XAUUSD: Gold Recovers As US Economic Data Dampens Rate Hike Bets

Table of Contents

Weakening US Economic Indicators Fuel Gold Price Rally

Recent US economic reports paint a picture of a potentially slowing economy, providing a significant boost to the gold price. Several key indicators fell short of market expectations, raising concerns about a possible economic slowdown or even a recession. This has directly impacted the XAUUSD, causing the gold price to rise. Keywords related to this section include: US Economy, GDP, Inflation Data, CPI, PPI, Employment Data, Non-Farm Payrolls, Economic Slowdown, Recession Fears.

- Lower-than-projected GDP growth: The latest GDP figures revealed slower-than-anticipated growth, signaling a potential loss of economic momentum. This dampens optimism about sustained economic expansion.

- Decreasing inflation rates (CPI and PPI): While a decline in inflation is generally positive, the sharper-than-expected drop in both Consumer Price Index (CPI) and Producer Price Index (PPI) readings suggest a potential cooling of the economy, impacting the Fed's hawkish stance.

- Signs of weakening in the labor market (e.g., slower job growth): A slowdown in job growth, as evidenced by recent Non-Farm Payrolls reports, indicates a potential cooling of the labor market, adding further weight to recessionary fears.

- Increased recessionary concerns among analysts: Many market analysts are expressing growing concerns about the possibility of a US recession, given the confluence of these weaker-than-expected economic indicators. This uncertainty fuels safe-haven demand for gold, driving up its price.

Impact on Federal Reserve Policy and Interest Rate Expectations

The weaker-than-expected economic data significantly reduces the pressure on the Fed to continue its aggressive interest rate hike cycle. The possibility of a slower pace of rate hikes, or even a pause, is now being considered. This shift in expectation has had a direct and positive impact on the gold price. Keywords for this section include: Federal Reserve, Fed Rate Hikes, Interest Rate Expectations, Monetary Policy, Quantitative Tightening, Dollar Index (DXY), XAUUSD Outlook.

- Decreased likelihood of further aggressive rate hikes: The softer economic data makes a case for the Fed to adopt a less hawkish approach, potentially slowing down the pace of interest rate increases.

- Potential shift towards a more dovish monetary policy stance by the Fed: A dovish shift by the Fed would involve less aggressive tightening measures, reducing the attractiveness of the US dollar and boosting demand for alternative assets like gold.

- Impact on the US Dollar Index (DXY): A weakening US dollar, often a consequence of a less aggressive Fed, strengthens the XAUUSD pair as gold is priced in dollars. A weaker dollar makes gold more affordable for investors using other currencies.

Safe-Haven Demand Drives Gold Investment

Gold's role as a safe-haven asset is once again prominent. Amidst growing economic uncertainty and geopolitical risks, investors are turning to gold as a hedge against potential market downturns. Keywords relevant to this section are: Safe-Haven Asset, Gold Investment, Market Uncertainty, Geopolitical Risks, Risk-Off Sentiment.

- Increased investor demand for safe-haven assets amid economic concerns: Economic uncertainty triggers a "risk-off" sentiment, leading investors to seek the relative safety and stability of gold.

- Geopolitical tensions contributing to market uncertainty: Ongoing global geopolitical instability further contributes to market uncertainty, increasing demand for gold as a safe haven.

- Gold's historical performance as a hedge against inflation and economic downturns: Gold's historical track record as a store of value during times of inflation and economic distress strengthens its appeal as a safe-haven investment.

Technical Analysis of XAUUSD Chart

Analyzing the XAUUSD chart using technical indicators like moving averages, RSI, and MACD, alongside identification of support and resistance levels and chart patterns, provides further evidence supporting the recent price surge. These tools help traders identify potential entry and exit points, contributing to informed trading strategies. Keywords here include: XAUUSD Chart, Technical Indicators, Support Levels, Resistance Levels, Trading Strategy, Chart Patterns. (Note: A detailed technical analysis would require a chart and specific data which cannot be provided here.)

Conclusion

The recent rally in gold prices, reflected in the XAUUSD pair, is a result of several converging factors. Weaker-than-expected US economic data has reduced expectations of aggressive Fed rate hikes, simultaneously increasing safe-haven demand for gold. This confluence of events has significantly impacted the XAUUSD, leading to a notable increase in gold's value. To successfully navigate the XAUUSD market, stay informed about evolving economic conditions and their impact on interest rates. Monitor key economic indicators and adjust your XAUUSD trading strategy accordingly. Continue to follow our analysis for further insights into the XAUUSD market and to identify profitable gold trading opportunities.

