Will Trump's Policies Affect Bitcoin's Price? A 2024 Price Prediction

Table of Contents

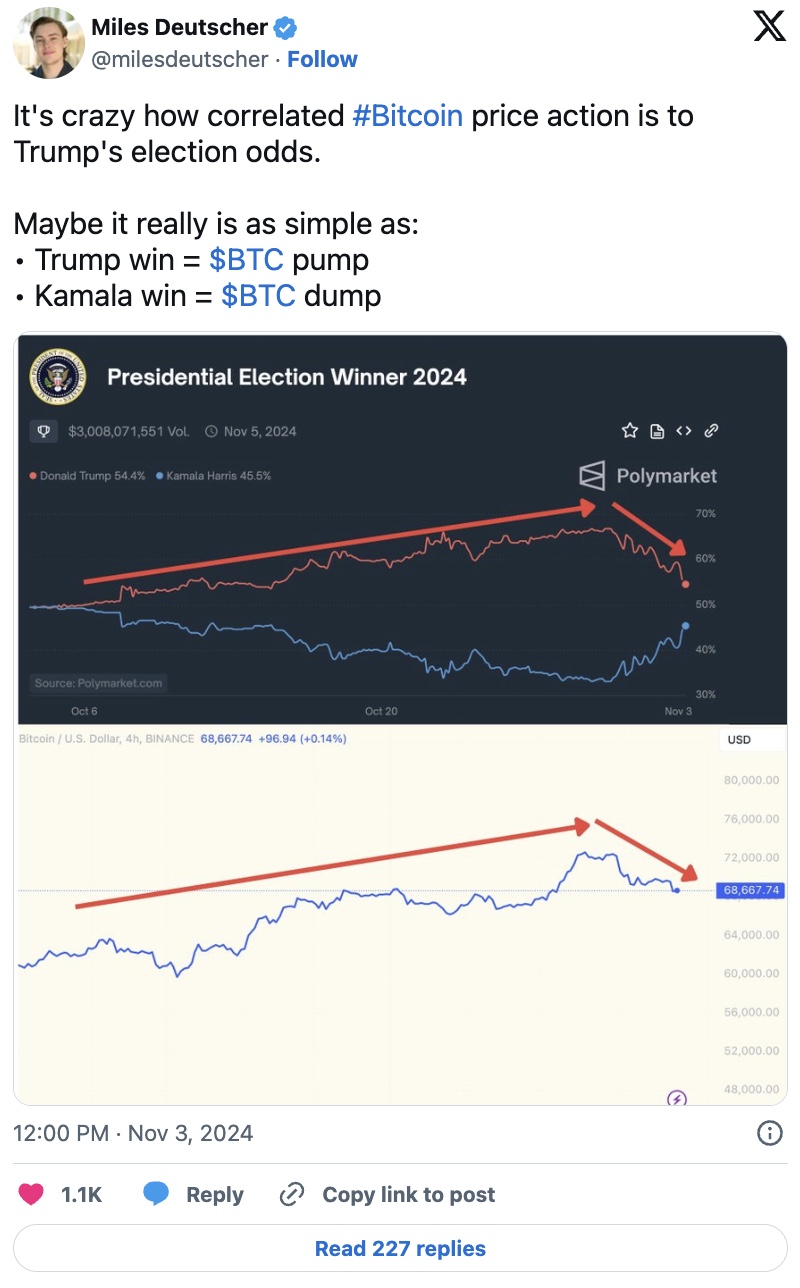

The 2024 US presidential election looms large, and with Donald Trump a potential candidate, many are wondering: How will his policies, if implemented, affect the volatile world of Bitcoin? This article delves into the potential impact of a Trump presidency on Bitcoin's price, offering a comprehensive prediction for 2024. We will examine his past stances on cryptocurrency, potential regulatory changes, and the broader economic climate under a Trump administration. Understanding the interplay between politics and cryptocurrency is crucial for anyone invested in or considering investing in Bitcoin.

Trump's Past Stances on Cryptocurrency and Regulation

Historical Perspective:

Trump's public statements on Bitcoin and cryptocurrencies have been relatively scarce compared to his pronouncements on other economic issues. He hasn't offered detailed policy proposals specific to crypto. However, his general approach to regulation and the economy offers clues. His administration saw a mixed bag regarding financial technology – a focus on deregulation in some areas but also crackdowns on certain financial practices. This ambiguity makes predicting his specific approach to Bitcoin regulation challenging.

- Analysis of previously expressed views on cryptocurrency regulation: While no direct statements exist, his preference for deregulation suggests a potential for a less interventionist approach than some other candidates might take. However, his administration also demonstrated a willingness to act decisively when perceived threats to the financial system emerged.

- Mention of any advisors or associates with known stances on crypto: Identifying key advisors with potential influence on a Trump administration's cryptocurrency policy is critical. Their past statements and affiliations within the crypto industry would provide valuable insights. Research into potential cabinet appointees' views on digital assets will be vital in forming a more accurate prediction.

- Link to relevant news articles or official statements: [Insert links to relevant news articles and official statements regarding Trump's stance on financial regulation and technology].

Potential Regulatory Changes Under a Trump Administration:

A second Trump presidency could bring either increased regulatory scrutiny or a more hands-off approach to Bitcoin and cryptocurrencies.

- Increased regulatory scrutiny or a more lenient approach?: A more lenient approach might stimulate innovation and adoption, potentially driving up the Bitcoin price. Conversely, increased scrutiny, possibly driven by concerns about money laundering or market manipulation, could lead to tighter regulations and stifle growth, negatively impacting the price.

