Will A Canadian Tire-Hudson's Bay Partnership Succeed? A Detailed Analysis

Table of Contents

Synergies and Potential Benefits of a Canadian Tire-Hudson's Bay Partnership

A merger between Canadian Tire and Hudson's Bay could unlock significant synergies, creating a retail powerhouse unlike any other in Canada. However, success hinges on careful planning and execution.

Expanded Market Reach and Customer Base

A combined Canadian Tire-Hudson's Bay entity would dramatically increase customer reach. Canadian Tire's strength lies in automotive parts, hardware, and sporting goods, while Hudson's Bay dominates fashion and home goods. This union would create a one-stop shop for a vast consumer demographic.

- Increased brand visibility: A larger combined entity would command greater attention and media coverage, boosting brand recognition for both companies.

- Access to new customer demographics: Canadian Tire would gain access to Hudson's Bay's fashion-conscious clientele, while Hudson's Bay could tap into Canadian Tire's loyal base of DIY enthusiasts and outdoor adventurers.

- Cross-selling opportunities: Imagine purchasing a new barbeque at Canadian Tire and then browsing for stylish outdoor furniture at Hudson's Bay – a seamless shopping experience driven by integrated marketing and loyalty programs. Data sharing between the companies could lead to highly targeted advertising and personalized offers, maximizing sales opportunities. This synergy is key to the potential success of the partnership.

The integration of loyalty programs would be crucial, offering combined rewards and exclusive deals to incentivize spending across both brands. This enhanced customer experience is a key factor in determining the success of this hypothetical merger.

Enhanced Supply Chain and Operational Efficiency

Merging operations could streamline logistics, distribution, and procurement, leading to significant cost savings.

- Improved inventory management: Combining inventory data would enable more accurate forecasting and reduce stockouts or overstocking, optimizing supply chain efficiency.

- Reduced transportation costs: Consolidating warehousing and distribution networks would lead to economies of scale, lowering transportation costs.

- Optimized warehouse operations: Centralized warehouse management would improve efficiency and reduce overhead.

Economies of scale are a significant potential advantage. By consolidating purchasing power and streamlining operations, the combined entity could negotiate better deals with suppliers, further reducing costs and boosting profitability. This efficiency is a vital element in achieving the financial goals of such a venture.

Brand Complementarity and Cross-Promotion Opportunities

Despite their distinct brand identities, Canadian Tire and Hudson's Bay products complement each other. This natural synergy presents lucrative cross-promotion opportunities.

- Joint marketing campaigns: Coordinated marketing efforts could highlight the complementary nature of their product offerings, creating a compelling value proposition for consumers.

- Co-branded products: Imagine exclusive product lines combining Canadian Tire's outdoor expertise with Hudson's Bay's fashion sensibility – a new line of stylish, durable outdoor clothing, for example.

- Shared loyalty programs: A unified loyalty program offering rewards across both brands would encourage customer loyalty and drive sales.

- Strategic placement of stores: Co-locating stores in select locations could maximize customer traffic and create a synergistic shopping environment.

Successful brand collaborations like this rely on careful branding strategies that maintain the unique identities of both Canadian Tire and Hudson's Bay while showcasing their combined strengths. Examples of successful retail partnerships can provide valuable insights into best practices.

Challenges and Potential Risks of a Canadian Tire-Hudson's Bay Partnership

While the potential benefits are significant, integrating two such large companies poses considerable challenges.

Brand Identity and Image Conflicts

Maintaining distinct brand identities while leveraging synergies is a delicate balancing act.

- Maintaining brand integrity: Preserving the individual brand identities of Canadian Tire and Hudson's Bay is essential to avoid alienating existing customer bases.

- Navigating different customer expectations: Canadian Tire and Hudson's Bay cater to different customer segments with distinct expectations. A successful merger requires careful consideration of these differing expectations.

- Managing potential brand dilution: Poorly managed integration could lead to brand dilution, diminishing the value of both brands.

A clear brand strategy is paramount to address these challenges. The merger needs a detailed plan to manage the different customer expectations, maintaining brand integrity while effectively integrating the two retail giants.

Integration Challenges and Operational Difficulties

Integrating two large organizations with different cultures, technologies, and operational structures presents significant hurdles.

- Potential for IT system incompatibility: Integrating different IT systems and databases can be a complex and costly undertaking.

- Staff restructuring: Merging two large workforces will likely lead to redundancies and restructuring, requiring careful management to minimize disruption.

- Challenges in merging different corporate cultures: Different corporate cultures can create friction and hinder integration efforts, impacting efficiency and productivity.