Featured Posts

-

Foul Call Controversy Pistons Game 4 Loss Sparks Debate

May 17, 2025

Foul Call Controversy Pistons Game 4 Loss Sparks Debate

May 17, 2025 -

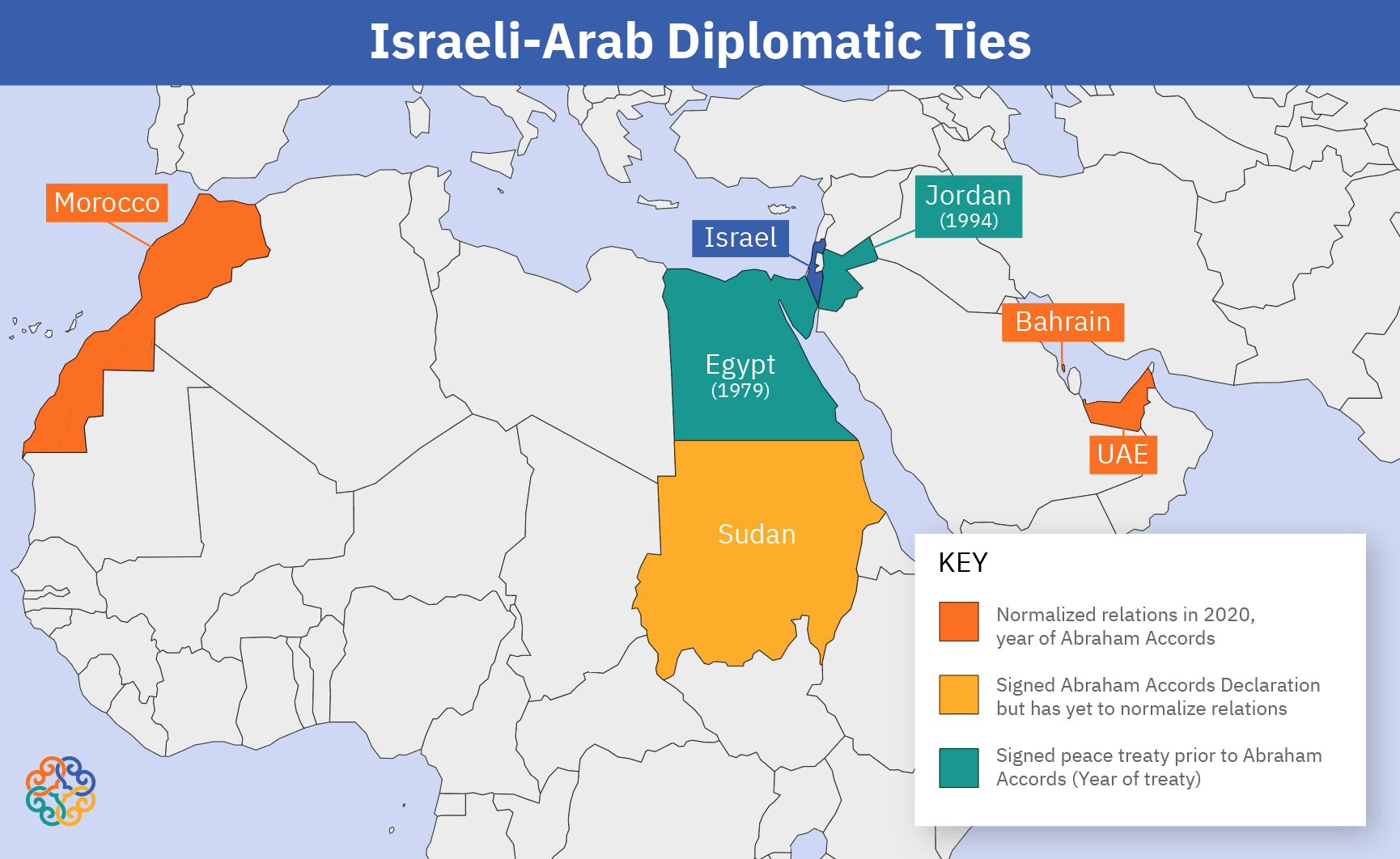

The Nature Of Trumps Relationships With Arab Leaders Handsome Attractive Tough

May 17, 2025

The Nature Of Trumps Relationships With Arab Leaders Handsome Attractive Tough

May 17, 2025 -

Jackbit Best Crypto Casino With Instant Withdrawals

May 17, 2025

Jackbit Best Crypto Casino With Instant Withdrawals

May 17, 2025 -

Why Do Guests Disobey Red Carpet Rules A Cnn Perspective

May 17, 2025

Why Do Guests Disobey Red Carpet Rules A Cnn Perspective

May 17, 2025 -

Deepfake Detection Foiled Cybersecurity Experts Clever Trick

May 17, 2025

Deepfake Detection Foiled Cybersecurity Experts Clever Trick

May 17, 2025

Latest Posts

-

2025s Top Rated Crypto Casinos Bitcoin Casinos With Fast Withdrawals And Exclusive Bonuses

May 17, 2025

2025s Top Rated Crypto Casinos Bitcoin Casinos With Fast Withdrawals And Exclusive Bonuses

May 17, 2025 -

Top Bitcoin Casinos 2025 Easy Withdrawals Exclusive Bonuses And Best Crypto Gambling Sites

May 17, 2025

Top Bitcoin Casinos 2025 Easy Withdrawals Exclusive Bonuses And Best Crypto Gambling Sites

May 17, 2025 -

Best Crypto Casinos 2025 Top Bitcoin Casinos With Easy Withdrawals And Exclusive Bonuses

May 17, 2025

Best Crypto Casinos 2025 Top Bitcoin Casinos With Easy Withdrawals And Exclusive Bonuses

May 17, 2025 -

Jackbit Your Best Crypto Casino Choice In 2025

May 17, 2025

Jackbit Your Best Crypto Casino Choice In 2025

May 17, 2025 -

Review Of Jackbit A Top Bitcoin Casino With Fast Withdrawals

May 17, 2025

Review Of Jackbit A Top Bitcoin Casino With Fast Withdrawals

May 17, 2025