Will Big Oil Increase Production? OPEC+ Meeting Imminent

Table of Contents

Current Global Oil Supply and Demand

The global oil market is currently characterized by a significant imbalance between supply and demand. This "oil supply shortage" is driving up prices and creating uncertainty for consumers and businesses alike. Several factors contribute to this precarious situation:

-

High global demand: The post-pandemic economic recovery has led to a surge in global oil demand, exceeding pre-pandemic levels. Increased industrial activity and travel have significantly boosted consumption.

-

Sanctions on Russian oil: The ongoing conflict in Ukraine and subsequent sanctions imposed on Russian oil have significantly disrupted global supply chains. This has reduced the availability of Russian oil, a major player in the global market, exacerbating the existing supply deficit.

-

Limited spare capacity: OPEC+ members, who control a significant portion of global oil production, have limited spare capacity to increase production significantly. This restricts their ability to immediately respond to increased demand.

-

Growing concerns about energy security: The current energy crisis has highlighted the vulnerability of many nations to volatile oil prices and supply disruptions. This underscores the urgency for a stable and reliable energy supply.

-

Price volatility: The fluctuating oil prices are causing instability in various sectors, impacting consumer spending, business investments, and overall economic growth. This volatility is a direct consequence of the tight oil market and the uncertainty surrounding future supply.

The interplay of these factors has created a volatile and unpredictable global oil market, characterized by high prices and concerns about energy security. The "global energy crisis" is a direct result of this imbalance, making the upcoming OPEC+ decision even more crucial.

OPEC+’s Past Decisions and Their Impact

OPEC+'s past decisions regarding oil production have significantly influenced global oil prices and market stability. Analyzing these past actions provides valuable insight into potential future outcomes.

-

Past production cuts: OPEC+ has implemented several production cuts in recent years, often in response to declining oil prices or geopolitical instability. These cuts have generally resulted in higher oil prices.

-

Compliance rates within OPEC+: The effectiveness of OPEC+'s production cuts depends heavily on the compliance rates of its member countries. Variations in compliance can significantly impact the actual impact of production adjustments.

-

Influence of individual member countries: Countries like Saudi Arabia and Russia wield considerable influence within OPEC+. Their individual decisions and stances on production levels often shape the collective decisions of the group.

-

Historical context of OPEC+ decision-making: Understanding the historical context – including past agreements, crises, and economic conditions – is essential to predicting future behavior.

Historically, OPEC+ production cuts have had a considerable impact on oil price volatility. Understanding the effectiveness of past strategies and the factors influencing them is crucial to anticipating the outcome of the upcoming meeting concerning Big Oil production increase.

Factors Influencing the Imminent OPEC+ Decision

The upcoming OPEC+ meeting's decision on production will be influenced by a complex interplay of factors:

-

Geopolitical considerations: The war in Ukraine and its impact on global energy markets are paramount. US-Saudi relations and broader geopolitical tensions also play a significant role. These "geopolitical risks" significantly impact the stability and predictability of oil supplies.

-

Economic forecasts: Future oil demand projections are crucial. Global economic growth forecasts and the potential impact of recessionary pressures on energy consumption will influence the decision-making process.

-

Internal pressures within OPEC+: Different member countries have varying interests and production capabilities. Negotiating a consensus on production quotas can be challenging and may impact the final decision.

-

Concerns about future oil prices and market stability: OPEC+ will likely aim to strike a balance between maintaining stable prices and ensuring sufficient supply to meet global demand. This careful balancing act shapes their decision-making.

-

The role of alternative energy sources: The growing adoption of renewable energy sources and the ongoing energy transition are increasingly influencing the long-term outlook for oil demand. This factor inevitably plays a role in OPEC+'s strategic considerations.

The Role of Major Oil Producers

Saudi Arabia and Russia are key players. Saudi Aramco, the world's largest oil producer, and Gazprom, a major Russian energy company, hold significant sway over the global oil market. The impact of Russian oil sanctions and Saudi Arabia's strategic considerations will strongly shape the outcome. Their individual interests, combined with the overall global energy landscape, will define the trajectory of Big Oil production.

Potential Outcomes and Their Implications

The OPEC+ meeting could result in several scenarios, each with far-reaching consequences:

-

Scenario 1: Increased production: An increase in production would likely lead to lower oil prices, increased supply, and potentially improved geopolitical stability, albeit with potential short-term impacts on producer revenues.

-

Scenario 2: Maintained production levels: Maintaining current production levels would likely result in continued price volatility, potentially impacting global economic growth and inflation.

-

Scenario 3: Further production cuts: Further cuts would likely lead to even higher oil prices, increased energy insecurity for many nations, and potentially exacerbate existing economic challenges, particularly regarding inflation.

Each scenario carries distinct economic and political implications, impacting everything from inflation rates and consumer spending to international relations and energy security. Accurately predicting the "oil price prediction" under each scenario is challenging but crucial for various economic sectors.

Conclusion

The key factors influencing the OPEC+ decision on Big Oil production increase are complex and interwoven. Current market dynamics – high demand, supply disruptions, and limited spare capacity – create an environment of uncertainty. The potential outcomes, ranging from increased production to further cuts, will have profound implications for global energy markets and the world economy. The upcoming OPEC+ meeting is critical for determining the future trajectory of global oil prices and energy security.

