World Trading Tournament (WTT): Lessons Learned From AIMSCAP's Participation

Table of Contents

Strategic Planning and Preparation for the WTT

Success in a trading tournament like the WTT hinges on meticulous preparation. AIMSCAP's approach exemplified this principle.

Pre-Tournament Market Analysis & Strategy Development

AIMSCAP's strategy began months before the WTT. Their pre-tournament preparation included:

- Extensive Market Research: Utilizing advanced econometric models and fundamental analysis, they identified potential trading opportunities across various asset classes, focusing on currency pairs exhibiting high volatility and liquidity.

- Risk Assessment Strategies: AIMSCAP developed robust risk management protocols, incorporating stop-loss orders and position sizing techniques to limit potential losses. They employed Value at Risk (VaR) calculations to estimate potential losses with a given probability.

- Diverse Trading Strategies: Their approach wasn't limited to a single strategy. They employed a combination of swing trading, day trading, and algorithmic trading techniques, adapting their approach based on market conditions and identified opportunities. For instance, they leveraged algorithmic trading for high-frequency, short-term trades while using swing trading for longer-term opportunities.

For example, their market analysis focused heavily on the Eurozone and emerging market currencies, recognizing the potential for significant price movements in these areas. Their risk management strategy involved limiting exposure to any single asset to no more than 5% of their total capital.

Team Dynamics and Collaboration

The WTT is not a solo endeavor; it requires seamless teamwork. AIMSCAP fostered strong collaboration by:

- Role Specialization: Team members were assigned specific roles based on their expertise (market analysis, risk management, trade execution). This specialization ensured efficient workflow and minimized errors.

- Clear Communication Channels: Constant communication was maintained throughout the tournament using secure channels. Regular briefings ensured everyone was on the same page.

- Collaborative Decision-Making: Trading decisions were made collectively after thorough discussion and analysis, minimizing individual biases and maximizing the team's overall expertise.

For example, a crucial decision regarding a large position in the USD/JPY pair was made after a team discussion that incorporated insights from fundamental analysis, technical charting, and algorithmic signals.

Performance During the World Trading Tournament (WTT)

The WTT presented various challenges and opportunities. AIMSCAP's performance reflected their adaptability and strategic planning.

Key Trading Decisions and Their Outcomes

Several key trades defined AIMSCAP's WTT experience:

- Successful Trade: A long position in GBP/USD during a period of positive UK economic data resulted in a significant profit, demonstrating their ability to capitalize on market trends.

- Unsuccessful Trade: A short position in gold during a period of unexpected geopolitical instability resulted in a loss, highlighting the importance of anticipating unforeseen market shocks.

Analyzing both successful and unsuccessful trades allowed AIMSCAP to refine their approach. The GBP/USD trade reinforced the effectiveness of fundamental analysis in identifying profitable opportunities; the gold trade highlighted the need to incorporate geopolitical risk factors into their models.

Adaptability and Responding to Market Volatility

The WTT tested AIMSCAP's capacity to navigate unexpected market volatility:

- Market Shift Response: When a sudden market correction occurred, AIMSCAP quickly adjusted their trading strategies, reducing their overall exposure and focusing on less volatile assets.

- Flexibility in Approach: Their ability to switch between different trading strategies (algorithmic, day trading, swing trading) enabled them to exploit opportunities arising from different market dynamics.

For example, during a period of heightened uncertainty caused by a major political event, AIMSCAP shifted their focus from high-risk, high-reward trades to lower-risk, defensive strategies, preserving capital and minimizing losses.

Post-Tournament Analysis and Key Takeaways from the WTT

After the WTT, a rigorous post-tournament analysis was conducted.

Evaluating Performance and Identifying Areas for Improvement

AIMSCAP's review process involved:

- Detailed Performance Metrics: A meticulous review of all trades, analyzing profit/loss ratios, win rates, and risk management effectiveness.

- Identifying Weaknesses: Areas for improvement were pinpointed, including the need for more sophisticated risk models and greater diversification across asset classes.

- Strength Assessment: Their systematic approach to risk management and their well-structured team proved to be significant strengths.

Based on this analysis, AIMSCAP made significant changes to their trading algorithms and risk management protocols, refining their strategies for future competitions.

Valuable Lessons for Aspiring Traders

The WTT experience provided AIMSCAP with several crucial lessons applicable to all traders:

- Thorough Preparation is Key: The value of comprehensive market research, meticulous planning, and robust risk management cannot be overstated.

