Will Trump's Next 100 Days Influence Bitcoin's Price? A Market Prediction

Table of Contents

Main Points:

Economic Policy Shifts and Bitcoin's Response:

Potential Regulatory Changes:

The cryptocurrency landscape is heavily reliant on regulatory clarity. Trump's administration could bring about significant changes impacting Bitcoin's price. Potential regulatory shifts could include:

- Increased SEC scrutiny of crypto exchanges: This could lead to stricter listing requirements, potentially impacting the availability and price of Bitcoin.

- New legislation regarding stablecoins: Regulations aimed at stabilizing the cryptocurrency market could positively or negatively impact Bitcoin's price depending on their specific nature.

- Changes in tax policies related to cryptocurrency: Altered tax rules for capital gains or income generated from Bitcoin could influence investor behavior and, consequently, its price. Keywords like "crypto regulation," "SEC," and "CFTC" are frequently used in discussions around this topic. The impact will depend on the specifics of any proposed legislation.

Fiscal Policy and Inflation:

Trump's fiscal policies, characterized by spending and tax cuts, have implications for inflation. High inflation typically erodes the value of fiat currencies, potentially increasing the demand for Bitcoin as a hedge against inflation. Conversely, deflationary pressures could negatively affect Bitcoin's price.

- Increased government spending: This could lead to higher inflation, potentially boosting Bitcoin's price as investors seek alternative stores of value.

- Tax cuts impacting investment: The impact of tax cuts on investment in Bitcoin is complex and depends on multiple factors such as investor confidence and the overall economic climate.

- Monetary policy interaction: The interplay between fiscal policy and the Federal Reserve's monetary policy will also significantly influence inflation and, therefore, Bitcoin's price. Keywords like "inflation," "deflation," "fiscal policy," and "monetary policy" are vital for understanding this relationship.

Geopolitical Events and Bitcoin's Safe-Haven Status:

International Relations and Market Uncertainty:

Trump's foreign policy decisions have often created market uncertainty. During such periods, Bitcoin has sometimes acted as a safe-haven asset, attracting investors seeking to protect their capital.

- Trade disputes and global tensions: Escalating trade wars or international conflicts could lead to investors seeking refuge in Bitcoin, increasing its demand and price.

- Political instability: Unpredictable political events worldwide could trigger a flight to safety, benefiting Bitcoin's price.

- Past performance analysis: Reviewing Bitcoin's historical performance during periods of geopolitical instability can help in understanding its potential role as a safe-haven asset. Keywords like "geopolitical risk," "market volatility," and "safe-haven asset" are crucial in this context.

Impact of Trade Wars and Sanctions:

Trump's trade policies and sanctions can significantly impact global markets. These actions could indirectly affect the demand for and price of Bitcoin:

- Disruptions to supply chains: Trade wars could lead to supply chain disruptions, potentially impacting the technology sector and indirectly affecting Bitcoin's price.

- Capital flight: Sanctions against certain countries could lead to capital flight, some of which might flow into Bitcoin as a means of circumventing financial restrictions.

- Global economic slowdown: Trade wars and sanctions could slow global economic growth, impacting investor sentiment towards Bitcoin. Keywords such as "trade war," "sanctions," "global economy," and "Bitcoin demand" are important to consider.

Market Sentiment and Media Influence:

Trump's Public Statements and Bitcoin's Price:

Trump's tweets and public statements have historically influenced financial markets. His views on Bitcoin, whether explicitly stated or implied, could significantly impact market sentiment.

- Direct mentions of Bitcoin: Any direct mention of Bitcoin by Trump could cause significant price swings, depending on the tone and nature of the statement.

- Indirect influence through economic policy: Trump's broader economic policies could influence investor perception of Bitcoin, impacting its price indirectly.

- Media amplification: Media coverage of Trump's statements regarding Bitcoin or broader economic policies will amplify their impact on market sentiment. Keywords like "market sentiment," "media influence," "Trump tweets," and "Bitcoin price prediction" are relevant here.

Overall Public Perception and Investor Confidence:

Public perception of Bitcoin and investor confidence are crucial factors affecting its price. Trump's actions and statements could impact both.

- Regulatory clarity's impact on confidence: Clear regulatory frameworks could boost investor confidence, positively affecting Bitcoin's price.

- Public statements on technology: Trump's views on disruptive technologies in general could indirectly influence public perception of Bitcoin.

- Overall economic outlook: The overall economic climate, influenced by Trump's policies, will significantly impact investor confidence in Bitcoin. Keywords like "investor confidence," "market psychology," and "Bitcoin adoption" are vital to this section.

Conclusion: Assessing Trump's Influence on Bitcoin's Future – A Call to Action

Predicting Bitcoin's price is inherently challenging, and the influence of Trump's next 100 days adds another layer of uncertainty. While his policies could positively or negatively impact Bitcoin's price through various channels – regulatory changes, economic shifts, geopolitical events, and market sentiment – the ultimate effect remains unpredictable. However, understanding the potential points of influence, as outlined above, is crucial for navigating the market. To stay informed about Trump's impact on Bitcoin and make informed investment decisions, stay updated on both political and cryptocurrency market news. Continue your research by exploring resources on cryptocurrency regulation, global economic forecasts, and the historical correlation between political events and Bitcoin's price fluctuations. Understanding the interplay between Trump's impact on Bitcoin and broader market trends is key to navigating this dynamic landscape.

Featured Posts

-

Nottingham Attacks Survivors Share Their Stories

May 09, 2025

Nottingham Attacks Survivors Share Their Stories

May 09, 2025 -

Elon Musks Business Ventures How He Accumulated His Massive Fortune

May 09, 2025

Elon Musks Business Ventures How He Accumulated His Massive Fortune

May 09, 2025 -

King Zvinuvachuye Maska Ta Trampa V Pidtrimtsi Putina

May 09, 2025

King Zvinuvachuye Maska Ta Trampa V Pidtrimtsi Putina

May 09, 2025 -

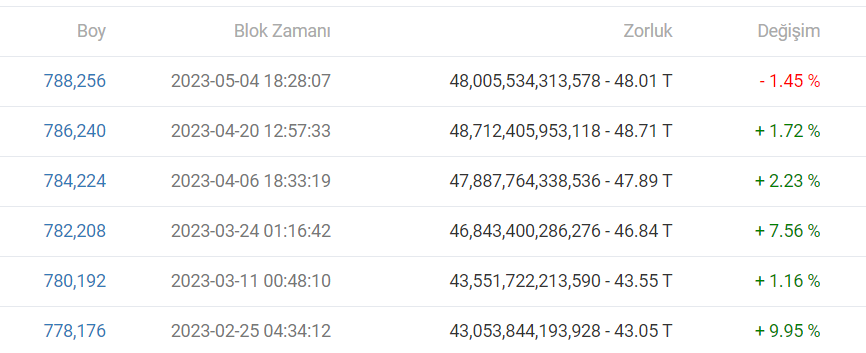

Bitcoin Madenciligi Zorluk Artisi Ve Madencilik Sonu

May 09, 2025

Bitcoin Madenciligi Zorluk Artisi Ve Madencilik Sonu

May 09, 2025 -

Polufinaly I Final Ligi Chempionov 2024 2025 Prognozy Daty Matchey I Gde Smotret

May 09, 2025

Polufinaly I Final Ligi Chempionov 2024 2025 Prognozy Daty Matchey I Gde Smotret

May 09, 2025