Winning The Euromillions: Financial Planning For A £202m Jackpot

Table of Contents

Assembling Your Dream Team of Financial Experts

Winning the Euromillions necessitates expert guidance to avoid costly mistakes and make informed decisions. Assembling a skilled team of financial professionals is paramount. Ignoring this step could lead to significant financial losses and missed opportunities.

-

Importance of professional advice: The sheer scale of a £202 million win presents unique challenges. Navigating legal, tax, and investment complexities requires specialized expertise. Without professional guidance, you risk making irreversible errors that could severely impact your long-term financial health.

-

Key professionals: Your dream team should include:

- Solicitor specializing in high-net-worth individuals: A solicitor with experience handling substantial wealth can guide you through legal matters, including asset protection, contract negotiation, and estate planning. They'll ensure all legal aspects of your win are handled correctly and efficiently.

- Independent financial advisor (IFA): An IFA provides unbiased advice on investment strategies tailored to your specific risk tolerance and financial goals. They'll help you create a diversified investment portfolio designed for long-term growth.

- Accountant: A skilled accountant is crucial for tax optimization and overall financial management. They will help you navigate complex tax laws, minimize your tax liability legally, and ensure accurate financial record-keeping.

- Trust and estate lawyer: This professional will advise you on establishing trusts to protect your assets and plan for the distribution of your wealth to beneficiaries, both during your lifetime and after your passing. This is essential for preserving your legacy.

-

Benefits of a coordinated approach: The coordinated efforts of this team guarantee a comprehensive financial plan that addresses all aspects of your newfound wealth, maximizing its potential and mitigating risks.

Securing Your Winnings and Protecting Your Privacy

Protecting your identity and your winnings is the first crucial step after winning the Euromillions. The sudden influx of wealth makes you a target for scams and fraud.

- Claiming your winnings anonymously (where possible): Many lottery organizations offer options for anonymous claim processing. Consult your lottery's guidelines to explore this possibility and safeguard your privacy.

- Establishing a secure bank account: Open a dedicated bank account specifically for managing your winnings. This separates your lottery funds from your existing accounts, providing better oversight and security. Consider private banking services for enhanced security and discretion.

- Protecting your identity: Be extremely cautious about sharing your win with others. Avoid publicizing your win unless absolutely necessary. Be wary of unsolicited financial advice and proposals.

- Legal considerations: Creating trusts and considering offshore options (under the guidance of your legal team) can provide added asset protection and tax benefits.

Strategic Investment for Long-Term Financial Growth

A £202 million win demands a long-term investment strategy focused on preserving and growing your wealth.

- Diversification: Spread your investments across various asset classes, including stocks, bonds, real estate, private equity, and alternative investments. Diversification reduces your risk exposure and protects against market fluctuations.

- Low-risk investment options: Allocate a portion of your winnings to low-risk investments like government bonds and high-yield savings accounts to preserve capital and provide a stable foundation.

- Medium to high-risk options: Consider medium to high-risk investments such as stocks and real estate, with professional guidance, to maximize returns over the long term. This should be done strategically and in line with your risk tolerance.

- Long-term investment planning: Develop a long-term investment plan to build a legacy for future generations. Consider setting up family trusts or foundations to ensure your wealth is managed and distributed according to your wishes.

- Ethical and sustainable investments: Increasingly, individuals are considering ethical and sustainable investment options, aligning their investments with their values. This area is growing and offers significant potential.

Managing Lifestyle Changes and Charitable Giving

Winning the Euromillions brings the potential for significant lifestyle changes. Careful planning is essential to avoid financial overextension.

- Gradual lifestyle changes: Avoid making drastic changes immediately. Gradually adjust your lifestyle to prevent impulsive spending and financial shocks.

- Budgeting and financial tracking: Use budgeting tools and financial tracking software to manage your expenses effectively. This ensures you maintain control of your spending and avoid overspending.

