XRP ETF Approved In Brazil: Latest Ripple XRP News And Market Impact

Table of Contents

The Significance of Brazil's XRP ETF Approval

Brazil's approval of an XRP ETF is a pivotal moment for the cryptocurrency world. Its impact reverberates far beyond the borders of South America, sending ripples through the global financial system.

First of its Kind in a Major Economy

Brazil's pioneering move represents a significant step forward for cryptocurrency adoption within a major global economy. This is not a small, obscure market; Brazil is a substantial player, and its regulatory nod to XRP signifies a growing acceptance of cryptocurrencies within established financial systems.

- Increased legitimacy for XRP and cryptocurrencies in general: The approval lends credibility to XRP and the broader crypto space, potentially attracting more mainstream investors hesitant about unregulated assets.

- Potential for increased institutional investment in XRP: Institutional investors, previously wary of the regulatory uncertainty surrounding crypto, may now feel more comfortable allocating funds to XRP through a regulated ETF.

- Sets a precedent for other countries to consider XRP ETF applications: This successful application could incentivize other nations to follow suit, opening doors for wider global XRP ETF availability. This could lead to a domino effect, transforming how the world views and invests in cryptocurrencies.

Implications for Ripple's Legal Battle

The positive regulatory development in Brazil could indirectly influence Ripple's ongoing legal battle with the Securities and Exchange Commission (SEC) in the United States. A demonstration of global regulatory acceptance might sway the SEC's perspective.

- Positive media coverage and increased investor confidence: Favorable news from Brazil generates positive press, bolstering investor confidence in XRP despite the ongoing legal challenge.

- Potential for a more favorable outcome in the SEC lawsuit: The international acceptance of XRP as a legitimate asset class could influence the SEC's final decision, potentially leading to a more favorable settlement.

- Strengthened argument for XRP's classification as a non-security: While the SEC might argue XRP is a security, global regulatory acceptance counters that argument by suggesting XRP functions as a readily traded, decentralized currency, rather than an investment contract.

Market Impact and Price Analysis

The approval of the XRP ETF in Brazil is expected to trigger significant market reactions, impacting both short-term and long-term price movements.

Short-Term Price Volatility

The announcement is likely to cause immediate price fluctuations in XRP, potentially leading to a significant price surge due to increased buying pressure. However, the sustainability of this growth depends on broader market factors.

- Increased trading volume on exchanges: We can expect a substantial increase in XRP trading volume across various cryptocurrency exchanges as investors respond to the news.

- Potential short-term price surge due to increased buying pressure: Increased demand resulting from the ETF approval will likely drive up the price temporarily.

- Analysis of historical price reactions to similar events: Analyzing the past performance of XRP and other cryptocurrencies following similar regulatory developments can help us better understand potential price trajectories.

Long-Term Price Projections and Investment Opportunities

The long-term price trajectory of XRP hinges on several factors. While the Brazilian ETF approval is positive, its overall impact will be shaped by global market trends, further regulatory developments, and Ripple’s continued innovation.

- Potential for increased institutional investment in the long term: The ETF provides a more accessible and regulated entry point for institutional investors, potentially driving significant long-term investment in XRP.

- Analysis of market capitalization and trading volume trends: Tracking these key metrics will provide valuable insights into the long-term success and adoption of the XRP ETF and, by extension, XRP itself.

- Risk assessment for investors considering XRP investments: While the Brazilian ETF approval is positive, investors should still conduct thorough due diligence and assess the inherent risks associated with cryptocurrency investments.

The Future of XRP and Crypto ETFs

Brazil’s groundbreaking decision could trigger a wave of similar approvals globally, reshaping the crypto landscape and opening new avenues for investment.

Potential for Global Adoption

The success of the XRP ETF in Brazil is likely to inspire other countries to consider similar applications, potentially leading to a global boom in XRP ETF availability.

- Discussion of regulatory hurdles in other jurisdictions: Navigating the regulatory landscape in different countries poses unique challenges; analyzing these hurdles provides context for understanding the future adoption of XRP ETFs worldwide.

- Analysis of potential markets for XRP ETFs: Identifying potential markets ripe for XRP ETF adoption will be key to predicting the future success of this investment vehicle.

- Comparison to the adoption of Bitcoin and Ethereum ETFs: Comparing the XRP ETF’s adoption to that of Bitcoin and Ethereum ETFs will help provide insight into the timing and trajectory of potential future adoption.

