XRP Classification Update: Ripple Lawsuit Settlement And Commodity Implications

Table of Contents

The Ripple Lawsuit: A Deep Dive

The legal battle between Ripple Labs and the SEC centers on the classification of XRP, Ripple's native cryptocurrency. The outcome will significantly impact the cryptocurrency market and set a precedent for future regulatory actions.

The SEC's Case Against Ripple

The SEC's case rests heavily on the Howey Test, a framework used to determine whether an investment constitutes a security. The SEC argues that XRP sales constituted an investment contract, meeting the Howey Test criteria:

- Investment of Money: The SEC claims investors purchased XRP with the expectation of profit.

- Common Enterprise: Investors pooled their money into XRP, relying on Ripple's efforts to increase its value.

- Expectation of Profits: The SEC contends that profits derived from XRP were primarily based on Ripple's efforts, not solely on market forces.

- Efforts of Others: Ripple's promotional activities and development efforts were crucial to the anticipated increase in XRP's value.

The SEC alleges Ripple engaged in an unregistered securities offering, violating federal securities laws. The case hinges on the interpretation of these points and how they apply to XRP's unique characteristics. Key dates in the case include the initial complaint filing in December 2020 and ongoing procedural developments. Key players include the SEC Chair Gary Gensler and Ripple's CEO Brad Garlinghouse.

Ripple's Defense Strategy

Ripple's defense challenges the SEC's interpretation of the Howey Test. Their core arguments center on the decentralized nature of XRP and its functionality as a payment mechanism:

- Decentralization: Ripple argues XRP operates as a decentralized digital asset, unlike securities typically associated with centralized control. They highlight the independent operation of XRP's network and the lack of direct control by Ripple.

- Utility as a Payment Mechanism: Ripple emphasizes XRP's use in facilitating cross-border payments, arguing its primary function is as a medium of exchange rather than an investment contract.

- Community-Driven Development: Ripple points to the active community contributing to XRP's development and ecosystem, further supporting the argument for decentralization.

Ripple's defense aims to distinguish XRP from other cryptocurrencies that have been classified as securities, emphasizing its unique attributes and operational structure.

Potential Settlement Outcomes and Their Implications for XRP Classification

The Ripple lawsuit's resolution will profoundly influence the XRP market and broader regulatory landscape. Two primary scenarios—a settlement favorable to Ripple and an unfavorable outcome— present starkly contrasting implications.

A Settlement Favorable to Ripple

A settlement where the SEC acknowledges XRP as a non-security or a commodity would have significant positive repercussions:

- Increased XRP Price and Trading Volume: A clear regulatory stance would likely boost investor confidence, driving up XRP's price and trading activity.

- Enhanced Regulatory Clarity: It would provide much-needed clarity on the regulatory treatment of cryptocurrencies, potentially influencing how other digital assets are classified.

- Improved Investor Confidence: A favorable outcome could revitalize investor sentiment, attracting new participants to the XRP ecosystem.

- Positive Ripple Effect on Other Cryptocurrencies: A favorable ruling for Ripple could set a precedent, potentially benefiting other cryptocurrencies facing similar legal challenges.

An Unfavorable Settlement or Court Ruling for Ripple

Conversely, a ruling against Ripple classifying XRP as a security would have severe consequences:

- Significant Drop in XRP Price: The resulting uncertainty and potential delisting from exchanges could trigger a sharp decline in XRP's value.

- Delisting from Exchanges: Many exchanges might delist XRP to mitigate regulatory risk, limiting trading accessibility for investors.

- Legal Challenges for XRP Holders: Investors holding XRP could face legal ramifications, potentially impacting their ability to trade or transfer the asset.

- Negative Impact on the Overall Crypto Market: An unfavorable outcome could undermine investor confidence in the broader cryptocurrency market, impacting the price of other cryptocurrencies.

XRP as a Commodity: Exploring the Alternatives

While the SEC focuses on the securities classification, the possibility of XRP being classified as a commodity deserves consideration.

Commodity Characteristics of XRP

Several aspects of XRP align with the characteristics of a commodity:

- Decentralized Nature: XRP operates on a decentralized blockchain, lacking centralized control, a key characteristic of commodities.

- Utility as a Medium of Exchange: Its primary function is facilitating cross-border payments, similar to how commodities are used for exchange.

- Trading on Exchanges: XRP is traded on various cryptocurrency exchanges, mirroring how commodities are traded on established markets.

