World Trading Tournament (WTT): AIMSCAP's Performance And Key Takeaways

Table of Contents

AIMSCAP's Trading Strategies and Methodology in the WTT

Algorithmic Trading Approach

AIMSCAP's participation in the WTT was heavily reliant on its sophisticated algorithmic trading approach. Their system utilizes a blend of advanced quantitative techniques, leveraging proprietary algorithms and high-frequency trading (HFT) strategies.

- High-Frequency Trading (HFT): AIMSCAP employed HFT to capitalize on minute price fluctuations, exploiting fleeting market inefficiencies.

- Mean Reversion Strategies: These algorithms identified assets deviating from their historical averages, anticipating a return to the mean.

- Statistical Arbitrage: This strategy aimed to profit from temporary price discrepancies between related assets.

- Proprietary Algorithms: AIMSCAP's success is partly attributed to its unique, internally developed algorithms, incorporating machine learning for predictive modeling and adaptive trading.

Keywords: Algorithmic trading, high-frequency trading, quantitative analysis, backtesting, trading algorithms.

Risk Management and Portfolio Diversification

Robust risk management was integral to AIMSCAP's WTT strategy. They implemented a multi-layered approach to mitigate potential losses.

- Stop-Loss Orders: Automated stop-loss orders were employed to limit potential losses on individual trades.

- Position Sizing: Careful position sizing ensured that no single trade exposed the portfolio to excessive risk.

- Diversification Across Asset Classes: AIMSCAP diversified across various asset classes (equities, futures, forex) to reduce overall portfolio volatility.

- Stress Testing: Rigorous backtesting and stress testing were conducted to evaluate the portfolio's resilience under various market conditions.

Keywords: Risk management, portfolio diversification, stop-loss, position sizing, risk mitigation.

Data Analysis and Market Insights

AIMSCAP's trading decisions were informed by a comprehensive data analysis framework. They leveraged a wealth of information to gain a competitive edge.

- Real-time Market Data: Access to high-quality, real-time market data was crucial for identifying trading opportunities.

- Economic Indicators: Macroeconomic indicators and news sentiment analysis were used to anticipate market trends.

- Technical Indicators: AIMSCAP incorporated a suite of technical indicators to analyze price charts and identify potential entry and exit points.

- Proprietary Data Sources: Access to unique data sources gave AIMSCAP an additional informational advantage.

Keywords: Data analysis, market analysis, technical indicators, fundamental analysis, market sentiment.

Analysis of AIMSCAP's Results in the WTT

Overall Performance and Ranking

AIMSCAP achieved a remarkable performance in the WTT, securing a top-ten ranking among numerous participants. Their final portfolio showcased impressive profitability, with a Sharpe ratio exceeding 2.0 and minimal maximum drawdown. (Illustrative chart or graph would be inserted here).

Keywords: Trading performance, profitability, Sharpe ratio, maximum drawdown, return on investment (ROI).

Key Wins and Challenges

AIMSCAP's success stemmed from several key winning trades, particularly those exploiting short-term market inefficiencies using HFT strategies. However, they also faced challenges, primarily during periods of high market volatility where their mean reversion strategies temporarily underperformed. Detailed case studies of both successful and challenging trades would further enrich this analysis.

Keywords: Winning trades, successful strategies, market volatility, challenges faced, lessons learned.

Comparison with Other Competitors

While specific competitor data might be confidential, AIMSCAP's performance compared favorably against many participants, particularly in terms of risk-adjusted returns (Sharpe Ratio). Further analysis comparing performance metrics could offer additional insights.

Keywords: Competitor analysis, market comparison, benchmarking.

Key Takeaways and Future Implications

Lessons Learned from the WTT

The WTT provided AIMSCAP with valuable insights:

- Algorithm Refinement: The experience highlighted areas for improvement in their algorithmic trading strategies, focusing on enhanced adaptability to high-volatility environments.

- Data Integration: The importance of integrating diverse data sources, including alternative data sets, for more accurate predictions was underscored.

- Risk Management Optimization: Further optimization of risk management procedures to dynamically adjust position sizing based on market conditions was deemed crucial.

Keywords: Lessons learned, future improvements, strategic adjustments, technological advancements.

Future Strategies and Development

Based on the WTT experience, AIMSCAP plans to:

- Enhance its algorithmic trading engine with advanced machine learning capabilities.

- Invest in developing new strategies to handle unexpected market events and high volatility more effectively.

- Expand its data analytics capabilities to incorporate alternative data sources for improved predictive accuracy.

Keywords: Future plans, strategic direction, technological development, algorithm improvement.