Call to Action: The upcoming OPEC+ meeting is critical for determining the future trajectory of global oil prices and energy security. Stay tuned for updates and further analysis on the implications of their decision regarding Big Oil production increase. Continue to monitor our site for the latest insights on Big Oil production and global energy markets.

Featured Posts

-

Trainer Responds To Backlash Against Lizzos Fitness Transformation

May 04, 2025

Trainer Responds To Backlash Against Lizzos Fitness Transformation

May 04, 2025 -

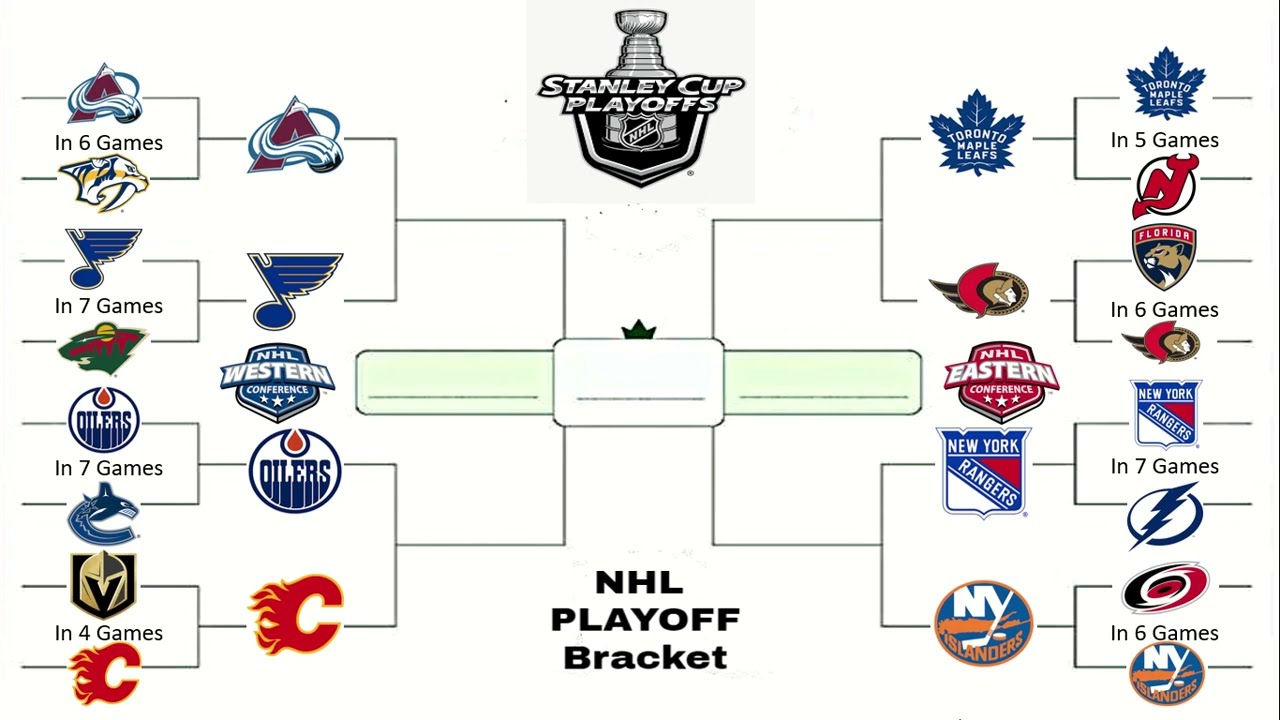

Decoding The First Round Your Guide To The Nhl Stanley Cup Playoffs

May 04, 2025

Decoding The First Round Your Guide To The Nhl Stanley Cup Playoffs

May 04, 2025 -

Hong Kong Restaurant Review Honjo Modern Japanese In Sheung Wan

May 04, 2025

Hong Kong Restaurant Review Honjo Modern Japanese In Sheung Wan

May 04, 2025 -

Is Rupert Lowe The Right Leader To Replace Nigel Farage In Reform

May 04, 2025

Is Rupert Lowe The Right Leader To Replace Nigel Farage In Reform

May 04, 2025 -

Narco Submarines And High Potency Cocaine Driving The Global Epidemic

May 04, 2025

Narco Submarines And High Potency Cocaine Driving The Global Epidemic

May 04, 2025

Latest Posts

-

Lizzos Twitch Debut A New Era Of Music Begins

May 04, 2025

Lizzos Twitch Debut A New Era Of Music Begins

May 04, 2025 -

Unheard Music Lizzo Szas Abandoned Rock Band Plans

May 04, 2025

Unheard Music Lizzo Szas Abandoned Rock Band Plans

May 04, 2025 -

Lizzo Announces New Music On Twitch Get Ready To Gag

May 04, 2025

Lizzo Announces New Music On Twitch Get Ready To Gag

May 04, 2025 -

A Rock Collaboration We Almost Got Lizzo Sza And More

May 04, 2025

A Rock Collaboration We Almost Got Lizzo Sza And More

May 04, 2025 -

Trainer Responds To Backlash Against Lizzos Fitness Transformation

May 04, 2025

Trainer Responds To Backlash Against Lizzos Fitness Transformation

May 04, 2025