Winning Strategies: AIMSCAP's Approach To The World Trading Tournament (WTT)

Table of Contents

AIMSCAP is a leading financial analytics and trading firm known for its innovative approach to market analysis and risk management. Their participation in the WTT has consistently showcased their expertise and ability to navigate the complexities of the global financial markets. Let's explore the winning strategies that have propelled AIMSCAP to the forefront of the WTT.

Rigorous Market Analysis: The Foundation of AIMSCAP's Success

AIMSCAP's success in the World Trading Tournament is built upon a foundation of meticulous market analysis, incorporating both fundamental and technical approaches, all underpinned by robust risk management protocols.

Fundamental Analysis: Uncovering Underlying Value

AIMSCAP employs a comprehensive fundamental analysis approach, focusing on the intrinsic value of assets. This involves in-depth research encompassing financial statement analysis, industry research, and macroeconomic factors.

- Financial Statement Analysis: Analyzing financial statements like balance sheets, income statements, and cash flow statements to assess a company's financial health and profitability. Key indicators such as Price-to-Earnings (P/E) ratios, debt-to-equity ratios, and return on equity (ROE) are meticulously scrutinized.

- Industry Research: Conducting thorough research into the specific industries in which AIMSCAP invests, identifying growth potential, competitive dynamics, and regulatory influences.

- Macroeconomic Analysis: Considering the broader economic environment, including inflation rates, interest rates, and global economic growth, to understand their impact on asset prices.

Technical Analysis: Charting the Path to Profitability

Complementing their fundamental analysis, AIMSCAP leverages technical analysis to identify optimal entry and exit points in the market. This involves the study of price charts and the use of various technical indicators.

- Chart Patterns: Identifying recurring chart patterns, such as head and shoulders, double tops/bottoms, and triangles, to predict future price movements.

- Trading Indicators: Utilizing a range of technical indicators, including moving averages (e.g., 50-day and 200-day moving averages), Relative Strength Index (RSI), and Moving Average Convergence Divergence (MACD), to gauge momentum and potential reversals. AIMSCAP’s skilled analysts interpret these indicators in conjunction with chart patterns for enhanced accuracy.

Risk Management: Protecting Gains and Limiting Losses

Risk management is paramount in the highly volatile world of trading. AIMSCAP implements stringent risk mitigation strategies to protect capital and maximize profitability in the World Trading Tournament.

- Stop-Loss Orders: Utilizing stop-loss orders to automatically exit a trade if the price moves against their position, limiting potential losses.

- Position Sizing: Carefully determining the appropriate size of each trade based on risk tolerance and account equity. This prevents any single trade from significantly impacting their overall portfolio.

- Diversification: Diversifying their portfolio across different asset classes and sectors to reduce overall risk and improve resilience against market fluctuations. This is crucial for long-term success in the WTT.

Adaptability and Strategic Flexibility in a Dynamic Market

The World Trading Tournament presents a dynamic and unpredictable landscape. AIMSCAP’s ability to adapt to changing market conditions and maintain strategic flexibility is a key factor in their success.

Responding to Market Volatility: Navigating Uncertainty

AIMSCAP has developed sophisticated strategies for navigating periods of heightened market volatility and uncertainty. Their approach involves:

- Scenario Planning: Developing contingency plans to address various potential market scenarios, allowing them to react swiftly and decisively to unexpected events.

- Real-Time Monitoring: Continuously monitoring market developments and news to identify potential risks and opportunities.

- Agile Decision-Making: Employing a quick and decisive decision-making process, enabling them to capitalize on fleeting opportunities and mitigate risks effectively. Examples include rapidly adjusting positions during flash crashes or geopolitical events.

Dynamic Portfolio Management: Optimizing for Success

AIMSCAP’s portfolio management strategy is far from static. It’s characterized by constant adaptation and optimization based on prevailing market conditions.

- Rebalancing: Regularly rebalancing their portfolio to maintain the desired asset allocation, ensuring alignment with their overall investment strategy.

- Asset Allocation Adjustments: Adapting asset allocation based on market trends and opportunities. For example, shifting from bonds to equities during periods of anticipated growth.

- Opportunity Exploitation: Actively seeking out and capitalizing on emerging opportunities in the market, swiftly adjusting their portfolio to take advantage of favorable conditions.

Teamwork and Collaboration: The Power of a Unified Approach

AIMSCAP’s success in the World Trading Tournament isn't solely down to individual brilliance; it’s a testament to the power of teamwork and collaboration.

Expertise and Specialization: A Symphony of Skills

AIMSCAP’s team comprises specialists in various areas, creating a synergistic blend of expertise.

- Fundamental Analysts: Responsible for in-depth research and valuation of assets.

- Technical Analysts: Focusing on chart patterns, technical indicators, and trade setups.

- Traders: Executing trades based on the analysis provided by their colleagues.

- Risk Managers: Overseeing risk management protocols and ensuring compliance.

Communication and Coordination: The Glue That Binds Success

Effective communication and coordinated effort are essential for AIMSCAP’s success.

- Regular Meetings: Holding regular meetings to share information, discuss market developments, and coordinate trading strategies.

- Clear Communication Channels: Employing efficient communication channels to ensure timely dissemination of information.

- Collaborative Decision-Making: Adopting a collaborative approach to decision-making, leveraging the collective intelligence of the team.

