growth as key drivers of elevated stock prices. Strong earnings demonstrate the underlying strength of many companies, justifying higher valuations. The expectation of future growth further fuels investor confidence and bidding.

-

Inflation Considerations: While inflation is a concern, BofA’s valuation models incorporate its impact. They analyze the relationship between inflation, interest rates, and corporate earnings to determine how these factors ultimately affect stock prices. Their assessment suggests that current inflation levels, while impacting profit margins for some sectors, aren't necessarily dampening overall market growth to a degree that warrants extreme caution.

-

Sector-Specific Outperformance: BofA highlights specific sectors, such as technology and healthcare, as being particularly well-positioned for continued growth, even amidst elevated valuations. These sectors often benefit from technological innovation and demographic trends, supporting higher valuations in their constituent companies.

Considering Long-Term Growth Potential Over Short-Term Volatility

When assessing stock market valuations, a long-term investment horizon is paramount. Focusing solely on short-term fluctuations can lead to impulsive decisions that may hurt long-term returns.

-

Market Volatility is Normal: Short-term market volatility is inherent. Periods of high and low valuations are normal parts of the market cycle, and attempting to time the market perfectly is often unsuccessful.

-

Diversification Mitigates Risk: Diversifying your investment portfolio across different asset classes and sectors significantly reduces the risk associated with high valuations in any single sector. A well-diversified portfolio can help to buffer against losses in one area.

-

Strategic Investment Planning: A well-defined investment strategy, aligned with your risk tolerance and financial goals, is essential. This strategy should encompass a long-term perspective and include mechanisms for managing risk during periods of market uncertainty.

-

Dollar-Cost Averaging: A strategy like dollar-cost averaging, which involves investing a fixed amount at regular intervals regardless of market price, can help mitigate the risk of investing a lump sum at a potentially high valuation point.

The Role of Innovation and Technological Advancements

Technological innovation is a powerful engine driving future growth and justifying higher valuations in specific sectors.

-

Disruptive Technologies: Disruptive technologies create new markets and reshape existing ones, leading to significant growth opportunities. This justifies higher valuations for companies at the forefront of innovation.

-

Sector Outperformance: Sectors such as technology, biotechnology, and renewable energy are expected to outperform others due to technological advancements and increasing demand.

-

Stock Picking Strategies: In high-growth sectors, a focused stock-picking strategy, identifying companies with strong fundamentals and significant growth potential, can enhance returns.

Addressing Common Concerns About High Stock Market Valuations

High stock market valuations naturally raise concerns about potential market corrections or even a bear market.

-

Market Corrections are Expected: Market corrections are a normal part of the market cycle. While they can be unsettling, they're not necessarily indicators of a prolonged downturn.

-

BofA's Perspective on Corrections: BofA's analysis typically considers the likelihood of corrections but doesn't necessarily predict imminent crashes. Their projections usually factor in the possibility of market adjustments and evaluate their potential impact on overall market health.

-

Incorporating Recession Risk: Incorporating recession risk into your long-term financial planning is prudent. This involves maintaining a diversified portfolio and having a sufficient emergency fund.

-

Strategies for Market Downturns: Having a clear plan for navigating market downturns, including strategies like rebalancing your portfolio or adjusting your investment timeline, can help alleviate concerns.

Conclusion

Elevated stock market valuations, while seemingly intimidating, don't necessarily signal an impending market crash according to BofA's analysis. By focusing on long-term growth potential, diversifying investments, and understanding the underlying economic factors, investors can navigate these periods effectively. BofA's perspective highlights the importance of a strategic, long-term approach, even when faced with seemingly high stock market valuations. The key is to maintain a balanced, diversified portfolio and focus on your long-term financial goals.

Call to Action: Don't let elevated stock market valuations scare you. Develop a robust, long-term investment strategy and consult with a financial advisor to understand how to manage your portfolio effectively in this market environment. Learn more about navigating elevated stock market valuations and building a resilient investment portfolio tailored to your specific needs and risk tolerance.

Featured Posts

-

Obituary Actress Priscilla Pointer Known For Carrie Dies At 100

May 01, 2025

Obituary Actress Priscilla Pointer Known For Carrie Dies At 100

May 01, 2025 -

Comparativo App De Ia Da Meta Vs Chat Gpt

May 01, 2025

Comparativo App De Ia Da Meta Vs Chat Gpt

May 01, 2025 -

Little Coffee Secures Four Investment Offers From Dragons Den

May 01, 2025

Little Coffee Secures Four Investment Offers From Dragons Den

May 01, 2025 -

Deutscher Koalitionspoker Spielt Ein Architekt Des Scheiterns Mit

May 01, 2025

Deutscher Koalitionspoker Spielt Ein Architekt Des Scheiterns Mit

May 01, 2025 -

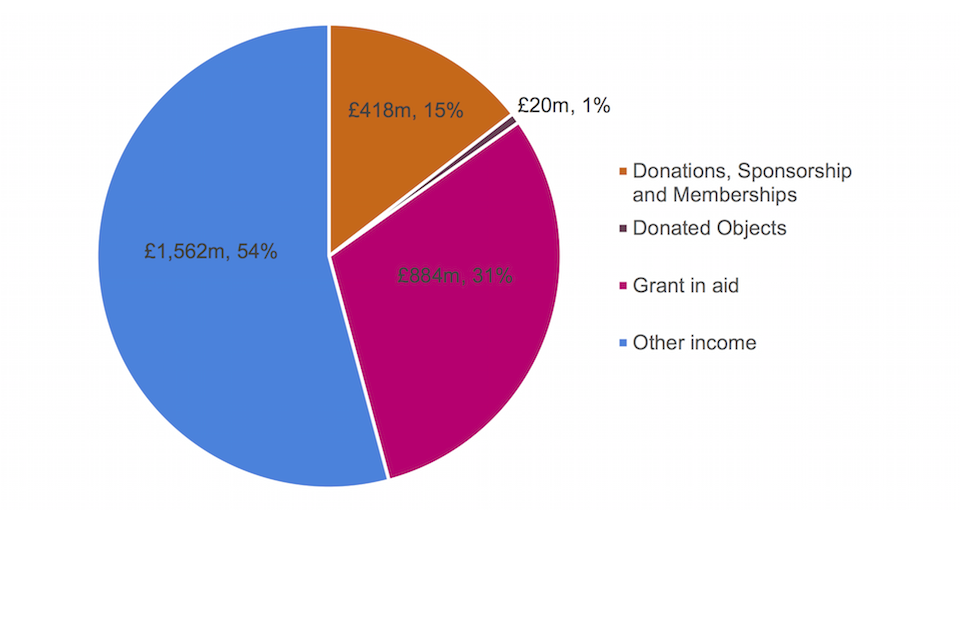

Understanding Michael Sheens Charitable Giving The 1 Million Initiative

May 01, 2025

Understanding Michael Sheens Charitable Giving The 1 Million Initiative

May 01, 2025