Will The Bank Of Canada Cut Rates Again? Impact Of Tariffs On Employment And Monetary Policy

Table of Contents

The Current Economic Climate in Canada

Inflation and Economic Growth

The Bank of Canada's primary mandate is to maintain price stability and foster sustainable economic growth. Understanding current inflation rates and GDP growth is crucial to predicting future interest rate movements. Currently, inflation is [insert current inflation rate and source], deviating [explain deviation from target]. This [explain impact of deviation – positive or negative for rate cuts]. GDP growth projections for [insert year] stand at [insert percentage and source], showing [explain whether this is strong, weak, or stagnant growth and its impact on interest rate decisions]. Further complicating the picture is the consumer confidence index, which currently sits at [insert index and source], reflecting [explain consumer sentiment and how it relates to spending and economic growth]. The ongoing global economic slowdown also casts a shadow on Canada’s economic outlook, adding another layer of complexity to the Bank of Canada's deliberations.

- Current inflation figures: [Insert data and source]

- GDP growth projections: [Insert data and source]

- Consumer confidence index: [Insert data and source]

- Impact of global economic slowdown: [Explain impact, citing relevant sources]

The Labor Market

The health of the Canadian labor market is another key factor influencing the Bank of Canada's decisions. The unemployment rate currently stands at [insert unemployment rate and source], indicating [explain whether this is high, low, or stable and its impact on the economy]. Job growth in key sectors like [mention specific sectors like technology, healthcare, manufacturing] has been [describe job growth in these sectors – strong, weak, or stagnant] recently. Tariffs, however, are causing significant ripples, particularly impacting industries like manufacturing and agriculture. Increased import costs due to tariffs can lead to reduced competitiveness, potential job losses, and a slowdown in these sectors. The potential for further job losses due to ongoing trade uncertainty is a concern for the Bank of Canada.

- Unemployment rate statistics: [Insert data and source]

- Job growth in key sectors: [Insert data and source for each sector]

- Impact of tariffs on specific industries: [Explain the impact on manufacturing and agriculture, citing examples]

- Potential for job losses: [Explain potential job losses and their impact on economic growth]

The Impact of Tariffs on the Canadian Economy

Trade Wars and Supply Chains

The imposition of tariffs disrupts international trade and creates significant challenges for Canadian businesses. For instance, tariffs on [mention specific examples like steel or lumber] have directly impacted Canadian producers who rely on exporting these goods. These tariffs lead to reduced demand and lower revenues, negatively affecting employment and investment. Furthermore, disruptions to global supply chains, caused by trade wars, increase costs for businesses and consumers alike, potentially leading to inflationary pressures. Canadian businesses heavily reliant on imports now face increased input costs, impacting their pricing strategies and profitability.

- Examples of specific tariffs and their impact on Canadian businesses: [Provide specific examples with quantifiable data whenever possible]

- Disruption of supply chains: [Explain the consequences of disrupted supply chains]

- Increased costs for consumers: [Explain how tariffs lead to higher prices for consumers]

Tariff-Induced Inflation

Tariffs contribute directly to inflationary pressures by increasing the cost of imported goods. This, in turn, impacts consumer purchasing power and can lead to a decrease in overall consumer spending. For example, tariffs on [mention specific imported goods] have already resulted in price increases of [mention percentage increase]. This reduces consumer disposable income and slows down economic growth, potentially forcing the Bank of Canada to intervene with further rate cuts to stimulate demand. The risk of wage stagnation is also heightened in such an environment, further dampening consumer spending.

- Examples of price increases due to tariffs: [Provide specific examples with quantifiable data]

- Impact on consumer purchasing power: [Explain the effect on consumer spending]

- Potential for wage stagnation: [Explain why tariffs might lead to wage stagnation]

The Bank of Canada's Response and Future Policy Decisions

Previous Rate Cuts and Their Effectiveness

The Bank of Canada has already implemented [number] rate cuts in [time period], aiming to stimulate economic activity. These cuts [explain the impact of these cuts – for example, lower borrowing costs, increased consumer spending]. However, the effectiveness of these cuts has been [assess their effectiveness – positive, negative, or mixed] due to [explain the reasons – for example, external factors, limited impact on investment]. This past experience will inform the Bank of Canada's future decisions.

- Dates and magnitudes of previous rate cuts: [List the dates and magnitudes of previous rate cuts]

- Impact on borrowing costs: [Explain the impact on interest rates and consumer borrowing]

- Effects on consumer spending and investment: [Analyze the effects of previous rate cuts on spending and investment]

Factors Influencing Future Rate Cuts

The Bank of Canada's future decisions will be heavily influenced by several factors. The most important is the inflation rate. If inflation remains below the target range, further rate cuts are more likely. The strength of the Canadian dollar, global economic uncertainty, and the overall health of the labor market will all play significant roles. The ongoing trade disputes and their impact on the Canadian economy remain a major uncertainty. The Bank will carefully monitor these factors before making any further decisions about interest rates. They may choose to hold steady, cut rates further, or even potentially raise them, depending on how these variables evolve.