Conclusion: Mastering Winning Strategies in the World Trading Tournament

AIMSCAP’s consistent success in the World Trading Tournament hinges on a powerful combination of rigorous market analysis, encompassing both fundamental and technical approaches, coupled with dynamic adaptability, stringent risk management, and seamless teamwork. Their winning strategies underscore the importance of a holistic approach to trading, integrating diverse skill sets and leveraging collaborative efforts. Learn from AIMSCAP's winning strategies in the World Trading Tournament and elevate your trading game. Explore our resources to discover how you can implement these successful approaches in your own trading journey. Discover more about AIMSCAP's winning strategies and dominate the World Trading Tournament – learn more today!

Featured Posts

-

Is The Goldbergs Ending Soon A Look At The Shows Future

May 21, 2025

Is The Goldbergs Ending Soon A Look At The Shows Future

May 21, 2025 -

The Goldbergs Exploring The Shows Recurring Themes And Storylines

May 21, 2025

The Goldbergs Exploring The Shows Recurring Themes And Storylines

May 21, 2025 -

Arunas Unexpected Loss At Wtt Chennai Open

May 21, 2025

Arunas Unexpected Loss At Wtt Chennai Open

May 21, 2025 -

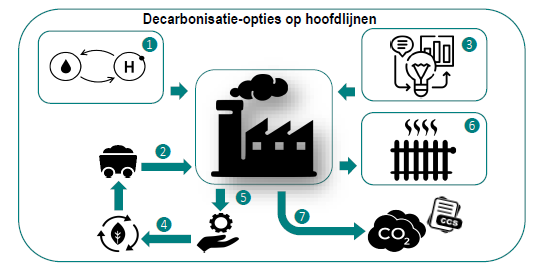

Abn Amro Kamerbrief Certificaten Verkoopprogramma En Strategieen

May 21, 2025

Abn Amro Kamerbrief Certificaten Verkoopprogramma En Strategieen

May 21, 2025 -

Razvod Vanje Mijatovic Sta Se Zapravo Dogodilo

May 21, 2025

Razvod Vanje Mijatovic Sta Se Zapravo Dogodilo

May 21, 2025

Latest Posts

-

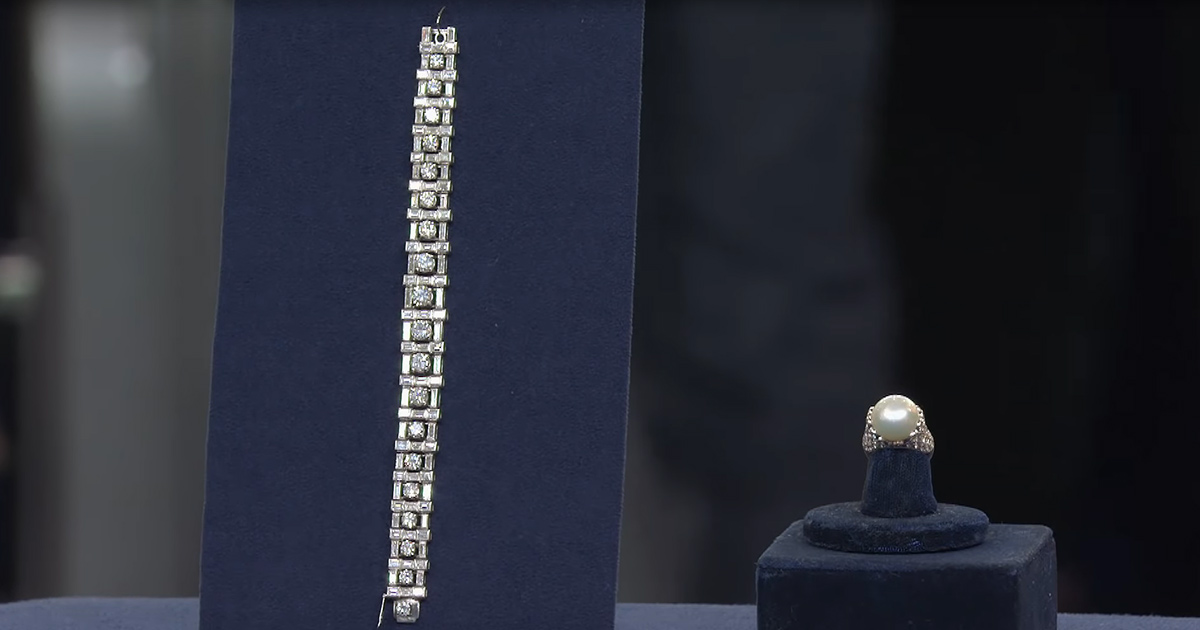

Couple Arrested Following Jaw Dropping Antiques Roadshow Appraisal

May 21, 2025

Couple Arrested Following Jaw Dropping Antiques Roadshow Appraisal

May 21, 2025 -

Couple Sentenced After Antiques Roadshow Reveals Stolen Property

May 21, 2025

Couple Sentenced After Antiques Roadshow Reveals Stolen Property

May 21, 2025 -

Antiques Roadshow A National Treasure And A Shocking Arrest

May 21, 2025

Antiques Roadshow A National Treasure And A Shocking Arrest

May 21, 2025 -

Antiques Roadshow Appraisal Exposes Stolen Items Leading To Imprisonment

May 21, 2025

Antiques Roadshow Appraisal Exposes Stolen Items Leading To Imprisonment

May 21, 2025 -

Jaw Dropping Antiques Roadshow Find Culminates In Trafficking Charges

May 21, 2025

Jaw Dropping Antiques Roadshow Find Culminates In Trafficking Charges

May 21, 2025