XRP News: Ripple's $50M SEC Settlement – What's Next For XRP?

Table of Contents

The Ripple-SEC Settlement: A Summary

The Ripple-SEC settlement, finalized in April 2023, involved a $50 million payment from Ripple to the SEC. Crucially, Ripple did not admit guilt in the settlement. This aspect is significant as it differentiates this case from other SEC enforcement actions against cryptocurrency companies. The settlement largely focuses on Ripple's past sales of XRP, resolving a major legal hurdle for the company.

- Key terms of the settlement agreement: The agreement covered past sales of XRP, but it did not declare XRP a security. This ambiguity remains a key point of discussion. The settlement largely avoids defining XRP's legal status in the long term.

- Impact on Ripple's operations: The settlement allows Ripple to continue its operations, focusing on its technology, including its On-Demand Liquidity (ODL) solution, and building partnerships. It removes a significant legal cloud from their operations.

- Ripple's official statement on the settlement: Ripple celebrated the settlement as a victory, emphasizing the absence of guilt and their commitment to ongoing innovation in the blockchain space. They highlighted their focus on continued development and expansion.

Impact on XRP Price and Market Sentiment

The XRP price experienced significant volatility before, during, and after the settlement announcement. The uncertainty surrounding the case had previously depressed the price. The settlement initially led to a surge in price, reflecting a positive market reaction to the removal of significant legal uncertainty. However, the long-term impact on price remains to be seen, depending on several factors including continued regulatory clarity and adoption of Ripple's technology.

- Price fluctuations before, during, and after the settlement announcement: A detailed chart analysis would be needed to fully showcase these fluctuations; however, the overall trend shows increased stability post-settlement.

- Changes in trading volume and market capitalization: Trading volume increased following the settlement news, indicating renewed interest in XRP. Market capitalization also saw a boost, reflecting the positive market sentiment.

- Expert opinions and predictions on future price movements: Expert opinions vary, but many predict increased stability and potential growth based on Ripple's continued development and the removal of regulatory uncertainty.

Legal Implications and Future Regulatory Landscape for XRP

The Ripple-SEC settlement sets a somewhat ambiguous legal precedent. While it resolved Ripple’s immediate legal issues, it doesn't definitively classify XRP as a security or not. This lack of explicit classification leaves uncertainty for other crypto projects facing similar regulatory scrutiny. The SEC's future approach to crypto regulation remains uncertain, pending further court cases and legislative developments.

- Analysis of the SEC's future approach to crypto regulation: The SEC's approach is likely to remain aggressive towards projects perceived as violating securities laws, but the Ripple settlement might lead to more nuanced approaches in the future.

- Potential legal challenges remaining for Ripple: While the main case is settled, potential future legal challenges related to XRP are still possible, particularly depending on changing regulatory interpretations.

- Impact on other crypto projects facing similar regulatory scrutiny: The Ripple case provides a precedent that could influence future cases against other cryptocurrency companies. The outcome's ambiguity, however, means other projects will likely still face individual legal scrutiny.

Ripple's Future Roadmap and Development Plans Post-Settlement

With the legal battle behind them, Ripple can now fully focus on its technology development, partnerships, and market expansion. Their On-Demand Liquidity (ODL) solution, which utilizes XRP for faster and cheaper cross-border payments, remains a key focus. The settlement likely strengthens their position to secure further partnerships and expand the adoption of their technology.

- Key upcoming projects and technological advancements: Ripple will likely continue its investments in improving the efficiency and scalability of its blockchain and payment solutions. Innovation in the ODL system will be crucial.

- New partnerships or collaborations: The settlement should make Ripple a more attractive partner for financial institutions and other businesses, leading to increased collaborations.

- Expansion into new markets or sectors: Ripple may actively pursue expansion into new geographical markets and potentially explore new sectors where its technology can be applied.

Investing in XRP After the Settlement: Risks and Opportunities

Investing in XRP, like any cryptocurrency, involves risks and opportunities. The settlement reduces legal risk, but regulatory uncertainty remains in the broader crypto market. Price volatility is inherent in cryptocurrencies, and XRP is no exception. Investors should carefully assess their risk tolerance before investing.

- Potential risks: Volatility, regulatory uncertainty, and the ongoing debate around XRP’s legal classification remain substantial risks.