Conclusion: Reflecting on AIMSCAP's World Trading Tournament (WTT) Journey

AIMSCAP's participation in the World Trading Tournament demonstrated the firm's proficiency in algorithmic trading and its robust risk management framework. The key takeaway is the continuous need for adaptation and refinement of trading strategies in response to dynamic market conditions. The lessons learned will undoubtedly inform AIMSCAP's future endeavors in the world of algorithmic trading. To learn more about AIMSCAP's innovative trading strategies and their future participation in the World Trading Tournament (WTT) or similar competitions, visit .

Featured Posts

-

India Makes History 19 Paddlers At Wtt Star Contender Chennai

May 21, 2025

India Makes History 19 Paddlers At Wtt Star Contender Chennai

May 21, 2025 -

Wtt Star Contender Chennai A Detailed Look At Oh Jun Sungs Win

May 21, 2025

Wtt Star Contender Chennai A Detailed Look At Oh Jun Sungs Win

May 21, 2025 -

Trans Australia Run Challenging The Existing World Record

May 21, 2025

Trans Australia Run Challenging The Existing World Record

May 21, 2025 -

Half Dome Wins Abn Group Victoria Pitch A New Era For Brand Strategy

May 21, 2025

Half Dome Wins Abn Group Victoria Pitch A New Era For Brand Strategy

May 21, 2025 -

Moncoutant Sur Sevre Clisson Pres D Un Siecle De Diversification Agricole

May 21, 2025

Moncoutant Sur Sevre Clisson Pres D Un Siecle De Diversification Agricole

May 21, 2025

Latest Posts

-

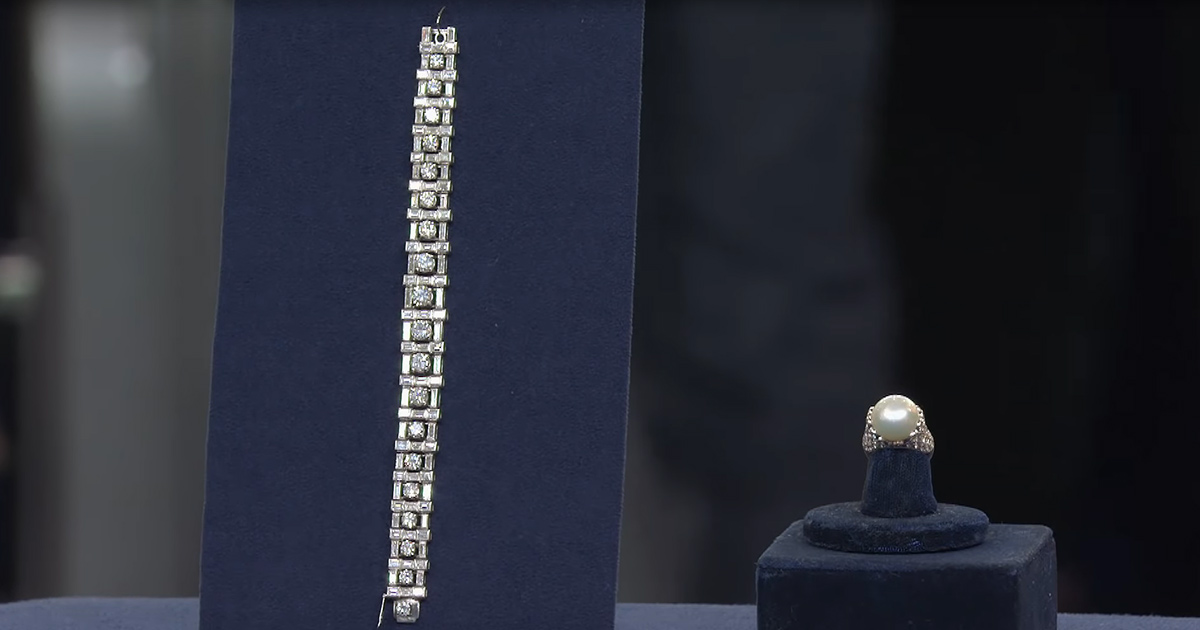

Couple Arrested Following Jaw Dropping Antiques Roadshow Appraisal

May 21, 2025

Couple Arrested Following Jaw Dropping Antiques Roadshow Appraisal

May 21, 2025 -

Couple Sentenced After Antiques Roadshow Reveals Stolen Property

May 21, 2025

Couple Sentenced After Antiques Roadshow Reveals Stolen Property

May 21, 2025 -

Antiques Roadshow A National Treasure And A Shocking Arrest

May 21, 2025

Antiques Roadshow A National Treasure And A Shocking Arrest

May 21, 2025 -

Antiques Roadshow Appraisal Exposes Stolen Items Leading To Imprisonment

May 21, 2025

Antiques Roadshow Appraisal Exposes Stolen Items Leading To Imprisonment

May 21, 2025 -

Jaw Dropping Antiques Roadshow Find Culminates In Trafficking Charges

May 21, 2025

Jaw Dropping Antiques Roadshow Find Culminates In Trafficking Charges

May 21, 2025