- Importance of inflation targets: [Explain how inflation targets guide the Bank’s decisions]

- Consideration of exchange rates: [Explain the impact of exchange rates on interest rate decisions]

- Global economic uncertainty: [Explain the impact of global uncertainty on Canadian economy and interest rates]

- Potential for further rate cuts or holding steady: [Summarize the likelihood of each scenario based on the analysis]

Conclusion

The impact of tariffs on employment and the overall Canadian economy is significant. Increased costs, supply chain disruptions, and reduced competitiveness are all contributing factors to a challenging economic landscape. While previous rate cuts have had some effect, the ongoing uncertainty related to trade and global economic conditions makes predicting future Bank of Canada actions difficult. Whether the Bank of Canada will cut rates again depends heavily on the evolution of inflation, employment, and economic growth in the coming months. The likelihood of further interest rate cuts is [explain your assessment based on the presented analysis – high, low, or uncertain].

Call to Action: Stay informed about the Bank of Canada's decisions and their effect on the Canadian economy. Regularly check for updates on interest rates and economic indicators to make informed financial decisions. Understanding the Bank of Canada's response to economic challenges like tariffs is crucial for navigating the complexities of the Canadian economy. Continue to monitor the Bank of Canada's pronouncements on interest rates and their analysis of the impact of tariffs.

Featured Posts

-

Yankees Giants Series Whos On The Injured List April 11 13

May 12, 2025

Yankees Giants Series Whos On The Injured List April 11 13

May 12, 2025 -

The Case For Henry Cavill As Wolverine In Marvels World War Hulk Adaptation

May 12, 2025

The Case For Henry Cavill As Wolverine In Marvels World War Hulk Adaptation

May 12, 2025 -

Canadas Natural Gas Giant A Look At Unprecedented Growth

May 12, 2025

Canadas Natural Gas Giant A Look At Unprecedented Growth

May 12, 2025 -

Adam Sandlers Net Worth How Comedy Pays Big

May 12, 2025

Adam Sandlers Net Worth How Comedy Pays Big

May 12, 2025 -

Challenge Season 41 Spoiler Alert Unexpected Twist And Veteran Survival

May 12, 2025

Challenge Season 41 Spoiler Alert Unexpected Twist And Veteran Survival

May 12, 2025

Latest Posts

-

Extended Border Controls In The Netherlands Impact Of Reduced Arrests And Asylum Applications

May 12, 2025

Extended Border Controls In The Netherlands Impact Of Reduced Arrests And Asylum Applications

May 12, 2025 -

Netherlands To Maintain Heightened Border Security Despite Falling Asylum Numbers

May 12, 2025

Netherlands To Maintain Heightened Border Security Despite Falling Asylum Numbers

May 12, 2025 -

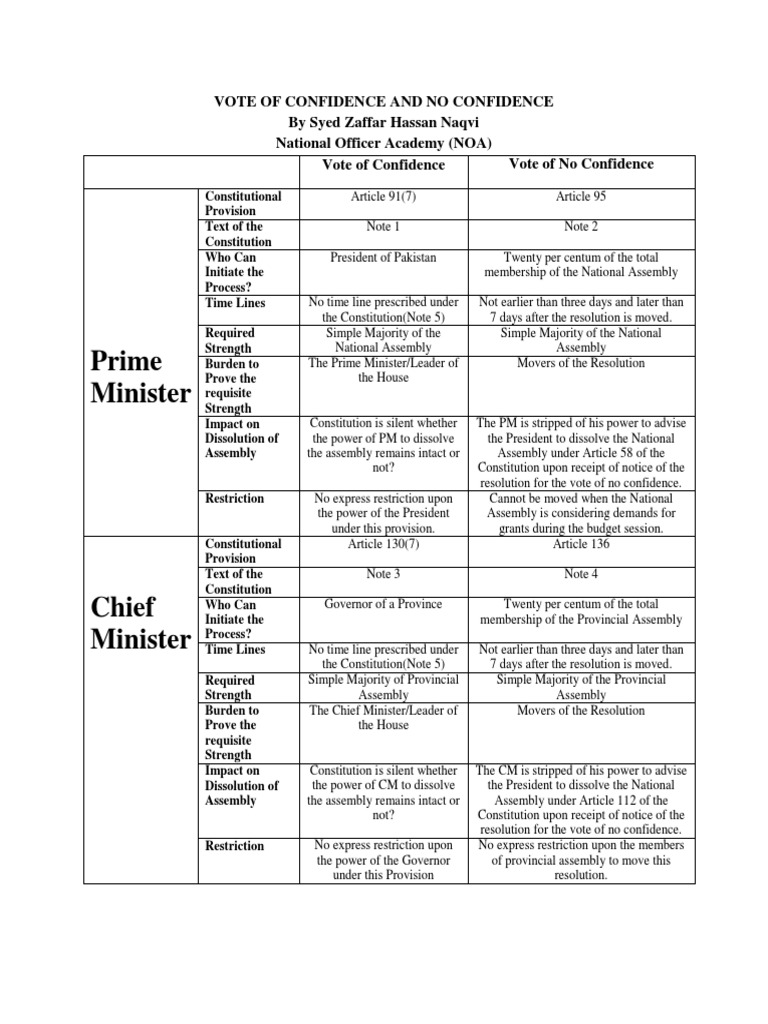

Faber Retains Position After No Confidence Vote

May 12, 2025

Faber Retains Position After No Confidence Vote

May 12, 2025 -

Asylum Volunteer Royal Honors Fabers Complete Policy Reversal

May 12, 2025

Asylum Volunteer Royal Honors Fabers Complete Policy Reversal

May 12, 2025 -

Potenziale Zur Kostensenkung In Asylunterkuenften Ein Bericht Der Beiraete

May 12, 2025

Potenziale Zur Kostensenkung In Asylunterkuenften Ein Bericht Der Beiraete

May 12, 2025