Will Palantir Be A Trillion-Dollar Company By 2030? An In-Depth Analysis

Table of Contents

Palantir's Current Market Position and Financial Performance

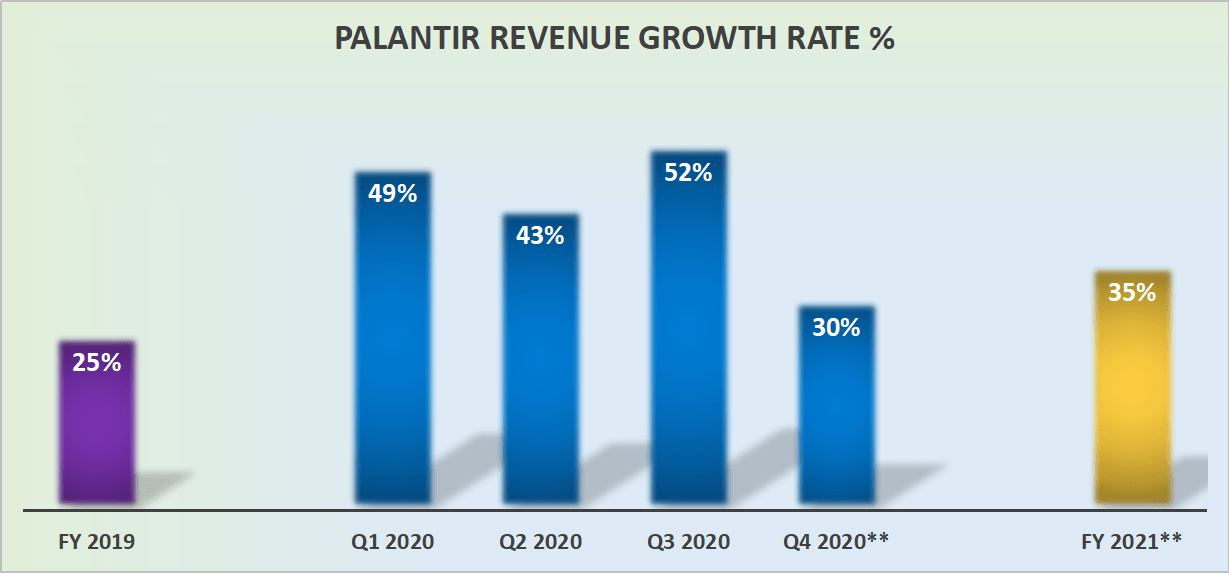

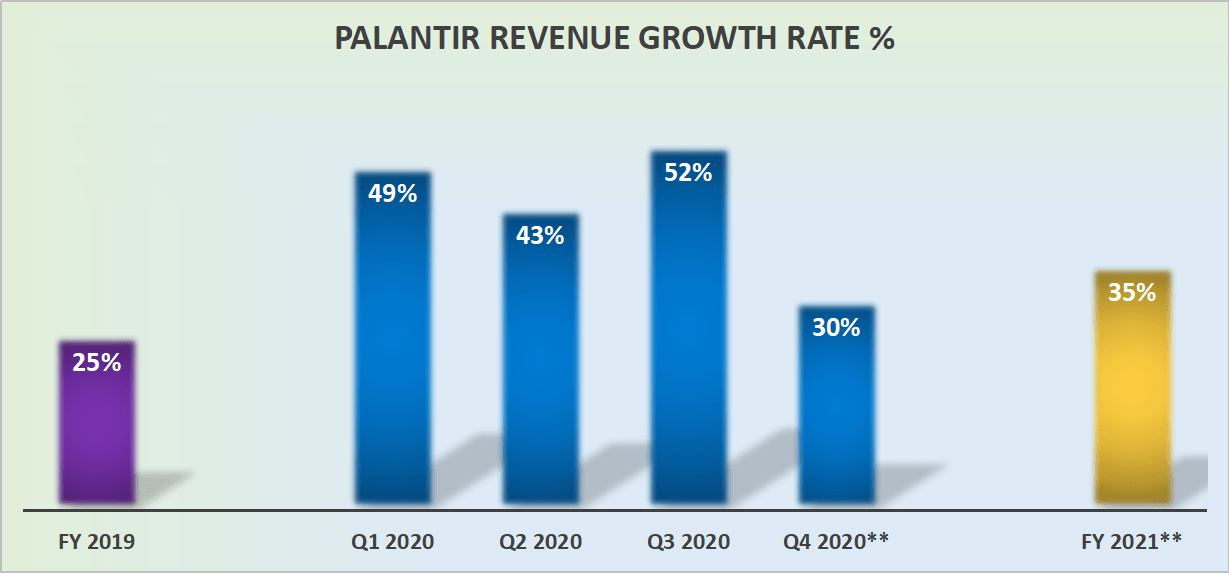

Revenue Growth and Profitability

Palantir's revenue growth has been impressive, showcasing consistent year-over-year increases. However, profitability remains a key area of focus. Analyzing key financial metrics like revenue, operating income, and net income provides a clearer picture. Comparing Palantir's performance against competitors like Databricks, Snowflake, and Tableau is crucial to understanding its relative position within the big data analytics market.