- Charitable giving: Consider the significant impact you can have through philanthropy. Plan for charitable giving—setting up a foundation or supporting existing charities—to make a positive difference in the world.

Tax Implications of a Euromillions Win

Lottery winnings are subject to tax, so understanding your tax liabilities is paramount.

- Understanding tax liabilities: Consult with your accountant to determine your tax obligations in your country of residence. Tax laws vary significantly, and professional advice is crucial.

- Minimizing tax burden: Your accountant can help you legally minimize your tax burden through various tax-efficient strategies and investment vehicles.

- Tax-efficient investment vehicles: Explore tax-advantaged investment vehicles to reduce your overall tax liability and maximize returns.

Conclusion

Winning the Euromillions is a life-altering event. However, proper financial planning is essential to ensure your wealth lasts for generations. By assembling a skilled team of experts, securing your winnings, diversifying investments, managing lifestyle changes responsibly, and addressing tax implications proactively, you can transform your £202m jackpot into a lasting legacy. Don't let the excitement overshadow the importance of careful planning. Secure your financial future by taking control and planning your post-Euromillions win strategy today. Learn more about winning the Euromillions and planning your financial future wisely.

Featured Posts

-

Moroka Swallows Vs Orlando Pirates Analyzing Salengs Salary Difference

May 28, 2025

Moroka Swallows Vs Orlando Pirates Analyzing Salengs Salary Difference

May 28, 2025 -

Googles Veo 3 Ai Potential And Limitations For Video Production

May 28, 2025

Googles Veo 3 Ai Potential And Limitations For Video Production

May 28, 2025 -

Ronaldo 40 Yas Siniri Yok Basari Devam Ediyor

May 28, 2025

Ronaldo 40 Yas Siniri Yok Basari Devam Ediyor

May 28, 2025 -

Alejandro Garnacho Transfer Man United Demands E60m

May 28, 2025

Alejandro Garnacho Transfer Man United Demands E60m

May 28, 2025 -

Newark Airports Crisis Why It Matters To Everyone

May 28, 2025

Newark Airports Crisis Why It Matters To Everyone

May 28, 2025

Latest Posts

-

Jon Jones Lingering Grudge Can He Move Past Daniel Cormier

May 30, 2025

Jon Jones Lingering Grudge Can He Move Past Daniel Cormier

May 30, 2025 -

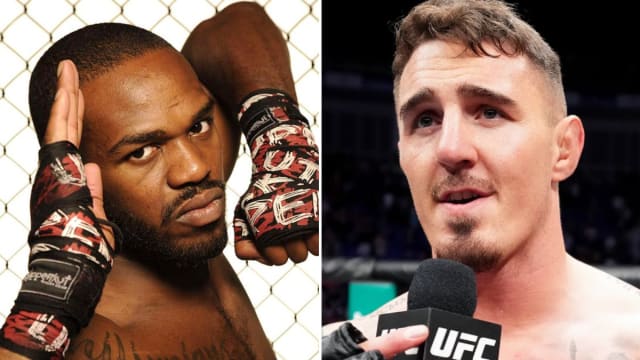

Jon Jones Mocks Tom Aspinall Amidst Ufc Return Delay

May 30, 2025

Jon Jones Mocks Tom Aspinall Amidst Ufc Return Delay

May 30, 2025 -

Jon Jones And Daniel Cormier An Unresolved Rivalry

May 30, 2025

Jon Jones And Daniel Cormier An Unresolved Rivalry

May 30, 2025 -

Daniel Cormier And Jon Jones The Publicists Role In Their Historic Feud

May 30, 2025

Daniel Cormier And Jon Jones The Publicists Role In Their Historic Feud

May 30, 2025 -

The Untold Story Cormiers Message To Jon Jones Publicist And The Fallout

May 30, 2025

The Untold Story Cormiers Message To Jon Jones Publicist And The Fallout

May 30, 2025