Implications for the Broader Crypto Market

The success of the XRP ETF in Brazil could significantly impact the broader crypto market, attracting more investors and fueling further innovation.

- Increased interest in other crypto assets: The increased interest in XRP could spill over to other cryptocurrencies, driving broader market growth.

- Potential for development of new crypto-related financial products: The success of the XRP ETF could encourage the development of novel crypto-related products and services.

- Impact on the overall cryptocurrency market capitalization: The successful integration of XRP into the traditional financial system could significantly impact the total market capitalization of cryptocurrencies.

Conclusion

The approval of an XRP ETF in Brazil represents a significant turning point for Ripple and the cryptocurrency industry. It demonstrates a growing acceptance of cryptocurrencies within mainstream finance and has the potential to significantly impact XRP's price, trading volume, and future growth prospects. While short-term volatility is expected, the long-term implications could be transformative. This development warrants close monitoring for investors interested in XRP and the broader cryptocurrency market. Stay informed on the latest XRP ETF news and developments to make informed investment decisions. Learn more about the potential of Ripple's XRP and explore the emerging landscape of cryptocurrency ETFs today.

Featured Posts

-

Flamengo Derrota Gremio No Brasileirao Com Show De Giorgian De Arrascaeta

May 08, 2025

Flamengo Derrota Gremio No Brasileirao Com Show De Giorgian De Arrascaeta

May 08, 2025 -

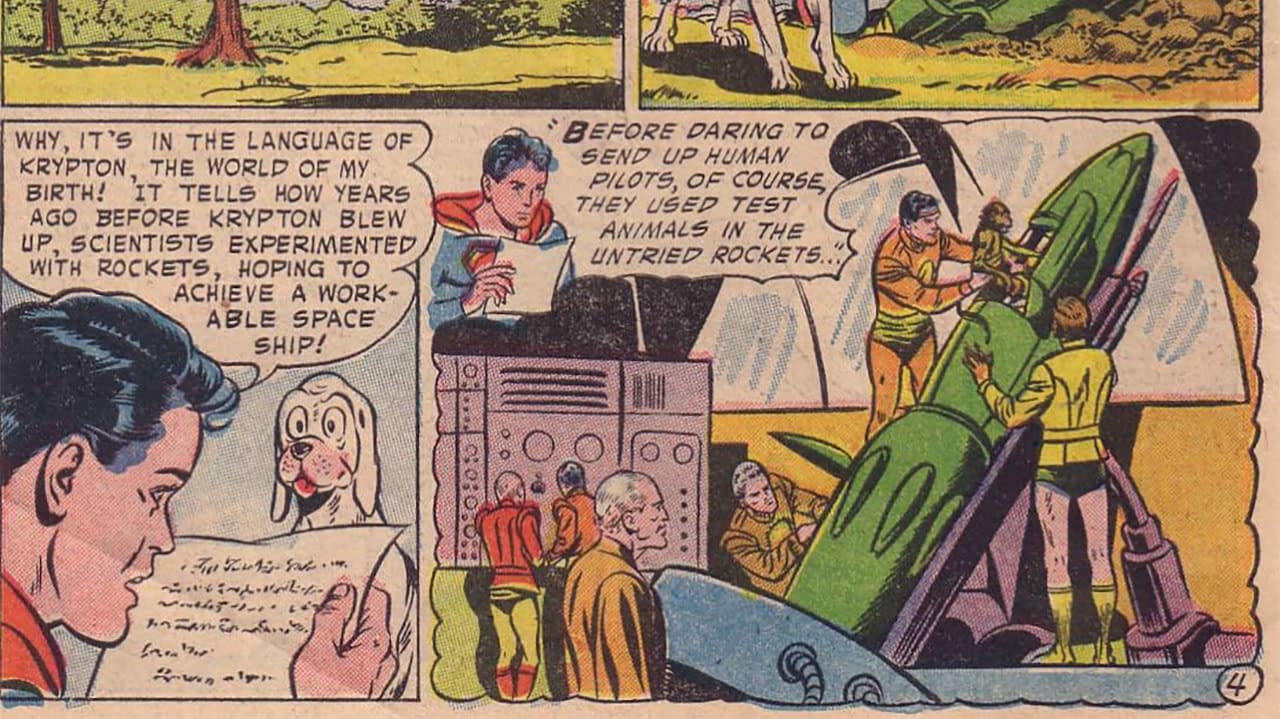

Supermans Summer Special Kryptos Appearance Next Week

May 08, 2025

Supermans Summer Special Kryptos Appearance Next Week

May 08, 2025 -

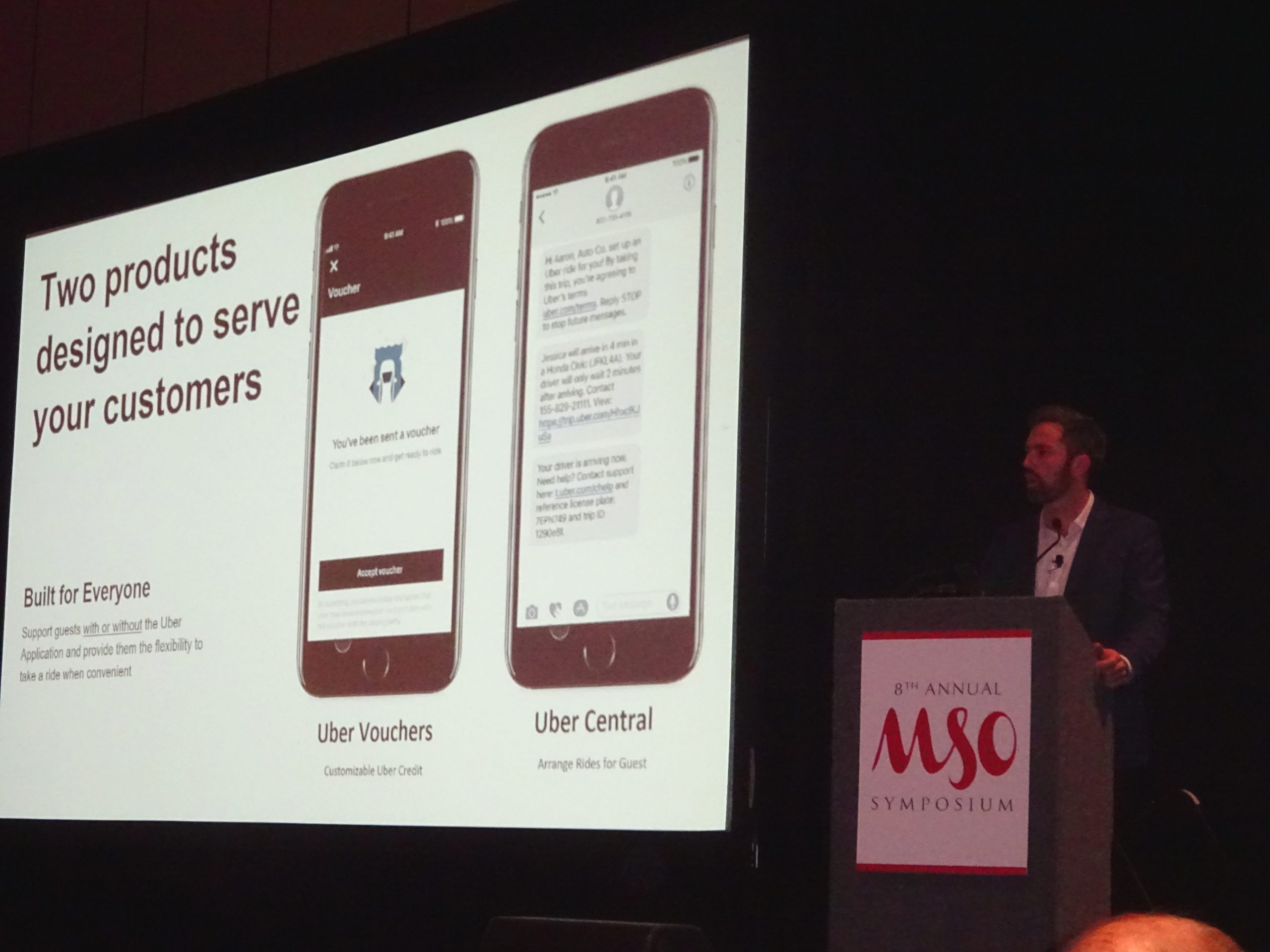

Is Ubers Cash Only Auto Service Right For You

May 08, 2025

Is Ubers Cash Only Auto Service Right For You

May 08, 2025 -

Kuzma Weighs In On Tatums Popular Instagram Upload

May 08, 2025

Kuzma Weighs In On Tatums Popular Instagram Upload

May 08, 2025 -

Ethereum Price Forecast Factors Influencing Future Value

May 08, 2025

Ethereum Price Forecast Factors Influencing Future Value

May 08, 2025