- Potential opportunities: The price appreciation potential remains significant if the cryptocurrency market recovers and Ripple continues to successfully expand its technology and partnerships.

- Diversification strategies for XRP investors: Diversification is crucial to mitigate risk. Investors should avoid putting all their investments into a single cryptocurrency, like XRP.

Conclusion: The Future of XRP After the Ripple Settlement

The Ripple-SEC settlement marks a significant turning point for XRP and the broader cryptocurrency landscape. While the settlement brings clarity to Ripple's immediate future, the long-term impact on XRP's price and regulatory standing remains uncertain. The absence of a definitive classification of XRP as a security leaves room for both optimism and continued caution. The Ripple team’s renewed focus on innovation and expansion presents potential growth opportunities, but investors must carefully weigh the risks involved before making any investment decisions. Stay tuned for more updates on XRP news and continue to monitor the evolving regulatory landscape. Conduct thorough due diligence before investing in XRP.

Featured Posts

-

Processo Becciu Aggiornamenti Sui Fondi 8xmille

May 01, 2025

Processo Becciu Aggiornamenti Sui Fondi 8xmille

May 01, 2025 -

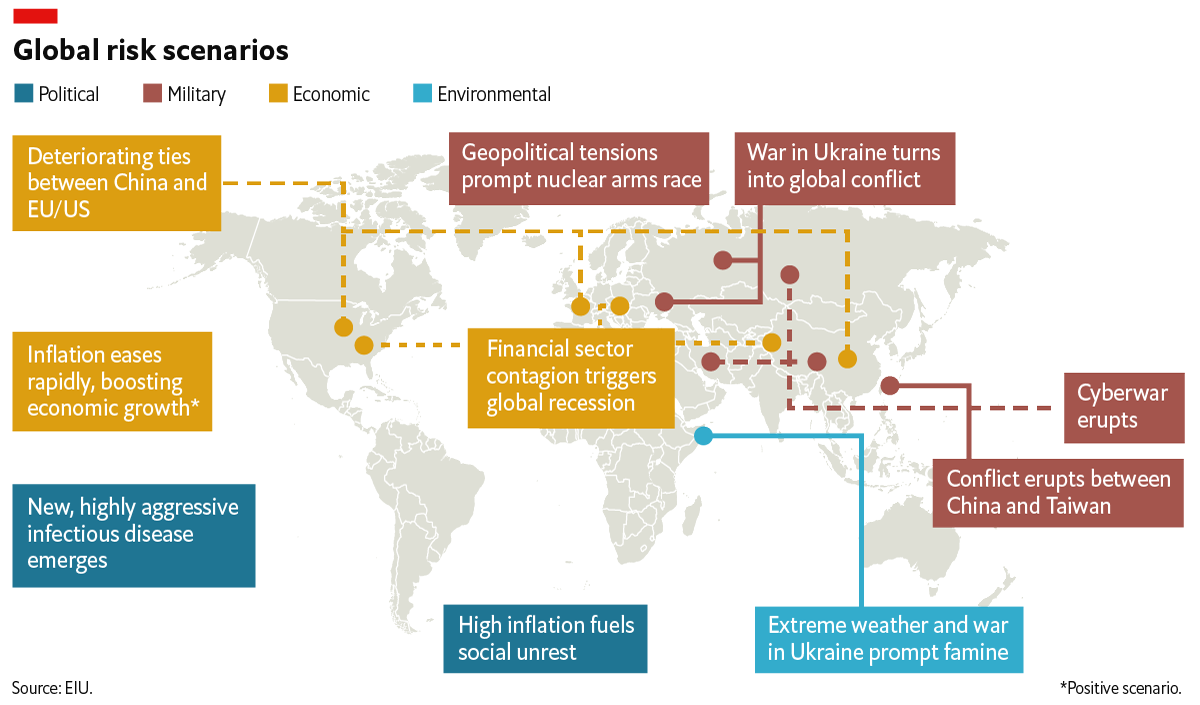

Nvidias Geopolitical Risks The Trump Administrations Legacy And Beyond

May 01, 2025

Nvidias Geopolitical Risks The Trump Administrations Legacy And Beyond

May 01, 2025 -

Retailer Warning Current Low Prices Wont Survive Ongoing Tariffs

May 01, 2025

Retailer Warning Current Low Prices Wont Survive Ongoing Tariffs

May 01, 2025 -

Guardians Rally Past Yankees Despite Bibees Early Home Run

May 01, 2025

Guardians Rally Past Yankees Despite Bibees Early Home Run

May 01, 2025 -

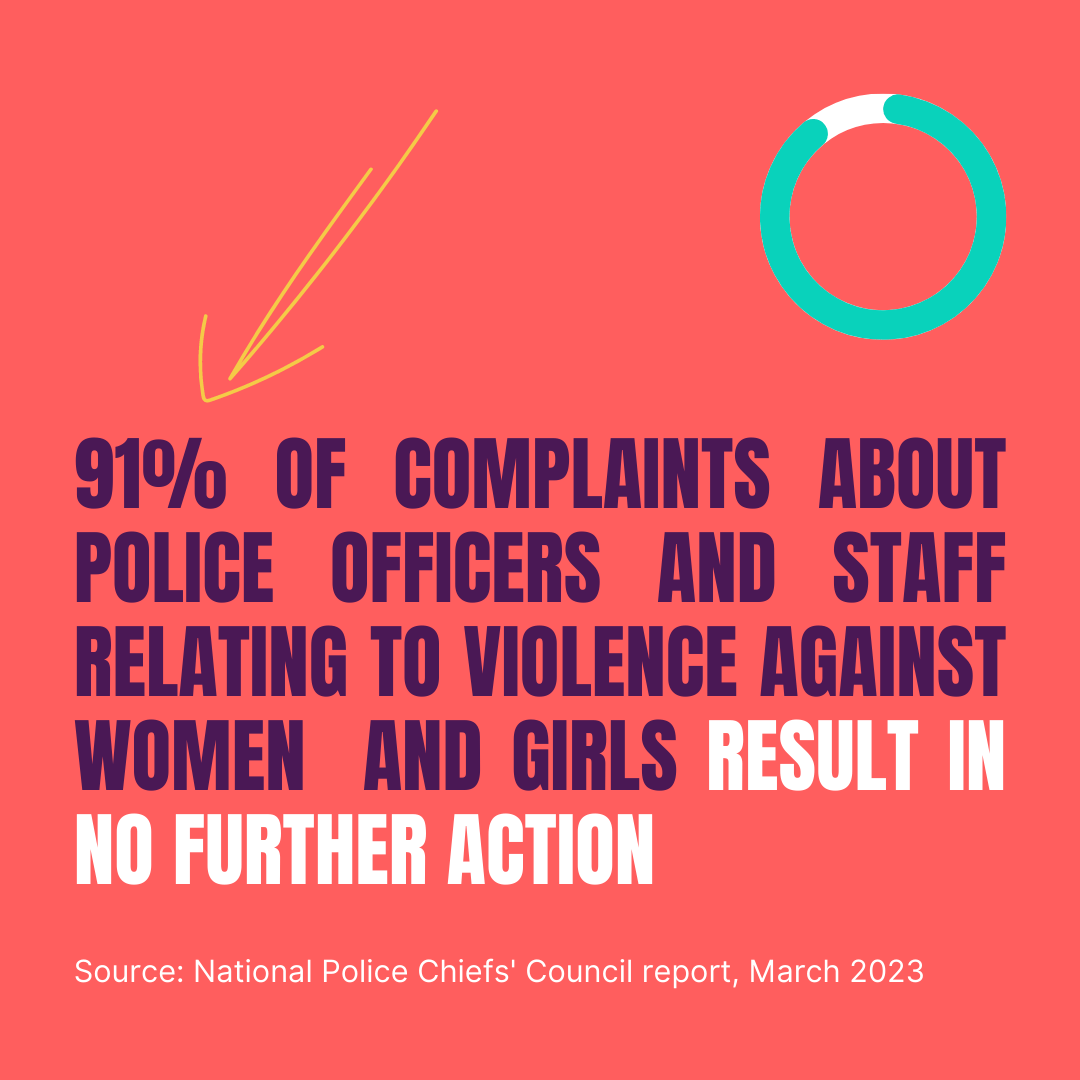

Lack Of Police Accountability Campaigners Voice Deep Concerns

May 01, 2025

Lack Of Police Accountability Campaigners Voice Deep Concerns

May 01, 2025