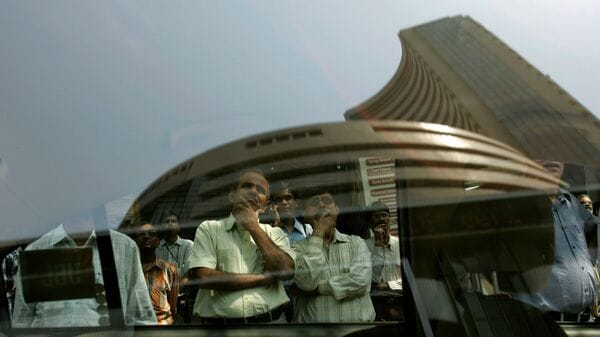

Why Stretched Stock Market Valuations Shouldn't Deter Investors: A BofA Analysis

Table of Contents

BofA's Analysis: Dissecting the Valuation Narrative

BofA's research provides a comprehensive look at current market valuations, challenging the narrative of an overvalued market primed for a crash. Let's break down their analysis:

Understanding Current Market Valuation Metrics

Common valuation metrics, such as the Price-to-Earnings ratio (P/E) and the Cyclically Adjusted Price-to-Earnings ratio (Shiller PE), are often cited to gauge market valuation. However, these metrics have limitations, particularly in the current economic climate.

- BofA's Current Market Valuation Findings (Illustrative): BofA may report a high P/E ratio, but also highlight strong earnings growth projections. (Note: Specific numerical data would need to be sourced from a current BofA report).

- Why these metrics might be misleading: High valuations can be justified by low interest rates, strong future earnings growth, and robust economic fundamentals. Simply looking at P/E ratios in isolation ignores these crucial context factors.

- Influencing Factors: Interest rates and inflation significantly impact stock valuations. Low interest rates generally support higher valuations, as investors seek higher returns in the stock market. Conversely, high inflation can erode earnings and compress valuations.

The Role of Low Interest Rates in Justifying Higher Valuations

Low interest rates play a critical role in supporting higher price-to-earnings ratios. This is because:

- Inverse Relationship: Low interest rates make borrowing cheaper for companies, boosting investment and earnings growth. Simultaneously, they reduce the attractiveness of low-yield bonds, driving capital into the equity market, increasing demand and thus prices.

- Impact on Investor Behavior: Low rates encourage investors to take on more risk, seeking higher returns in the stock market, further bidding up prices.

- Future Interest Rate Hikes: While future interest rate hikes could negatively impact valuations, BofA's analysis likely incorporates potential rate increases into their long-term projections. The impact would depend on the pace and magnitude of these hikes.

Long-Term Growth Prospects and Their Impact on Valuation

BofA's analysis likely emphasizes the importance of long-term growth prospects in justifying current valuations. Factors driving these projections include:

- Technological Advancements: Breakthroughs in AI, biotechnology, and other sectors drive innovation, efficiency, and productivity growth, boosting corporate earnings.

- Emerging Markets: Growth in developing economies creates significant opportunities for multinational corporations, fueling further earnings expansion.

- Long-Term Value Creation: Focusing solely on short-term price fluctuations neglects the potential for long-term value creation. BofA’s analysis likely advocates considering the long game. (Note: Specific data from a BofA report supporting these points would strengthen this section.)

Addressing Investor Concerns about High Valuations

Many investors are hesitant due to perceived high valuations. Let's address these concerns:

The Myth of "Overvalued" Markets

The notion that high valuations inevitably lead to market crashes is a misconception.

- Historical Context: History shows periods of sustained growth even with seemingly high valuations. Market timing is notoriously difficult, and focusing on short-term fluctuations can be detrimental to long-term returns.

- Examples of Continued Growth: (Provide specific historical examples where high valuations were followed by further market growth.)

- Importance of Diversification & Long-Term Strategies: A well-diversified portfolio and a long-term investment horizon are crucial to mitigate risks associated with market volatility.

Identifying Opportunities Within a "Stretched" Market

Even in a seemingly overvalued market, opportunities exist:

- Sector-Specific Analysis: Focusing on undervalued sectors or industries can help mitigate overall market valuation risks.

- Strong Fundamentals & Growth Potential: Identify companies with strong earnings growth, robust balance sheets, and competitive advantages. Fundamental analysis is crucial alongside valuation metrics.

- Significance of Fundamental Analysis: Don't rely solely on valuation ratios. Dig deep into a company's financials, competitive landscape, and management team.

Practical Strategies for Navigating Stretched Stock Market Valuations

Investors can mitigate risks and capitalize on opportunities by adopting the following strategies:

Diversification as a Risk Mitigation Strategy

A well-diversified portfolio is essential:

- Different Asset Classes: Include stocks, bonds, real estate, and other asset classes to reduce overall portfolio risk.

- Mitigating Potential Losses: Diversification helps cushion against losses in any single sector or asset class.

- Asset Allocation Strategies: Tailor your asset allocation to your risk tolerance and investment goals.

Long-Term Investing and Value Investing Approaches

Long-term investing and value investing strategies are beneficial:

- Weathering Volatility: A long-term approach helps ride out short-term market fluctuations.

- Intrinsic Value Focus: Value investing prioritizes companies trading below their intrinsic value, offering a margin of safety.

- Successful Long-Term & Value Investing Examples: (Cite specific examples of successful long-term and value investing strategies).

Conclusion

Despite concerns about stretched stock market valuations, BofA's analysis highlights several factors justifying current market levels. Long-term growth prospects, low interest rates, and strategic investing approaches, such as diversification and value investing, are crucial for navigating this environment. Don't let concerns about stretched stock market valuations deter you. By employing a diversified, long-term approach and conducting thorough research, understanding the nuances of market valuations, you can capitalize on opportunities within the market. For more detailed information, refer to BofA's full research report (insert link here).

Featured Posts

-

The Ultimate Nba Playoffs Triple Doubles Leader Quiz

May 08, 2025

The Ultimate Nba Playoffs Triple Doubles Leader Quiz

May 08, 2025 -

Andor Season 2 Trailer Delay Fuels Fan Frustration And Theories

May 08, 2025

Andor Season 2 Trailer Delay Fuels Fan Frustration And Theories

May 08, 2025 -

Carusos Historic Performance Thunder Clinch Game 1 Playoff Victory

May 08, 2025

Carusos Historic Performance Thunder Clinch Game 1 Playoff Victory

May 08, 2025 -

Saving Private Ryan Nathan Fillions Unforgettable Three Minute Performance

May 08, 2025

Saving Private Ryan Nathan Fillions Unforgettable Three Minute Performance

May 08, 2025 -

Official Lotto Lotto Plus 1 And Lotto Plus 2 Winning Numbers

May 08, 2025

Official Lotto Lotto Plus 1 And Lotto Plus 2 Winning Numbers

May 08, 2025