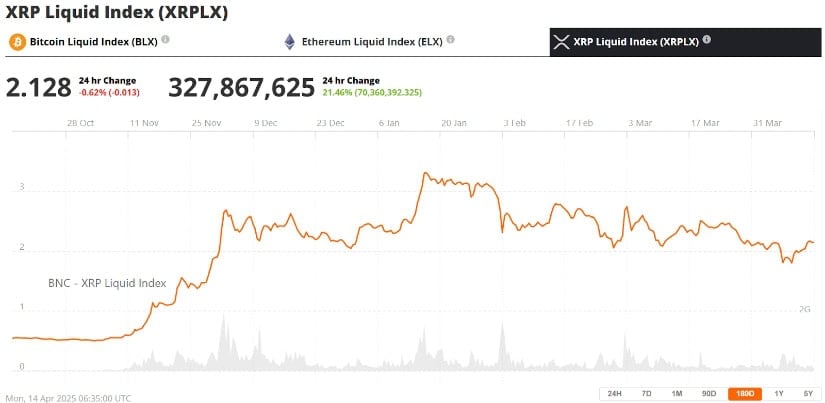

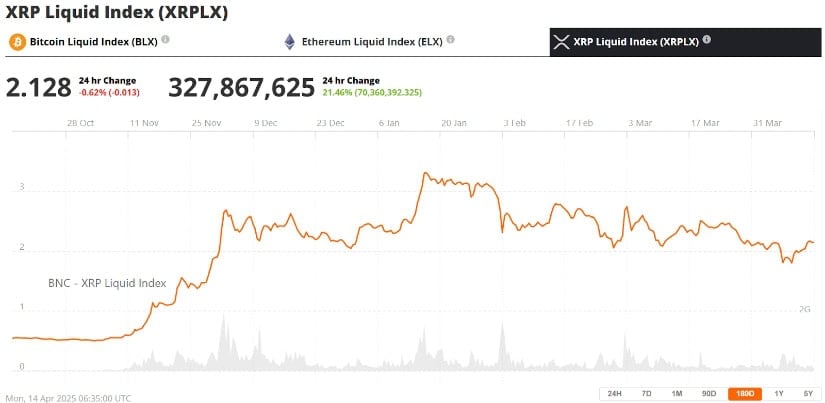

XRP: ETF Hopes, SEC Developments, And Ripple's Future

Table of Contents

The Allure of an XRP ETF

The potential approval of an XRP ETF holds significant allure for investors. An exchange-traded fund offers several key advantages: increased accessibility, regulatory clarity, and the potential for enhanced price stability. Currently, several countries are exploring the regulatory frameworks for crypto ETFs, and the approval of an XRP ETF could significantly impact its market capitalization and investor confidence. However, several challenges remain. The SEC's scrutiny of cryptocurrencies, particularly concerning whether they qualify as securities, presents a significant hurdle.

The benefits of an XRP ETF are compelling:

- Increased liquidity: An ETF would dramatically increase the liquidity of XRP, making it easier to buy and sell.

- Reduced trading fees: Trading ETFs typically involves lower fees compared to trading XRP directly on exchanges.

- Simplified investment process: Investing in an ETF is generally simpler than navigating the complexities of cryptocurrency exchanges.

- Potential for mainstream adoption: ETF approval could lead to broader mainstream adoption of XRP, attracting institutional and retail investors alike.

However, several obstacles hinder XRP ETF approval:

- Regulatory hurdles: Navigating the complex and evolving regulatory landscape for cryptocurrencies is a major challenge.

- SEC scrutiny: The SEC's ongoing scrutiny of Ripple and its classification of XRP as a security casts a shadow on the prospect of ETF approval.

SEC Lawsuit Against Ripple: A Defining Moment

The SEC lawsuit against Ripple Labs, filed in December 2020, is a pivotal moment in XRP's history. The SEC alleges that Ripple conducted an unregistered securities offering through the sale of XRP. Ripple vehemently denies these allegations, arguing that XRP is a decentralized digital asset with utility in its payment network and not a security.

The core arguments are:

- SEC's Allegation: The SEC claims XRP sales constituted an unregistered securities offering, violating federal securities laws.

- Ripple's Defense: Ripple contends that XRP is a utility token, not a security, and that its sales were not subject to SEC registration requirements.

The outcome of this lawsuit will profoundly impact XRP's price and future. A ruling in favor of the SEC could severely damage XRP's value and adoption, while a victory for Ripple could significantly boost its legitimacy and price. Furthermore, the case sets a significant precedent for the broader crypto regulatory landscape, influencing how future projects are classified and regulated.

The Ripple Defense and Its Significance

Ripple's defense centers on several key arguments:

- Programmatic sales vs. investment contracts: Ripple emphasizes the programmatic nature of XRP sales, arguing they don't meet the criteria of an investment contract under the Howey Test.

- Emphasis on XRP's decentralized nature: Ripple highlights XRP's decentralized functionality and use within its payment network, arguing against its classification as a security.

- Arguments for XRP as a utility token: Ripple focuses on XRP's utility as a payment and settlement tool within its ecosystem.

The case's outcome will heavily influence future SEC actions against other crypto projects. A Ripple victory could encourage other projects to resist similar accusations, while a loss could embolden the SEC to pursue more aggressive regulatory actions. The possibility of a settlement remains, although its terms would significantly impact XRP's market position.

Ripple's Ongoing Development and Future Plans

Despite the ongoing legal battle, Ripple continues to innovate and expand. Beyond the SEC lawsuit, Ripple is actively involved in:

- On-chain developments: Continual improvements and upgrades to the XRP Ledger enhance its efficiency and scalability.

- Adoption by financial institutions: Ripple continues to forge partnerships with financial institutions globally, integrating XRP into their payment systems.

- Technological advancements: Ripple is actively developing new technologies and products to expand its ecosystem and enhance its offerings.

- Global expansion plans: Ripple continues to expand its reach into new markets and regions.

- Commitment to regulatory compliance: Ripple actively engages with regulators worldwide to navigate the regulatory landscape and foster a compliant environment.

Conclusion

The future of XRP remains uncertain, heavily reliant on the outcome of the SEC lawsuit and Ripple's ongoing development. The potential for XRP ETFs, the significance of the SEC case, and Ripple's continued innovation are all crucial factors to consider. Staying informed about the latest developments regarding the XRP ETF, closely following the SEC lawsuit against Ripple, and monitoring Ripple's progress are essential for making informed investment decisions. Keep up-to-date on all things XRP!

Featured Posts

-

From Scratch To Seven Seas A Northumberland Mans Global Sailing Adventure

May 01, 2025

From Scratch To Seven Seas A Northumberland Mans Global Sailing Adventure

May 01, 2025 -

Ancheta Dosarelor X Actualizari De La Viata Libera Galati

May 01, 2025

Ancheta Dosarelor X Actualizari De La Viata Libera Galati

May 01, 2025 -

Cdu Csu And Spd Coalition Talks A Potential Roadmap For Germanys Future

May 01, 2025

Cdu Csu And Spd Coalition Talks A Potential Roadmap For Germanys Future

May 01, 2025 -

Michael Jordan Fast Facts For Basketball Fans

May 01, 2025

Michael Jordan Fast Facts For Basketball Fans

May 01, 2025 -

Is Chat Gpt The Future Of Online Shopping Open Ai Challenges Google

May 01, 2025

Is Chat Gpt The Future Of Online Shopping Open Ai Challenges Google

May 01, 2025