Regulatory Implications of Commodity Classification

Classifying XRP as a commodity would entail different regulatory oversight compared to securities:

- Regulatory Bodies: Commodity regulation would fall under the purview of agencies like the Commodity Futures Trading Commission (CFTC), rather than the SEC.

- Reporting Requirements: Compliance requirements would differ significantly, with a focus on market manipulation and trading practices specific to commodities.

- Impact on Market Manipulation: Regulations would target market manipulation and ensure fair trading practices specific to the commodity market.

Conclusion:

The Ripple lawsuit and its potential settlement hold significant implications for the classification of XRP and the broader cryptocurrency landscape. The outcome will determine whether XRP is considered a security, a commodity, or neither, impacting its regulatory framework, trading accessibility, and investor confidence. Understanding these potential scenarios is crucial for navigating the complexities of the evolving crypto market. Stay informed about the latest updates on the XRP classification and its legal implications to make informed decisions about your investments. Continue following developments regarding the Ripple lawsuit and its impact on the commodity status of cryptocurrencies.

Featured Posts

-

A Look At Ongoing Nuclear Litigation Key Cases And Trends

May 02, 2025

A Look At Ongoing Nuclear Litigation Key Cases And Trends

May 02, 2025 -

Avrupa Is Birliginde Yeni Bir Doeneme Giriyoruz

May 02, 2025

Avrupa Is Birliginde Yeni Bir Doeneme Giriyoruz

May 02, 2025 -

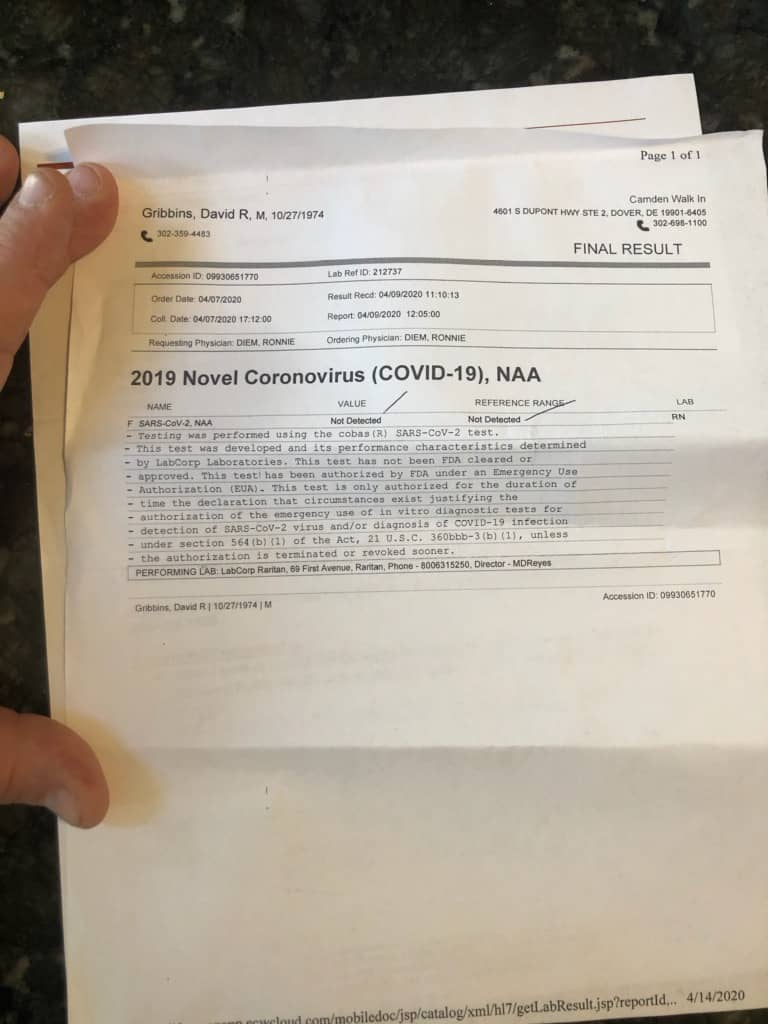

Pandemic Fraud Lab Owner Pleads Guilty To Fake Covid Test Results

May 02, 2025

Pandemic Fraud Lab Owner Pleads Guilty To Fake Covid Test Results

May 02, 2025 -

Olympic Hopes Shattered Tongas Victory Over Samoa

May 02, 2025

Olympic Hopes Shattered Tongas Victory Over Samoa

May 02, 2025 -

Trustcare Health Expands Adding Mental Health Treatment To Its Portfolio

May 02, 2025

Trustcare Health Expands Adding Mental Health Treatment To Its Portfolio

May 02, 2025