- Teamwork Enhances Success: Collaboration and effective communication are essential for optimizing performance in any trading environment.

- Adaptability is Crucial: Markets are unpredictable. Flexibility and the ability to adjust strategies in response to unforeseen events are critical for success.

These are invaluable trading tips, applicable far beyond the confines of the WTT.

Conclusion: Learning from AIMSCAP's WTT Journey

AIMSCAP's participation in the World Trading Tournament (WTT) underscored the importance of strategic planning, adaptability, and post-tournament analysis. Their experience provides a valuable blueprint for other traders aiming to participate in similar competitions or simply refine their trading skills. The lessons learned – from meticulous pre-tournament preparation and robust risk management to the value of teamwork and adaptability – are applicable to any trading endeavor. Prepare for your future WTT events or simply improve your trading strategies by learning from AIMSCAP's successes and challenges. Strategize, participate, and excel in the world of trading tournaments! Take the lessons learned from AIMSCAP’s WTT journey and use them to improve your own trading tournament participation.

Featured Posts

-

Pivdenniy Mist Detalniy Analiz Remontu Pidryadnikiv Ta Finansuvannya

May 21, 2025

Pivdenniy Mist Detalniy Analiz Remontu Pidryadnikiv Ta Finansuvannya

May 21, 2025 -

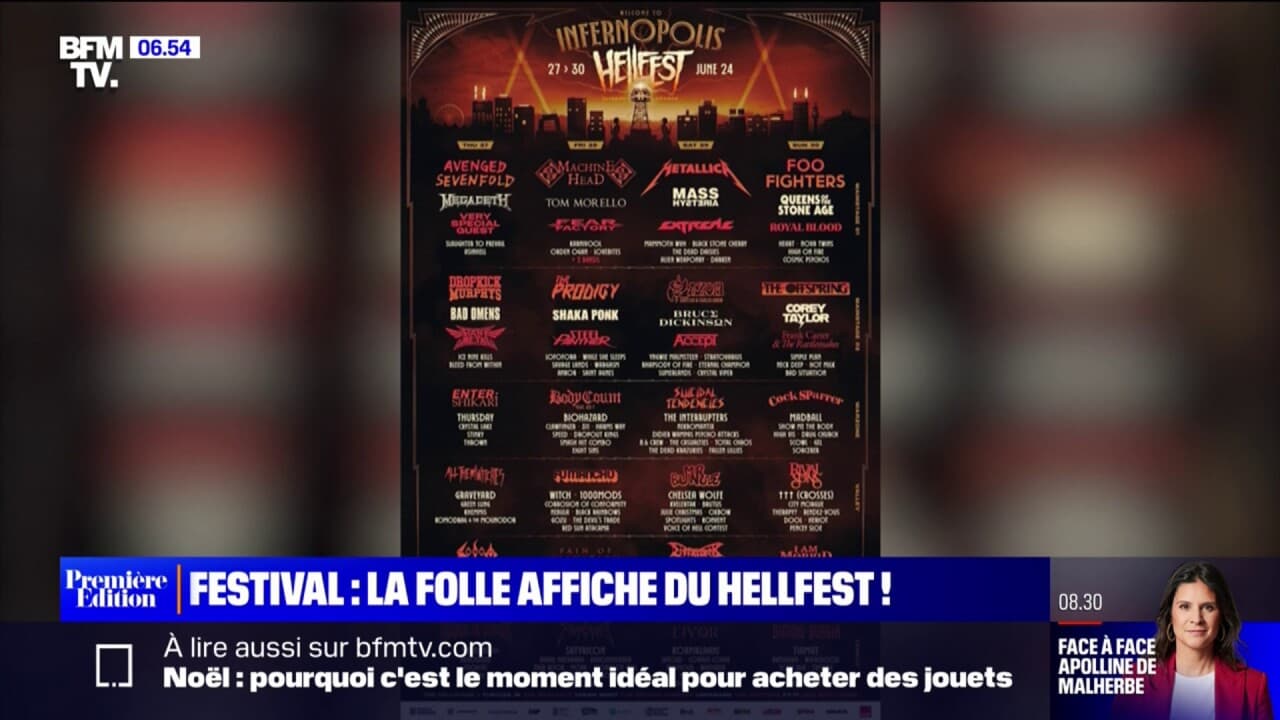