- Potential impact on Bitcoin mining operations: Any changes to energy policies or environmental regulations could impact the profitability and location of Bitcoin mining operations.

- Effects on cryptocurrency exchanges and trading activities: Increased KYC/AML requirements or stricter rules on trading could limit accessibility and liquidity, influencing price volatility.

- Discussion of potential tax implications: Changes in capital gains tax or specific cryptocurrency tax laws could significantly impact Bitcoin investment strategies and, consequently, its price.

Economic Policy and its Impact on Bitcoin

Macroeconomic Factors:

Trump's economic policies, characterized by tax cuts and deregulation, could have a significant indirect impact on Bitcoin's price.

- Impact of potential tax cuts or increases on Bitcoin investment: Lower capital gains taxes might incentivize Bitcoin investment, potentially boosting demand and price. Conversely, higher taxes could discourage investment.

- Influence of trade policies on global markets and Bitcoin's value: Trade disputes and protectionist policies could create economic uncertainty, potentially driving investors towards Bitcoin as a safe-haven asset.

- Relationship between economic uncertainty and Bitcoin's price volatility: Periods of economic instability often lead to increased Bitcoin price volatility as investors seek alternative assets.

- Mentioning safe-haven asset status of Bitcoin and its potential reaction to economic instability: Bitcoin's reputation as a hedge against inflation and economic uncertainty could see increased demand during periods of instability under a Trump administration.

Geopolitical Landscape and Bitcoin

International Relations:

Trump's "America First" approach to foreign policy could influence the global adoption of Bitcoin and its price.

- Potential impact of trade wars or international conflicts on Bitcoin's price: Geopolitical tensions can lead to increased demand for Bitcoin as a decentralized, globally accessible asset, potentially increasing its value.

- Influence of global adoption on price stability: Increased global adoption could lead to greater price stability, while a decrease in international adoption could lead to increased volatility.

- Discussion on Bitcoin's role in circumventing sanctions: Bitcoin's potential use in circumventing international sanctions could be a point of contention in any future Trump administration.

- Mention the possible impact of any changes in US relations with China on Bitcoin: Any significant shifts in US-China relations could impact the global cryptocurrency market and Bitcoin's price, given China's substantial influence on the digital asset landscape.

2024 Bitcoin Price Prediction Considering Trump's Policies

Scenario Analysis:

Predicting Bitcoin's price is inherently speculative, but considering potential Trump administration policies allows for a range of scenarios:

- Optimistic scenario (e.g., favorable regulation leads to price increase): A less-interventionist regulatory approach could fuel innovation and adoption, potentially driving Bitcoin's price to, say, $100,000 or more by the end of 2024.

- Pessimistic scenario (e.g., stricter regulation leads to price decrease): Increased regulatory scrutiny and crackdowns could dampen enthusiasm, potentially pushing the price down to $20,000 or lower.

- Neutral scenario (e.g., minimal impact on Bitcoin price): Minimal policy changes could leave Bitcoin's price relatively unaffected, hovering around its current levels or experiencing moderate growth based on other market forces.

- Include specific price targets with justifications: These price targets are highly speculative and depend on various factors beyond Trump's policies, including technological advancements, market sentiment, and global economic conditions.

Conclusion:

The potential impact of a Trump presidency on Bitcoin's price in 2024 remains uncertain. Various scenarios are possible, ranging from significant price increases under a favorable regulatory environment to substantial decreases under stricter regulations. His past economic policies and general stance on regulation offer some clues, but the lack of specific pronouncements on crypto makes definitive predictions challenging. His approach to international relations also plays a significant role, influencing the global adoption of Bitcoin and its price stability.

Call to Action: Stay informed on the latest developments regarding Trump's policies and their potential effects on the Bitcoin price in 2024. Continue your research and make informed investment decisions. Remember that this analysis is for informational purposes only and should not be considered financial advice. Conduct thorough due diligence before making any investment decisions.

Featured Posts

-

Arsenal Ps Zh Predviduvanja Za Prviot Mech Od Ligata Na Shampionite

May 08, 2025

Arsenal Ps Zh Predviduvanja Za Prviot Mech Od Ligata Na Shampionite

May 08, 2025 -

Pressure On Arteta Intensifies Arsenal News And Analysis Following Collymores Comments

May 08, 2025

Pressure On Arteta Intensifies Arsenal News And Analysis Following Collymores Comments

May 08, 2025 -

Thunder Grizzlies Showdown Key Players And Predictions

May 08, 2025

Thunder Grizzlies Showdown Key Players And Predictions

May 08, 2025 -

Nereden Izleyebilirim Arsenal Psg Maci Canli Yayin Bilgileri

May 08, 2025

Nereden Izleyebilirim Arsenal Psg Maci Canli Yayin Bilgileri

May 08, 2025 -

2024

May 08, 2025

2024

May 08, 2025

Latest Posts

-

Superman Sneak Peek Kryptos Attack On The Man Of Steel

May 08, 2025

Superman Sneak Peek Kryptos Attack On The Man Of Steel

May 08, 2025 -

The Ultimate Guide To The Best Krypto Stories

May 08, 2025

The Ultimate Guide To The Best Krypto Stories

May 08, 2025 -

Discover The Best Krypto Stories Ever Written

May 08, 2025

Discover The Best Krypto Stories Ever Written

May 08, 2025 -

A Comprehensive Guide To The Best Krypto Stories

May 08, 2025

A Comprehensive Guide To The Best Krypto Stories

May 08, 2025 -

Ranking The Best Krypto Stories A Definitive List

May 08, 2025

Ranking The Best Krypto Stories A Definitive List

May 08, 2025