Addressing these challenges requires a thorough integration plan, taking into account the intricacies of both organizations. Clear communication and robust change management strategies are crucial for a smooth transition.

Regulatory and Antitrust Concerns

A merger of this scale would likely face regulatory scrutiny and potential antitrust challenges.

- Competition Bureau review: The Competition Bureau of Canada would closely examine the proposed merger to assess its impact on competition.

- Potential for divestments: To satisfy regulatory concerns, the companies might be required to divest certain assets or business units.

- Impact on market competition: The merger could significantly alter the Canadian retail landscape, potentially reducing competition in certain markets.

Thorough legal due diligence and proactive engagement with regulators are critical to navigate these potential hurdles. Anticipating and addressing these concerns is key to securing regulatory approval.

Conclusion

The potential success of a Canadian Tire-Hudson's Bay partnership hinges on careful planning, effective execution, and a clear understanding of both the opportunities and risks. While synergies exist in market reach, supply chain efficiency, and brand complementarity, potential brand identity conflicts, integration difficulties, and regulatory hurdles pose substantial challenges. Further analysis of a potential Canadian Tire-Hudson's Bay partnership is vital to fully grasp the long-term implications and chances for success. The future of this hypothetical retail giant rests on addressing these critical factors.

Featured Posts

-

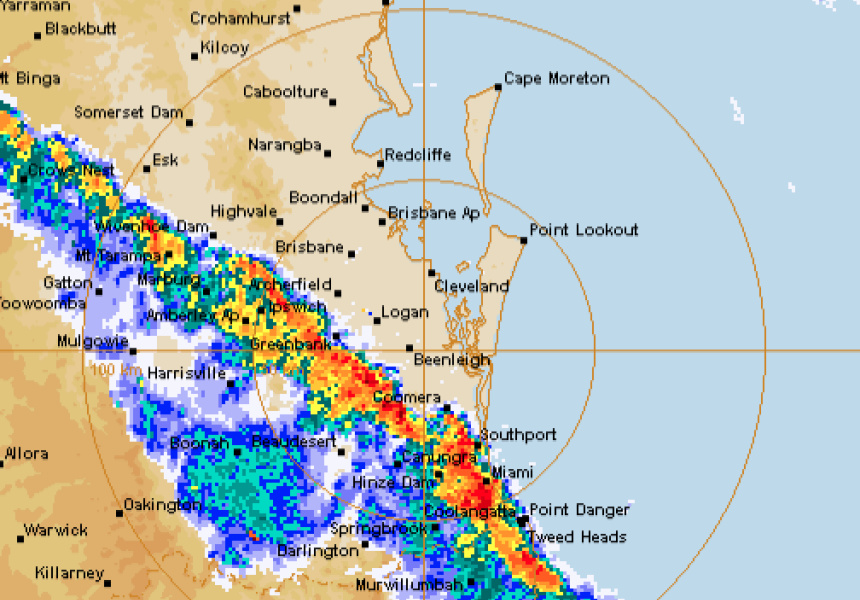

Damaging Winds How Fast Moving Storms Impact Your Area

May 20, 2025

Damaging Winds How Fast Moving Storms Impact Your Area

May 20, 2025 -

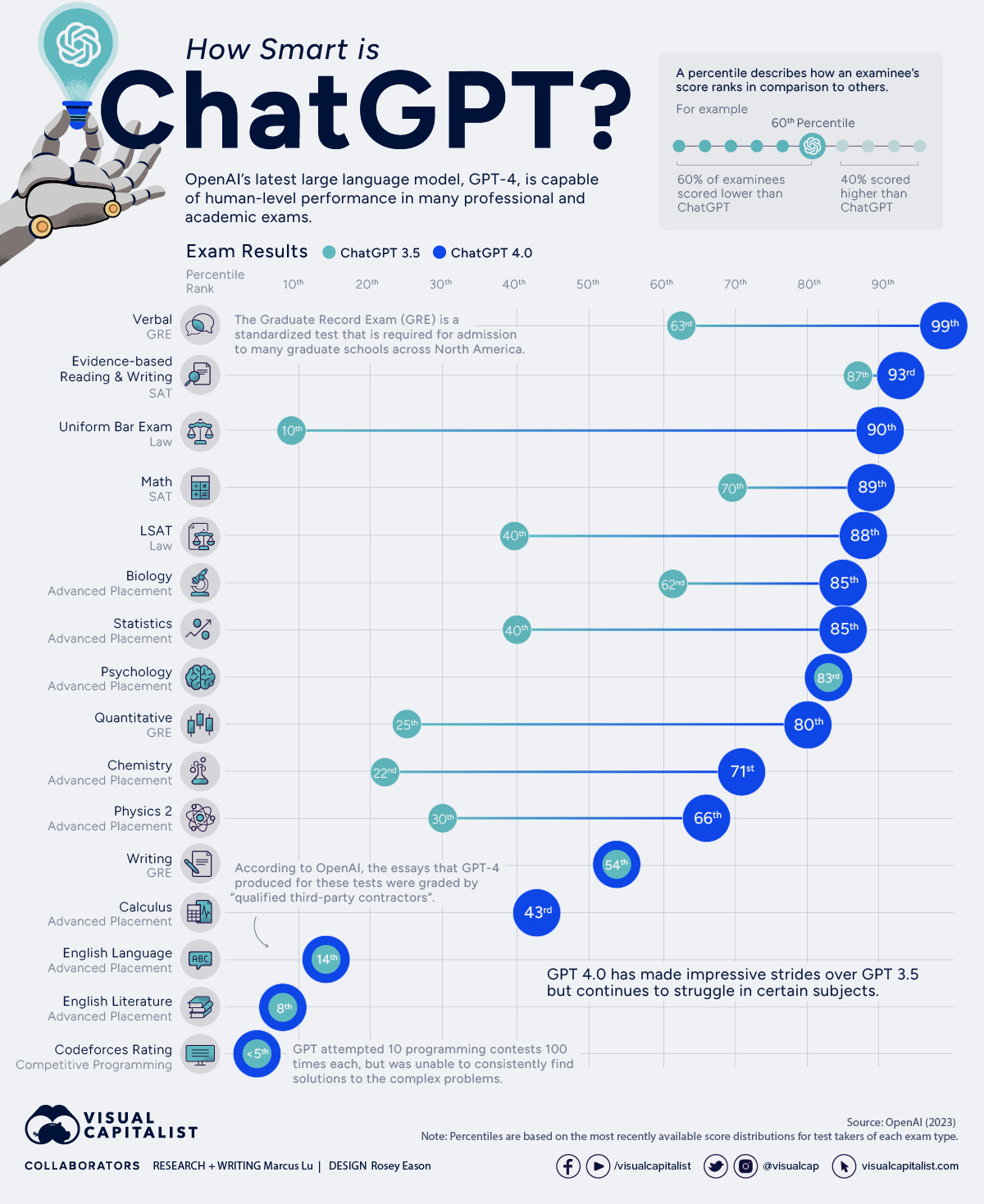

Chat Gpt Plus Introducing The Ai Coding Agent

May 20, 2025

Chat Gpt Plus Introducing The Ai Coding Agent

May 20, 2025 -

Bbc Deepfake Agatha Christie Fact Or Fiction

May 20, 2025

Bbc Deepfake Agatha Christie Fact Or Fiction

May 20, 2025 -

Family Struck By Train Two Adults Killed Childrens Fate Unknown

May 20, 2025

Family Struck By Train Two Adults Killed Childrens Fate Unknown

May 20, 2025 -

Stay Safe Strong Wind And Severe Storm Warning Issued

May 20, 2025

Stay Safe Strong Wind And Severe Storm Warning Issued

May 20, 2025

Latest Posts

-

Huuhkajien Avauskokoonpano Naein Suomi Aloittaa Ottelun

May 20, 2025

Huuhkajien Avauskokoonpano Naein Suomi Aloittaa Ottelun

May 20, 2025 -

Suomi Ruotsi Huuhkajien Avauskokoonpanossa Muutoksia Kaellman Sivussa

May 20, 2025

Suomi Ruotsi Huuhkajien Avauskokoonpanossa Muutoksia Kaellman Sivussa

May 20, 2025 -

Jalkapallo Huuhkajien Yllaetykset Avauskokoonpanoon Merkittaeviae Muutoksia

May 20, 2025

Jalkapallo Huuhkajien Yllaetykset Avauskokoonpanoon Merkittaeviae Muutoksia

May 20, 2025 -

Huuhkajien Avauskokoonpanossa Kolme Muutosta Kaellman Pohjanpalo Ja Muut

May 20, 2025

Huuhkajien Avauskokoonpanossa Kolme Muutosta Kaellman Pohjanpalo Ja Muut

May 20, 2025 -

Huuhkajat Kolme Muutosta Avauskokoonpanoon Kaellman Penkille

May 20, 2025

Huuhkajat Kolme Muutosta Avauskokoonpanoon Kaellman Penkille

May 20, 2025