Novelistes L Espace Julien Avant Le Hellfest

May 21, 2025

Novelistes L Espace Julien Avant Le Hellfest

May 21, 2025 -

Understanding The Kartels Impact On Rum Culture A Stabroek News Analysis

May 21, 2025

Understanding The Kartels Impact On Rum Culture A Stabroek News Analysis

May 21, 2025 -

Puede Javier Baez Demostrar Su Salud Y Su Valor En La Proxima Temporada

May 21, 2025

Puede Javier Baez Demostrar Su Salud Y Su Valor En La Proxima Temporada

May 21, 2025 -

Its A Girl Peppa Pigs Family Grows

May 21, 2025

Its A Girl Peppa Pigs Family Grows

May 21, 2025

Latest Posts

-

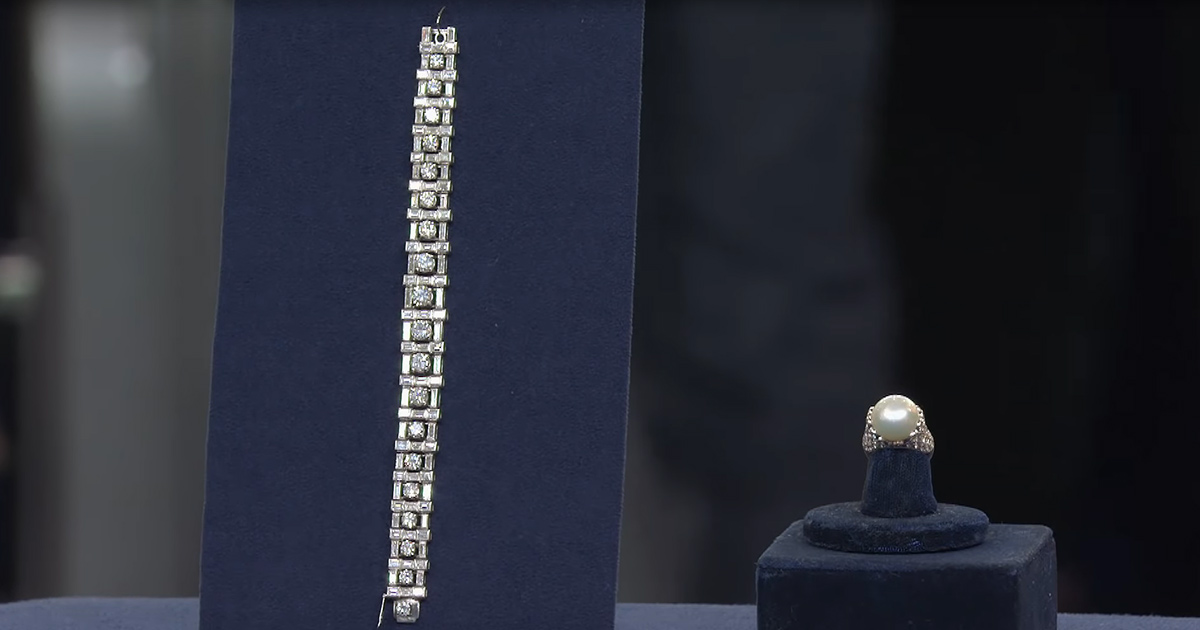

Couple Arrested Following Jaw Dropping Antiques Roadshow Appraisal

May 21, 2025

Couple Arrested Following Jaw Dropping Antiques Roadshow Appraisal

May 21, 2025 -

Couple Sentenced After Antiques Roadshow Reveals Stolen Property

May 21, 2025

Couple Sentenced After Antiques Roadshow Reveals Stolen Property

May 21, 2025 -

Antiques Roadshow A National Treasure And A Shocking Arrest

May 21, 2025

Antiques Roadshow A National Treasure And A Shocking Arrest

May 21, 2025 -

Antiques Roadshow Appraisal Exposes Stolen Items Leading To Imprisonment

May 21, 2025

Antiques Roadshow Appraisal Exposes Stolen Items Leading To Imprisonment

May 21, 2025 -

Jaw Dropping Antiques Roadshow Find Culminates In Trafficking Charges

May 21, 2025

Jaw Dropping Antiques Roadshow Find Culminates In Trafficking Charges

May 21, 2025