- 2022 Revenue: [Insert actual figure] – representing a [percentage]% increase from the previous year.

- Operating Income (2022): [Insert actual figure] – indicating [positive/negative] growth.

- Net Income (2022): [Insert actual figure] – showing [positive/negative] growth.

- Year-over-Year Revenue Growth (Average over past 5 years): [Insert average percentage]

Government Contracts vs. Commercial Partnerships

Palantir's revenue stream is diverse, encompassing both lucrative government contracts and increasingly significant commercial partnerships. Government contracts often offer higher short-term revenue but carry higher risk due to geopolitical factors and budgetary constraints. Commercial partnerships provide more stable, long-term growth potential, but may yield lower margins initially.

- Government Contracts: Key clients include [List examples, e.g., US Government agencies, allied nations' defense departments]. These contracts contribute approximately [percentage]% to overall revenue.

- Commercial Partnerships: Significant clients include [List examples, e.g., major financial institutions, pharmaceutical companies]. This sector contributes approximately [percentage]% to overall revenue and is projected to grow significantly.

Technological Innovation and Competitive Advantage

Palantir's proprietary platforms, Gotham (focused on government clients) and Foundry (catering to commercial clients), provide a significant competitive advantage. Continuous investment in R&D, coupled with a robust patent portfolio, ensures Palantir stays at the forefront of big data analytics technology.

- Key Technologies: Foundry's AI-driven capabilities and Gotham's advanced data integration features represent a substantial technological moat.

- R&D Investment: Palantir allocates a significant portion of its revenue to research and development, ensuring the continuous evolution of its platforms and maintaining a competitive edge.

- Patents Held: Palantir holds numerous patents in key areas like data integration, AI algorithms and data visualization.

Factors Influencing Palantir's Future Growth

Market Demand for Big Data Analytics

The market for big data analytics is experiencing exponential growth, driven by the increasing volume of data generated daily and the growing need for data-driven decision-making across all sectors. However, this market is also highly competitive.

- Market Size Projection (2030): [Insert market size projection from a reputable source].

- Growth Rate: [Insert projected annual growth rate].

- Key Market Trends: Increased adoption of cloud-based analytics, growing demand for AI-powered insights, rising concerns about data security and privacy.

Geopolitical Factors and Government Spending

Palantir's reliance on government contracts makes it susceptible to geopolitical shifts and changes in government spending priorities. Increased defense budgets or a surge in demand for data analytics in the wake of global crises could significantly boost Palantir's revenue.

- Impact of Geopolitical Events: [Discuss potential scenarios and their impact, e.g., increased conflict leading to higher defense spending].

- Government Spending Trends: Analyze historical data and projections for government spending on data analytics and intelligence gathering.

Competition and Market Share

Palantir faces stiff competition from established players and emerging startups in the big data analytics market. Maintaining and growing market share requires continuous innovation and effective competitive strategies.

- Key Competitors: [List key competitors with brief descriptions of their strengths and weaknesses, e.g., AWS, Microsoft Azure, Google Cloud].

- Market Share Strategy: Palantir's strategy focuses on its specialized platforms, strong client relationships, and continuous innovation to maintain and expand market share.

Conclusion: Palantir's Trillion-Dollar Trajectory: A Realistic Assessment

Whether Palantir will achieve a trillion-dollar valuation by 2030 is a complex question. While its impressive growth trajectory and technological leadership position are undeniable strengths, factors like intense competition, reliance on government contracts, and macroeconomic uncertainties pose significant challenges. Its success hinges on maintaining its technological edge, expanding its commercial client base, and navigating the evolving geopolitical landscape. The potential is undoubtedly there, but achieving a trillion-dollar valuation requires consistent execution and favorable market conditions. Follow Palantir's journey, monitor its stock performance, and learn more about Palantir's future to make informed decisions. Disclaimer: This article is for informational purposes only and does not constitute financial advice.

Featured Posts

-

Dijon Et La Cite De La Gastronomie Analyse Des Difficultes Rencontrees Par Epicure

May 10, 2025

Dijon Et La Cite De La Gastronomie Analyse Des Difficultes Rencontrees Par Epicure

May 10, 2025 -

Palantirs 30 Fall A Smart Investment Decision

May 10, 2025

Palantirs 30 Fall A Smart Investment Decision

May 10, 2025 -

Community Rallies After Racist Killing Devastates Family

May 10, 2025

Community Rallies After Racist Killing Devastates Family

May 10, 2025 -

Family Outing Dakota Johnsons Materialist Premiere Support System

May 10, 2025

Family Outing Dakota Johnsons Materialist Premiere Support System

May 10, 2025 -

Did Snls Harry Styles Impression Miss The Mark The Singer Reacts

May 10, 2025

Did Snls Harry Styles Impression Miss The Mark The Singer Reacts

May 10, 2025